How to Get Multiple Auto Insurance Quotes in 2024

Most drivers pay an average of $123/mo for full coverage insurance, but the best insurance comparison sites can help you save on your rate. Is there a way to get multiple auto insurance quotes at once? Our experts share where to get multiple auto insurance quotes so you can compare auto insurance quickly.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Sep 12, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Sep 12, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Car insurance quotes can help you estimate how much you’ll pay for coverage

- An auto insurance quote will vary based on factors like your age, gender, location, and driving history

- You should be able to find a quote for car insurance coverage using a comparison tool online, by contacting an insurance agent, or via an individual company

Want to know where to get multiple auto insurance quotes? Car insurance quotes are beneficial because they give a good idea of how much you’ll pay for coverage and allow you to determine your area’s best auto insurance companies. Fortunately, learning how to get multiple auto insurance quotes is easy with a quote comparison tool.

Read on to learn how to find the best deals on coverage by shopping around and comparing multiple quotes. If you want to jump right into comparing multiple car insurance quotes, use our free quote comparison tool to get started.

- Affordable Auto Insurance

- 10 Cheapest Auto Insurance Companies in 2024 (Discover Hidden Savings!)

- What should I do if I can’t afford auto insurance?

- High-Risk Auto Insurance in 2024 (What You Should Know)

- Cheap Auto Insurance When Unemployed in 2024 (Save Big With These 9 Companies!)

- Government Assistance Programs for Low-Income Drivers in 2024

- Why is it so hard to find cheap auto insurance? (2024)

- Does cheap no-fault auto insurance exist? (2024)

- Auto Insurance Discounts

- Best Auto Insurance Discounts for Electric Vehicles in 2024

- Best Navy Federal Auto Insurance Discounts in 2024 (Check Out the Top 10 Companies)

- Best RBC Auto Insurance Discounts in 2024

- Best Auto Insurance Discounts for Farm Bureau Members in 2024

- Best Persistency Auto Insurance Discounts in 2024

- Ameriprise Auto Insurance Discounts for Members

- Best Auto Insurance Discounts for American Express Employees in 2024

- Best Auto Insurance Discounts for Boeing Employees in 2024

- Best Membership Auto Insurance Discounts in 2024

- Best Longevity Auto Insurance Discounts in 2024

- Best Auto Insurance Discounts for Police Officers in 2024

- Best Emergency Medical Services (EMS) Auto Insurance Discounts in 2024

- Best Auto Insurance Discounts for Attorneys in 2024

- Best CPA Auto Insurance Discounts in 2024

- Best Alumni Auto Insurance Discounts in 2024

- Best Auto Insurance Discounts for University of Michigan Alumni in 2024

- Best Teamster Auto Insurance Discounts in 2024 (Save up to 25% With These Deals)

- Best Auto Insurance Discounts for American Federation of Teachers (AFT) in 2024

- Best Auto Insurance Discounts for American Federation of Government Employees (AFGE) in 2024

- Best Auto Insurance Discounts for Married Couples in 2024

- Best Multi-Vehicle Auto Insurance Discounts in 2024

- Best Home and Auto Insurance Bundling Discounts in 2024

- American Access Auto Insurance Discounts (2024)

- Nationwide SmartRide App Review (2024)

- Best Anti-Lock Brakes Auto Insurance Discounts in 2024

- MAPFRE DriveAdvisor App Review (2024)

- Best Federal Employee Auto Insurance Discounts in 2024 (Get up to 10% Off With These 7 Companies)

- Travelers IntelliDrive Review 2024 (See Real Customer Feedback Here)

- Best Doctor Auto Insurance Discounts in 2024

- Best Auto-Pay Insurance Discounts in 2024

- Best Auto Insurance Discounts for Uber Drivers in 2024

- Best Pay-in-Full Auto Insurance Discounts in 2024

- How to Get an Anti-Theft Auto Insurance Discount in 2024

- Best Customer Loyalty Auto Insurance Discounts in 2024 (Save up to 25% With These 10 Companies)

- Best Motorcycle Insurance Discounts in 2024 (Save 20% With These Deals!)

