Best Jacksonville, Florida Auto Insurance in 2026 (Top 10 Companies Ranked)

The best Jacksonville, Florida auto insurance starts from $115 per month with Allstate, USAA, and Erie topping the list for offering competitive rates and strong coverage options. Their comprehensive offerings and unwavering commitment to customer satisfaction make them stand out for Jacksonville drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated October 2024

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Jacksonville Florida

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Jacksonville Florida

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Jacksonville Florida

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsAllstate, USAA, and Erie stand out as the best Jacksonville, Florida auto insurance providers offering a mix of comprehensive coverage, competitive rates, and exceptional customer service. Allstate ranks as the top overall choice, providing extensive coverage options and reliable service for a slightly higher auto insurance premium.

For military families, USAA offers unbeatable rates and benefits tailored specifically for their needs. Erie, known for its local service and affordability, is an excellent option for those seeking both quality and value.

Our Top 10 Company Picks: Best Jacksonville, Florida Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Comprehensive Coverage | Allstate | |

| #2 | 10% | A++ | Military Discounts | USAA | |

| #3 | 10% | A+ | Local Service | Erie |

| #4 | 25% | A | Customizable Policies | Liberty Mutual |

| #5 | 25% | A | Wide Network | Farmers | |

| #6 | 25% | A++ | Competitive Rates | Geico | |

| #7 | 20% | B | Large Network | State Farm | |

| #8 | 12% | A+ | Innovative Tools | Progressive | |

| #9 | 8% | A++ | Strong Discounts | Travelers | |

| #10 | 20% | A | Personalized Service | American Family |

This guide breaks down the top 10 companies in Jacksonville, helping you find the perfect policy based on coverage, price, and customer satisfaction. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Allstate offers the best Jacksonville, Florida auto insurance, starts at $132/mo

- USAA provides top military-focused insurance, while Erie excels in local service

- Customizable coverage and competitive rates are vital factors for auto insurance

#1 – Allstate: Top Overall Pick

Pros

- Comprehensive Coverage: Allstate excels in providing comprehensive coverage options for Jacksonville, Florida auto insurance.

- Low Monthly Rates: Allstate offers competitive monthly rates at $132 for Jacksonville, Florida auto insurance with minimum coverage. Find more information about Allstate’s rates in our review of Allstate insurance.

- Generous Multi-Vehicle Discount: Save up to 25% on Jacksonville, Florida auto insurance by insuring multiple vehicles with Allstate.

Cons

- High Full Coverage Costs: Allstate’s full coverage rates in Jacksonville, Florida may be steep at $356 monthly.

- Limited Availability of Discounts: This provider’s discounts may not be as extensive as competitors for Jacksonville, Florida auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Discounts

Pros

- Military Discounts: USAA provides exceptional discounts tailored for military personnel and their families in Jacksonville, Florida auto insurance. <style=”font-weight: 400;”>Check out insurance savings for military members and their families in our complete USAA auto insurance review.

- Affordable Minimum Coverage: The minimum coverage rates are highly competitive at $115 monthly for Jacksonville, Florida auto insurance.

- Top A.M. Best Rating: The A++ rating signifies strong financial stability for Jacksonville, Florida auto insurance.

Cons

- Membership Restriction: Only available to military members and their families in Jacksonville, Florida, limiting accessibility.

- Limited Customization: Fewer options to customize policies compared to other Jacksonville, Florida auto insurance providers.

#3 – Erie: Best for Local Service

Pros

- Strong Local Presence: Erie offers personalized local service for Jacksonville, Florida auto insurance customers.

- Low Monthly Rates: Provides affordable minimum coverage at $129 monthly for Jacksonville, Florida auto insurance. Dive into our in-depth Erie auto insurance review to find the best policy for your needs.

- Excellent Claims Satisfaction: High ratings in claims handling ensure a smooth process for Jacksonville, Florida auto insurance policyholders.

Cons

- Limited Availability: Erie’s coverage is not available nationwide, which may be a drawback for some Jacksonville, Florida customers.

- Less Digital Presence: May lag behind in digital tools and online services for Jacksonville, Florida auto insurance.

#4 – Liberty Mutual: Best for Customizable Policies

Pros

- Highly Customizable Policies: Liberty Mutual offers flexibility in creating Jacksonville, Florida auto insurance policies tailored to individual needs.

- Multi-Vehicle Discount: Save up to 25% on Jacksonville, Florida auto insurance with Liberty Mutual by insuring multiple vehicles. To see monthly premiums and honest rankings, read our Liberty Mutual review.

- Competitive Full Coverage: Despite higher minimum coverage rates at $138 monthly, full coverage remains competitively priced for Jacksonville, Florida auto insurance.

Cons

- High Minimum Coverage Rates: Liberty Mutual’s minimum coverage rates are relatively higher at $138 for Jacksonville, Florida auto insurance.

- Average Customer Satisfaction: Liberty Mutual receives mixed reviews for customer service and claims handling in Jacksonville, Florida.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Wide Network

Pros

- Extensive Network: Farmers boasts one of the largest networks, providing robust Jacksonville, Florida auto insurance options. <style=”font-weight: 400;”>Take a look at our Farmers insurance company review to learn more.

- Significant Multi-Vehicle Discounts: Enjoy a 25% discount on Jacksonville, Florida auto insurance when insuring multiple vehicles with Farmers.

- Local Agents Availability: Access to local agents ensures personalized service for Jacksonville, Florida auto insurance.

Cons

- High Minimum Coverage Rates: Farmers’ minimum coverage rate is on the higher side at $136 monthly for Jacksonville, Florida auto insurance.

- Limited Discount Options: Compared to competitors, Farmers offers fewer discounts for Jacksonville, Florida auto insurance.

#6 – Geico: Best for Competitive Rates

Pros

- Affordable Rates: Geico is known for competitive pricing, with minimum coverage in Jacksonville, Florida starting at $120 monthly. Learn more about Geico’s rates in our Geico auto insurance company review.

- Top-Rated Customer Service: Geico provides highly rated customer service for Jacksonville, Florida auto insurance.

- 25% Multi-Vehicle Discount: Insure multiple vehicles and save significantly on Jacksonville, Florida auto insurance.

Cons

- Limited Local Agents: This provider’s online focus may not suit those preferring in-person services for Jacksonville, Florida auto insurance.

- Higher Full Coverage Costs: Geico’s full coverage costs are higher at $312 monthly for Jacksonville, Florida auto insurance.

#7 – State Farm: Best for Large Network Advantage

Pros

- Extensive Network: State Farm provides a wide-reaching network for Jacksonville, Florida auto insurance, ensuring accessible service. Wondering about their level of customer service? Find out in our State Farm company review.

- Competitive Minimum Coverage Rates: Offers affordable minimum coverage at $125 monthly for Jacksonville, Florida auto insurance.

- Solid Multi-Policy Discounts: State Farm offers discounts for bundling policies, benefiting Jacksonville, Florida auto insurance customers.

Cons

- Lower A.M. Best Rating: State Farm’s B rating might concern some Jacksonville, Florida auto insurance customers.

