Best Killeen, Texas Auto Insurance in 2025

On average, Killeen, TX auto insurance rates are $4,849/yr. The cheapest auto insurance company in Killeen, Texas, is USAA. However, Killeen, TX auto insurance quotes vary for each person. Killeen car insurance must meet the minimum Texas car insurance requirements with coverage levels of 30/60/25 for liability. Compare Killeen, TX auto insurance online to find the best price for you.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Sep 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Sep 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- On average, Killeen, TX auto insurance rates are $4,849/yr

- USAA, State Farm, and Geico is the cheapest auto insurance companies in Killeen

- The most significant factors in auto insurance are your driving record, age, vehicle, and credit history

How much is auto insurance in Killeen, TX? Killeen, TX auto insurance rates are $4,849 per year, which is $806 more expensive than the Texas auto insurance average and $987 more than the national average.

Killeen, TX auto insurance quotes are expensive, but personal factors could change coverage costs.

Read through this short guide to learn how to secure cheap auto insurance in Killeen, TX, for every age, credit history, and driving record.

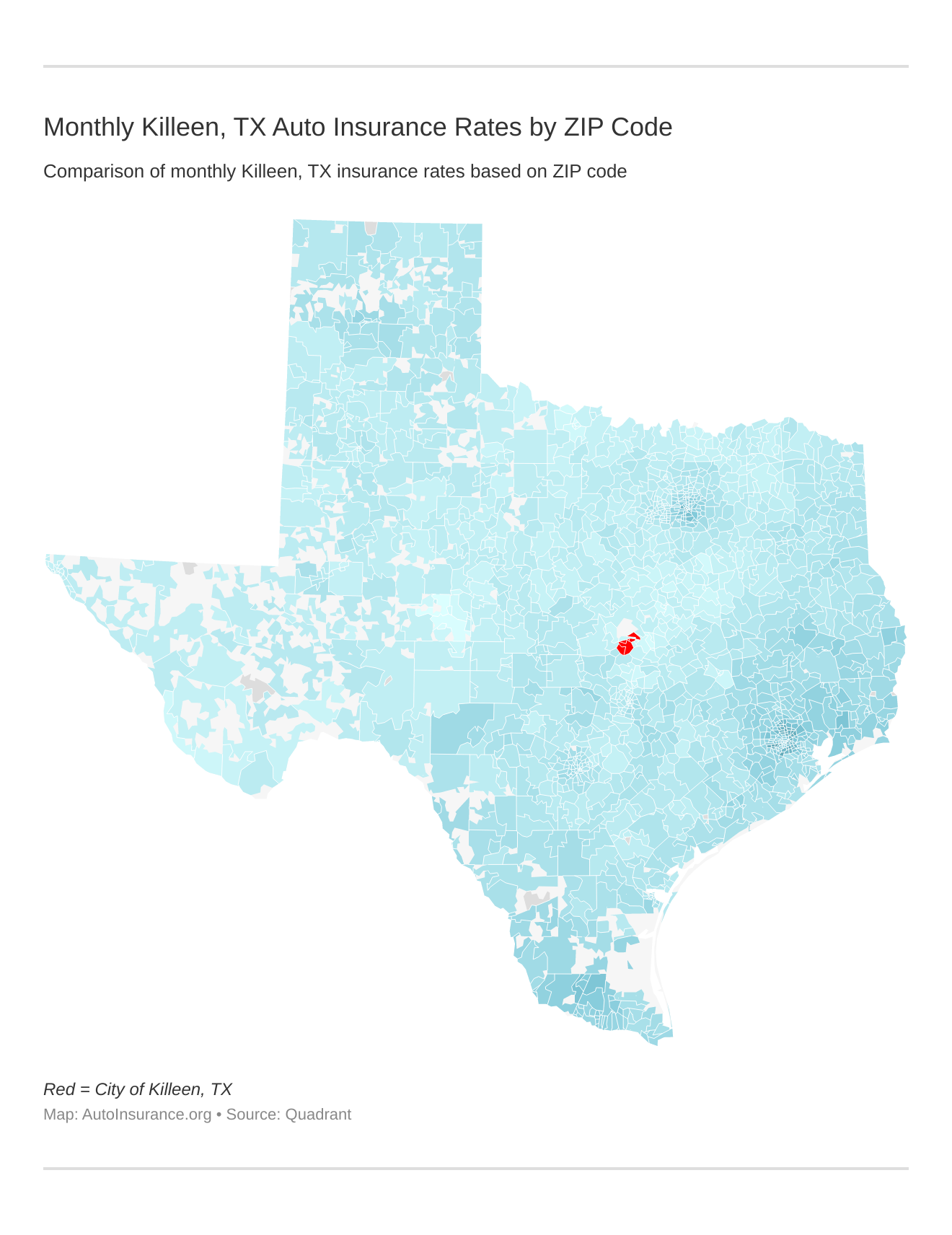

Monthly Killeen, TX Car Insurance Rates by ZIP Code

Check out the monthly Killeen, TX auto insurance rates by ZIP Code below:

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

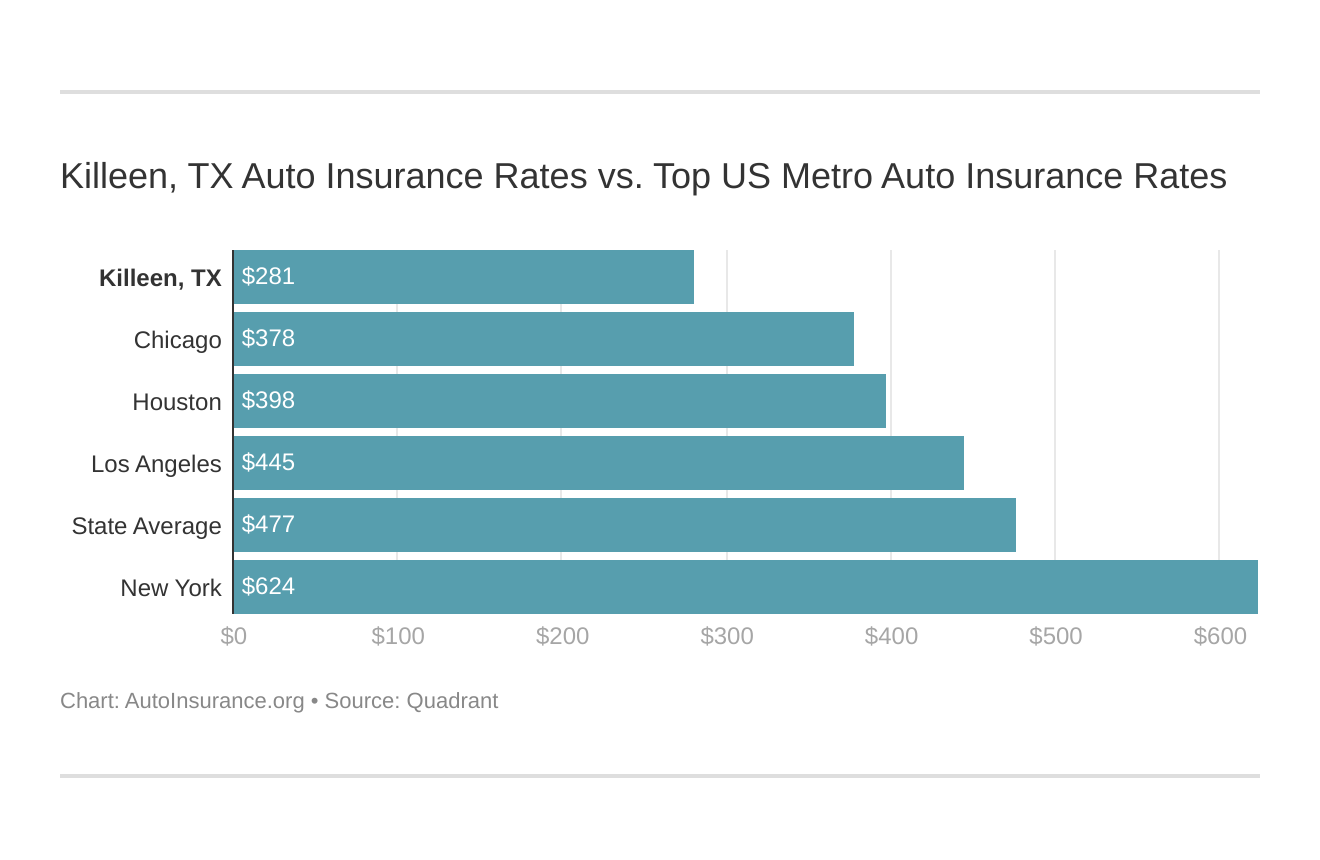

Killeen, TX Car Insurance Rates vs. Top US Metro Car Insurance Rates

You might find yourself asking how does my Killeen, TX stack up against other top metro auto insurance rates? We’ve got your answer below.