- Best New Car Auto Insurance Discounts in 2024

- Best Low-Mileage Auto Insurance Discounts in 2024 (Get 8% Off With These 10 Companies)

- Best First Responder Auto Insurance Discounts in 2024 (Save up to 15% With These 10 Companies)

- Best Auto Insurance Discounts for Good Drivers in 2024

- State Farm Drive Safe and Save Review (2024)

- Vanishing Deductible Defined (2024)

- Progressive Snapshot Review (2024)

- Which car insurance companies have the biggest multi-car discounts? (2024)

- What are the benefits of a dashcam? (2024)

- How to Lower Your Auto Insurance Rates in 2024 (6 Simple Steps)

- Best State Farm Auto Insurance Discounts in 2024 (Save 50% With These Deals!)

- Best Progressive Auto Insurance Discounts in 2024

- Best Garaging & Storing Auto Insurance Discounts in 2024 (Get 20% Off With These 10 Companies)

- Best Driver’s Ed Auto Insurance Discounts in 2024 (Save up to 20% With These 10 Companies)

- Best Non-Smoker & Non-Drinker Auto Insurance Discounts in 2024 (Save up to 20% With These 10 Companies)

- Best Auto Insurance Discounts for Recent Graduates in 2024 (Save up to 25% With These 10 Companies)

- Best Green Vehicle Auto Insurance Discounts in 2024 (Find the Top 10 Companies Here)

- How to Get a Defensive Driver Auto Insurance Discount in 2024

- Cheap Farm Vehicle Auto Insurance in 2024 (Save Big With These 10 Companies!)

- Allstate Drivewise Review (2024)

- Best Esurance Auto Insurance Discounts in 2024 (Save Up to 25% With These 10 Companies!)

- Best Auto Insurance Discounts in 2024

- Best Auto Insurance for Disabled Veterans in 2024 (Top 10 Companies Ranked)

- Best Geico Auto Insurance Discounts in 2024 (Save 25% With These Special Offers!)

- Best Farmers Auto Insurance Discounts in 2024 (Save 30%!)

- Best AAA Auto Insurance Discounts in 2024 (Save 25% With This Company)

- Best Safeco Auto Insurance Discounts in 2024 (15% Lower Rates With These 10 Companies)

- Best Metlife Auto Insurance Discounts in 2024

- Best Amica Auto Insurance Discounts in 2024 (Save 25% Today!)

- Best Hanover Auto Insurance Discounts in 2024

- Best Hartford Auto Insurance Discounts in 2024

- Does LoJack affect auto insurance rates?

- How to Get a No-Claim Bonus (NCB) Auto Insurance Discount in 2024

- How to Save on Auto Insurance for Three Vehicles in 2024

- Best Good Student Auto Insurance Discounts in 2024 (Save up to 35% With These 10 Companies)

- How to Get Auto Insurance

- Best Rental Auto Insurance That Covers Additional Drivers in 2024 (Top 8 Companies)

- How to Get Insurance for a Car Not in Your Name (2024)

- How to Get Auto Insurance for the First Time in 2024 (7 Simple Steps)

- Buying Auto Insurance for a New Car (2024)

- How to Get Auto Insurance in 2024 (Follow These Simple Steps)

- Receiving and Evaluating Quotes

- How to Ask an Auto Insurance Company for Quotes in 2024

- How to Get an Auto Insurance Quote Without Giving Personal Information in 2024

- Do auto insurance quotes change daily? (What You Should Know in 2024)

- How to Get an Auto Insurance Quote Without a Car in 2024

- Why to Get Multiple Auto Insurance Quotes (2024)

- Where to Get an Instant Auto Insurance Estimate in 2024 (Follow These Steps)

- Auto Insurance Rates by ZIP Code (2024)

- How to Get Fast and Free Auto Insurance Quotes in 2024 (Step-by-Step Guide)

- How to Evaluate Auto Insurance Quotes in 2024 (X Simple Steps)

- How to Get Free Online Auto Insurance Quotes in 2024 (8 Easy Steps to Follow)

Auto Insurance Quotes Explained

Auto insurance quotes estimate how much you’ll pay for your car insurance coverage. The factors that affect auto insurance rates the most are location, age, driving history, credit score, and more.