- Limited Discounts: Fewer discount options compared to other Jacksonville, Florida auto insurance providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Innovative Tools

Pros

- Cutting-Edge Tools: Progressive provides innovative digital tools to enhance the Jacksonville, Florida auto insurance experience.

- Affordable Minimum Coverage: Offers competitive rates at $122 monthly for Jacksonville, Florida auto insurance.

- Snapshot Program Savings: Its Snapshot program can lead to additional savings for Jacksonville, Florida auto insurance customers. Our complete Progressive review goes over this in more detail.

Cons

- Complex Discount Structure: Progressive’s discount structure can be confusing for Jacksonville, Florida auto insurance customers.

- Mixed Customer Reviews: There are mixed reviews for claims handling and customer service in Jacksonville, Florida.

#9 – Travelers: Best for Strong Discounts

Pros

- Wide Range of Discounts: Travelers offers a comprehensive array of discounts for Jacksonville, Florida auto insurance customers.

- Affordable Minimum Coverage: Their competitive minimum coverage rate is at $130 monthly for Jacksonville, Florida auto insurance.

- Superior Financial Stability: Travelers’ A++ rating ensures reliability for Jacksonville, Florida auto insurance policyholders. Read our full review of Travelers insurance for more information.

Cons

- Limited Local Agents: Travelers may lack local agents in certain areas of Jacksonville, Florida.

- High Full Coverage Costs: Full coverage rates are higher at $340 monthly for Jacksonville, Florida auto insurance.

#10 – American Family: Best for Personalized Service

Pros

- Personalized Service: American Family excels in providing tailored Jacksonville, Florida auto insurance services. Read our online American Family review to find out more about the company.

- Low Minimum Coverage Rates: Enjoy affordable minimum coverage rates at $133 monthly with American Family in Jacksonville, Florida.

- Good Multi-Policy Discount: Save up to 20% on Jacksonville, Florida auto insurance by bundling policies with American Family.

Cons

- Higher Full Coverage Rates: American Family’s full coverage costs are relatively higher at $353 monthly for Jacksonville, Florida auto insurance.

- Limited Availability: American Family’s services might not be available in all areas of Jacksonville, Florida.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance in Jacksonville, Florida

Jacksonville, Florida auto insurance laws require that you have at least the minimum auto insurance requirement by state to be financially responsible in the event of an accident. In order to meet the liability insurance requirements, it is necessary to have minimum coverage limits in place.

For bodily injury liability coverage, the minimum required is $10,000 per person and $20,000 per accident. Additionally, property damage liability coverage must be at least $10,000.

Navigating the Cost of Auto Insurance in Jacksonville

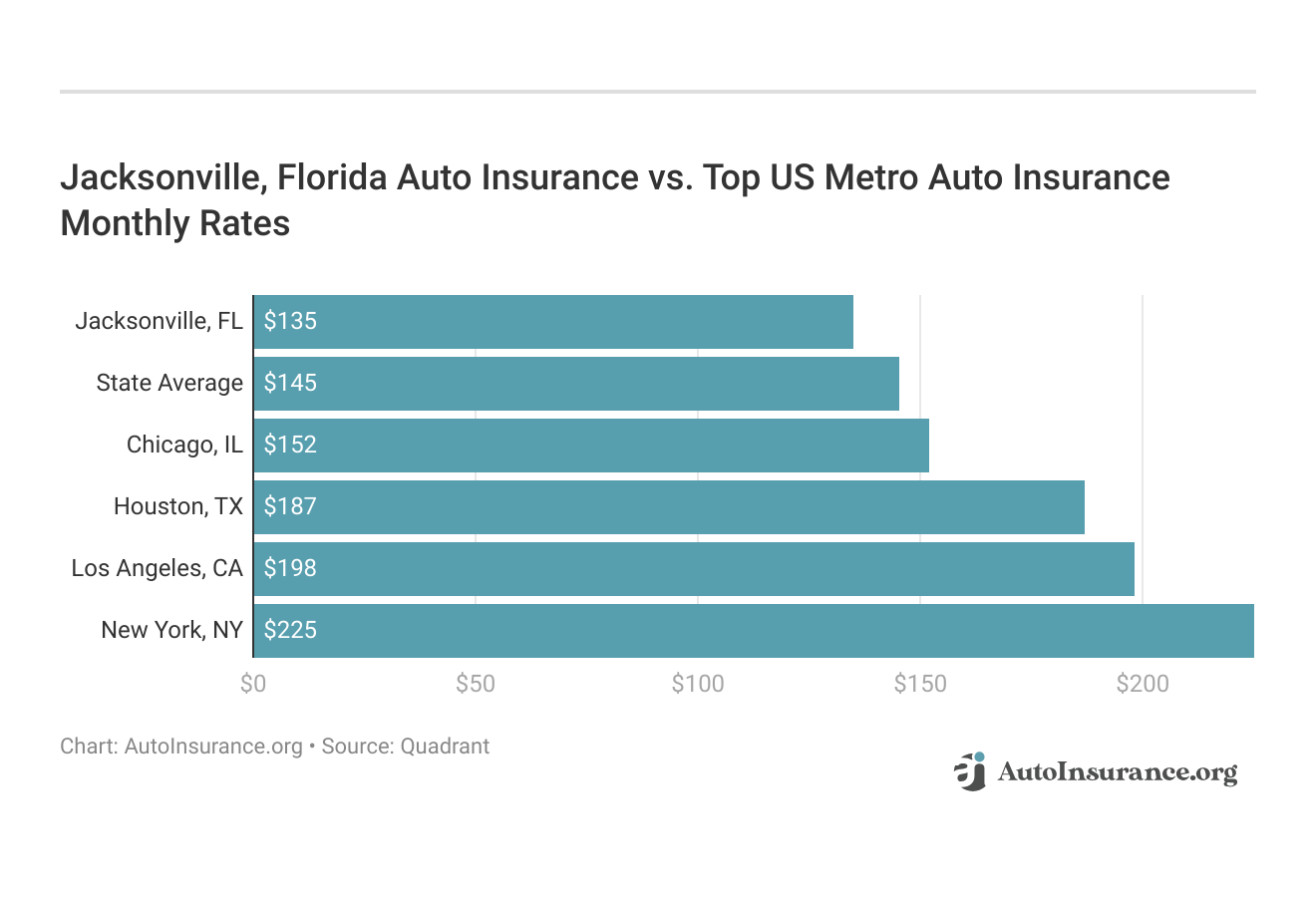

If you are in the process of buying auto insurance, you must understand how insurance companies calculate your insurance rate? You might find yourself asking how does my Jacksonville, FL stack up against other top metro auto insurance rates? We’ve got your answer below.

There are several factors on how insurance providers determine rates, including your driving record, what vehicle you drive, where you live, etc. In this guide, we will demystify the factors that influence your insurance rate.