Are you ready to compare affordable Killeen, TX auto insurance quotes? Enter your ZIP code above to get started.

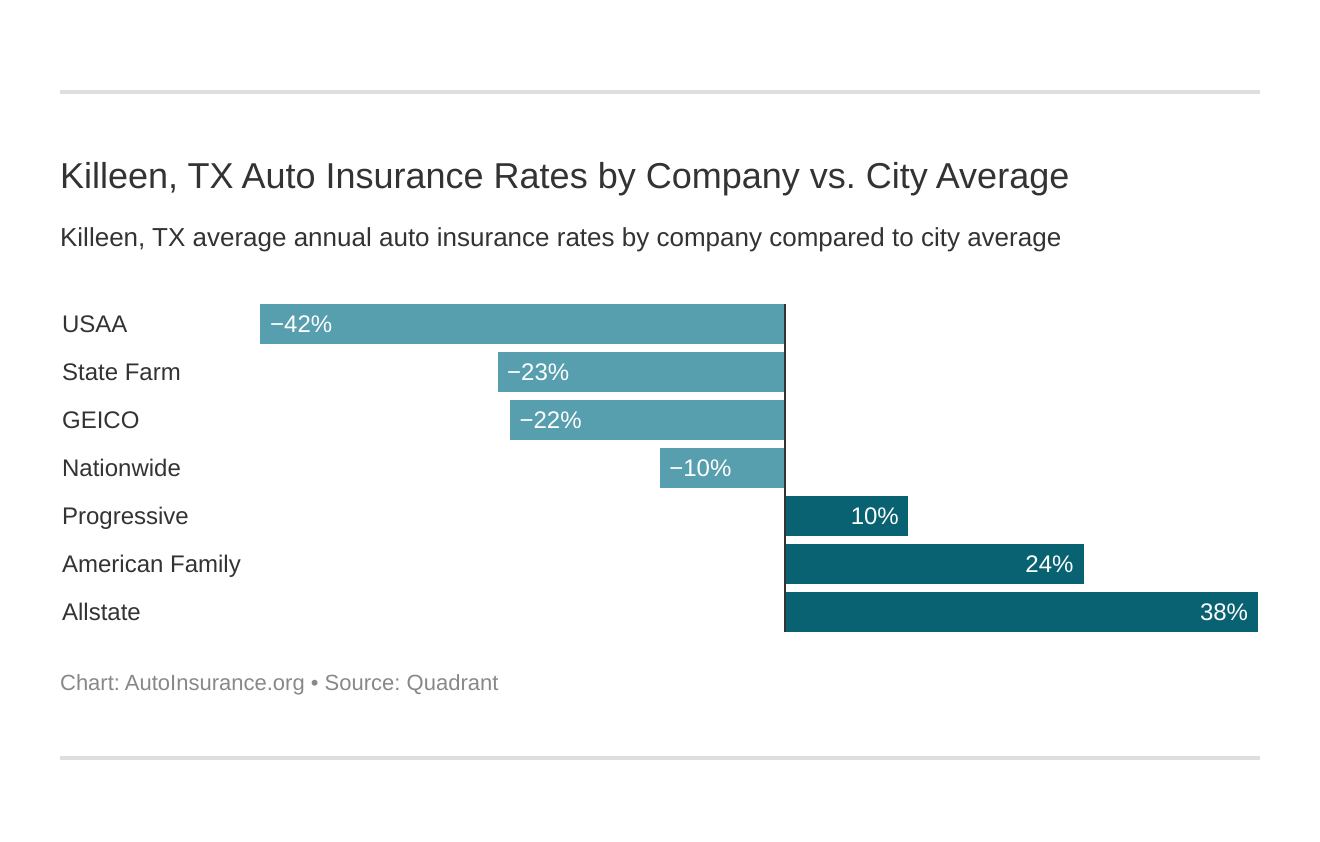

What is the cheapest Killeen, TX auto insurance company?