You may find that each company gives you a slightly different auto insurance quote. This is because car insurance quotes can vary from one provider to the next based on how heavily they weigh certain factors. To find the insurance that works best for you, it’s essential to shop for car insurance quotes online so you can compare multiple options at once.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Where to Get Auto Insurance Quotes

You can get access to car insurance quotes in multiple ways. However, depending on what you’re looking for, you may find that some options work better than others.

Direct Quotes Online or Over the Phone

It’s simple and easy to find auto insurance quotes online with most insurance companies.

If you have a computer and Internet access available, you can load your favorite search engine and enter “insurance quotations” in the search bar. You will get quite a few entries under this category.

If you’re aware of what companies you want to get quotes from, you can click on the company’s website and find an area to request a quote.

Most well-known insurance providers, like Allstate and Geico, offer free online auto insurance quotes. During the process, however, you’ll likely be assigned to an agent with the company. Read our Allstate auto insurance review and our Geico auto insurance review to learn more about their rates. Take the information you have collected and type it into the spaces provided.

After you’ve finished keying in the information, ordinarily you will have a quotation within a few minutes. You may obtain different quotations by varying coverage options such as changing deductibles for physical damage to your car.

Advantages of obtaining insurance quotes online:

- Wider variety of insurance companies

- Paperless or near-paperless interaction with your chosen insurance company

- Ease of comparing the price effect of varying coverages

- Immediate acquisition of new insurance coverage

You can also call any insurance company you’re considering to try and purchase coverage directly from the provider rather than through an agent. Doing so could help you save money on your insurance premium.

Captive Agents

Some companies have captive agents or individuals who work solely for one insurance provider. These agents should be able to provide a quote for coverage with the company based on your personal information.

Independent Agents and Brokers

Independent agents could be helpful if you’re looking for insurance quotes, as they can often provide quotes from multiple companies at once. This information could help you save money on coverage. Find auto insurance company agents in your area by researching online.

Go to your local independent insurance agent with the information you have available and request a variety of quotes from them.

Most independent insurance agents represent several companies and are able to give you quotations from different ones. The advantages of doing this are as follows:

- Your quotation comes with the recommendation of someone you know and trust

- You will have the choice of two or three different insurance companies

- If you have a claim, you can contact your local insurance agent

- The agent will do the work of searching for you

Read more: Auto Insurance Broker Defined

Comparison Websites

Want to know where to get multiple auto insurance quotes online? Finding car insurance online is often easiest if you use a comparison website. This is your best bet on where to get multiple auto insurance quotes at once. These sites compare quotes from multiple providers at once, allowing you to compare online car insurance quotes to see which offers the best price.

Specialty Agencies

If you have a DUI on your record or other incidents that may qualify you as a high-risk driver, you may need to pursue a specialty agency to find proper coverage. The best auto insurance companies for high-risk drivers will offer the most affordable coverage for people with DUIs. Specialty agencies help individuals find nonstandard coverage when they may have difficulty purchasing insurance with many other companies.

Best Practices for Finding Multiple Auto Insurance Quotes

Before you decide on a company, it’s important to learn enough to ensure you’re comfortable. Research each company’s financial strength, and read comments and auto insurance company complaints from former and current customers. If you are wondering “How do I file auto insurance company complaints?” you can usually do so online.

Find and compare a minimum of three quotes before determining which company you want. Doing so will help you ensure you don’t end up paying too much for coverage. When you compare quotes, pay attention to the coverage options, too. As you add coverage to a policy, you’ll likely pay more in overall premiums.

Other Considerations When Shopping for Auto Insurance Quotes

You can do a few helpful things to find car insurance quotes that will work with your budget.

Research the Company

As you consider a company, look up its financial strength. Research customer reviews from past and current customers. Use information online to determine whether the insurer sounds like a company that would work for you.

