Best Kia Stinger Auto Insurance in 2026 (Top 10 Companies Ranked)

Secure the best Kia Stinger auto insurance from State Farm, Allstate, and Nationwide, with rates as low as $46 per month. They are the top choice for competitive pricing and significant discounts, making them top choices for Kia Stinger insurance price comparisons. Discover the best options for your needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated July 2024

Company Facts

Full Coverage for Kia Stinger

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Kia Stinger

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Kia Stinger

A.M. Best Rating

Complaint Level

Pros & Cons

The best Kia Stinger auto insurance providers are State Farm, Allstate, and Nationwide, with rates starting at $46 per month. These companies offer the most competitive prices, considering multiple factors. Curious why is Kia Stinger insurance so expensive? Discover how these top picks ensure you get the best value.

Another key topic discussed in the article is understanding coverage options. It explains how different coverage levels can impact the overall cost of auto insurance and highlights the importance of choosing the right protection for your Kia Stinger. This section helps you make informed decisions about your coverage needs.

Our Top 10 Company Picks: Best Kia Stinger Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 15% B Many Discounts State Farm

#2 12% A+ Add-on Coverages Allstate

#3 10% A+ Usage Discount Nationwide

#4 18% A++ Military Savings USAA

#5 14% A++ Cheap Rates Geico

#6 11% A Online App AAA

#7 16% A+ Online Convenience Progressive

#8 13% A++ Accident Forgiveness Travelers

#9 17% A Customizable Polices Liberty Mutual

#10 19% A Local Agents Farmers

Uncover affordable auto insurance rates from the top providers by entering your ZIP code above.

- Discover Discounts available for Kia Stinger drivers

- State Farm is the top pick for competitive rates and comprehensive coverage

- Kia Stinger insurance is costly due to high performance and repair expenses

#1 – State Farm: Top Overall Pick

Pros

- Comprehensive Coverage Options: As mentioned in our State Farm auto insurance review, State Farm offers a variety of comprehensive coverage options tailored for the Kia Stinger, ensuring that drivers have robust protection for their high-performance vehicle.

- Customizable Policies: State Farm allows Kia Stinger owners to customize their insurance policies to fit their specific needs, providing flexibility in coverage options and deductibles to better suit individual preferences.

- Competitive Rates for Mature Drivers: State Farm provides competitive rates, especially for mature drivers with good driving records, making it an affordable choice for insuring the Kia Stinger at around $135 per month.

Cons

- Higher Premiums for Young Drivers: Young drivers insuring a Kia Stinger may face higher premiums with State Farm, making it a less cost-effective option for this demographic.

- Limited Discounts: Compared to other insurers, State Farm offers fewer discounts specific to the Kia Stinger, potentially leading to higher overall insurance costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Add-on Coverages

Pros

- Wide Range of Discounts: Allstate offers a broad range of discounts for Kia Stinger drivers, including safe driver discounts and multi-policy discounts, which can significantly reduce insurance costs. Learn more about their discounts in our Allstate auto insurance review.

- Customizable Coverage: Allstate allows Kia Stinger owners to customize their coverage options, ensuring they get the specific protection they need for their sports sedan.

- Strong Financial Stability: With a strong financial stability rating, Allstate ensures Kia Stinger owners can rely on them for prompt and fair claim settlements.

Cons

- Higher Base Premiums: At $165 per month, Allstate’s base premiums for Kia Stinger insurance are higher compared to some other insurers, which might not be ideal for budget-conscious drivers.

- Average Customer Service: While Allstate provides decent customer service, it is not rated as highly as some competitors, which could be a drawback for Kia Stinger owners requiring frequent support.

#3 – Nationwide: Best for Usage Discount

Pros

- Vanishing Deductible Program: Nationwide offers a vanishing deductible program that rewards Kia Stinger drivers for safe driving by reducing their deductible over time.

- Broad Coverage Options: Nationwide provides extensive coverage options tailored for the Kia Stinger, ensuring that drivers have comprehensive protection for their vehicle.

- Strong Customer Satisfaction: Nationwide has high customer satisfaction ratings, ensuring that Kia Stinger owners receive reliable service and support when needed. For more information, read our Nationwide auto insurance review.

Cons

- High Monthly Premiums: At $199 per month, Nationwide’s insurance premiums for the Kia Stinger are relatively high, making it less affordable for some drivers.

- Fewer Discounts for Young Drivers: Young drivers may find fewer discount options with Nationwide, resulting in higher overall insurance costs for the Kia Stinger.

