How to Lower Your Auto Insurance Rates in 2026 (6 Simple Steps)

Lower your auto insurance rates by finding discounts, evaluating your policy, driving safely, and shopping for quotes. For example, enrolling in a usage-based insurance program could save you up to 40% on the coverage you need. Below, we'll explain ways to reduce monthly rates if your car insurance is too high.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Leslie Kasperowicz

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated January 2025

Lower your auto insurance rates by seeking out car insurance discounts, evaluating your policy, shopping for cheap quotes, and much more.

Many factors affect auto insurance rates, including your driving record, credit, and vehicle. While you can’t change certain factors, improving other areas leads to lower rates.

Now, let’s go through a list of easy ways to lower your car insurance rates. Save on auto insurance by entering your ZIP code above and comparing quotes.

- Step #1: Look for Discounts – Find insurers offering discounts available to you

- Step #2: Evaluate Your Policy – Consider changing coverages and/or your deductible

- Step #3: Drive Safely – Avoid accidents, tickets, and DUIs for cheaper coverage

- Step #4: Improve Your Credit – Good credit leads to lower rates

- Step #5: Consider Cheaper Car – Older/cheaper cars cost less to insure

- Step #6: Shop for Quotes – Compare cheap quotes from the top providers

Step #1 – Look for Discounts

If you’re wondering how to get lower car insurance rates, auto insurance discounts are a great place to start. Most companies offer numerous discounts based on the policy, driver, and vehicle. Additionally, many drivers qualify for multiple discounts and can bundle them for the most savings.

You may qualify for numerous discounts, including low mileage and driving courses, as well as discounts based on how you pay your bill. For example:

- You can get a low-mileage discount if you don’t drive a lot, since less time on the road equals lower accident risk.

- Some companies also give discounts to drivers who complete a defensive driving course, though you’ll usually need to be at least 55 to qualify.

- In addition, you can get discounts for paying your bill in full, signing up for automatic payments, and going paperless.

- Most car insurance companies give cheaper rates if you bundle insurance products such as auto, homeowners, renters, boat, RV, pet, and ATV insurance. (Read More: How to Get a Homeowners Auto Insurance Discount)