Determine the Coverage You Want

You can buy liability auto insurance only or get coverage with all the bells and whistles. Think about your vehicle and what you need to cover, and go from there. If you have a newer vehicle, you may want to consider carrying collision auto insurance insurance and comprehensive auto insurance to help if your car is ever damaged.

You may also need specialty coverages, like roadside assistance coverage, guaranteed auto protection (GAP) insurance, or new car replacement insurance. But it depends on your unique scenario.

You may not need a full coverage policy if your vehicle is several years old and paid off. But you can always speak with an insurance expert to help you determine the best coverage for your needs.

Read more: Types of Auto Insurance

Consider Your Budget

You must stay within your budget when shopping for car insurance. Finding and comparing quotes can help you do this, but you may also need to reconsider your coverage options or see if a higher deductible would help you pay lower premiums.

Pick A Policy

After you’ve evaluated your needs and considered your options, you should be ready to compare quotes and find the right policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Information Needed to Get Auto Insurance Quotes

Most companies or websites require some information to generate an accurate quote. Learning how to obtain quotes for auto insurance is important. This information often includes:

- Basic personal information

- Current insurance provider

- Driver’s license info

- Current mileage on your vehicle

- Annual mileage on your vehicle

- Vehicle identification number

- Driving history

- Desired coverage

If you provide incorrect or inaccurate information, the quote you receive will likely not adequately reflect what you would actually pay for coverage. So, try to give the most accurate information possible. Determining what documents you need to get auto insurance should also help you get an accurate quote.

Why should I get multiple insurance quotes?

Ordinarily, consumers stay with the same insurance company for years, thinking that price increases or variations are normal. Consumers have little contact with their companies other than paying for insurance on a regular basis.

Sometimes a loss covered by insurance occurs, though, and you have intimate contact with the insurance company through their claims process.

At that point, most policyholders develop definite ideas about their insurance company based on how they view the process.

Even so, economically it can be advantageous to get new insurance quotations to compare prices for your car insurance at least every other year. Reasons for getting new insurance quotes can be:

- Moving to a new area

- Changing the way you use your vehicle

- Recently licensed teen driver(s)

- Changes in your marital status

Read more:Best Auto Insurance Companies for Teens

If you move, for example, from Washington, D.C., to Montana, you will discover a major drop in insurance premiums.

This is partially because the average insurance customer in Washington, D.C., has an accident every 4.5 years, whereas Montanans have accidents usually no more often than every 10 years.

Read more: Why does auto insurance vary from state to state?

For some reason, married people have fewer automobile accidents than those who are unmarried. The distance you drive to work affects your possibility of having an accident.

Teen drivers typically have sharp reflexes, but they do not have the experience with driving necessary to use good judgment.

How to Get Cheap Auto Insurance Quotes

To find the most affordable rate, it's best to compare auto insurance quotes from at least three providers.Jeff Root Licensed Insurance Agent

As you shop for multiple quotes, you may find your rates are higher than expected. If this is the case, you can do a few things to lower your car insurance quotes:

- Improve your credit score. Auto insurance and your credit score interact in important ways. The better your credit, the lower your insurance rates. So work on improving your score over time.

- Shop around. Don’t purchase the first policy you find. Take your time to find and compare quotes from several providers to find the best one.

- Drive carefully. A good driving record will allow you to keep your auto insurance quotes down.

- Consider discounts. If companies offer auto insurance discounts, ask whether you qualify and how much you could save on coverage.

- Increase your deductible. You could pay lower monthly or annual rates for coverage with a higher auto insurance deductible.

Don’t feel rushed to make a decision. Over time, you’ll be able to find the best company in your area for coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Companies Determine Auto Insurance Quotes

Most companies follow similar steps when determining auto insurance rates. For example, companies assess risk to determine which policyholders pay lower rates and which pay higher rates. Companies often consider the same factors when determining auto insurance rates.

ZIP Code

Auto insurance rates by ZIP code can differ. If you live in an area with heavy traffic or a place known for vandalism or car accidents, you may pay more for coverage, and some states tend to have higher insurance rates than others.

