Best Hickory, North Carolina Auto Insurance in 2026 (Find the Top 10 Companies Here)

USAA, Progressive, and Geico offers the best Hickory, North Carolina auto insurance, rates starting at $56/month. USAA stands out for military families, Progressive offers flexible options, and Geico is known for its affordability. These three are top choices for the best Hickory, North Carolina auto insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated October 2024

6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Hickory NC

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Hickory NC

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Hickory NC

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe best Hickory, North Carolina auto insurance options are offered by USAA, Progressive, and Geico. USAA is the top pick overall for its unmatched rates and benefits for military families, while Progressive and Geico also stand out for their affordability and extensive coverage options.

These companies excel in balancing cost with quality, ensuring comprehensive protection tailored to the needs of Hickory residents.

Our Top 10 Company Picks: Best Hickory, North Carolina Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 9% | A++ | Military Members | USAA | |

| #2 | 10% | A+ | Coverage Options | Progressive | |

| #3 | 9% | A++ | Senior Discounts | Geico | |

| #4 | 8% | A | Loyalty Rewards | American Family | |

| #5 | 11% | A+ | Local Agents | Allstate | |

| #6 | 7% | A+ | Multi-Policy Savings | Nationwide |

| #7 | 14% | B | Financial Strength | State Farm | |

| #8 | 7% | A++ | Coverage Options | Travelers | |

| #9 | 8% | A | Add-on Coverages | Liberty Mutual |

| #10 | 10% | A+ | Small Businesses | The Hartford |

For the most competitive rates and reliable service, USAA, Progressive, and Geico are your best choices.

- The best Hickory, North Carolina auto insurance rates start at $135/month

- USAA is the top pick for the best Hickory, North Carolina auto insurance

- Tailored coverage options for unique needs in Hickory, North Carolina

#1 – USAA: Top Overall Pick

Pros

- Specialized Military Support: USAA auto insurance review shows that the company offers the best auto insurance in Hickory, North Carolina, for military members with tailored solutions and benefits.

- Comprehensive Coverage Options: Provides a broad range of coverage options, making it a top choice for those seeking the best auto insurance in Hickory, North Carolina.

- High Customer Satisfaction: USAA is known for high customer satisfaction, ensuring reliable and high-quality auto insurance services in Hickory, North Carolina.

Cons

- Eligibility Restrictions: USAA’s services are limited to military members and their families, excluding others from accessing the best auto insurance in Hickory, North Carolina.

- Limited Physical Locations: Operates mainly online and by phone, which might not suit those looking for in-person service for the best auto insurance in Hickory, North Carolina.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Coverage Options

Pros

- Wide Coverage Choices: Progressive offers a diverse range of coverage options, making it a strong contender for the best auto insurance in Hickory, North Carolina.

- Snapshot Program: Their Snapshot program can provide discounts based on driving habits, offering potential savings on the best auto insurance in Hickory, North Carolina. Learn more in our Progressive auto insurance review.

- Advanced Online Tools: Features robust online tools and apps, making it easier to manage your policy and claims for the best auto insurance in Hickory, North Carolina.

Cons

- Inconsistent Customer Service: Some customers report varying experiences with Progressive’s customer service, which may affect the overall perception of the best auto insurance in Hickory, North Carolina.

- Rate Fluctuations: Progressive’s rates can change significantly based on personal factors, potentially leading to unpredictable costs for the best auto insurance in Hickory, North Carolina.

#3 – Geico: Best for Senior Discounts

Pros

- Senior Discounts: As per our Geico auto insurance review, the company offers discounts for senior drivers, making it a cost-effective option for the best auto insurance in Hickory, North Carolina.

- Strong Online Presence: Geico’s user-friendly online platform and mobile app help manage policies efficiently, supporting their reputation for the best auto insurance in Hickory, North Carolina.

- Affordable Rates: Known for competitive rates, Geico often provides some of the lowest premiums, making it a leading choice for the best auto insurance in Hickory, North Carolina.

Cons

- Claims Handling Issues: Some customers experience delays and complications with Geico’s claims process, which may impact its standing as the best auto insurance in Hickory, North Carolina.

- Limited Personal Touch: Geico’s focus on online and phone interactions might not appeal to those seeking a personal touch in their auto insurance services in Hickory, North Carolina.