The cheapest auto insurance company in Killeen, based on average rates, is USAA.

Which Killeen, TX auto insurance company has the cheapest rates? And how do those rates compare against the average Texas auto insurance company rates? We’ve got the answers below.

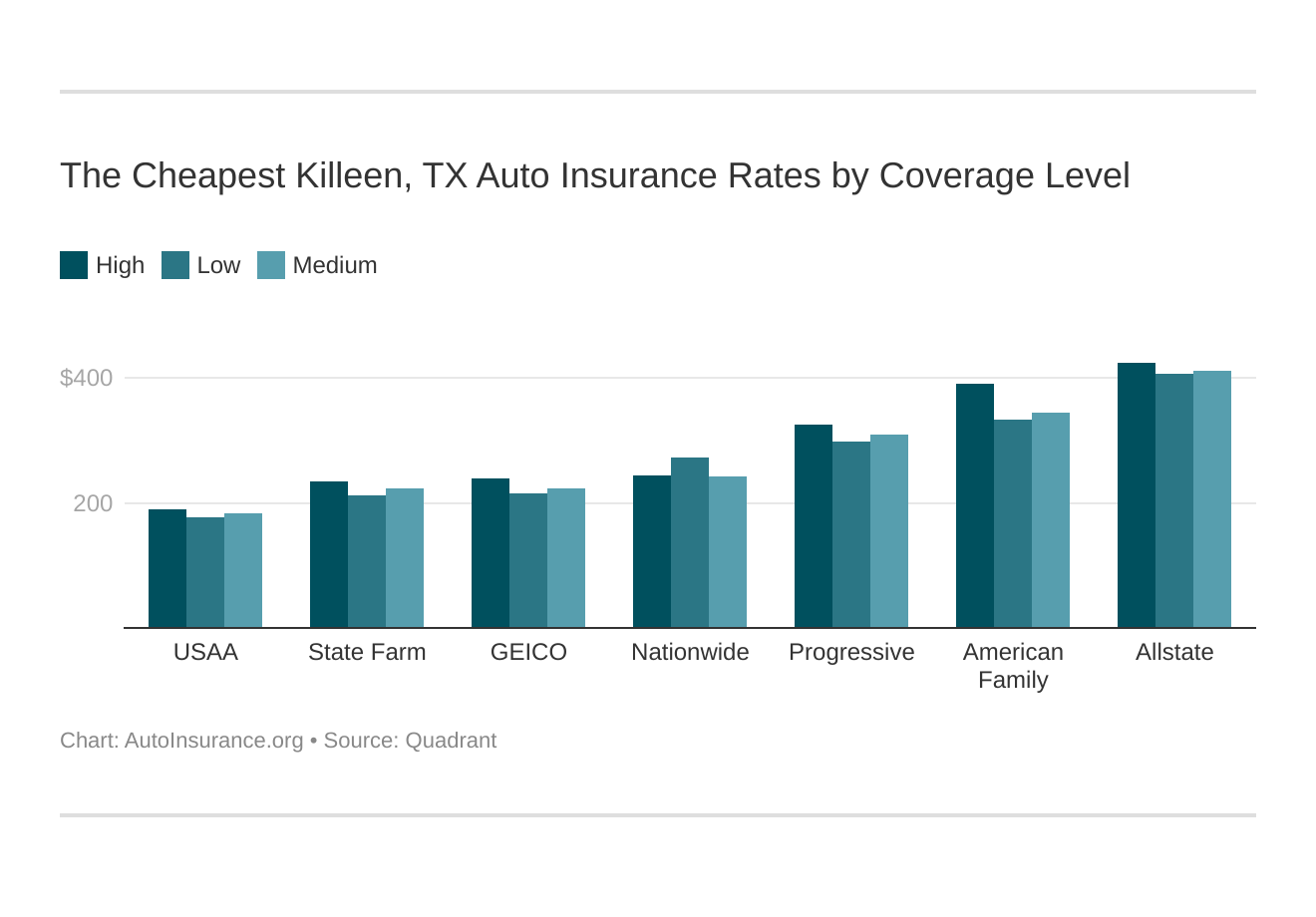

The best auto insurance companies in Killeen, TX, ranked from cheapest to most expensive are:

- USAA – $2,202

- State Farm – $2,679

- Geico – $2,719

- Nationwide – $3,040

- Progressive – $3,734

- American Family – $4,282

- Allstate – $4,976

Each Killeen, TX car insurance company has a unique premium that’s impacted by several factors.