#4 – USAA: Best for Military Savings

Pros

- Lowest Premium Rates: As outlined in USAA auto insurance review, the company offers the lowest premium rates at $116 per month for Kia Stinger insurance, making it the most affordable option among competitors.

- Exceptional Customer Service: USAA is renowned for its exceptional customer service, providing Kia Stinger owners with top-notch support and efficient claim processing.

- Exclusive Military Discounts: USAA offers exclusive discounts for military members and their families, making Kia Stinger insurance even more affordable for eligible individuals.

Cons

- Membership Restrictions: USAA is only available to military members, veterans, and their families, limiting its accessibility for some Kia Stinger drivers.

- Limited Local Offices: USAA has fewer local offices compared to other insurers, which might be inconvenient for Kia Stinger owners preferring in-person assistance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Geico: Best for Cheap Rates

Pros

- Competitive Rates for Good Drivers: Geico offers competitive rates at $182 per month, especially for Kia Stinger drivers with good driving records, helping to keep insurance costs manageable.

- Extensive Discount Options: As mentioned in our Geico auto insurance review, the company provides a wide range of discounts for Kia Stinger owners, including discounts for safety features and multi-vehicle policies.

- User-Friendly Online Tools: Geico’s user-friendly online tools and mobile app make it easy for Kia Stinger drivers to manage their policies and file claims efficiently.

Cons

- Higher Rates for High-Risk Drivers: Kia Stinger drivers with less-than-perfect driving records may face higher rates with Geico, making it a less ideal option for those with infractions.

- Average Customer Satisfaction: Geico’s customer satisfaction ratings are average, which might not meet the expectations of Kia Stinger owners seeking top-tier service.

#6 – AAA: Best for Online App

Pros

- Roadside Assistance Included: AAA includes comprehensive roadside assistance in their insurance policies, providing Kia Stinger drivers with added peace of mind and convenience.

- Multiple Discounts Available: As mentioned in our AAA auto insurance review, AAA offers multiple discounts for Kia Stinger insurance, such as safe driver and multi-policy discounts, helping to reduce overall costs.

- Reputation for Reliability: Known for its reliability, AAA ensures Kia Stinger owners receive dependable service and support, especially in emergency situations.

Cons

- Membership Required: AAA insurance requires a membership, which adds an additional cost for Kia Stinger drivers not already members of the organization.

- Higher Rates for Urban Drivers: Kia Stinger drivers in urban areas may face higher rates with AAA due to increased risk factors associated with city driving.

#7 – Progressive: Best for Online Convenience

Pros

- Usage-Based Insurance Program: Progressive’s Snapshot program allows Kia Stinger drivers to save money based on their actual driving habits, potentially lowering insurance costs.

- Comprehensive Coverage Options: As mention in Progressive auto insurance review, Progressive offers a wide range of coverage options tailored for the Kia Stinger, ensuring drivers can select the protection they need.

- Strong Online Presence: Progressive’s robust online presence and mobile app provide Kia Stinger owners with convenient policy management and claims processing.

Cons

- Higher Rates for High-Mileage Drivers: Kia Stinger drivers who log a lot of miles may face higher premiums with Progressive, making it less suitable for frequent travelers.

- Mixed Customer Service Reviews: Progressive has mixed reviews for customer service, which could be a concern for Kia Stinger owners needing consistent support.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Accident Forgiveness

Pros

- Comprehensive Coverage Packages: Travelers offers comprehensive coverage packages that are ideal for Kia Stinger drivers seeking extensive protection for their vehicle.

- Good Claims Handling: As outlined in our Travelers auto insurance review, Travelers is known for its efficient claims handling process, ensuring Kia Stinger owners experience minimal hassle during claims.

- Variety of Discount Options: Travelers provides a variety of discount options for Kia Stinger insurance, including safe driver and multi-policy discounts, which can lower premiums.

Cons

- Highest Premium Rates: At $276 per month, Travelers has the highest premium rates for Kia Stinger insurance, which might be a significant financial burden for some drivers.

- Limited Availability: Travelers insurance is not available in all areas, potentially limiting access for some Kia Stinger owners seeking their coverage.

#9 – Liberty Mutual: Best for Customizable Polices

Pros

- Better Car Replacement: Liberty Mutual offers a better car replacement program, ensuring Kia Stinger drivers can replace their car with a newer model in case of a total loss.