#4 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards Program: American Family offers a rewards program for long-term customers, enhancing its appeal as a top choice for the best auto insurance in Hickory, North Carolina.

- Innovative Coverage Options: Provides unique coverage options such as ride-share insurance, making it a versatile option for the best auto insurance in Hickory, North Carolina.

- Customer-Centric Policies: Emphasizes flexible payment options and customer-friendly policies, contributing to its reputation for the best auto insurance in Hickory, North Carolina. Unlock details in our American Family auto insurance review.

Cons

- Limited Discount Opportunities: American Family may offer fewer discount options compared to competitors, potentially affecting its overall value as the best auto insurance in Hickory, North Carolina.

- Customer Service Variability: Mixed reviews on customer service can impact perceptions of American Family as the best auto insurance provider in Hickory, North Carolina.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Local Agents

Pros

- Local Agent Network: Allstate’s network of local agents provides personalized service, enhancing its reputation for the best auto insurance in Hickory, North Carolina.

- Comprehensive Coverage Options: Allstate auto insurance review offers a wide range of coverage options and exclusive add-ons, making it a top choice for the best auto insurance in Hickory, North Carolina.

- Drivewise Program: The Drivewise program rewards safe driving, offering potential savings for the best auto insurance in Hickory, North Carolina.

Cons

- Higher Premiums: Allstate’s insurance premiums can be higher compared to some other providers, which might affect its affordability as the best auto insurance in Hickory, North Carolina.

- Inconsistent Service Reviews: Customer feedback on service can be mixed, potentially impacting its standing as the best auto insurance provider in Hickory, North Carolina.

#6 – Nationwide: Best for Multi-Policy Savings

Pros

- Multi-Policy Savings: Nationwide offers significant savings for bundling multiple types of insurance, which contributes to its reputation for the best auto insurance in Hickory, North Carolina. See more details on our Nationwide auto insurance review.

- Vanishing Deductible Program: Their vanishing deductible program, which lowers deductibles over time for safe driving, enhances its appeal as the best auto insurance in Hickory, North Carolina.

- Customizable Coverage: Provides a range of customizable coverage options, making it a versatile choice for the best auto insurance in Hickory, North Carolina.

Cons

- Limited Discount Opportunities: Nationwide may offer fewer discounts compared to some competitors, which could affect its overall value as the best auto insurance in Hickory, North Carolina.

- Customer Service Issues: Reports of challenges with customer service, including delays in claims processing, might impact its reputation as the best auto insurance provider in Hickory, North Carolina.

#7 – State Farm: Best for Financial Strength

Pros

- Large Agent Network: State Farm’s extensive network of local agents offers personalized service, contributing to its reputation for the best auto insurance in Hickory, North Carolina.

- Generous Discounts: Based on our State Farm auto insurance review, the company provides substantial savings for bundling multiple policies, enhancing its value as the best auto insurance in Hickory, North Carolina.

- Personalized Service: Known for its tailored advice and support through local agents, State Farm is a strong contender for the best auto insurance in Hickory, North Carolina.

Cons

- Higher Premiums: Premiums with State Farm can be higher compared to some competitors, which may affect its overall affordability as the best auto insurance in Hickory, North Carolina.

- Customer Service Challenges: Some customers report difficulties with customer service and claims handling, which could impact its status as the best auto insurance provider in Hickory, North Carolina.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Coverage Options

Pros

- Wide Range of Coverage: Travelers offers extensive coverage options, including specialized protections, making it a top choice for the best auto insurance in Hickory, North Carolina.

- Discounts for Safety Features: Provides discounts for cars equipped with advanced safety features, enhancing its appeal as the best auto insurance in Hickory, North Carolina.

- Customizable Policies: Allows for extensive policy customization, meeting various needs and preferences for the best auto insurance in Hickory, North Carolina. Unlock details in our Travelers auto insurance review.

Cons

- Limited Discount Options: May offer fewer discount opportunities compared to other insurers, which might affect its value as the best auto insurance in Hickory, North Carolina.

- Service Variability: Customer service experiences can vary, with some reports of delays and issues with claims, potentially impacting its reputation as the best auto insurance provider in Hickory, North Carolina.

#9 – Liberty Mutual: Best for Add-on Coverages

Pros

- Customizable Add-Ons: Liberty Mutual offers a range of add-on coverages, such as accident forgiveness, making it a flexible option for the best auto insurance in Hickory, North Carolina.

