Liberty Mutual Auto Insurance Review for 2026 (Rates & Discounts Listed Here)

Utilize this Liberty Mutual auto insurance review to check affordable rates and coverage options. Rates start at a minimum of $60/month. Liberty Mutual offers discounts like multi-policy and RightTrack for safe drivers, along with great customer service and extensive coverage, making it a flexible choice.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Since graduating from the University of WA with a B.A. in English Literature, Shawn has been professionally writing in the spheres of entertainment, insurance, business, marketing, and politics. He is passionate about using his writing skills and insurance knowledge to educate the general population on everyday issues surrounding these misunderstood topics. His work has been published on SUPERJ...

Shawn Laib

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated December 2024

In this Liberty Mutual auto insurance review, we explore the insurer’s competitive pricing, which starts at $60 per month, and its range of flexible coverage options.

Discounts that the insurer offers plus a feature like the RightTrack program helps the policyholder in saving. They have a variety of coverage options and even offer bundling with home and other types for additional savings.

Liberty Mutual Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 4.3 |

| Business Reviews | 4.0 |

| Claim Processing | 3.3 |

| Company Reputation | 4.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.1 |

| Customer Satisfaction | 4.0 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.2 |

| Plan Personalization | 4.5 |

| Policy Options | 5.0 |

| Savings Potential | 4.5 |

From liability coverage to full protection, there are several coverage options tailor-fit for your needs.

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

- Liberty Mutual Insurance provides auto coverage starting at $60 monthly for basics

- Policyholders can access discounts and features like RightTrack for extra savings

- Bundling with home and other insurances offers additional savings opportunities

What You Should Know About Liberty Mutual Insurance

Liberty Mutual Insurance is a household name and has been around for over a century. However, while Liberty Mutual is one of the best auto insurance companies in the country, but it also carries some of the highest car insurance costs.

In addition to the above-average rates and good bundling, like home and renters insurance discounts, Liberty Mutual also has the RightTrack program for policyholders. Compare around for quotes and never settle for anything less.

Age and Gender-Based Auto Insurance Rates from Liberty Mutual

When determining the recommended auto insurance coverage levels, note that Liberty Mutual also raises its monthly rates as you age, and depending on your sex and what coverage you require most. A female of that same age pays an average of roughly $283 for his or her minimal coverage, while a male pays about $325.

Liberty Mutual Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $283 | $723 |

| Age: 16 Male | $325 | $785 |

| Age: 18 Female | $231 | $626 |

| Age: 18 Male | $279 | $626 |

| Age: 25 Female | $72 | $187 |

| Age: 25 Male | $83 | $215 |

| Age: 30 Female | $67 | $174 |

| Age: 30 Male | $77 | $200 |

| Age: 45 Female | $66 | $171 |

| Age: 45 Male | $68 | $174 |

| Age: 60 Female | $60 | $148 |

| Age: 60 Male | $64 | $159 |

| Age: 65 Female | $65 | $167 |

| Age: 65 Male | $66 | $170 |

Rates drop dramatically for drivers 25 and older, as a 30-year-old female pays rates of $67 for minimum coverage and $174 for full-cover.

Liberty Mutual offers competitive coverage options and discounts, but its rates can be higher than average, especially for younger or high-risk drivers.Michelle Robbins Licensed Insurance Agent

In contrast, full coverage is generally more expensive than liability coverage in all age and gender categories, with rates peaking for the youngest drivers, then ascending in a gradual slide with increasing age.