- Accident Forgiveness Program: Liberty Mutual’s accident forgiveness program can prevent premium increases for Kia Stinger owners after their first accident.

- Variety of Coverage Options: As mentioned in our Liberty Mutual auto insurance review, the company provides a variety of coverage options for the Kia Stinger, allowing drivers to tailor their policies to meet specific needs.

Cons

- Higher Monthly Premiums: At $201 per month, Liberty Mutual’s premiums for Kia Stinger insurance are relatively high, making it less affordable for some drivers.

- Average Customer Service Ratings: Liberty Mutual has average customer service ratings, which might not meet the expectations of Kia Stinger owners seeking superior service.

#10 – Farmers: Best for Local Agents

Pros

- Comprehensive Coverage Options: Farmers offers a wide range of comprehensive coverage options for the Kia Stinger, ensuring drivers have robust protection for their vehicle.

- Discounts for Bundling Policies: Farmers provides significant discounts for Kia Stinger drivers who bundle their auto insurance with other policies, such as home insurance.

- Good Customer Service: Farmers is known for good customer service, providing Kia Stinger owners with reliable support and efficient claims processing. Check out this page Farmers auto insurance review to know more details.

Cons

- Higher Premiums for Young Drivers: Young Kia Stinger drivers may face higher premiums with Farmers, making it less cost-effective for this demographic.

- Limited Online Tools: Farmers’ online tools and mobile app are less advanced compared to competitors, which could be a drawback for tech-savvy Kia Stinger owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kia Stinger Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Kia Stinger from various providers.

Kia Stinger Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $54 $163

Allstate $52 $165

Farmers $51 $157

Geico $64 $182

Liberty Mutual $66 $201

Nationwide $66 $199

Progressive $57 $177

State Farm $46 $135

Travelers $90 $276

USAA $37 $116

Compare Kia Stinger auto insurance rates from top providers to find the best deal. Get coverage that fits your budget and driving needs.

Kia Stinger Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $132 |

| Discount Rate | $78 |

| High Deductibles | $114 |

| High Risk Driver | $282 |

| Low Deductibles | $167 |

| Teen Driver | $483 |

Comparing Kia Stinger insurance rates highlights significant savings when opting for high deductibles and low-risk driver profiles. To find the best rates, consider your deductible options and driver category.

Read More: Auto Insurance for Different Types of Drivers

Kia Stingers are Expensive to Insure

The chart below details how Kia Stinger insurance rates compare to other sports cars like the Audi TTS, Cadillac ATS-V, and Ford Mustang.

Kia Stinger Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Audi R8 | $50 | $112 | $33 | $207 |

| Audi RS 7 | $44 | $92 | $33 | $183 |

| Audi TTS | $33 | $60 | $28 | $132 |

| Cadillac ATS-V | $34 | $70 | $33 | $150 |

| Chevrolet Camaro | $29 | $50 | $31 | $123 |

| Ford Mustang | $29 | $60 | $35 | $139 |

| Kia Stinger | $28 | $52 | $38 | $132 |

The Kia Stinger’s insurance costs are competitive when compared to similar sports cars, offering a balance of coverage and affordability. Evaluating comprehensive and collision rates can help you choose the best insurance option for your high-performance vehicle.

Read More: Cheap Audi Auto Insurance

Factors That Impact the Cost of Kia Stinger Insurance

You might have noticed that there is a multitude of factors that impact Kia Stinger auto insurance rates. Your age, location, driving record, and model year all play a role in what you will ultimately pay to insure the Kia Stinger.

Younger drivers, particularly teenagers, often face higher premiums due to their lack of experience and higher risk of accidents. In contrast, mature drivers with clean records typically enjoy lower rates.

Where you live also significantly influences your insurance costs; urban areas with higher traffic and crime rates tend to result in more expensive premiums compared to rural locations. Additionally, your driving history is crucial—those with a record of accidents or traffic violations can expect to pay more for coverage.

The model year of your Kia Stinger is another important factor, as newer models generally have higher insurance rates due to their increased value and repair costs. However, equipping your vehicle with advanced safety features can lead to a safety features auto insurance discount, helping to lower your overall premium.

Age of the Vehicle

The average Kia Stinger auto insurance rates are higher for newer models. For example, auto insurance rates for a 2023 Kia Stinger are higher compared to 2018 Kia Stinger rates.