Additionally, some states require additional coverage. You will need to check with your state’s department of motor vehicles to determine the types of coverage you need. Keep in mind that additional coverage means higher rates.

Gender

Sometimes, a person’s gender can impact their auto insurance rates. Why are auto insurance rates higher for males? Men are often involved in more accidents than women.

For instance, teen males pay around $600 more annually for coverage than teen females. As you age, your gender should play less of a role in your car insurance costs.

Age

You may pay higher insurance rates if you’re a teen driver or a driver over 65.

Because companies assess the risk associated with each policyholder, teen drivers and drivers in their 60s or older often pay more for coverage.

Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $328 | $378 | $99 | $103 | $88 | $86 | $86 | $84 |

| $448 | $519 | $168 | $176 | $162 | $160 | $158 | $157 | |

| $305 | $414 | $116 | $137 | $115 | $117 | $113 | $114 | |

| $405 | $461 | $125 | $128 | $114 | $111 | $111 | $109 | |

| $597 | $629 | $160 | $167 | $139 | $139 | $136 | $136 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $78 | $78 | |

| $626 | $626 | $174 | $200 | $171 | $174 | $167 | $170 |

| $283 | $318 | $87 | $91 | $78 | $77 | $77 | $76 | |

| $303 | $387 | $124 | $136 | $113 | $115 | $111 | $112 |

| $591 | $662 | $131 | $136 | $112 | $105 | $109 | $103 | |

| $253 | $292 | $77 | $79 | $72 | $71 | $71 | $69 | |

| $229 | $284 | $94 | $103 | $86 | $86 | $84 | $84 | |

| $407 | $469 | $126 | $133 | $115 | $113 | $112 | $109 |

| $530 | $740 | $99 | $108 | $98 | $99 | $96 | $97 | |

| $180 | $203 | $74 | $79 | $59 | $59 | $58 | $57 | |

| U.S. Average | $416 | $501 | $128 | $139 | $119 | $119 | $117 | $117 |

As you can see, people over the age of 25 are going to have the best rates. You will hold those rates for quite some time before seeing them rise again as you become older. You can find the best auto insurance for young adults by comparing rates online.

Read more: Average Auto Insurance Rates by Age

Marital Status

Though it may seem outdated, married couples are likely to pay less for coverage than single individuals.

Auto Insurance Monthly Rates by Marital Status

| Insurance Company | Single Adult | Married Adult |

|---|---|---|

| Allstate | $291 | $125 |

| American Family | $208 | $165 |

| Farmers | $250 | $176 |

| Geico | $193 | $177 |

| Liberty Mutual | $353 | $177 |

| Nationwide | $232 | $189 |

| Progressive | $227 | $191 |

| State Farm | $204 | $206 |

| Travelers | $201 | $254 |

| U.S. Average | $233 | $197 |

Providers may assume that married couples are less likely to file claims and are more likely to drive responsibly.