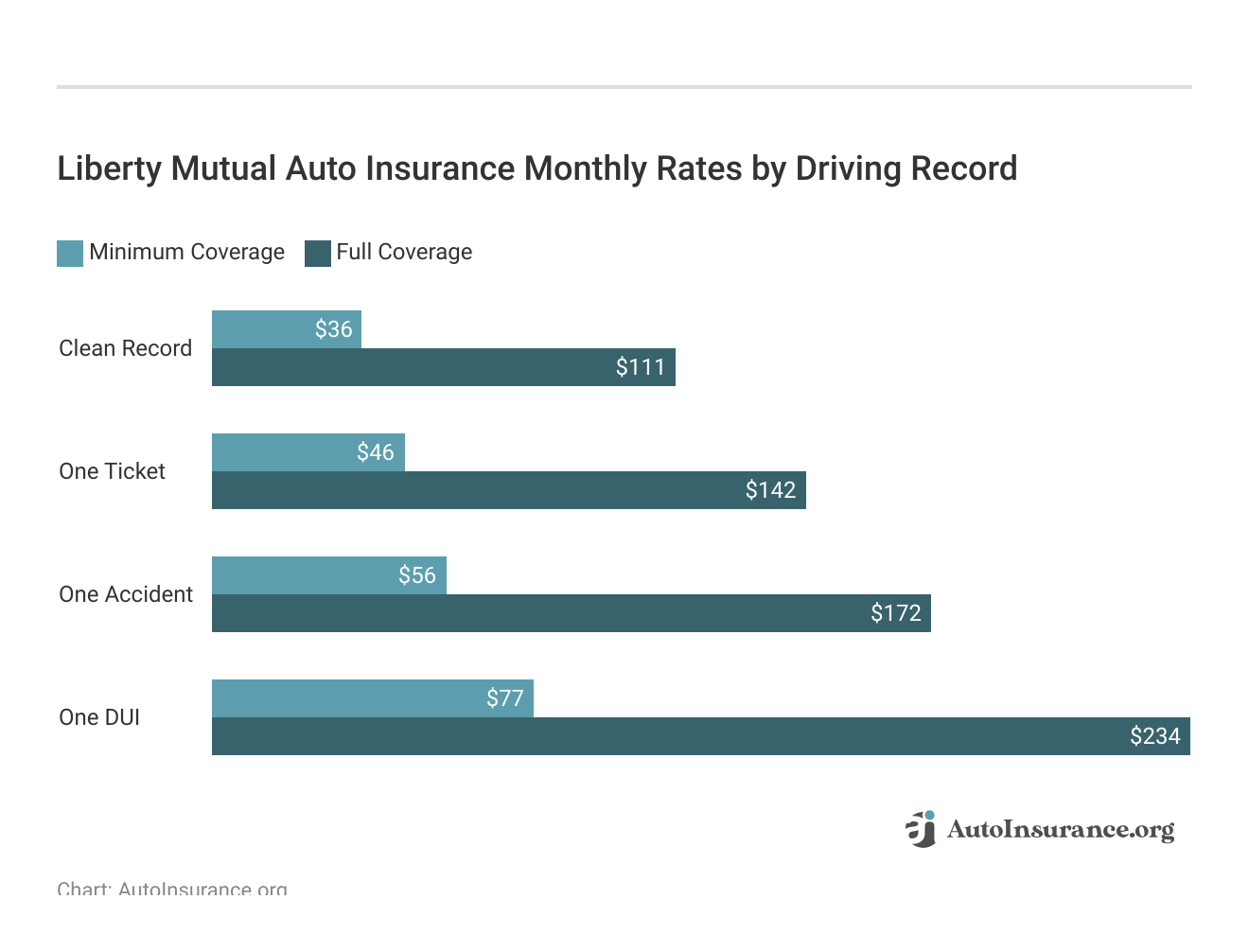

The Impact of Driving Records on Liberty Mutual Auto Insurance Rates

Liberty Mutual’s auto insurance monthly rates are influenced by the driver’s record, reflecting the potential risk associated with different driving behaviors. Minimum coverage costs $36 and full coverage is $111, both for people with clean driving records. But, if you have driving infractions, the rates go up drastically.

A driver with one ticket pays approximately $46 for minimum coverage and $142 for full coverage. If a driver has one accident, the monthly rates rise to $56 for minimum coverage and $172 for full coverage.