The only company that is more expensive than Killeen’s average is Allstate. However, Allstate has over 30 discounts. Although you may not qualify for all of them, you could save 30% on auto insurance.

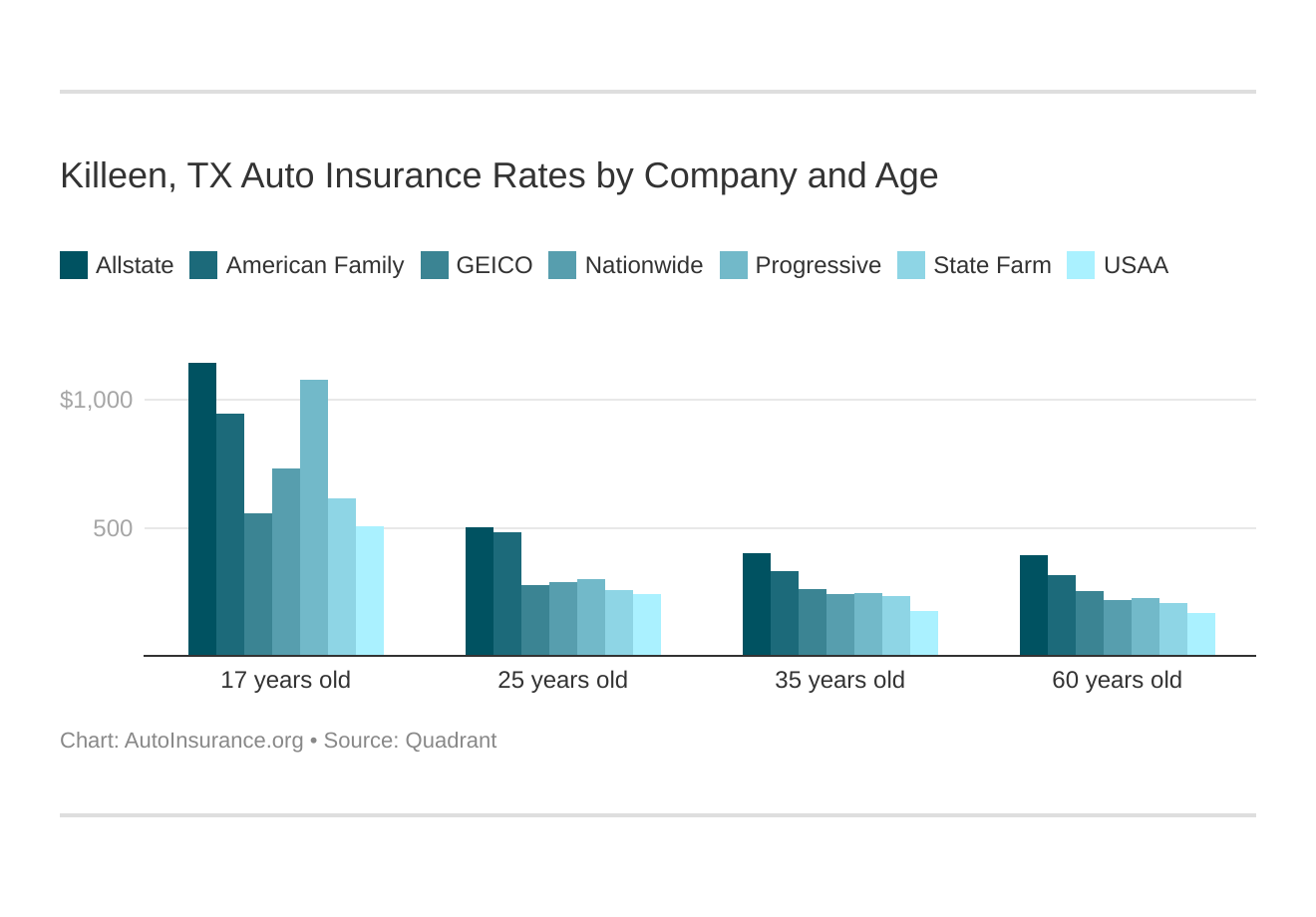

Killeen, TX auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

Your coverage level will play a major role in your Killeen auto insurance rates. Find the cheapest Killeen, TX auto insurance rates by coverage level below:

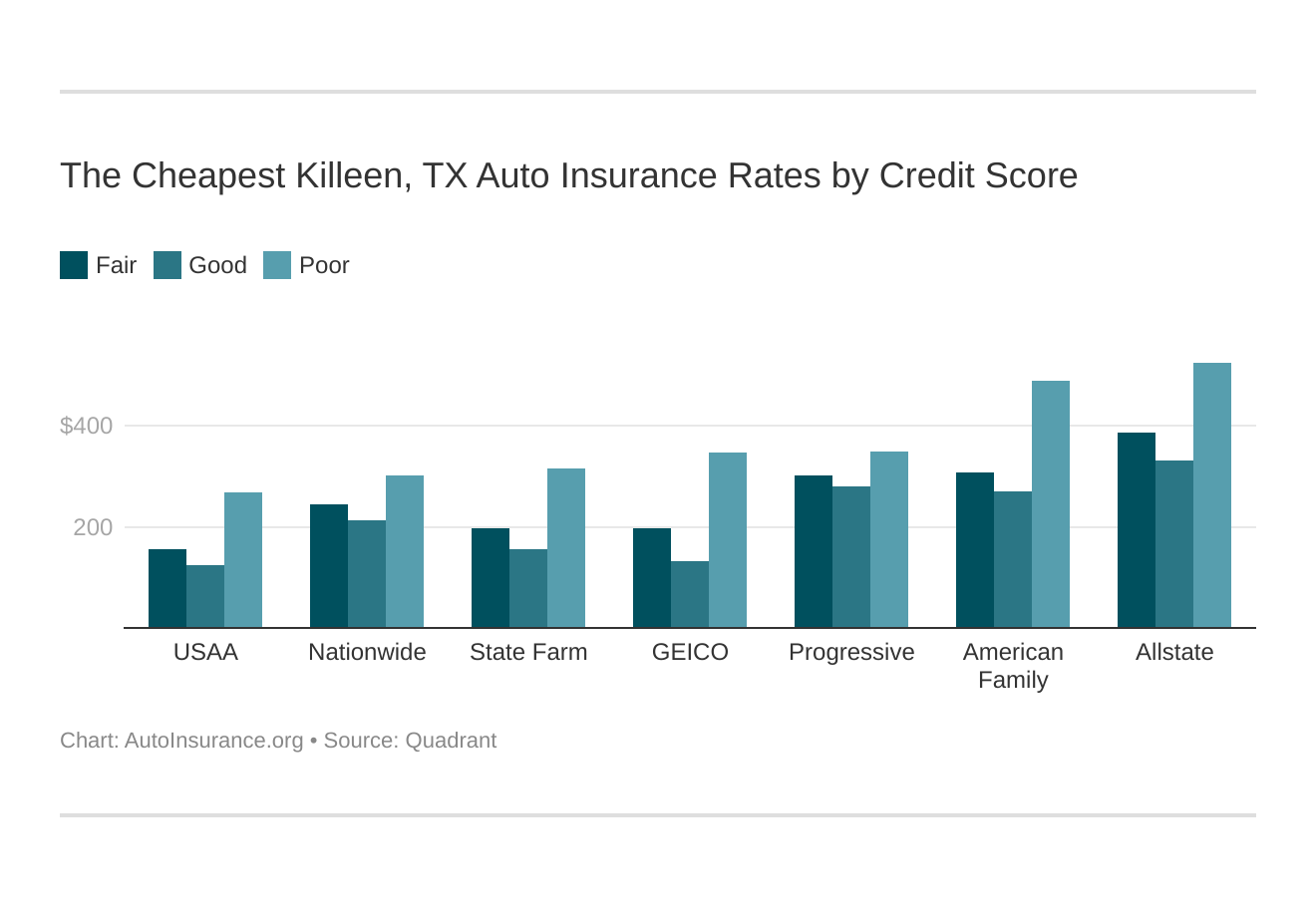

Your credit score will play a major role in your Killeen auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Killeen, TX auto insurance rates by credit score below.