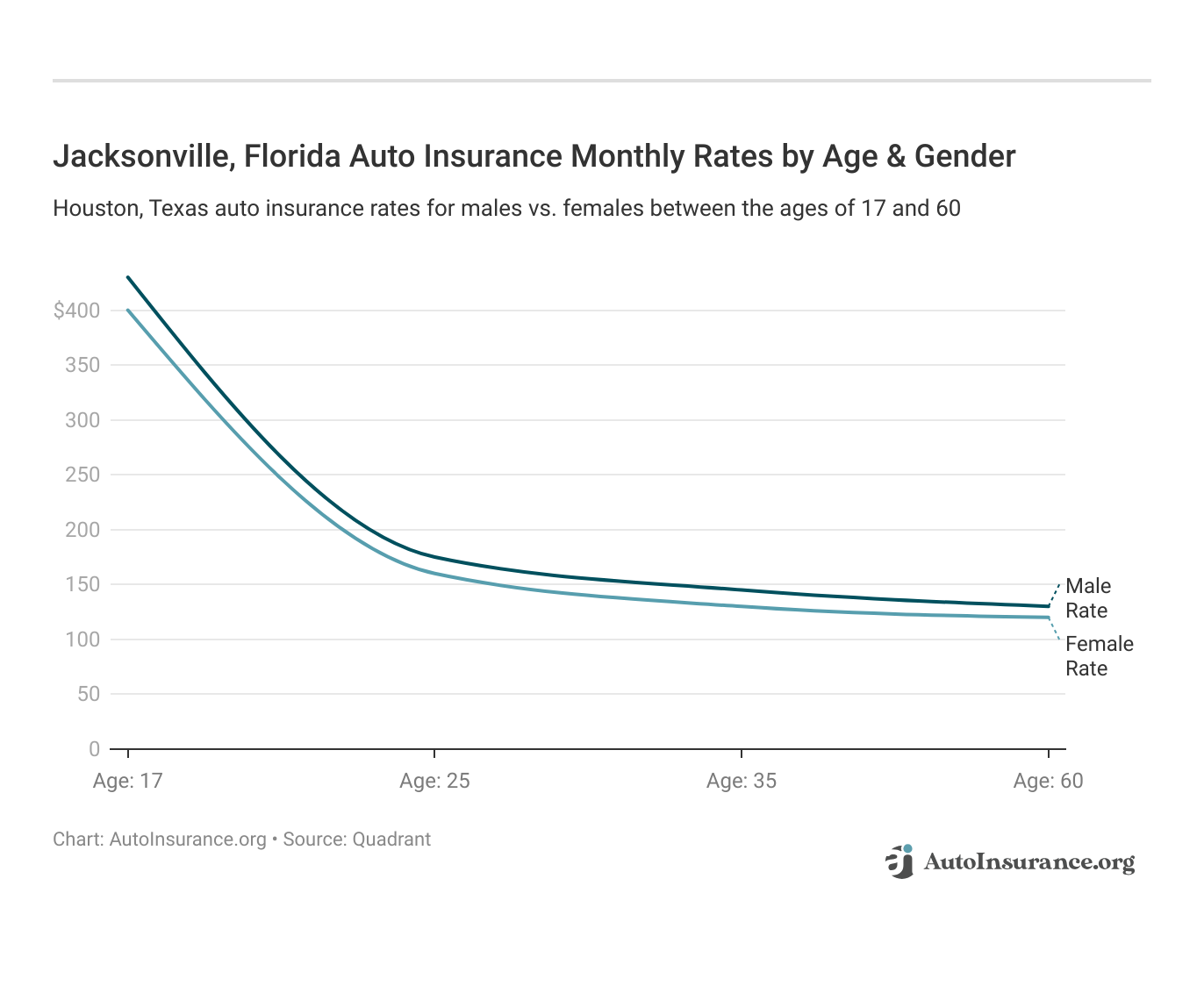

Auto Insurance Rates Based on Gender and Age

Insurance rates are calculated using many factors, including your age and gender. These states no longer using gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania.

But age is still a significant factor because young drivers are often considered high-risk. Florida does use gender, so check out the average monthly auto insurance rates by age and gender in Jacksonville, FL.

Based on research, insurance companies believe that young drivers, especially teens, are more likely to engage in risky driver behavior. Due to the additional risk of a claim, insurance companies tend to charge a higher than average premium from teen drivers.