The most substantial increase occurs for drivers with a DUI, who face monthly rates of $77 for minimum coverage and $234 for full coverage auto insurance. Those tiered rates place a premium on clean driving history as the way to get the best rates available for any car to insure.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

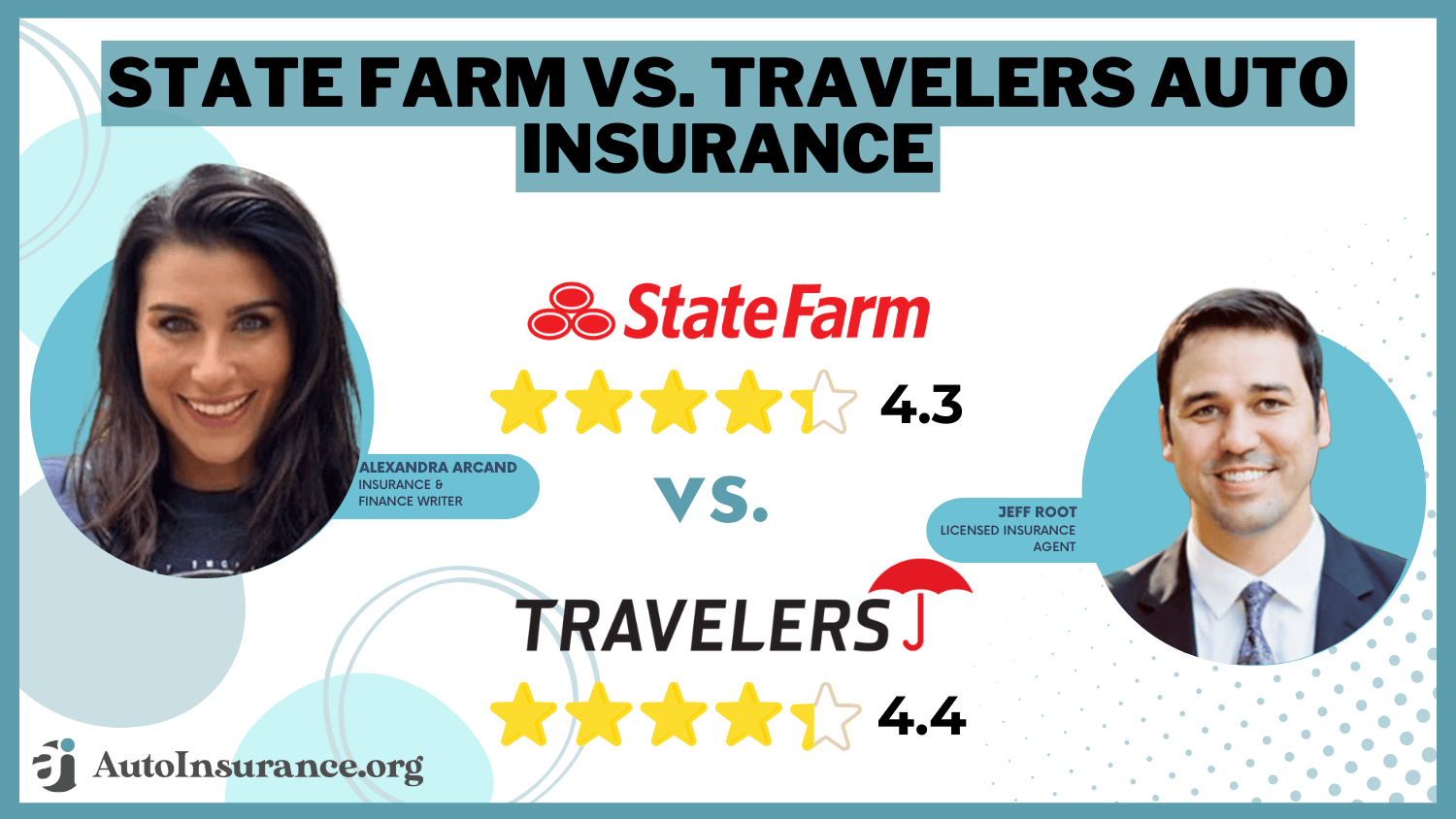

Comparing Liberty Mutual’s Insurance Rates: By Age and Gender Against Major Competitors

Liberty Mutual’s auto insurance rates show noticeable differences compared to leading competitors, particularly based on age and gender. For example, 16-year-old female drivers face premiums of approximately $723 per month, while their male counterparts pay around $785. On the other hand, Geico provides much more affordable options, with rates for females at $298 and for males at $312.

As drivers age to 18, Liberty Mutual maintains a steady rate of $626 for both genders, which is higher than competitors like American Family, which charges $305 for females and $414 for males.