Kia Stinger Auto Insurance Monthly Rates by Age of the Vehicle

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Kia Stinger | $260 | $518 | $342 | $1,420 |

| 2023 Kia Stinger | $272 | $536 | $360 | $1,448 |

| 2022 Kia Stinger | $284 | $554 | $378 | $1,476 |

| 2021 Kia Stinger | $296 | $572 | $396 | $1,504 |

| 2020 Kia Stinger | $308 | $590 | $414 | $1,532 |

| 2019 Kia Stinger | $320 | $608 | $432 | $1,560 |

| 2018 Kia Stinger | $332 | $626 | $450 | $1,588 |

As shown, the age of the Kia Stinger significantly impacts insurance costs, with newer models like the 2023 Stinger being more expensive to insure. Understanding these costs can help you make informed decisions when choosing your Kia Stinger.

Driver Age

Driver age can have a significant effect on Kia Stinger auto insurance rates. For example, 30-year-old drivers pay $6 more for Kia Stinger auto insurance than 40-year-old drivers.

Kia Stinger Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $620 |

| Age: 18 | $484 |

| Age: 20 | $300 |

| Age: 30 | $138 |

| Age: 40 | $132 |

| Age: 45 | $128 |

| Age: 50 | $121 |

| Age: 60 | $118 |

Driver age greatly impacts Kia Stinger auto insurance rates, with younger drivers paying significantly more. For the best rates, consider how age affects premiums and choose coverage accordingly.

Driver Location

Where you live can have a large impact on Kia Stinger insurance rates. For example, drivers in Houston may pay $97 per month more than drivers in Columbus.

Kia Stinger Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $226 |

| New York, NY | $208 |

| Houston, TX | $207 |

| Jacksonville, FL | $192 |

| Philadelphia, PA | $177 |

| Chicago, IL | $175 |

| Phoenix, AZ | $154 |

| Seattle, WA | $128 |

| Indianapolis, IN | $113 |

| Columbus, OH | $110 |

Where you live significantly affects Kia Stinger insurance rates, with some cities costing much more than others. Consider your location to find the most affordable premiums.

Your Driving Record

Your driving record can have an impact on the cost of Kia Stinger auto insurance. Teens and drivers in their 20s see the highest jump in their Kia Stinger auto insurance rates with violations on their driving records.

Kia Stinger Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $620 | $930 | $1,240 | $775 |

| Age: 20 | $484 | $725 | $967 | $605 |

| Age: 30 | $300 | $450 | $600 | $375 |

| Age: 40 | $138 | $207 | $276 | $173 |

| Age: 50 | $132 | $198 | $264 | $165 |

| Age: 60 | $128 | $192 | $256 | $160 |

| Age: 50 | $121 | $181 | $242 | $151 |

| Age: 60 | $118 | $177 | $236 | $148 |

Drivers with accidents, tickets, and DUIs see much higher auto insurance rates than drivers with clean records. Avoid infractions to get the lowest rates possible.

Safety Ratings

The Kia Stinger’s top-tier safety ratings positively impact its auto insurance rates. Ensuring your vehicle’s safety features can help you qualify for auto insurance discounts.

Kia Stinger Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Kia Stinger’s top-tier safety ratings positively impact its auto insurance rates. Ensuring your vehicle’s safety features can help you qualify for auto insurance discounts.

Crash Test Ratings

Not only do good Kia Stinger crash test ratings mean you are better protected in a crash, but good crash ratings also mean cheaper Kia Stinger auto insurance rates.

Kia Stinger Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Kia Stinger 4 DR RWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2024 Kia Stinger 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2023 Kia Stinger 4 DR RWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2023 Kia Stinger 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2022 Kia Stinger 4 DR RWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2022 Kia Stinger 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2021 Kia Stinger 4 DR RWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2021 Kia Stinger 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2020 Kia Stinger 4 DR RWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2020 Kia Stinger 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2019 Kia Stinger 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2019 Kia Stinger 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2018 Kia Stinger 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2018 Kia Stinger 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

The Kia Stinger’s excellent crash test ratings contribute to both safety and lower insurance costs. Choosing a vehicle with high safety ratings can lead to significant savings on your auto insurance premiums.

Kia Stinger Safety Features

Good Kia Stinger safety features can result in insurers giving you auto insurance discounts. The safety features of the Kia Stinger are:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kia Stinger Finance and Insurance Cost

If you are financing a Kia Stinger, most lenders will require you to carry higher Kia Stinger coverage options including comprehensive coverage. So, be sure to shop around and compare Kia Stinger auto insurance quotes from the best auto insurance companies using our free tool below.