- Safe Driving Discounts: Provides discounts for safe driving behaviors, contributing to its appeal as the best auto insurance in Hickory, North Carolina. Discover more about offerings in our Liberty Mutual auto insurance review.

- Flexible Payment Plans: Offers various payment options to accommodate different financial situations, enhancing its suitability as the best auto insurance in Hickory, North Carolina.

Cons

- Higher Premiums: Insurance premiums with Liberty Mutual can be higher compared to other providers, potentially affecting its overall affordability as the best auto insurance in Hickory, North Carolina.

- Customer Service Concerns: Some customers report issues with Liberty Mutual’s customer service, including claims handling, which could impact its standing as the best auto insurance provider in Hickory, North Carolina.

#10 – The Hartford: Best for Small Businesses

Pros

- Business Insurance Expertise: The Hartford specializes in small business insurance, offering tailored solutions that can extend to personal auto insurance for the best coverage in Hickory, North Carolina.

- Safe Driving Discounts: As outlined by our The Hartford auto insurance review, the company provides discounts based on safe driving practices, contributing to its reputation for the best auto insurance in Hickory, North Carolina.

- Tailored Business Policies: Offers comprehensive insurance solutions that can be adapted for personal use, enhancing its appeal for the best auto insurance in Hickory, North Carolina.

Cons

- Focus on Business Insurance: The Hartford’s emphasis on business insurance might limit options for personal auto insurance, affecting its overall suitability as the best auto insurance in Hickory, North Carolina.

- Mixed Service Reviews: Customer service reviews are varied, with some reports of difficulties in claims and support, potentially impacting its status as the best auto insurance provider in Hickory, North Carolina.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance in Hickory, North Carolina

In Hickory, North Carolina, having the right auto insurance is essential for both legal compliance and personal protection. The state requires minimum auto insurance coverage that includes $30,000 in bodily injury liability per person and $60,000 per accident to cover medical expenses if you’re found at fault. Additionally, drivers must carry $25,000 in property damage liability to cover damages to other vehicles or property.

USAA stands out as the best choice for auto insurance with unmatched coverage options and exceptional service for its members.Dani Best Licensed Insurance Producer

While the minimum auto insurance protects you from legal penalties, many drivers opt for additional coverage to safeguard against larger accidents and financial risks. Whether you’re navigating city streets or backroads, having the right level of insurance provides peace of mind and keeps you road-ready.

Hickory, North Carolina Auto Insurance Monthly Rates by Providers & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $67 | $150 |

| American Family | $65 | $146 |

| Geico | $60 | $145 |

| Liberty Mutual | $72 | $165 |

| Nationwide | $68 | $150 |

| Progressive | $62 | $140 |

| State Farm | $66 | $155 |

| The Hartford | $74 | $170 |

| Travelers | $64 | $160 |

| USAA | $56 | $135 |

The table compares Hickory, North Carolina auto insurance rates by coverage level. USAA offers the lowest minimum coverage at $56, while The Hartford is highest at $74. For full coverage, USAA is again cheapest at $135, with The Hartford most expensive at $170. Geico and Progressive also provide competitive rates for both coverage types.