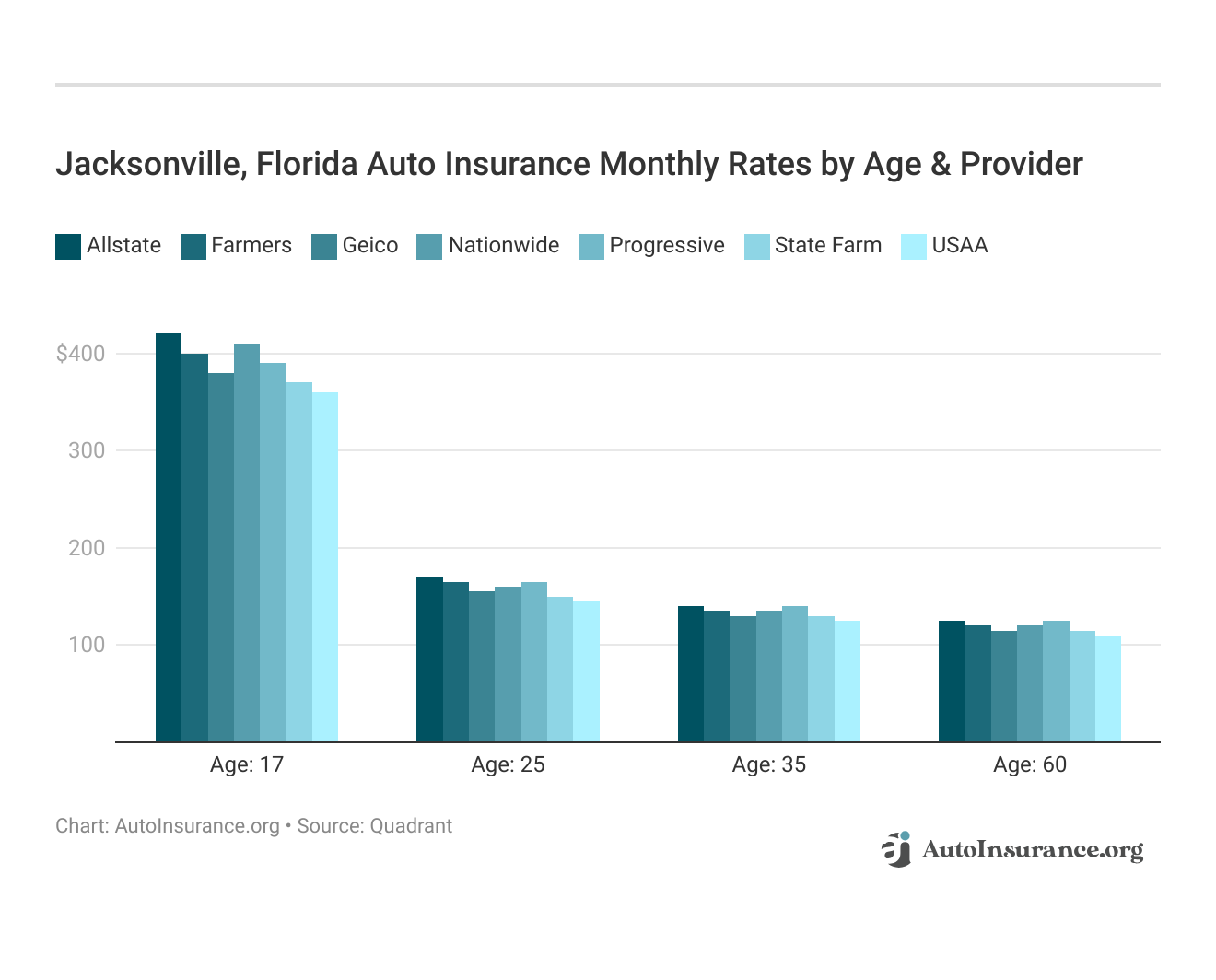

Jacksonville, FL auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

Young drivers looking to reduce their premium rates should keep a clean driving record. As you age and mature as a driver, your insurance premium will start to align with the city averages. Your gender is another factor that influences your insurance rate.

Some states in the country have disallowed insurance companies from using your gender for calculating premium rates. However, Florida still allows for gender as a factor in your insurance rate. Therefore, companies, on average, have lower insurance rates for females at different age brackets.

Your marital status can also impact your insurance rate. Insurance companies tend to believe that married people are risk-averse and therefore have a lower likelihood of filing a claim.

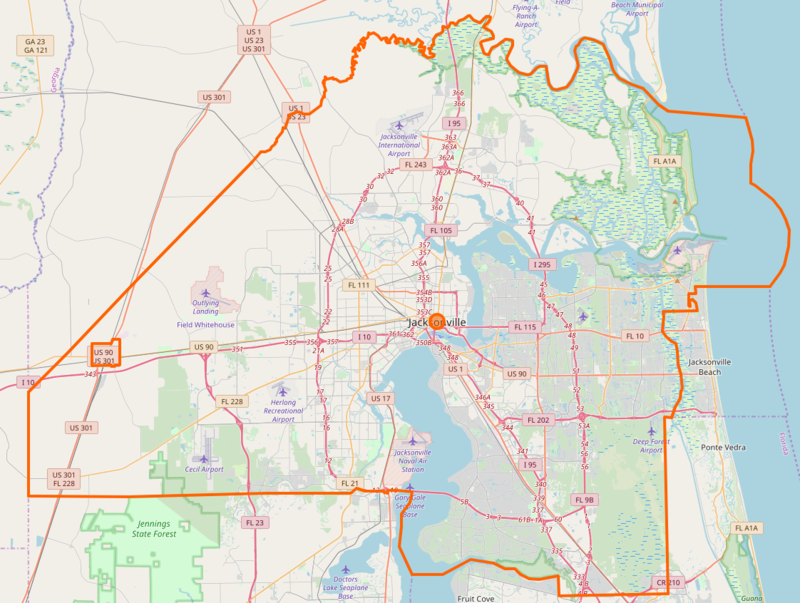

Cheapest ZIP Codes in Jacksonville

Not every part of a city has the same vibe and culture. Check out the monthly Jacksonville, FL auto insurance rates by ZIP code. Insurance companies also consider where you live while calculating your insurance rate. Where you live in Jacksonville may have an impact on your auto insurance rate.

Cheapest Jacksonville, Florida Auto Insurance Monthly Rates by ZIP Code

| ZIP | Rate |

|---|---|

| 32223 | $140 |

| 32224 | $145 |

| 32227 | $150 |

| 32233 | $155 |

| 32250 | $160 |

| 32256 | $165 |

| 32258 | $170 |

| 32234 | $175 |

| 32225 | $180 |

| 32246 | $185 |

| 32216 | $190 |

| 32226 | $195 |

| 32217 | $200 |

| 32257 | $205 |

| 32212 | $210 |

| 32222 | $215 |

| 32099 | $220 |

| 32220 | $225 |

| 32221 | $230 |

| 32277 | $235 |

| 32202 | $240 |

| 32218 | $245 |

| 32219 | $250 |

| 32204 | $255 |

| 32206 | $260 |

| 32209 | $265 |

| 32254 | $270 |

| 32244 | $275 |

| 32208 | $280 |

| 32211 | $285 |

| 32210 | $290 |

| 32207 | $295 |

| 32205 | $300 |

Insurers take into account the crime statistics, especially the theft data of your zip code. If there has been a higher number of car thefts in your neighborhood, the chances are that insurers would charge a higher than average premium.

Well, insurance companies have to the loss ratio in mind while calculating your insurance rate. Higher the risk, higher the premium.