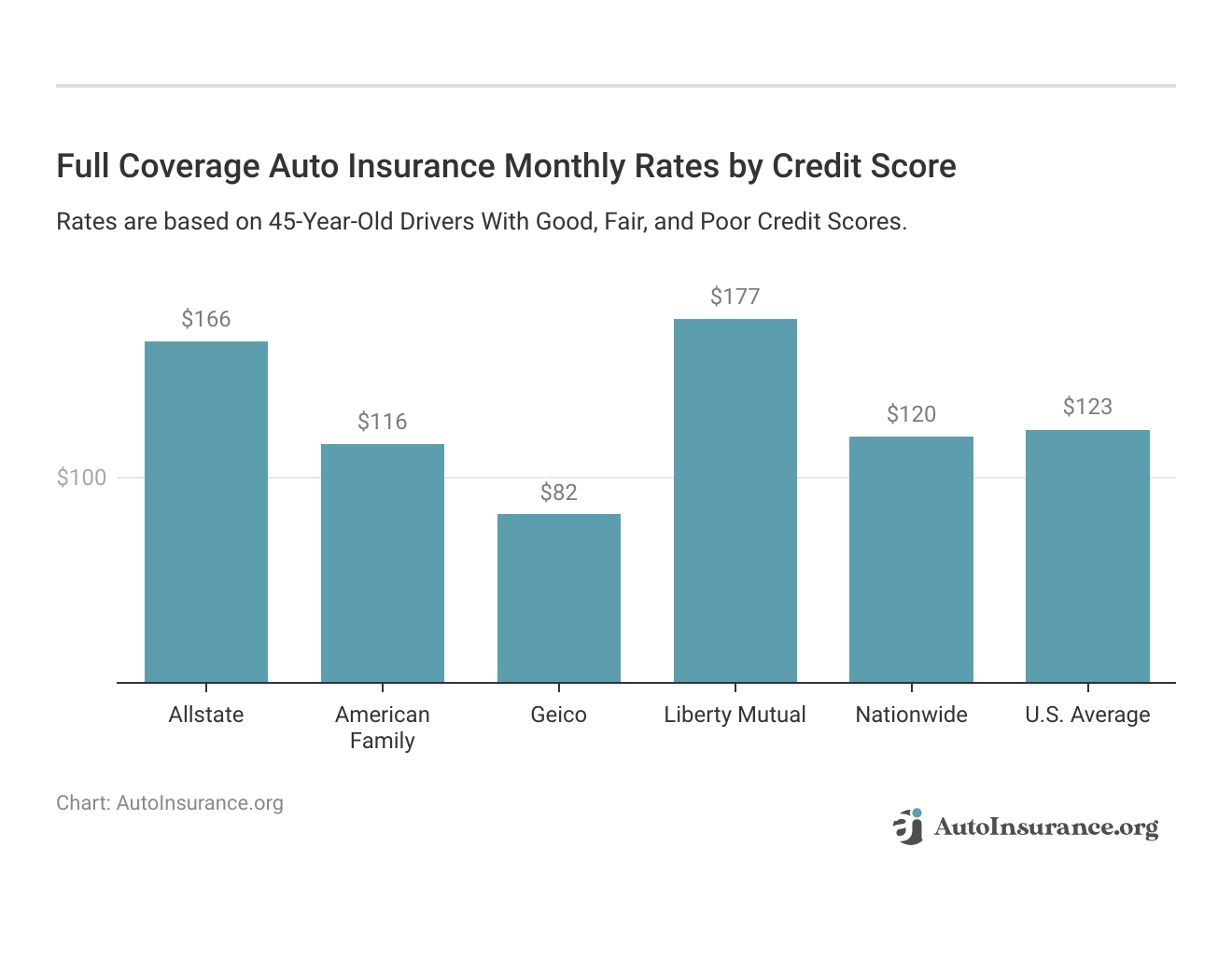

Credit Score

Your credit score could be a significant factor in car insurance rates. People with bad credit are more likely to file insurance claims. Read more about the best auto insurance companies for bad credit if you are struggling to find coverage with your current credit score.

Because companies are about assessing risk, your low credit score could mean higher-than-average insurance rates.

Read more:

How Credit Scores Affect Auto Insurance Rates

9 Best Companies for Credit-Based Auto Insurance

9 Best Auto Insurance Companies That Don’t Use Credit Scores

Driving History

You can expect cheaper car insurance rates if you have a clean driving history.

Sports Car Auto Insurance Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One Speeding Ticket | One DUI |

|---|---|---|---|---|

| AAA | $250 | $400 | $320 | $600 |

| Allstate | $222 | $356 | $280 | $520 |

| American Family | $200 | $350 | $250 | $400 |

| Erie | $230 | $380 | $300 | $550 |

| Farmers | $271 | $390 | $320 | $650 |

| Liberty Mutual | $278 | $420 | $350 | $720 |

| Nationwide | $200 | $350 | $250 | $450 |

| Progressive | $280 | $450 | $380 | $700 |

| State Farm | $150 | $300 | $200 | $400 |

| Travelers | $250 | $400 | $320 | $600 |

But your rates will be much higher if you have at-fault accidents, multiple violations, or a DUI on your record.