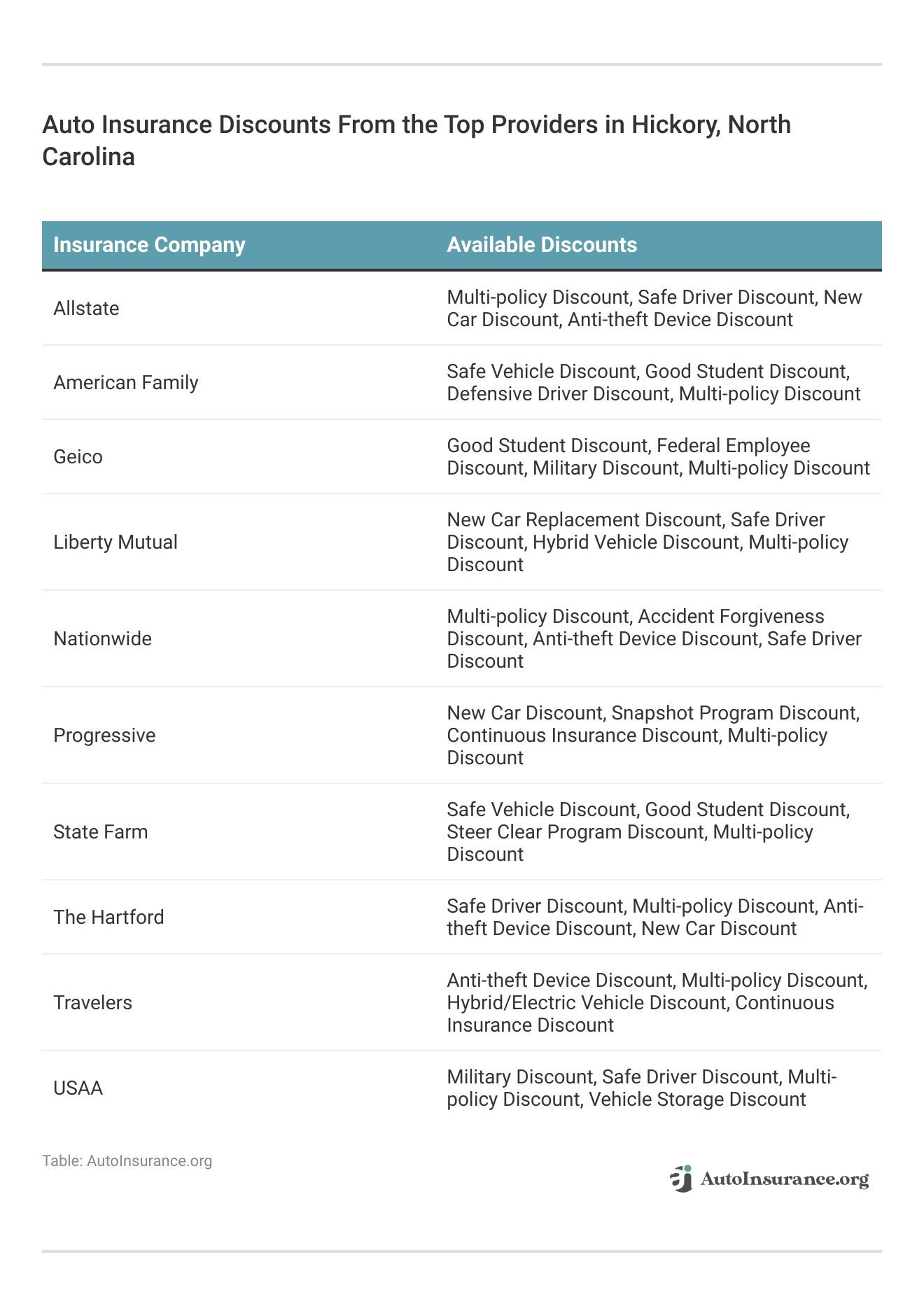

The table shows different ways to save money from top insurance companies. Each company has common deals like discounts for having multiple policies or being a safe driver, but also special benefits. For instance, Liberty Mutual gives better rates to people with hybrid cars, and USAA offers special discounts to military members.

No matter if you’re a student, a first-time car owner, or want coverage that doesn’t increase after an accident, this table points out the discounts that can reduce your insurance cost in Hickory, North Carolina.

Hickory, North Carolina Auto Insurance by Age, Gender, and Marital Status

When determining how much car insurance you need in Hickory, North Carolina, it’s crucial to understand how various factors influence pricing. Demographics such as age, gender, and marital status significantly impact the cost of coverage. In the following sections, we break down how major insurers adjust their rates based on these variables, helping you find the most affordable options tailored to your unique profile.

Hickory, North Carolina Auto Insurance Monthly Rates by Age, Gender & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $461 | $461 | $378 | $378 | $1,119 | $1,119 | $470 | $470 |

| Geico | $205 | $201 | $202 | $199 | $383 | $379 | $180 | $179 |

| Liberty Mutual | $147 | $147 | $153 | $153 | $263 | $263 | $147 | $147 |

| Nationwide | $195 | $195 | $195 | $195 | $333 | $333 | $195 | $195 |

| Progressive | $145 | $145 | $133 | $133 | $336 | $336 | $161 | $161 |

| State Farm | $192 | $192 | $166 | $166 | $284 | $284 | $237 | $237 |

| Travelers | $215 | $215 | $213 | $213 | $368 | $368 | $220 | $220 |

These figures highlight the annual costs for various demographic groups, showcasing the distinct pricing strategies used by each provider. From the steep premiums for young drivers to the more moderate rates for experienced drivers, every factor plays a crucial role in shaping the final cost.