Best Auto Insurance Company in Jacksonville, Florida

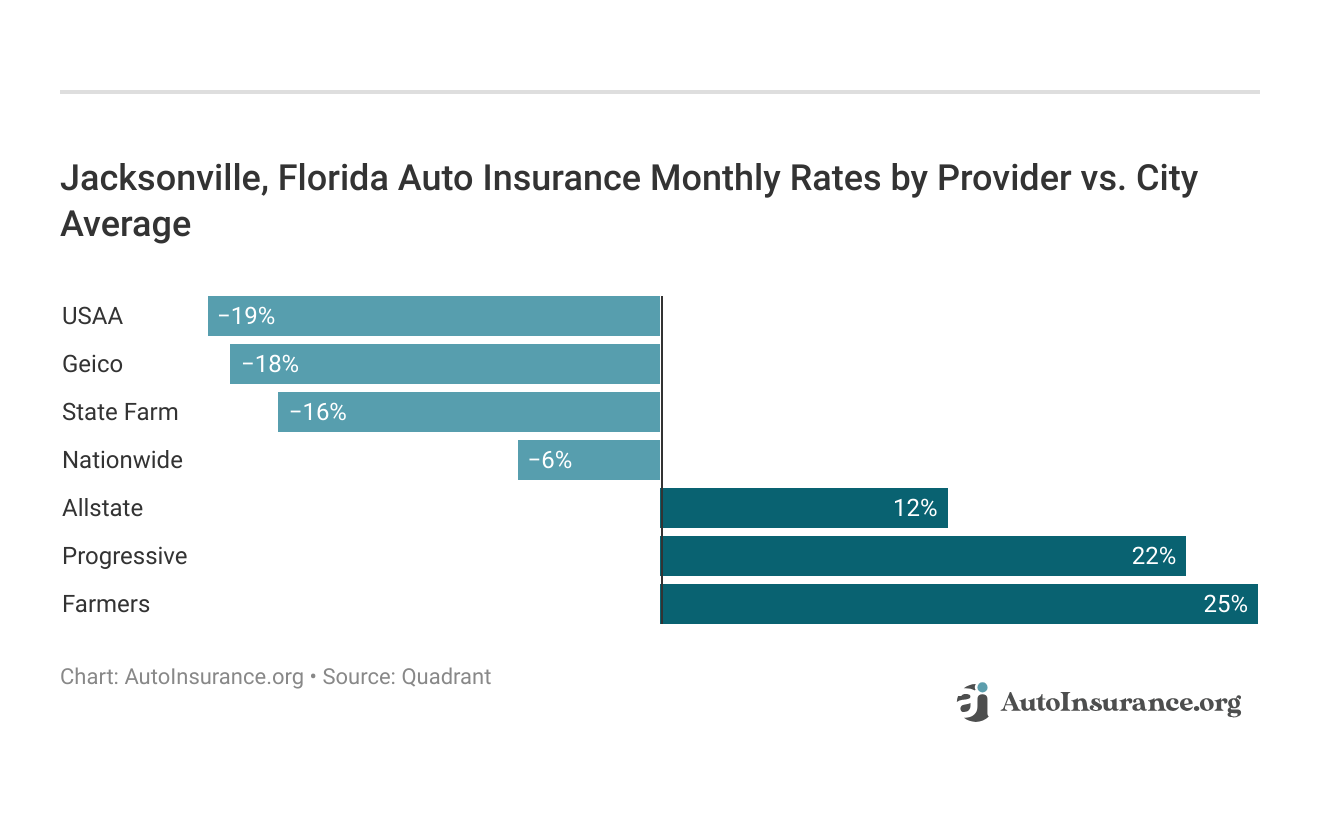

Choosing a auto insurance company can be confusing. Each insurer may weigh factors differently and therefore offer different products and rates.

Which Jacksonville, FL auto insurance company has the cheapest rates? And how do those rates compare against the average Florida auto insurance company rates? We’ve got the answers below.

We should carefully evaluate what each insurance carrier offers before buying an insurance product. Your driving record, credit score, the commute, etc. can influence which insurance company is the most appropriate for you. In this section, we will analyze what different insurance carriers are offering for each of these factors.

Learn more information on our “How Credit Scores Affect Auto Insurance Rates.”

Best Auto Insurance Rates by Company

Let us start by analyzing the most obvious question. Which is insurance carrier is the cheapest auto insurance provider in Jacksonville? All national insurers including, Geico, USAA, Allstate, etc. are present in Jax. You should shop around to get the best rate in this competitive insurance market.

Take a look at the following table to see the rates offered by different insurance carriers for varying demographics.

Cheapest Jacksonville, Florida Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male | Average |

|---|---|---|---|---|---|---|---|---|---|

| Allstate | $420 | $450 | $170 | $190 | $140 | $150 | $125 | $130 | $222 |

| American Family | $400 | $430 | $160 | $180 | $135 | $145 | $120 | $125 | $199 |

| Farmers | $410 | $440 | $165 | $185 | $140 | $150 | $125 | $130 | $218 |

| Geico | $380 | $410 | $155 | $175 | $130 | $140 | $115 | $120 | $203 |

| Liberty Mutual | $440 | $470 | $180 | $200 | $150 | $160 | $130 | $135 | $233 |

| Nationwide | $410 | $440 | $165 | $185 | $135 | $145 | $120 | $125 | $216 |

| Progressive | $390 | $420 | $160 | $180 | $140 | $150 | $125 | $130 | $212 |

| State Farm | $370 | $400 | $150 | $170 | $130 | $140 | $115 | $120 | $199 |

| Travelers | $400 | $430 | $160 | $180 | $135 | $145 | $120 | $125 | $199 |

| USAA | $360 | $390 | $145 | $165 | $125 | $135 | $110 | $115 | $193 |

The teens pay a substantial premium over an average Jaxon to maintain a similar auto insurance policy. However, premium rates for teens vary greatly between insurers. It underlines the importance of shopping around for the best rates. However, all major insurance companies we analyzed drop insurance rates as the driver gains experience.

Nevertheless, keep in mind that insurance is expected to help you get back on your feet when you are down. Therefore, you should not base your decision based on only the rate. The cheapest provider may not necessarily be the best insurance in your city or state.

Best Auto Insurance for Commute Rates

If your annual mileage is more than what the average Jacksonville resident, then some insurance companies may increase your premium. However, the good thing is not all insurance carrier tend to increase the premium for a reasonable increase in annual mileage. The trick here is that you shop around based on your expected annual mileage.

Let us analyze what the average mileage is in Jax and what major insurance carriers charge based on the annual mileage.

Jacksonville, Florida Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles | Average |

|---|---|---|---|

| Allstate | $165 | $180 | $173 |

| American Family | $155 | $170 | $163 |

| Farmers | $160 | $175 | $168 |

| Geico | $140 | $155 | $148 |

| Liberty Mutual | $175 | $190 | $183 |

| Nationwide | $150 | $165 | $158 |

| Progressive | $145 | $160 | $153 |

| State Farm | $130 | $145 | $138 |

| Travelers | $155 | $170 | $163 |

| USAA | $125 | $140 | $133 |

Insurance companies use the average commute distance to benchmark your commute and thereby calculating your insurance rate. With the help of Quadrant Data Solutions, we wanted to understand the impact of your annual commute on your insurance rate. Here is what we found different insurance carriers charge for varying commutes in Jacksonville.

Except for Nationwide and Progressive, almost all major insurance carriers tend to increase your premium with additional mileage. However, even though USAA, State Farm, and Geico tend to increase the premium based on your commute, they may still be the most economical insurers in Jacksonville.

Best Auto Insurance for Coverage Level Rates

When you buy additional services from Netflix, you have to pay a higher monthly subscription fee. Your coverage level will play a major role in your Jacksonville auto insurance rates. Find the cheapest Jacksonville, FL auto insurance rates by coverage level below:

Same is the case with auto insurance. If you add additional insurance coverage, you may have to pay an additional premium to maintain the coverage. The additional fee is understandable because as you add coverage on your policy, you are exposing the insurance company for the extra risk.

Jacksonville, Florida Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $132 | $356 |

| American Family | $133 | $353 |

| Erie | $129 | $345 |

| Farmers | $136 | $359 |

| Geico | $120 | $312 |

| Liberty Mutual | $138 | $367 |

| Progressive | $122 | $320 |

| State Farm | $125 | $328 |

| Travelers | $130 | $340 |

| USAA | $115 | $308 |

But, before you decide, let us review what are low and high coverage in Jacksonville. Low coverage is the state-mandated minimum coverage required to drive in Florida legally. Florida is a state with no-fault auto insurance coverage, which means that you are not ‘required’ to purchase bodily injury liability auto insurance coverage.

Instead, you have to purchase property damage liability of $10,000 per accident and personal injury protection of $10,000 per accident to drive in Florida legally. Because Florida is a no-fault state, the insurance carrier is expected to pay your medical expenses regardless of who caused the accident. However, it is highly advisable to carry bodily injury liability coverage.

In case you injure someone in an accident, you don’t want to be sued in case their medical cost reach beyond a certain PIP threshold. Along with the bodily injury liability coverage, there are other important coverage options that you should also consider adding to your policy. Some of these include collision, comprehensive and uninsured motorist coverage.

The amount of coverage and options may vary depending on your situation. For example in case you drive an old car that has lost most of its value in depreciation, then you may not necessarily need comprehensive coverage. You need to do a risk to reward analysis and then decide on the appropriate coverage.