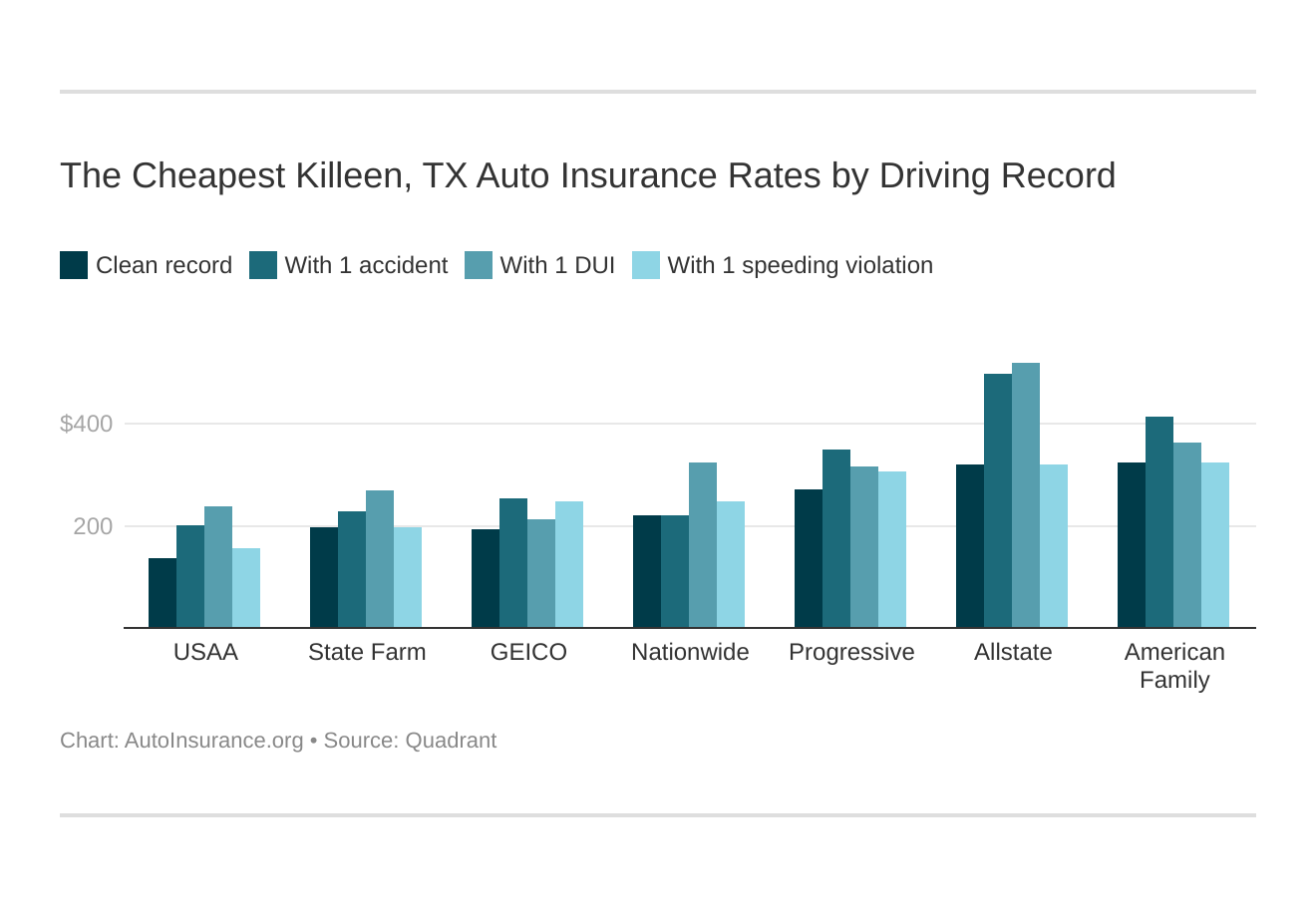

Your driving record will play a major role in your Killeen auto insurance rates. For example, other factors aside, a Killeen, TX DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Killeen, TX auto insurance rates by driving record.