Hickory, North Carolina Auto Insurance for Teen Drivers

Securing affordable auto insurance for teenage drivers in Hickory, North Carolina can be challenging. To help you navigate this, we’ve compiled a comparison of annual insurance rates for 17-year-old drivers in the area. The table below outlines the cost differences between various top insurance companies:

Hickory, North Carolina Teen Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $461 | $461 |

| Geico | $205 | $201 |

| Liberty Mutual | $147 | $147 |

| Nationwide | $195 | $195 |

| Progressive | $145 | $145 |

| State Farm | $192 | $192 |

| Travelers | $215 | $215 |

This comparison reveals striking differences in insurance premiums across various providers. Some insurers offer significantly lower rates, showcasing impressive savings compared to others with much higher costs. The disparity in premiums underscores the potential for substantial savings with more affordable options.

Hickory, North Carolina Auto Insurance for Seniors

Finding affordable auto insurance as a senior in Hickory, North Carolina, is crucial for managing your budget effectively. The table below highlights the annual average rates for auto insurance for married 60-year-old drivers in Hickory. By comparing the costs from various top providers, you can see how each company’s rates stack up.

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $470 | $470 |

| Geico | $180 | $179 |

| Liberty Mutual | $147 | $147 |

| Nationwide | $195 | $195 |

| Progressive | $161 | $161 |

| State Farm | $237 | $237 |

| Travelers | $220 | $220 |

Understanding the cost differences in auto insurance for seniors in Hickory, North Carolina, is essential for making an informed decision. By reviewing the rates, you can identify the most affordable options and ensure that you get the best coverage for your needs without compromising your budget.

Hickory, North Carolina Auto Insurance By Driving Record

Your driving record plays a crucial role in determining your auto insurance premiums. In Hickory, North Carolina, the cost of coverage varies significantly depending on whether you have a clean record or past infractions such as accidents, DUIs, or speeding violations. The following comparison highlights how annual insurance rates change with different driving histories across several leading insurance providers. To expand your knowledge, refer to our comprehensive handbook titled “How Auto Insurance Companies Check Driving Records.

Hickory, North Carolina Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $330 | $578 | $1,075 | $445 |

| Geico | $131 | $193 | $461 | $179 |

| Liberty Mutual | $106 | $136 | $332 | $136 |

| Nationwide | $135 | $175 | $432 | $175 |

| Progressive | $93 | $135 | $416 | $131 |

| State Farm | $117 | $170 | $423 | $170 |

| Travelers | $151 | $199 | $471 | $195 |

These figures reveal the impact of various driving offenses on insurance rates, providing insight into how each insurer adjusts premiums based on your driving history. Compare these rates to find the best coverage options in Hickory for your specific driving record.

Hickory, North Carolina Auto Insurance Rates After a DUI

It may be challenging to compare rates following a DUI, particularly in Hickory, North Carolina. But one thing you do know is a DUI is certainly going to raise those premium rates. Comparing rates from a wide range of providers might be needed to be sure to get the lowest rate.

The following shows a full breakdown of annual auto insurance rates after a DUI for several of the larger insurance companies in Hickory. You will understand with this information what best suits your budget and needs.

| Insurance Company | One DUI |

|---|---|

| Allstate | $1,075 |

| Geico | $461 |

| Liberty Mutual | $332 |

| Nationwide | $432 |

| Progressive | $416 |

| State Farm | $423 |

| Travelers | $471 |

By reviewing these rates, you can make a more informed decision on which insurance company offers the most competitive pricing for your situation, helping you manage the financial impact of a DUI while maintaining necessary coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Hickory, North Carolina Auto Insurance By Credit History

Here, you can observe the impact of credit scores on annual auto insurance rates from various companies. Geico, Liberty Mutual, and State Farm present some of the most favorable rates, particularly for those with good credit scores. Conversely, Allstate’s rates remain higher across the board.