Best Auto Insurance for Credit History Rates

A non-driving or vehicle-related factor that has a strong factor influencing your insurance rate is your credit history. You can potentially save a lot on premiums by keeping a good credit score.

Your credit score will play a major role in your Jacksonville auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Jacksonville, FL auto insurance rates by credit score below.

However, even if you have a poor credit history, you can still save some money on insurance by shopping wisely. Why? Because insurance companies value each factor differently in their pricing model. So, if company A is quoting a higher price based on your credit history, it may not be the same for company B.

Here are the average rates for different recommended auto insurance coverage levels offered by insurance companies in Jacksonville:

Jacksonville, Florida Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| Allstate | $150 | $175 | $220 |

| American Family | $140 | $165 | $210 |

| Farmers | $145 | $170 | $215 |

| Geico | $130 | $155 | $200 |

| Liberty Mutual | $160 | $185 | $230 |

| Nationwide | $140 | $165 | $210 |

| Progressive | $135 | $160 | $205 |

| State Farm | $125 | $150 | $195 |

| Travelers | $135 | $160 | $205 |

| USAA | $120 | $145 | $190 |

If you have a poor credit score, you might get the most economical quotes from USAA, State Farm, Geico, and Nationwide. However, if you a good credit score, you can probably save more by opting for State Farm and Geico.

Best Auto Insurance for Driving Record Rates

Your driving record has a direct correlation with your insurance rate. If you have a good driving record, the chances are that you would receive an economical rate compared to somebody who has DUI or accident on the record. Your driving record will play a major role in your Jacksonville auto insurance rates. For example, other factors aside, a Jacksonville, FL DUI may increase your auto insurance rates 40 to 50%.

Find the cheapest Jacksonville, FL auto insurance rates by driving record. A good driving record indicates that you are not a risky driver and therefore less likely to file a claim. However, if you cause an accident or commit DUI, your insurance rate is bound to become expensive. See the following table to understand the impact of your driving record on your auto insurance:

Jacksonville, Florida Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $140 | $170 | $210 | $250 |

| American Family | $130 | $160 | $200 | $240 |

| Farmers | $135 | $165 | $205 | $245 |

| Geico | $120 | $150 | $190 | $230 |

| Liberty Mutual | $160 | $190 | $230 | $270 |

| Nationwide | $130 | $160 | $200 | $240 |

| Progressive | $135 | $165 | $205 | $245 |

| State Farm | $125 | $155 | $195 | $235 |

| Travelers | $130 | $160 | $200 | $240 |

| USAA | $115 | $145 | $185 | $225 |

As evident from the data, if you commit DUI or cause an accident, your insurance rate may increase by as much as $3,000. State Farm is most accommodating if you don’t have a clean driving record. However, Geico might also be able to provide an economical quote based on your situation.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Factors Affecting Rates in Jacksonville

Driver-specific factors such as your credit score, driving record, and commute are not the only factors impacting your insurance rates. City-specific factors such as your zip code, economic prosperity in your city, and average income levels also affect your rates.

Factors affecting auto insurance rates in Jacksonville, FL may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Jacksonville, Florida auto insurance. In this section, we will review the city-specific factors influencing your auto insurance rates.

Growth & Prosperity

According to the Bureau of Economic Analysis, the Gross Metropolitan Product (GMP) of Jacksonville in 2017 was $76 billion making it the 46th largest metropolitan area by GMP.

According to the Metro Monitor Report by the Brookings Institution, Jacksonville is ranked 17th in economic growth among the metropolitans in the country. However, due to stagnant wages and productivity, Jax is ranked 61st in economic prosperity.

Median Household Income

According to DataUSA, the median household income of Jaxons is $51,497, which is less than the national median household income of $60,336. The average monthly premium for auto insurance in Jacksonville is $288.

Homeownership in Jacksonville

Does owning a house affect your auto insurance? Well, being a homeowner won’t directly impact your auto insurance rates or your ability to qualify for any auto insurance plans. However, insurance carriers may offer you additional discounts. According to insurers, the general homeownership rate in your city/zip code may indicate the general health of the local economy.

Let us review the car ownership rate in Jacksonville to understand how it impacts your auto insurance rates. The median property value in Jacksonville is $177,000. However, a large proportion of households have a property value in the $200,000-$250,000 range. The range is at part with the national median property value of $193,500.

The median property value in the city is also at par with the median property value in Florida. However, only 55% of houses are occupied by owners, which is far less than the national average of 64%. The low occupancy ratio is partly because of the out-of-state residents that live in Florida for select months of the year.

Education in Jacksonville

Your insurance carrier wants to know your education level before calculating your premium rate. Do you know why? As per insurance companies, higher education is associated with a lower risk profile. As per the research done by the New Jersey’s Department of Insurance, a driver with higher education tends to be more responsible.

So the question we are looking to answer is, how is Jacksonville fairing in higher education?Jacksonvillians have access to nine institutions of higher learning within the Jacksonville area. In 2016, various universities in Jacksonville granted a total of 17,318 degrees.

Wage by Gender in Common Jobs

In Jacksonville, insurance carriers do take your gender into account while calculating your insurance rate. On average, females pay slightly less than males to maintain insurance coverage. However, there is a considerable wage gap between genders in Florida. The average annual salary for females is only $45,343, whereas for males it is $60,114.

Due to the wage gap, females have to shell out a higher percentage of their income towards auto insurance.

Poverty by Age & Gender

In Jacksonville, 16% of the population lives below the poverty line, whereas the national average is 13%. Females are worst affected by poverty as the top three demographics in poverty are females in various age groups. A disproportionately high number of females in the age bracket of 25-34 are living below the poverty line in Jacksonville.

Employment by Occupations

In terms of job growth, Jacksonville is among the fastest-growing metros in the country. According to the Metro Monitor Report by the Brookings Institution, Jacksonville is 8th best metro for job growth. The largest employer in the city is the United States Military.

Driving-Related Factors Affecting Jacksonville, Florida Rates

While credit score, education level might impact your insurance rates. Your driving-related factors are the ones that will directly affect your premium. Driving-related factors include your driving record, what car you drive, traffic congestion in your area, road conditions, crime statistics, and much more. In this section, we will review these factors influencing your auto insurance rates.

Roads in Jacksonville

A network of interstates, beltways, and main arterial roads connect Jacksonville. In this section, let us review the roads in and around Jacksonville.

Major Highways

Jacksonville is well connected with three interstates (I-10, I-95, and I-295) flowing into the city. Highways 1, 17, 90, and 301 interconnects the town. Here’s the map of interstates and highways connecting Jacksonville:

Some of the important interstates in Jacksonville are Beltway Loop: I-295, Jacksonville to Alabama: I-10, and Jacksonville to Miami: I-95.

In 2019, the city has started collecting tolls on the I-295 express lanes. The express lanes are expected to reduce the commute time during peak hours, and Jaxons have to purchase a Sun Pass to use the express lanes.