Compare rates, discounts, and quotes from numerous companies to find the most affordable Kia Stinger auto insurance.Jeff Root LICENSED INSURANCE AGENT

Additionally, consider bundling your Kia Stinger insurance with other policies to maximize savings. Understanding the full scope of your insurance needs can help you make an informed decision and protect your investment effectively.

Ways to Save on Kia Stinger Insurance

If you want to reduce the cost of your Kia Stinger insurance rates, follow these tips below:

- Take a refresher course as an older driver.

- Save money on young driver Kia Stinger insurance rates by mentioning grades or GPA.

- Buy an older Kia Stinger.

- Make sure you’re raising a safe driver.

- Avoid the temptation to file a claim for minor incidents.

Read More: Is it worth claiming a scratch on your auto insurance?

Raising your deductible and lowering coverage also lowers auto insurance rates. However, you’ll pay more out of pocket in an accident.

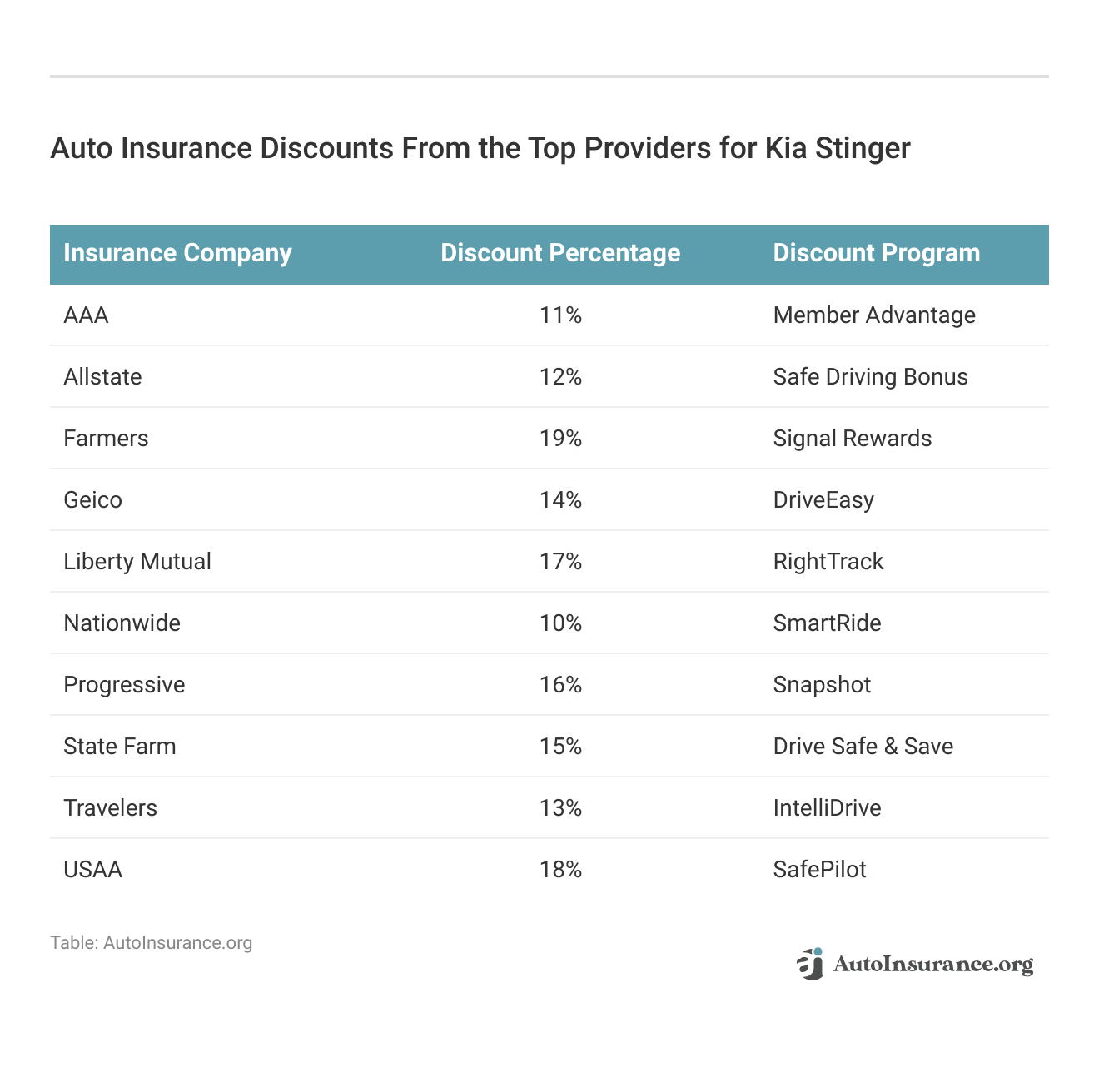

These discounts from top insurance providers for Kia Stinger offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Top Kia Stinger Insurance Companies

Who is the best auto insurance company for Kia Stinger insurance rates. While the actual rates you pay will depend on many factors, here are some of the top companies offering Kia Stinger auto insurance coverage (ordered by market share).