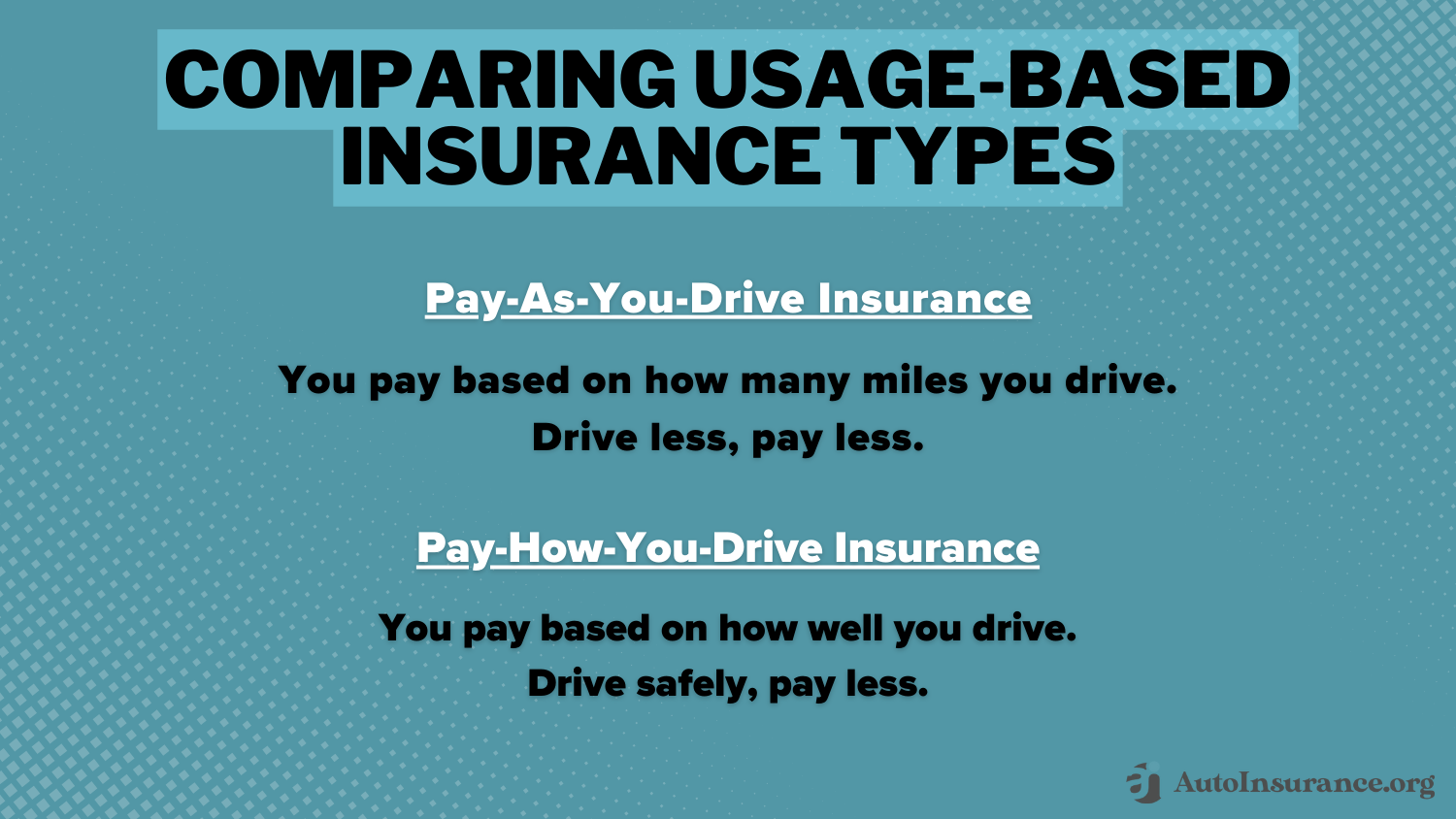

Many car insurance companies also offer usage-based car insurance programs that use telematics to monitor driving. These programs use an app to monitor specific driving behaviors like hard braking and offer a discount based on how safely you drive.

Each insurance company creates its own telematics program with different requirements and discounts. Check out the table below to compare usage-based insurance savings from the top providers:

Usage-Based Auto Insurance Discounts by Provider & Savings Amount

| Insurance Company | Program Name | Device Type | Sign-up Discount | Savings Potential |

|---|---|---|---|---|

| AAADrive | Mobile App | 15% | 30% |

| Drivewise | Mobile App | 10% | 40% | |

| KnowYourDrive | Mobile App or Plug-in | 10% | 20% | |

| DriveEasy | Mobile App | 20% | 25% | |

| RightTrack | Mobile App or Plug-in | 5% | 30% |

| Mile Auto | Neither | 20% | 40% | |

| SmartRide | Mobile App or Plug-in | 10% | 40% |

| Snapshot | Mobile App or Plug-in | $25 | 20% | |

| Drive Safe & Save | Mobile App or Plug-in | 5% | 50% | |

| TrueLane | Plug-in | 5% | 25% |

| IntelliDrive | Mobile App | 10% | 30% | |

| SafePilot | Mobile App | 5% | 20% |

Since not all discounts automatically apply to your policy, be sure to speak to your insurer to take advantage of all the discounts available to you.

While most car insurance companies won’t raise your rates if you score poorly, some companies increase rates if the program shows you aren’t driving safely. So, be sure to carefully consider the program before you sign up.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Step #2 – Evaluate Your Policy

Carefully consider the coverages on your car insurance policy to save extra money. For example, if you’re financing your vehicle, you could remove gap insurance after a certain amount of time.

While most experts recommend full coverage auto insurance, you could benefit from lower coverage depending on your situation. So, if you have an older car that isn’t worth much, you could drop full coverage, but ensure you can afford to pay for repairs out of pocket.

You could also remove some add-ons from your policy, such as roadside assistance and rental car reimbursement coverage. While the extras are good to have, removing them from your policy will save you money.

Another way to lower your car insurance rates is to raise your deductible. A deductible is an amount you pay before your insurance kicks in. Typically, deductibles range from $500 to $1,000. While a higher auto insurance deductible means you’ll pay more out of pocket in an accident, your car insurance rates will go down.

Step #3 – Drive Safely

Your driving record is one of the most significant factors determining car insurance rates. Tickets, accidents, and DUIs cause rates to skyrocket.