Liberty Mutual Auto Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $608 | $638 | $448 | $519 | |

| $414 | $509 | $305 | $414 | |

| $810 | $773 | $597 | $629 | |

| $298 | $312 | $220 | $254 | |

| $723 | $785 | $626 | $626 |

| $411 | $476 | $303 | $387 |

| $801 | $814 | $591 | $662 | |

| $311 | $349 | $229 | $284 | |

| $719 | $910 | $530 | $740 |

Other competitors, such as Allstate, American Family, Farmers, Nationwide, Progressive, State Farm, and Travelers, show a range of monthly rates for both age groups, with Farmers offering some of the highest auto insurance premium at $810 for 16-year-old females and $814 for males. Conversely, State Farm presents a more affordable option with rates of $311 for 16-year-old females and $349 for males.

The following overview puts Liberty Mutual in a comparison to other leading insurance providers and provides details on why one needs to shop around to find the best policy fitting his age and gender.

Exploring Liberty Mutual’s Comprehensive Auto Insurance Coverage Options

Auto insurance provided by Liberty Mutual contains both coverages, which most states require, and also those providing you with the maximum protection. Here’s an overview of a standard auto insurance policy with some of the common coverages that Liberty Mutual provides:

- Liability Coverage: This coverage protects you against financial loss by paying the cost of commercial/property damages and bodily injuries incurred by others in a collision in which you are at fault.

- Collision Coverage: Collision auto insurance provides financial protection for repairs to your own vehicle resulting from an accident, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage that helped in the case of an accident with another driver who either has little or no insurance. It helped pay damages for your vehicle.

- Medical Payments Coverage: This insurance pays the medical bills, which result from injuries incurred in an accident, without regard to fault.

- Personal Injury Protection (PIP): PIP pays for a lot of other things than medical bills after an accident, such as lost wages and child care costs.

Most states require only liability coverage, but you and your vehicle are not protected. Thus, most professionals suggest full coverage, which includes liability, collision, comprehensive, and other required covers.

Many drivers are also looking for other covers and features that provide more protection than what is provided by a typical auto insurance. Liberty Mutual offers drivers with a number of various options to be altogether covered. Extra Liberty Mutual auto coverages and features include the following:

- Accident Forgiveness: You can purchase accident forgiveness coverage when you maintained a clean driving record for five consecutive years; it covers your rates from increasing after your first future accident.

- New Car Replacement: Pays for a brand-new vehicle if your less-than-one-year-old car gets totaled in an accident.

- Roadside Assistance: You will have the chance to get roadside assistance for towing, jump-starts, fuel delivery, and locksmith services. This you can do by calling the Liberty Mutual number for roadside assistance.

- Original Parts Replacement: This feature ensures that any replacement parts on your vehicle are original manufacturer parts rather than aftermarket options.

- Lifetime Replacement Guarantee: Liberty Mutual offers a lifetime guarantee on repairs made at approved network locations, ensuring peace of mind for policyholders.

In addition, drivers can easily add on benefits like Mexico car insurance and teacher’s car insurance for those driving to or driving on behalf of official school business in Mexico. These full-coverage options further cement Liberty Mutual as one of the unequivocal leaders within the car insurance market.

From accident protection to support with a roadside emergency, and assurance with genuine parts, Liberty Mutual will cover you. Consider these features when considering your auto insurance needs so that you get the best roadside assistance plans out there.

Evaluating Liberty Mutual Auto Insurance: Customer Ratings and Experiences

Liberty Mutual Auto Insurance has received positive ratings across several consumer review platforms. It holds a score of 857 out of 1,000 from J.D. Power, indicating above-average customer satisfaction, and an A rating for excellent business practices.

Consumer Reports gives it a rating of 74 out of 100 for good customer satisfaction, stating fewer complaints than the average. Besides, A.M. Best rates Liberty Mutual A, which is considered excellent in financial strength, meaning stability and dependability in the insurance market.