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $821 | $533 | $467 |

| Geico | $261 | $240 | $222 |

| Liberty Mutual | $178 | $178 | $178 |

| Nationwide | $229 | $229 | $229 |

| Progressive | $216 | $189 | $176 |

| State Farm | $308 | $197 | $154 |

| Travelers | $271 | $247 | $244 |

Explore how credit scores can affect your insurance premiums in Hickory. From steep costs for those with poor credit to more manageable rates for those with good credit, the contrast is striking. This insight can help you navigate your options and find the best deal tailored to your financial profile.

Hickory, North Carolina Auto Insurance Rates By ZIP Code

Auto insurance rates by ZIP code in Hickory, North Carolina can vary. Compare the annual cost of auto insurance by ZIP code in Hickory, North Carolina to see how car insurance rates are affected by location.

| ZIP Code | Rates |

|---|---|

| 28602 | $250 |

This data highlights the significant impact of your ZIP code on auto insurance costs, underscoring the need to consider location-specific rates when seeking the most affordable coverage.

Hickory, North Carolina Auto Insurance Rates By Commute

Navigating the roads of Hickory, North Carolina, comes with its own set of costs, and your daily commute can greatly influence your auto insurance premiums. From short, 10-mile jaunts to lengthier 25-mile treks, your driving distance plays a pivotal role in determining how much you’ll pay for coverage.

Dive into the details below to discover how various insurance companies stack up, offering the most competitive rates based on your commute length.

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $607 | $607 |

| Geico | $241 | $241 |

| Liberty Mutual | $178 | $178 |

| Nationwide | $229 | $229 |

| Progressive | $194 | $194 |

| State Farm | $219 | $221 |

| Travelers | $254 | $254 |

By examining these figures, you can pinpoint which insurer offers the best bang for your buck, whether you’re clocking in a modest or more substantial commute. Adjust your insurance strategy based on your driving habits and make sure your wallet stays as happy as you are.To delve deeper, refer to our in-depth report titled “Cheap Usage-Based Auto Insurance.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best By Category: Cheapest Auto Insurance in Hickory, North Carolina

Finding the most affordable auto insurance in Hickory, North Carolina, is like discovering a hidden treasure. To simplify your search, we’ve crafted a detailed guide that highlights the best insurance options for various driving profiles. Whether you’re a teenager, a senior, or dealing with a speeding ticket, our table will help you uncover the most cost-effective coverage tailored to your unique needs.

Best Annual Auto Insurance Rates by Company in Hickory, North Carolina

| Category | Insurance Company |

|---|---|

| Teenagers | Liberty Mutual |

| Seniors | Progressive |

| Clean Record | Progressive |

| With 1 Accident | Progressive |

| With 1 DUI | Liberty Mutual |

| With 1 Speeding Violation | Progressive |

Embark on a journey through our creative chart of the cheapest auto insurance options in Hickory, North Carolina. This table serves as your ultimate guide to finding the best deals for every driving scenario, from fresh-faced teenagers to seasoned drivers and those with a traffic violation.

Picture it as a treasure map, leading you to the most affordable and fitting insurance solutions for your personal situation.

The Cheapest Hickory, North Carolina Auto Insurance Companies

What auto insurance companies in Hickory, North Carolina are the cheapest? We’ve analyzed the top insurance providers in the area to help you find the most budget-friendly options. If you’re wondering how to lower auto insurance rates, whether you’re a new driver or just looking to save on your current policy, comparing the annual rates from these leading companies will guide you to the best deals for your needs.

The Cheapest Hickory, North Carolina Auto Insurance Companies

| Insurance Company | Rates |

|---|---|

| Allstate | $607 |

| Geico | $241 |

| Liberty Mutual | $178 |

| Nationwide | $229 |

| Progressive | $194 |

| State Farm | $220 |

| Travelers | $254 |

This detailed comparison highlights the average annual rates from various top insurance providers. Liberty Mutual offers the most competitive rate, making it the most economical choice, while Allstate presents the highest annual cost. Use this information to make an informed decision and secure the best auto insurance deal in Hickory.

Factors Influencing Auto Insurance Rates in Hickory, North Carolina

Auto insurance rates in Hickory, North Carolina, can vary widely based on several factors that affect auto insurance rates. Local traffic patterns, the frequency of accidents, and vehicle theft rates are among the primary contributors.

USAA delivers superior auto insurance with tailored benefits and top-notch support, making it the best choice for those eligible.Kristen Gryglik Licensed Insurance Agent

Weather conditions, regional crime statistics, and road infrastructure also play significant roles in shaping insurance premiums. By understanding these factors, you can make more informed decisions and find ways to lower your insurance costs.