This table shows the average car insurance rates after a single ticket from top companies:

Full Coverage Auto Insurance Monthly Rates by Provider: One Ticket vs. Clean Record

Insurance Company One Ticket Clean Record

$108 $86

$188 $160

$136 $117

$105 $87

$119 $97

$58 $70

$173 $139

$106 $80

$212 $174

$137 $115

$140 $105

$96 $86

$277 $232

$136 $112

$134 $99

U.S. Average $147 $119

Drivers with a clean driving record pay significantly lower rates than drivers with tickets and accidents. Just one car accident can raise your rates, as seen in the table below:

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

Insurance Company Clean Record One Accident

$180 $220

$166 $225

$116 $176

$119 $97

$140 $198

$95 $132

$177 $234

$140 $161

$120 $186

$105 $150

$175 $230

$160 $200

U.S. Average $123 $172

Some insurers are extremely picky about covering drivers with a DUI on their record. Companies charge much higher rates for these drivers. Let’s take a look at rates with a DUI:

DUI Full Coverage Auto Insurance Monthly Rates vs. Clean Record by Provider

Insurance Company Clean Record One DUI

$86 $240

$160 $225

$117 $176

$97 $166

$139 $198

$80 $132

$174 $234

$115 $161

$105 $186

$86 $202

$112 $250

$99 $239

U.S. Average $119 $173

Maintaining a clean driving record is an easy way to get low car insurance rates, but don’t worry if you already have infractions on your record. Most states only allow insurance companies to increase rates for three to five years.

You save money on fines and higher rates and may also be eligible for additional car insurance discounts for maintaining a clean record.

Read More:

- Cheap Auto Insurance After a DUI

- Auto Insurance for Drivers With an Accident

- Best Auto Insurance Companies for Drivers With Speeding Tickets

Step #4 – Improve Your Credit

Many drivers don’t know that their credit score impacts their car insurance rates. Studies show that drivers with high credit scores are less likely to file claims since they can pay for damages out of pocket.

On the other hand, drivers with a low credit score file more claims and cannot typically pay for damages themselves.

This table shows average car insurance rates based on credit score:

Full Coverage Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $166 | $197 | $296 | |

| $116 | $136 | $203 | |

| $140 | $161 | $269 | |

| $82 | $100 | $148 | |

| $177 | $226 | $355 |

| $120 | $133 | $166 |

| $109 | $138 | $206 | |

| $91 | $118 | $200 | |

| $107 | $128 | $194 | |

| $71 | $90 | $136 |

Since a higher credit score equals lower car insurance rates, do everything possible to raise your score. Make on-time payments and use credit wisely to get better rates on everything from car insurance to mortgages.

In addition, periodically check your credit report to ensure it’s accurate. Report any inaccuracies immediately to improve your credit score.

Read More: How Credit Scores Affect Auto Insurance Rates

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Step #5 – Consider Cheaper Car

It should not be surprising that the type of car you own determines your car insurance rates. Drivers with newer or more expensive vehicles pay much higher rates for insurance since it costs more to repair or replace them. On the other hand, older cars or vehicles with a low MSRP cost less to insure.

Consider buying a cheaper or older car to keep rates low. For example, the Jeep Wrangler, Honda CR-V, and Ford F-150 have some of the cheapest car insurance rates. However, the Tesla Model S, BMW 7 Series, and Audi R8 have significantly higher rates.Daniel Walker Licensed Auto Insurance Agent

Instead, consider buying a less expensive car with advanced safety features to make the most of car insurance discounts.

Step #6 – Shop for Quotes

If you’ve exhausted all cost-saving measures with your current company, you should shop around for cheap coverage from the best auto insurance companies. Each company weighs your personal factors differently and offers different rates. For example, one company may overlook a fender bender while another will charge higher rates.

Here is a list of the top insurance companies and the average rates for minimum liability coverage:

Liability Auto Insurance Rates by Provider

Insurance Company Monthly Rates

$61

$44

$37

$53

$30

$67

$44

$39

$33

$38

$22

U.S. Average $45

We recommend comparing rates, ratings, and discounts from multiple car insurance companies to find the best coverage with the cheapest rates.

Rates can be especially high if you have a young driver on your auto policy.