Popular Road Trips/Sites

The largest city in the First Coast offers miles of beautiful beach area with three main beaches: Atlantic Beach, Neptune Beach, and Jacksonville Beach.

Jax also has many museums, theaters, art galleries, riverboat cruises, and musical events to keep you busy.

Don’t forget to ride the St. Johns River Taxi to complete your bucket list on popular places to visit in Jacksonville, Florida.

Speeding and Red Light Cameras

Florida law allows law enforcement to use red-light cameras. However, the good news is that Jacksonville stopped using red-light cameras in 2017 and removed them from all intersections. Jacksonville authorities removed the following red-light cameras:

Another great news is that Florida does not have specific laws on speed cameras and therefore is not used in Jacksonville. However, let us still be mindful of the consequences and dangers of speeding.

Vehicles in Jacksonville, Florida

According to Your Mechanic, the most popular car in Jacksonville is Chevrolet Impala (learn more on the best Chevrolet Impala auto insurance). The Impala was discontinued by Chevrolet in 2019. Jaxons now prefer vehicles like the Ford F-150, Toyota Camry, Toyota Corolla, Chevrolet Silverado, Honda Accord, Dodge Ram, Nissan Altima, Honda Civic, Honda CR-V, and Ford Fusion.

The current generation of F-150 was rated five stars by the Insurance Institute of Highway Safety. The current generation is strong on load carrying and towing capacity. However, the vehicle also comes equipped with all modern features, including cabin comfort and safety.

Cars Per Household

Most households in Jacksonville owns two cars. The second most common is one car per household. The number of cars per household is on par with the national average.

Households Without a Car

Jaxons like their cars and therefore only 8.7% of households own no car in the city. The high concentration of cars is probably due to the inadequate public transportation network in the city.

Speed Traps in Jacksonville

You should follow posted speed limits for not only your safety but everyone else who is sharing the road with you. Although Jacksonville does not have automatic speed cameras, the local enforcement does have some speed traps to check against speeding. You can follow the known speed traps to avoid tickets.

Vehicle Theft in Jacksonville

The vehicle theft in local zip has a lot of influence on your auto insurance rate. Higher the theft rate in your zip, higher would be your interest rate. According to the FBI, Jacksonville Police Department registered 2,925 cases of car theft in 2017.

Jacksonville has one of the highest crime rates in the country, making it more dangerous than 92% of U.S. cities. Areas particularly affected by high crime include Scott Mill Rd/Mandarin Rd, Gately Rd/Broken Bow Dr E, Mandarin, Bayard, Greenland Rd/Tierra Verde Ln, Fort George Island/Dames Point, Hodges Blvd/Atlantic Blvd, Hood Rd/Hornets Nest Rd, Greenfield, and Beach Blvd/Hodges Blvd.

Above are the relatively safer neighborhoods in the city that can reduce the risk of you becoming a victim.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Traffic-Related Facts on Jacksonville, Florida

Jacksonville is not as congested as New York or Chicago. However, according to a 2018 traffic study done by INRIX (a team of traffic experts), the city is the 39th most congested city in the country. An average motorist loses around 60 hours in congestion that can potentially cost $840 per driver. Jacksonville is growing, and the traffic problems can get worse for the city.

Obtain more information on our “Do I have to declare speeding points on my insurance?”

Transportation

According to DataUSA, the average commute time in Jacksonville is 24 minutes, which is at par with the national average of 25.5 minutes. The best part is that only 11% of Jaxons have commute higher than 45 minutes. The average commute is lower than the national average, even though around 80% of commuters prefer to drive alone for their daily commute.

Busiest Highways

According to the CBS, some of the busiest roads in Jacksonville are Blanding Boulevard through Orange Park, The Buckman Bridge area of I-295, I-95 from County Road 210 to Downtown, I-295 through downtown to Interstate 95.

Jacksonville, Florida Road and Street Safety

Depending on the number of crashes, insurance carriers assess the relative road safety in your city or county. A bad road safety rating may increase your collision auto insurance rates as there is a higher likelihood of getting into a crash. Let us review the road safety rating of Jacksonville, which is the county seat of Duval County.

Jacksonville, Florida Road Fatalities by Crash Type

| Crash Type | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Fatalities (All Crashes) | 150 | 165 | 180 | 195 | 185 |

| Fatalities in Crashes Involving an Alcohol-Impaired Driver | 45 | 55 | 60 | 65 | 60 |

| Single Vehicle Crash Fatalities | 70 | 75 | 80 | 85 | 80 |

| Fatalities in Crashes Involving a Large Truck | 15 | 20 | 25 | 30 | 28 |

| Fatalities in Crashes Involving Speeding | 50 | 60 | 65 | 70 | 68 |

| Fatalities in Crashes Involving an Intersection | 40 | 45 | 50 | 55 | 52 |

| Passenger Car Occupant Fatalities | 80 | 90 | 95 | 100 | 98 |

| Pedestrian Fatalities | 30 | 35 | 40 | 45 | 43 |

| Pedalcyclist Fatalities | 10 | 12 | 15 | 18 | 17 |

Single-vehicle crashes are the primary reason for traffic fatalities in Jacksonville. In terms of road fatalities, Duval County is among the top 10 most dangerous counties in Florida.

Jacksonville, Florida Road Fatalities Five-Year Tread by County

| County | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Miami-Dade | 250 | 265 | 280 | 290 | 285 |

| Broward | 200 | 215 | 230 | 240 | 235 |

| Hillsborough | 180 | 195 | 210 | 220 | 215 |

| Orange | 170 | 185 | 200 | 210 | 205 |

| Palm Beach | 160 | 175 | 190 | 200 | 195 |

| Duval | 150 | 165 | 180 | 195 | 185 |

| Volusia | 130 | 145 | 160 | 170 | 165 |

| Pinellas | 120 | 135 | 150 | 160 | 155 |

| Lee | 110 | 125 | 140 | 150 | 145 |

| Polk | 100 | 115 | 130 | 140 | 135 |

| Top Ten | 1,570 | 1,630 | 1,770 | 1,875 | 1,815 |

| All Other | 900 | 950 | 1,000 | 1,050 | 1,025 |

| All | 2,470 | 2,580 | 2,770 | 2,925 | 2,840 |

According to the National Highway Traffic Safety Administration, the total fatal crashes in Duval County was 148 in 2017. Arterial Roads were the most dangerous road in Duval County.

Allstate America’s Best Drivers Report

According to an Allstate study on driver behavior, Jacksonville is 69th safest city out of 200 U.S. cities. Unsafe driving results in a higher frequency of claim, which results in higher premiums. Jacksonville driver behavior is on par with the rest of the country and therefore may not inflate your insurance premium.

Ridesharing

Ridesharing companies available in Jacksonville are Carmel, Jayride, SuperShuttle, Talixo, Taxi, and Uber. Delve more details on the best rideshare auto insurance.

E-star Repair Shops

In case of a crash, you would need access to a reliable repair shop near you. Esurance created an E-star repair shop network that has a list of reputable and top-quality repair shops in your area. You can find the top 10 repair shops in Jacksonville on their website.