Liberty Mutual Insurance Business Ratings & Consumer Reviews

| Ratings |  |

|---|---|

| Score: 857 / 1,000 Above Avg. Satisfaction |

|

| Score: A Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction |

|

| Score: 0.55 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

One Reddit reviewer shared his positive experience in dealing directly with Liberty Mutual, claiming ease in both the sales and customer service process without having to work with an agent. He thought the rate was reasonable, especially with a group discount, although once more he would admit others may be lower in overall cost for insurance carriers.

Comment

byu/Help_Me_Reddit01 from discussion

inInsurance

Filing an auto insurance claim can be a straightforward process if you know what to expect. One user shared their experience after filing a claim about a year ago when they were rear-ended. They are of the view that their claims experience has been positive, and so they can attest to the fact that Liberty Mutual served them well in this case.

What makes Liberty Mutual just as competitive in the insurance market is its wide range of coverage and relatively competitive discounts, hence a great option for drivers who need affordable auto insurance.Justin Wright Licensed Insurance Agent

The positive feedback helps replace in this company a sense of responsibility towards the mainstays of business, like great customer service and competitive pricing, which encourages other people to look at Liberty Mutual when considering auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Coverage Choices With Liberty Mutual

As one of the top car insurance providers in the country, Liberty Mutual Insurance offers a variety of coverage options. However, rates tend to be higher than average, particularly for young drivers. Policyholders can save money through discounts, consider how to save money by bundling insurance policies, and participate in the RightTrack program.

An easy way to save money? Customize with Liberty Mutual. Plus, 13 other tips for lowering your car insurance. https://t.co/Fi4LjmDXye pic.twitter.com/W8CifJuAVP

— Liberty Mutual (@LibertyMutual) July 19, 2023

Most of the reviews are positive, but the main complaints among customers are about its high rates and poor customer service. This insurance company is ideal for drivers with a low risk who want protection other than that provided for their vehicle.

It is not ideal, though, for young drivers or those who take a lot of risks on the road or even those with a low credit score because that will make the premiums much higher. Enter your ZIP code to explore which companies have the cheapest auto insurance rates for you.

Frequently Asked Questions

How do I get a Liberty Mutual car insurance quote?

The quickest way to get a Liberty Mutual car insurance quote is by using the online server or calling a customer representative. You will need to input basic information about your vehicle, driving record, and coverage preferences in order to get an accurate quote based on the details.

Is Liberty Mutual a good car insurance company for drivers with a clean driving record?

Yes, Liberty Mutual is a good company for clean record drivers to get cheap rates beginning at $60 per month. For low-risk drivers, larger discounts for policies bundled together or the RightTrack program reducing premiums for safe driving can also be found with them.

Enter your zip code and discover what the best providers near you are charging.

How does Liberty Mutual’s car insurance compare to other providers in terms of coverage options?

Similarly, Liberty Mutual offers a wide array of coverage options from liability, collision and comprehensive coverage to rental car reimbursement. Their prices are more expensive than some competitors for certain drivers like young or high-risk drivers, but they have flexible policies with lots of customizable options like high-risk auto insurance.

What is the Liberty Mutual insurance rating for customer satisfaction?

Liberty Mutual consistently receives positive reviews for customer satisfaction. They hold a solid A rating from A.M. Best for financial strength and a score of 857 out of 1,000 from J.D. Power for customer service, indicating a reliable and dependable provider.

What is the Liberty Mutual car buying program?

The Liberty Mutual car buying program offers policyholders discounts when purchasing a new or used car through their partnered dealerships. This program helps you save on both the cost of the car and your auto insurance premiums, making it a valuable option for buyers.

What coverage does Liberty Auto Insurance provide for drivers who frequently travel?

Liberty Auto Insurance offers coverage for drivers who travel frequently, including comprehensive auto insurance for theft, accidents, and other incidents that can occur on the road. They also provide roadside assistance and offers coverage for rental cars, thus making travelers feel comfortable.

Is Land Rover approved by Liberty Mutual for body shop repairs?

Liberty Mutual works with body shops in its own network of approved repair facilities that includes places similar high-end brands as Land Rover. Land Rover owner, most likely having the best repairs at authorized shops covered under your policy.

Are Jaguar vehicles covered by Liberty Mutual body shop services?