Let’s take a look at rates for teenage drivers with the top insurance companies to get an idea of what young drivers will pay:

Teen Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

Insurance Company Age: 16 Female Age: 16 Male Age: 18 Female Age: 18 Male

$608 $638 $448 $519

$452 $456 $333 $371

$778 $742 $573 $603

$298 $312 $220 $254

$716 $778 $528 $633

$411 $476 $303 $387

$801 $814 $591 $662

$311 $349 $229 $284

$709 $897 $523 $729

Fortunately, there are ways to find cheaper car insurance rates for teenage drivers — simply shop for coverage from the companies with the cheapest teen auto insurance.

More About the Ways to Lower Your Auto Insurance Rates

Drivers wondering how to lower their auto insurance premiums can utilize car insurance discounts, improve their credit score, maintain a clean driving record, and buy an affordable vehicle for cheap premiums. Additionally, raise your deductibles and eliminate unnecessary coverages to keep rates low.

Rates vary from company to company, so enter your ZIP code into our free quote tool below to shop around to find the best rates. Compare multiple companies to see who offers the lowest rates and the best discounts.

Frequently Asked Questions

How do I lower my auto insurance rates?

While things like improving your credit score take time, there are quick ways to get cheaper car insurance rates.

Here are some ways to get lower rates quickly:

- Add car insurance discounts.

- Shop around.

- Raise your deductibles.

- Reduce coverage amounts.

- Bundle policies.

- Buy a vehicle that’s cheaper to insure.

- Maintain a clean driving record.

What factors increase car insurance rates?

Many factors impact car insurance rates, and each insurance company weighs them differently.

Factors that affect car insurance rates include the following:

- Age

- Driving record

- Credit score

- Coverage

- Vehicle

- ZIP code

If your rates are higher than average, it may be due to one of these factors. While factors like age can’t be changed, you can improve your credit score, clean up your driving record, and choose a less expensive vehicle to lower your rates.

At what age do car insurance rates decrease?

Typically, car insurance rates begin to decrease at age 25, once a driver gains experience behind the wheel and shows safe driving skills.

However, keep in mind that senior drivers may experience rate increases due to certain medical conditions.

To get started shopping for cheap insurance rates, enter your ZIP code into our free quote tool below.

What types of insurance can you skip?

The coverages you need depend on your specific situation. For example, drivers with older cars may only need liability coverage. On the other hand, drivers with newer leased cars need full coverage plus gap insurance.

In addition, drivers may skip add-ons like roadside assistance and rental car reimbursement, which increase rates.

Can you lower car insurance rates after an accident?