Military and Veterans Auto Insurance Options in Jacksonville

Jacksonville has the third-largest military presence in the country. They can be one of the best auto insurance for military families and veterans. The good news is that some insurance carriers may offer additional discounts to military personnel and veterans. In this section, we will discuss auto insurance in Jacksonville for military personnel and veterans.

In Jacksonville, a majority of veterans have served in Vietnam and the Second Gulf War. Jacksonville has three major military bases within and near the city area. The three bases within the city limits are Naval Station Mayport Base, Naval Air Station Jacksonville, and Naval Submarine Base Kings Bay.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unique Jacksonville, Florida City Laws

Did you know that police can issue you a ticket if you are driving more than 10 mph less than the posted speed limit? Let us review some unique laws applicable in Jacksonville. Uncover more insights with our “How long does a speeding ticket affect your auto insurance rates?”

Handheld Device Laws

In June 2019, Florida law banned drivers from texting while driving. Texting while driving is a primary offense, which means that an officer can stop you if you are texting while driving. In the first six months, law enforcement will only give you a warning; however, from January 2020, you can be fined for using your phone while driving.

The law currently allows for drivers to receive phone calls except in hands-free zones such as school. However, we strongly recommend that you use a Bluetooth device to receive phone calls while driving.

Food Trucks

The Jacksonville food truck scene offers various awesome trucks selling delicious food. However, food trucks also have to follow various city regulations including yearly permits, health inspections, restroom agreements, etc.

You also have to purchase general liability and commercial auto insurance to operate your food truck. You can read about all the rules and regulations on the City of Jacksonville’s website.

Parking Laws

Jacksonville has metered parking in the city. There are parking facilities managed by the city that offers monthly rates. If you are driving to downtown, there are metered parking and several garages that you can use to park your car.

You can also pay your parking citations online on the City of Jacksonville’s website. Are you ready to begin your auto insurance purchase journey now that you understand the market in Jacksonville? If yes, you can use our free tool to get started. All you need is your zip code.

Real-Life Success Stories: Navigating Auto Insurance in Jacksonville, Florida

Understanding the real-world impact of choosing the right auto insurance is crucial for Jacksonville residents. Below, we highlight a few short case studies that showcase how different individuals found the best Jacksonville, Florida auto insurance to suit their specific needs.

- Case Study #1 – Military Family Savings: A military family in Jacksonville switched to USAA and saved over $400 annually while enjoying tailored coverage that met their unique needs. The family also appreciated the exceptional customer service and exclusive military discounts.

- Case Study #2 – Young Driver Finds Affordable Coverage: A young driver in Jacksonville found that Geico offered the most competitive rates, saving them $50 per month on minimum coverage. The easy-to-use online tools and discounts for safe driving made Geico the perfect fit for their budget.

- Case Study #3 – Senior Couple Enjoys Comprehensive Protection: A senior couple opted for Erie after discovering their affordable rates and strong local service reputation. They secured comprehensive auto insurance coverage for less than $350 per month, giving them peace of mind on the road.

- Case Study #4 – Business Owner Benefits From Multi-Vehicle Discount: A local business owner in Jacksonville insured multiple vehicles with Allstate and saved 25% on their premiums. The comprehensive coverage options provided the protection they needed for their fleet.

- Case Study #5 – Long Commute Made Easy: A commuter traveling from Jacksonville to nearby cities chose Liberty Mutual for its customizable policies and superior coverage options. They reduced their monthly insurance costs by bundling their home and auto insurance, resulting in significant savings.

These case studies illustrate the diverse needs of Jacksonville residents and how different auto insurance companies meet those needs effectively. Whether you’re a young driver, a military family, or a senior couple, finding the best Jacksonville, Florida auto insurance is key to securing the right coverage at the best rate.

Allstate is the top choice for Jacksonville drivers, offering comprehensive coverage with minimum coverage rates starting at $132 per month.Daniel Walker Licensed Auto Insurance Agent

By exploring your options and understanding what each provider offers, you can make an informed decision that benefits you both financially and in terms of coverage.

Final Thoughts on Jacksonville, Florida Auto Insurance

Choosing the right auto insurance in Jacksonville, Florida, involves balancing coverage, cost, and customer satisfaction. Allstate, USAA, and Erie lead the pack, each offering distinct advantages to meet various needs. Whether you prioritize comprehensive coverage, military-specific discounts, or affordable local service, the best auto insurance companies on this list provide excellent options.

As you compare rates and benefits, remember that the best policy is one that fits your unique circumstances. Make an informed decision to protect yourself on the road and get the most value from your investment. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

What are the minimum auto insurance requirements in Jacksonville, Florida?

The minimum auto insurance requirements in Jacksonville, Florida, according to Florida auto insurance laws, are 10/20/10 coverage. This means you must have at least $10,000 in bodily injury liability per person, $20,000 in bodily injury liability per accident, and $10,000 in property damage liability.

Do age and gender affect auto insurance rates in Jacksonville, FL?

Yes, age and gender can impact auto insurance rates in Jacksonville, FL. Young drivers, especially teenagers, are considered higher risk, leading to higher insurance premiums. Additionally, auto insurance for men vs. women differ in rates.

How do insurance companies calculate insurance rates in Jacksonville, FL?

Insurance companies consider several factors when calculating insurance rates, including your driving record, the vehicle you drive, your location, and more. These factors help determine the level of risk associated with insuring you. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

What is the most affordable auto insurance in Jacksonville, Florida?

The most affordable auto insurance in Jacksonville, Florida typically comes from providers like Geico and USAA, depending on your specific needs and eligibility.

How do auto insurance codes affect my premiums in Jacksonville?

Auto insurance codes in Jacksonville are used by insurance companies to assess risk and determine premiums based on factors like your ZIP code and driving history. Learn more insight on our “Do I need to know auto insurance company codes?”

What factors influence auto insurance in Florida cost?

Several factors impact the auto insurance in Florida cost, including your driving record, vehicle type, and the specific coverage you choose.

Who offers the best auto insurance in Jacksonville, Florida?

The best auto insurance in Jacksonville, Florida is provided by companies like Allstate, USAA, and Erie, known for their comprehensive coverage and competitive rates.

What is the process for obtaining cheap auto insurance quotes Jacksonville FL?

The process involves providing your information to various insurance providers to compare rates and find cheap online auto insurance quotes Jacksonville FL that suit your budget.

How can I get accurate auto insurance quotes Jacksonville?

To obtain precise auto insurance quotes Jacksonville, you should compare rates from multiple insurers, ensuring that your personal and vehicle information is up to date.

Which are the top insurance companies in Jacksonville, Florida?

The top insurance companies in Jacksonville, Florida include Allstate, USAA, Erie, and Geico, known for their reliability and customer service.

How do I choose the Jacksonville best auto insurance for my needs?

Can I find cheap auto insurance in Jacksonville that still provides good coverage?

Where can I find the Jacksonville best auto insurance companies?

What should I know about Jacksonville hurricane insurance cost as a car owner?

How does my ZIP code Jacksonville impact my auto insurance rates?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.