Liberty Mutual covers Jaguar vehicles through its network of approved body shops. These shops are equipped to handle the specific needs of luxury vehicles, ensuring your Jaguar gets the care it requires following an accident or damage.

What do Liberty Mutual reviews say about its customer service and claims process?

Liberty Mutual reviews generally highlight its good customer service, with many customers appreciating the ease of filing claims and the support received during the process, including how to file an auto insurance claim<. However, some negative reviews point to slower response times and higher rates for certain drivers.

Where does Liberty Mutual rank among auto insurance companies?

Liberty Mutual usually falls within the top 10 U.S. auto insurers. It provides diverse types of coverage, strong customer service and competitive rates, although some reviews cite premiums that are higher than average for certain demographics.

What are Liberty Mutual customer reviews like?

How much does Liberty Mutual full coverage cost?

Does Liberty Mutual recommend comprehensive insurance for a Tesla?

Can I use Liberty Mutual’s in-network collision centers for Tesla repairs?

What does Liberty Mutual roadside assistance cover?

What is Liberty Mutual’s phone number for customer service?

Why does Liberty Mutual have higher premiums?

Does Liberty Mutual offer accident forgiveness?

Does Liberty Mutual offer renters insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Liberty Mutual good at paying claims?

The quickest way to get a Liberty Mutual car insurance quote is by using the online server or calling a customer representative. You will need to input basic information about your vehicle, driving record, and coverage preferences in order to get an accurate quote based on the details.

Yes, Liberty Mutual is a good company for clean record drivers to get cheap rates beginning at $60 per month. For low-risk drivers, larger discounts for policies bundled together or the RightTrack program reducing premiums for safe driving can also be found with them.

Enter your zip code and discover what the best providers near you are charging.

How does Liberty Mutual’s car insurance compare to other providers in terms of coverage options?

Similarly, Liberty Mutual offers a wide array of coverage options from liability, collision and comprehensive coverage to rental car reimbursement. Their prices are more expensive than some competitors for certain drivers like young or high-risk drivers, but they have flexible policies with lots of customizable options like high-risk auto insurance.

What is the Liberty Mutual insurance rating for customer satisfaction?

Liberty Mutual consistently receives positive reviews for customer satisfaction. They hold a solid A rating from A.M. Best for financial strength and a score of 857 out of 1,000 from J.D. Power for customer service, indicating a reliable and dependable provider.

What is the Liberty Mutual car buying program?

The Liberty Mutual car buying program offers policyholders discounts when purchasing a new or used car through their partnered dealerships. This program helps you save on both the cost of the car and your auto insurance premiums, making it a valuable option for buyers.

What coverage does Liberty Auto Insurance provide for drivers who frequently travel?

Liberty Auto Insurance offers coverage for drivers who travel frequently, including comprehensive auto insurance for theft, accidents, and other incidents that can occur on the road. They also provide roadside assistance and offers coverage for rental cars, thus making travelers feel comfortable.

Is Land Rover approved by Liberty Mutual for body shop repairs?

Liberty Mutual works with body shops in its own network of approved repair facilities that includes places similar high-end brands as Land Rover. Land Rover owner, most likely having the best repairs at authorized shops covered under your policy.

Are Jaguar vehicles covered by Liberty Mutual body shop services?

Liberty Mutual covers Jaguar vehicles through its network of approved body shops. These shops are equipped to handle the specific needs of luxury vehicles, ensuring your Jaguar gets the care it requires following an accident or damage.

What do Liberty Mutual reviews say about its customer service and claims process?

Liberty Mutual reviews generally highlight its good customer service, with many customers appreciating the ease of filing claims and the support received during the process, including how to file an auto insurance claim<. However, some negative reviews point to slower response times and higher rates for certain drivers.

Where does Liberty Mutual rank among auto insurance companies?

Liberty Mutual usually falls within the top 10 U.S. auto insurers. It provides diverse types of coverage, strong customer service and competitive rates, although some reviews cite premiums that are higher than average for certain demographics.

What are Liberty Mutual customer reviews like?

How much does Liberty Mutual full coverage cost?

Does Liberty Mutual recommend comprehensive insurance for a Tesla?

Can I use Liberty Mutual’s in-network collision centers for Tesla repairs?