Hickory Commute Time

Commute times can significantly influence auto insurance rates, as longer commutes often lead to higher insurance costs due to increased exposure to road risks. In Hickory, North Carolina, the average commute time is approximately 19.6 minutes, based on data from City-Data.

This average commute duration is relatively moderate, which can impact auto insurance rates by presenting a balance between the risks associated with longer commutes typically seen in larger cities and the lower risk factors found in more rural areas.

Therefore, Hickory drivers may experience insurance costs that reflect this middle ground, balancing urban traffic challenges with the safety of a less congested environment.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Hickory, North Carolina Auto Insurance Quotes

Before committing to an auto insurance policy in Hickory, North Carolina, it’s crucial to compare quotes from multiple insurance companies to find the best coverage at the most competitive rates. By entering your ZIP code below, you can easily obtain free, personalized auto insurance quotes based on Hickory’s local rates and insurance market conditions.

This comparison will help you evaluate different policy options, coverage levels, and pricing structures, ensuring that you choose the insurance plan that best meets your needs and budget. Don’t miss out on potential savings and optimal coverage—start comparing quotes today!

Frequently Asked Questions

Which companies offer the best Hickory, North Carolina auto insurance rates?

Top companies that offer the best Hickory, North Carolina auto insurance rates include USAA, Progressive and Geico. These insurers are known for their competitive pricing, discounts, and strong customer service, making them ideal options for drivers in Hickory.

What factors affect the cost of the best Hickory, North Carolina auto insurance?

Several factors influence the cost of the best Hickory, North Carolina auto insurance, including your driving record, vehicle type, age, coverage level, and even the specific neighborhood within Hickory. Insurers also consider credit scores, annual mileage, and claims history.

To expand your knowledge, refer to our comprehensive handbook titled “How Annual Mileage Affects Your Auto Insurance Rates.”

How can I lower my premiums for the best Hickory, North Carolina auto insurance?

To lower your premiums for the best Hickory, North Carolina auto insurance, consider raising your deductible, maintaining a good driving record, and asking about available discounts. Shopping around and comparing rates from multiple companies can also help you find more affordable coverage.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

What is full auto coverage in North Carolina?

Full coverage insurance in North Carolina is usually defined as a policy that provides more than the state’s minimum liability coverage, which is $30,000 in bodily injury coverage per person, up to $60,000 per accident, and $25,000 in property damage coverage.

How can I find the best Hickory, North Carolina auto insurance discounts?

To find the best Hickory, North Carolina auto insurance discounts, look for companies offering multi-policy savings, good driver discounts, or usage-based programs. Additionally, bundling home and auto insurance or maintaining a clean driving record can reduce your rates.

For more information, read our article titled “Auto Insurance Discounts to Ask for.”

Why is North Carolina car insurance so expensive?

In North Carolina, weather events like severe storms, tropical cyclones, and droughts are becoming increasingly common. These weather events cause insurers to pay out a higher number of claims, which tend to be more expensive and less predictable. As a result, they have to raise rates to keep pace.

What is an insurance premium?

An insurance premium is the amount you pay each month (or each year) to keep your insurance policy active. Your premium amount is determined by many factors, including risk, coverage amount and more depending on the type of insurance you have.

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool below.

How much does insurance increase after an accident in North Carolina?

Even those not-at-fault can expect their car insurance premium to rise by about 4% following a crash. On average, car insurance premiums go up 49%, or $348 per year post-accident. There may be exceptions based on factors such as the state, insurance provider, extent of damage, fault, and accident history.

What should I look for in the best Hickory, North Carolina auto insurance policy?

When searching for the best Hickory, North Carolina auto insurance policy, consider the level of coverage, the insurer’s reputation, customer reviews, and available discounts. Ensure the policy includes comprehensive, collision, and liability coverage to fully protect your vehicle and finances.

To enhance your understanding, explore our comprehensive resource on insurance titled “Types of Auto Insurance.”

What coverage is required for the best Hickory, North Carolina auto insurance?

The minimum coverage required for the best Hickory, North Carolina auto insurance includes liability coverage of at least 30/60/25. This means $30,000 per person for bodily injury, $60,000 per accident, and $25,000 for property damage. However, opting for higher coverage may provide better protection.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.