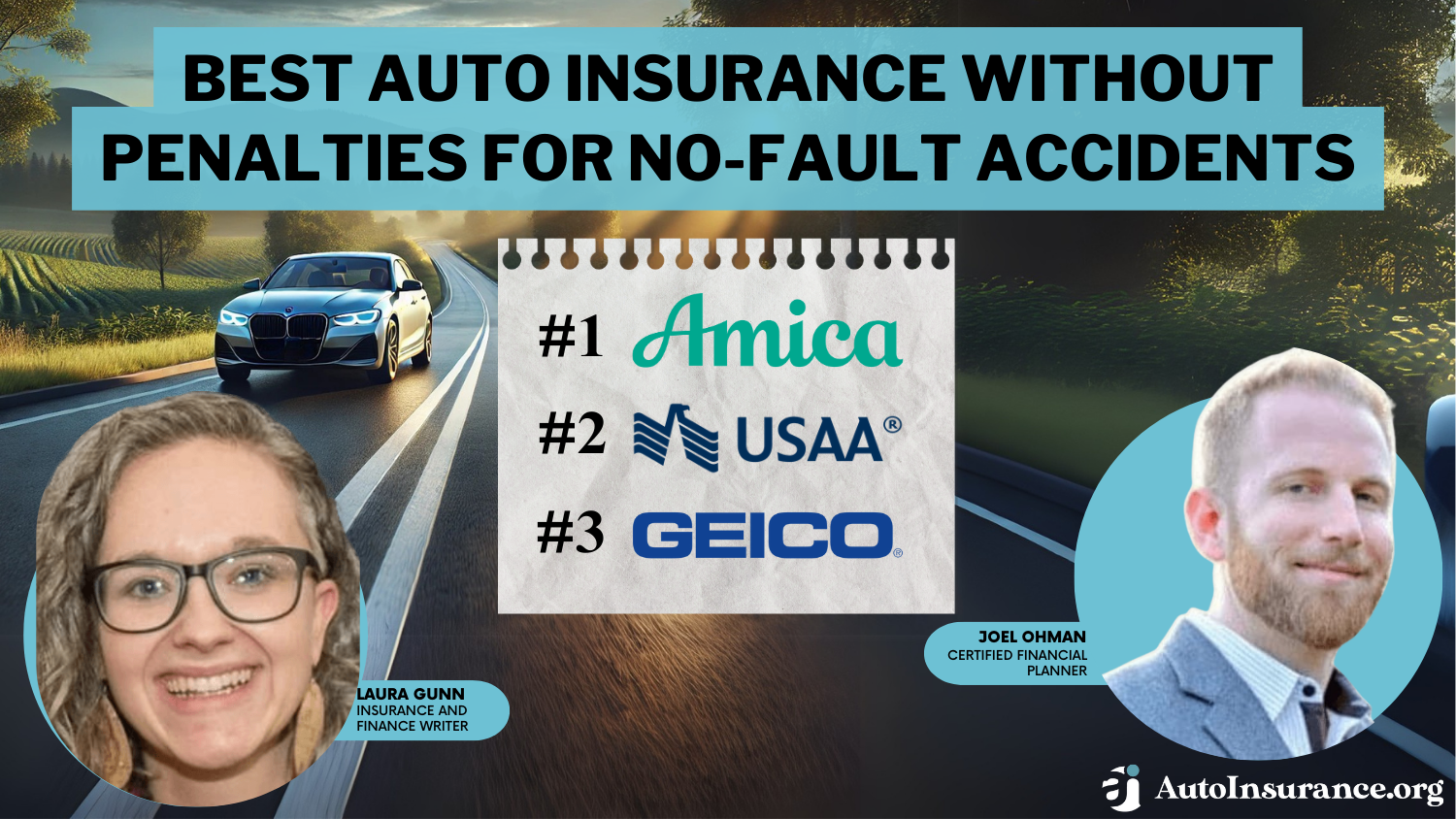

Many insurance companies offer accident forgiveness, which doesn’t raise rates after your first at-fault accident. Although most companies charge extra for this feature, a few provide it automatically.

Read More: Best Auto Insurance Companies for Accident Forgiveness

Drivers can also lower rates after an accident by reducing their coverage and raising their deductibles. However, these options increase out-of-pocket costs if you’re in another accident.

Remember, paying for damages yourself is always an option. It may be cheaper to pay for damages than to pay higher car insurance rates for years.

How do I lower my car insurance after a ticket?

Take a defensive driving course to get lower car insurance rates after a ticket. Most insurance companies offer a discount for attending the class, and many states allow you to remove points from your license with attendance.

Additionally, some car insurance companies are willing to overlook your first speeding ticket. However, that depends on the company and the infraction. For example, speeding in a school zone is much more dangerous than driving 10 miles an hour over the limit on the interstate.

The good news is that speeding tickets stop affecting your car insurance rates in three years in most states. So, maintain a clean driving record once the ticket is gone to get the lowest car insurance rates possible.

Can completing a defensive driving course help me lower my auto insurance rates?

Yes, completing a defensive driving course can potentially lead to lower auto insurance rates. Defensive driving courses provide drivers with additional skills and knowledge to anticipate and respond to potential hazards on the road. Some insurance companies offer discounts to drivers who have completed an approved defensive driving course. Contact your insurer to inquire about available discounts and approved courses in your area.

Learn More: How to Get a Defensive Driver Auto Insurance Discount

Should I consider bundling my auto insurance with other policies to save money?

Bundling your auto insurance with other policies, such as home or renters insurance, can often result in savings. Many insurance providers offer multi-policy discounts to customers who have multiple policies with the same company. Before bundling, compare the bundled rate with the combined costs of individual policies from different insurers to ensure you’re getting the best overall value.

To shop around for the best companies for bundling home and auto insurance, enter your ZIP code into our free quote comparison tool below.

How do I lower my car insurance with Geico?

Geico offers various discounts to help drivers save, such as a good driver, multi-vehicle, good student, defensive driving, federal employee, and safety feature discount. You can also reduce coverages and/or increase your deductible for cheaper rates.

Read More: Geico Auto Insurance Discounts

How do I lower my car insurance with Progressive?

With Progressive, drivers can save by qualifying for discounts, such as:

- Progressive Snapshot

- Good student discount

- Multi-policy discount

- Continuous insurance

- Online quote discount

Read More: Progressive Auto Insurance Discounts and Progressive Snapshot Review

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.