What does Liberty Mutual roadside assistance cover?

What is Liberty Mutual’s phone number for customer service?

Why does Liberty Mutual have higher premiums?

Does Liberty Mutual offer accident forgiveness?

Does Liberty Mutual offer renters insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Liberty Mutual good at paying claims?

Similarly, Liberty Mutual offers a wide array of coverage options from liability, collision and comprehensive coverage to rental car reimbursement. Their prices are more expensive than some competitors for certain drivers like young or high-risk drivers, but they have flexible policies with lots of customizable options like high-risk auto insurance.

Liberty Mutual consistently receives positive reviews for customer satisfaction. They hold a solid A rating from A.M. Best for financial strength and a score of 857 out of 1,000 from J.D. Power for customer service, indicating a reliable and dependable provider.

What is the Liberty Mutual car buying program?

The Liberty Mutual car buying program offers policyholders discounts when purchasing a new or used car through their partnered dealerships. This program helps you save on both the cost of the car and your auto insurance premiums, making it a valuable option for buyers.

What coverage does Liberty Auto Insurance provide for drivers who frequently travel?

Liberty Auto Insurance offers coverage for drivers who travel frequently, including comprehensive auto insurance for theft, accidents, and other incidents that can occur on the road. They also provide roadside assistance and offers coverage for rental cars, thus making travelers feel comfortable.

Is Land Rover approved by Liberty Mutual for body shop repairs?

Liberty Mutual works with body shops in its own network of approved repair facilities that includes places similar high-end brands as Land Rover. Land Rover owner, most likely having the best repairs at authorized shops covered under your policy.

Are Jaguar vehicles covered by Liberty Mutual body shop services?

Liberty Mutual covers Jaguar vehicles through its network of approved body shops. These shops are equipped to handle the specific needs of luxury vehicles, ensuring your Jaguar gets the care it requires following an accident or damage.

What do Liberty Mutual reviews say about its customer service and claims process?

Liberty Mutual reviews generally highlight its good customer service, with many customers appreciating the ease of filing claims and the support received during the process, including how to file an auto insurance claim<. However, some negative reviews point to slower response times and higher rates for certain drivers.

Where does Liberty Mutual rank among auto insurance companies?

Liberty Mutual usually falls within the top 10 U.S. auto insurers. It provides diverse types of coverage, strong customer service and competitive rates, although some reviews cite premiums that are higher than average for certain demographics.

What are Liberty Mutual customer reviews like?

How much does Liberty Mutual full coverage cost?

Does Liberty Mutual recommend comprehensive insurance for a Tesla?

Can I use Liberty Mutual’s in-network collision centers for Tesla repairs?

What does Liberty Mutual roadside assistance cover?

What is Liberty Mutual’s phone number for customer service?

Why does Liberty Mutual have higher premiums?

Does Liberty Mutual offer accident forgiveness?

Does Liberty Mutual offer renters insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Liberty Mutual good at paying claims?

The Liberty Mutual car buying program offers policyholders discounts when purchasing a new or used car through their partnered dealerships. This program helps you save on both the cost of the car and your auto insurance premiums, making it a valuable option for buyers.

Liberty Auto Insurance offers coverage for drivers who travel frequently, including comprehensive auto insurance for theft, accidents, and other incidents that can occur on the road. They also provide roadside assistance and offers coverage for rental cars, thus making travelers feel comfortable.

Is Land Rover approved by Liberty Mutual for body shop repairs?

Liberty Mutual works with body shops in its own network of approved repair facilities that includes places similar high-end brands as Land Rover. Land Rover owner, most likely having the best repairs at authorized shops covered under your policy.

Are Jaguar vehicles covered by Liberty Mutual body shop services?

Liberty Mutual covers Jaguar vehicles through its network of approved body shops. These shops are equipped to handle the specific needs of luxury vehicles, ensuring your Jaguar gets the care it requires following an accident or damage.

What do Liberty Mutual reviews say about its customer service and claims process?

Liberty Mutual reviews generally highlight its good customer service, with many customers appreciating the ease of filing claims and the support received during the process, including how to file an auto insurance claim<. However, some negative reviews point to slower response times and higher rates for certain drivers.