Top 10 Kia Stinger Auto Insurance Providers by Market Share

| Rank | Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 5% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

In addition, many of these companies offer discounts for security systems and other safety features that the Kia Stinger offers, helping you secure cheap Kia auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Free Kia Stinger Insurance Quotes Online

You can start comparing quotes for Kia Stinger auto insurance rates from some of the best auto insurance companies by using our free online tool now. This tool allows you to easily get insurance quotes tailored specifically for the Kia Stinger, ensuring you find the most competitive rates and coverage options available.

Whether you’re looking for comprehensive, collision, or liability coverage, getting multiple quotes will help you secure the best deal. Don’t miss the opportunity to save on your Kia Stinger insurance; get quotes today and see how much you could save.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Frequently Asked Questions

What is Kia Stinger auto insurance?

Kia Stinger auto insurance refers to the insurance coverage specifically designed for the Kia Stinger sports sedan. It provides financial protection in case of accidents, damages, theft, or other incidents involving the Kia Stinger.

Is auto insurance mandatory for a Kia Stinger?

Yes, auto insurance is mandatory for all vehicles, including the Kia Stinger. The specific insurance requirements may vary depending on your location and local regulations. It’s important to comply with the legal requirements and have the necessary insurance coverage for your Kia Stinger.

Read More: When did auto insurance become mandatory?

What types of coverage are available for Kia Stinger auto insurance?

Kia Stinger auto insurance typically offers a range of coverage options. These may include liability coverage (which is often required by law), collision coverage (for damages caused by collisions), comprehensive coverage (for non-collision-related damages like theft or vandalism), uninsured/underinsured motorist coverage, and personal injury protection (PIP) coverage.

Use our free comparison tool below to see what auto insurance quotes look like in your area.

How can I find affordable auto insurance for my Kia Stinger?

To find affordable auto insurance for your Kia Stinger, it’s recommended to shop around and obtain quotes from multiple insurance providers. Factors such as your driving record, age, location, and the coverage options you choose can affect the cost of insurance. Comparing quotes, considering available discounts, and maintaining a good driving record can help you find more affordable rates.

Are there any discounts available specifically for Kia Stinger auto insurance?

While specific discounts can vary among insurance providers, many companies offer discounts that may apply to Kia Stinger auto insurance. These could include discounts for safety features installed in the Kia Stinger, good driver discounts, multi-policy discounts (if you bundle your auto insurance with other policies), or loyalty discounts. It’s recommended to inquire about available discounts when obtaining insurance quotes.

Read More: How to Get a Customer Loyalty Auto Insurance Discount

Does the size or model year of the Kia Stinger affect insurance rates?

The size and model year of the Kia Stinger can potentially have an impact on insurance rates. Generally, sports sedans like the Kia Stinger may have higher insurance premiums due to factors such as higher repair costs and a higher likelihood of being driven at higher speeds.

Newer model years may also have higher insurance premiums due to the cost of replacement parts. However, the specific details can vary, so it’s best to consult with insurance providers to understand how these factors can impact your rates.

Can I use my Kia Stinger auto insurance for business purposes?

The coverage provided by your Kia Stinger auto insurance may have limitations when it comes to using the vehicle for business purposes. Personal auto insurance policies generally do not cover commercial use. If you intend to use your Kia Stinger for business purposes, such as ridesharing or delivery services, you may need to explore commercial auto insurance options.

It’s important to discuss your specific needs with your insurance provider to ensure you have the appropriate coverage.

Read More: Best Rideshare Auto Insurance

What should I do if I need to file an auto insurance claim for my Kia Stinger?

If you need to file an auto insurance claim for your Kia Stinger, you should contact your insurance provider as soon as possible. They will guide you through the claims process and provide instructions on what information or documentation is required. Be prepared to provide details about the incident, such as the date, time, location, and any necessary supporting evidence, such as photographs or witness statements.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.