Car Make and Model

The type of car on your policy will also impact your rates.

Performance vehicles or foreign cars will be more expensive to cover, while older vehicles that don’t cost as much to repair will be less expensive. Finding out where to get cheap auto insurance for older cars is important.

Read more: Compare Auto Insurance Rates by Vehicle Make and Model

How to Get Auto Insurance Discounts

Depending on the companies you consider, you may qualify for discounts on coverage. Discounts could help you save a significant amount on auto insurance. Some of the most common auto insurance discounts include:

- Good student

- Safe teen driver

- Telematics

- Automatic payment

- Paid-in-full

- eSignature

- Safety features

- Paperless billing

- Multi-vehicle

- Safe senior driver

- Multi-driver

- Multi-policy

Auto insurance discounts could help you save as much as 20% on your policy, so ask whether you’re eligible for any discounts on coverage.

Where to Get Multiple Auto Insurance Quotes: The Bottom Line

Car insurance quotes aren’t difficult to find, but shopping around is essential to get the best quotes on coverage for your vehicle. Now that you know where to get multiple auto insurance quotes, you can find quotes directly from providers or compare quotes online from several providers at once.

Online car insurance quotes are a great way to see how much you’ll pay for coverage, and you can instantly buy auto insurance online. This could help you save money over time on your car insurance coverage. Still, you may be able to lower your rates by improving your credit, considering discounts, lowering your coverage, or increasing your deductible.

Once you find an insurance company you like, continue to shop online and compare quotes once a year. If you want to get started on comparing multiple auto insurance quotes, you can use our free quote tool.

Enter your ZIP code below to view companies that have cheap auto insurance rates.Free Auto Insurance Comparison

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is a car insurance quote?

Car insurance quotes estimate how much you will pay for auto insurance coverage. These quotes are determined based on your personal information and several factors providers use to assess your level of risk.

Can I get free car insurance quotes?

You should be able to get free quotes online. Comparing quotes can help you save money on your car insurance coverage.

What’s the best way of finding and comparing car insurance quotes?

Searching for and comparing quotes online is the best way to purchase car insurance. This will help you save money and avoid paying too much.

What information do I need to provide when requesting auto insurance quotes?

When requesting quotes, you will typically need to provide details such as your name, address, contact information, vehicle information (including the year, make, and model), your driving history, and any additional drivers you want to include on the policy.

How can I find a reliable insurance agent or broker?

To find a reliable insurance agent or broker, you can ask for recommendations from friends, family, or colleagues who have had positive experiences with insurance professionals. You can also research and read reviews online, or contact your state’s insurance department for a list of licensed agents or brokers.

What factors affect the cost of auto insurance quotes?

Several factors can influence the cost of auto insurance quotes. These factors may include your driving record, age, location, the type of vehicle you drive, the coverage limits you select, your credit history, and any discounts you may qualify for (such as good student discounts or multi-policy discounts).

Which company offers the cheapest auto insurance?

Certain companies, like USAA and Geico, offer cheaper rates for specific customers. Still, you won’t know which company will provide you with the most affordable rates until you find and compare quotes.

Is there a way to get multiple auto insurance quotes at once?

Yes, using our quote comparison tool will allow you to get multiple auto insurance quotes at the same time.

Should I get multiple insurance quotes?

Yes, it’s highly recommended to compare quotes from multiple insurance companies. Prices and coverage options can vary significantly between insurers, so comparing quotes allows you to find the best coverage at the most competitive rate.

Do insurance quotes affect credit score?

Shopping around for auto insurance won’t affect your credit score because that’s not considered a “hard credit pull.” That happens when you apply for credit, such as for an auto loan or a credit card.

What is the cheapest way to insure multiple vehicles?

Reach out to car insurance providers with the lowest average policy rates and number discounts, including for insuring multiple vehicles. We recommend County Financial, Eric, Geico, Nationwide, and USAA.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.