Where does Liberty Mutual rank among auto insurance companies?

Liberty Mutual usually falls within the top 10 U.S. auto insurers. It provides diverse types of coverage, strong customer service and competitive rates, although some reviews cite premiums that are higher than average for certain demographics.

What are Liberty Mutual customer reviews like?

How much does Liberty Mutual full coverage cost?

Does Liberty Mutual recommend comprehensive insurance for a Tesla?

Can I use Liberty Mutual’s in-network collision centers for Tesla repairs?

What does Liberty Mutual roadside assistance cover?

What is Liberty Mutual’s phone number for customer service?

Why does Liberty Mutual have higher premiums?

Does Liberty Mutual offer accident forgiveness?

Does Liberty Mutual offer renters insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Liberty Mutual good at paying claims?

Liberty Mutual works with body shops in its own network of approved repair facilities that includes places similar high-end brands as Land Rover. Land Rover owner, most likely having the best repairs at authorized shops covered under your policy.

Liberty Mutual covers Jaguar vehicles through its network of approved body shops. These shops are equipped to handle the specific needs of luxury vehicles, ensuring your Jaguar gets the care it requires following an accident or damage.

What do Liberty Mutual reviews say about its customer service and claims process?

Liberty Mutual reviews generally highlight its good customer service, with many customers appreciating the ease of filing claims and the support received during the process, including how to file an auto insurance claim<. However, some negative reviews point to slower response times and higher rates for certain drivers.

Where does Liberty Mutual rank among auto insurance companies?

Liberty Mutual usually falls within the top 10 U.S. auto insurers. It provides diverse types of coverage, strong customer service and competitive rates, although some reviews cite premiums that are higher than average for certain demographics.

What are Liberty Mutual customer reviews like?

How much does Liberty Mutual full coverage cost?

Does Liberty Mutual recommend comprehensive insurance for a Tesla?

Can I use Liberty Mutual’s in-network collision centers for Tesla repairs?

What does Liberty Mutual roadside assistance cover?

What is Liberty Mutual’s phone number for customer service?

Why does Liberty Mutual have higher premiums?

Does Liberty Mutual offer accident forgiveness?

Does Liberty Mutual offer renters insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Liberty Mutual good at paying claims?

Liberty Mutual reviews generally highlight its good customer service, with many customers appreciating the ease of filing claims and the support received during the process, including how to file an auto insurance claim<. However, some negative reviews point to slower response times and higher rates for certain drivers.

Liberty Mutual usually falls within the top 10 U.S. auto insurers. It provides diverse types of coverage, strong customer service and competitive rates, although some reviews cite premiums that are higher than average for certain demographics.

What are Liberty Mutual customer reviews like?

How much does Liberty Mutual full coverage cost?

Does Liberty Mutual recommend comprehensive insurance for a Tesla?

Can I use Liberty Mutual’s in-network collision centers for Tesla repairs?

What does Liberty Mutual roadside assistance cover?

What is Liberty Mutual’s phone number for customer service?

Why does Liberty Mutual have higher premiums?

Does Liberty Mutual offer accident forgiveness?

Does Liberty Mutual offer renters insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Liberty Mutual good at paying claims?

Does Liberty Mutual recommend comprehensive insurance for a Tesla?

Can I use Liberty Mutual’s in-network collision centers for Tesla repairs?

What does Liberty Mutual roadside assistance cover?

What is Liberty Mutual’s phone number for customer service?

Why does Liberty Mutual have higher premiums?

Does Liberty Mutual offer accident forgiveness?

Does Liberty Mutual offer renters insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Liberty Mutual good at paying claims?

What does Liberty Mutual roadside assistance cover?

What is Liberty Mutual’s phone number for customer service?

Why does Liberty Mutual have higher premiums?

Does Liberty Mutual offer accident forgiveness?

Does Liberty Mutual offer renters insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Liberty Mutual good at paying claims?

Why does Liberty Mutual have higher premiums?

Does Liberty Mutual offer accident forgiveness?

Does Liberty Mutual offer renters insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Liberty Mutual good at paying claims?

Does Liberty Mutual offer renters insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Liberty Mutual good at paying claims?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.