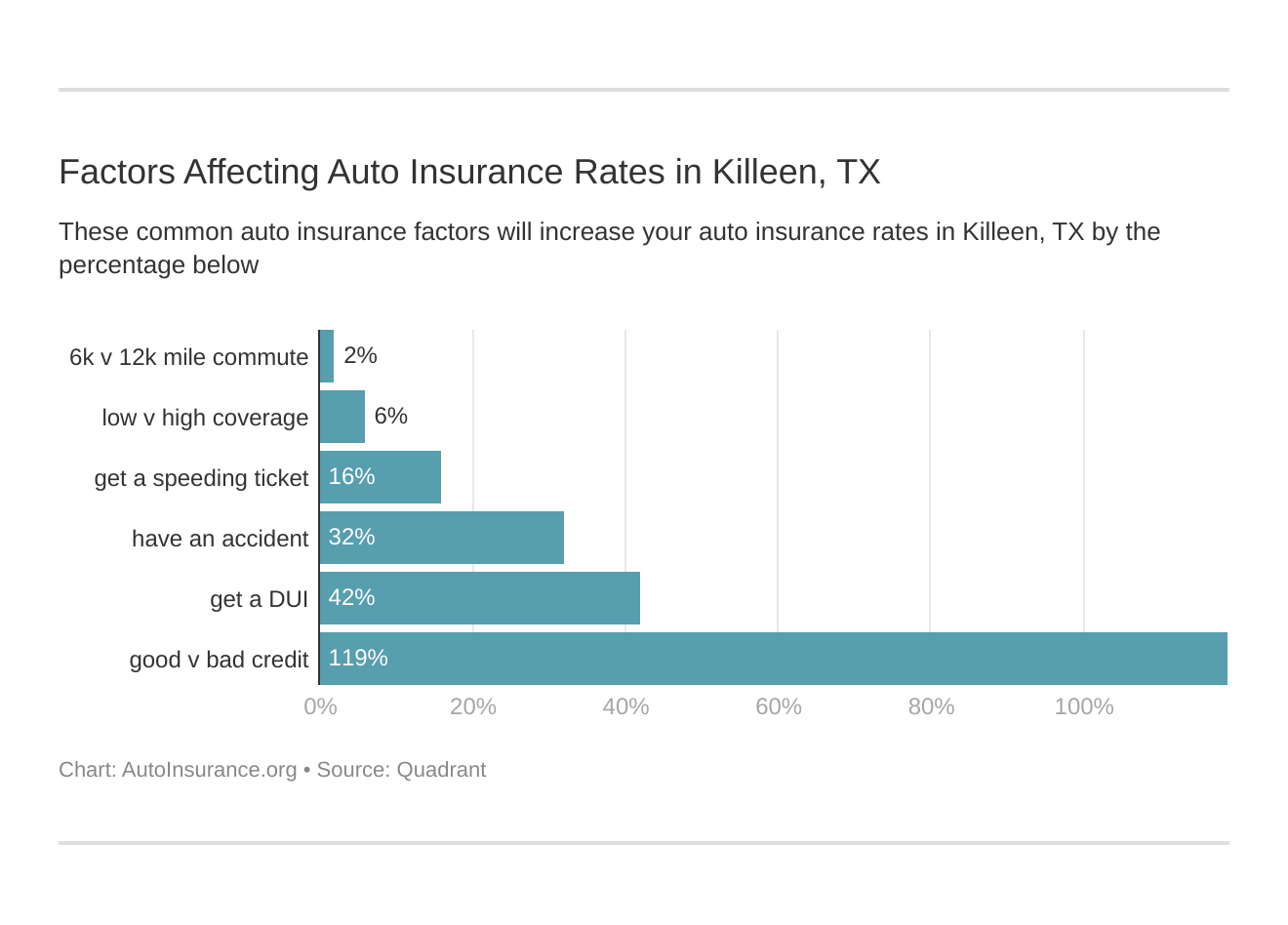

Factors affecting auto insurance rates in Killeen, TX may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Killeen, Texas auto insurance.

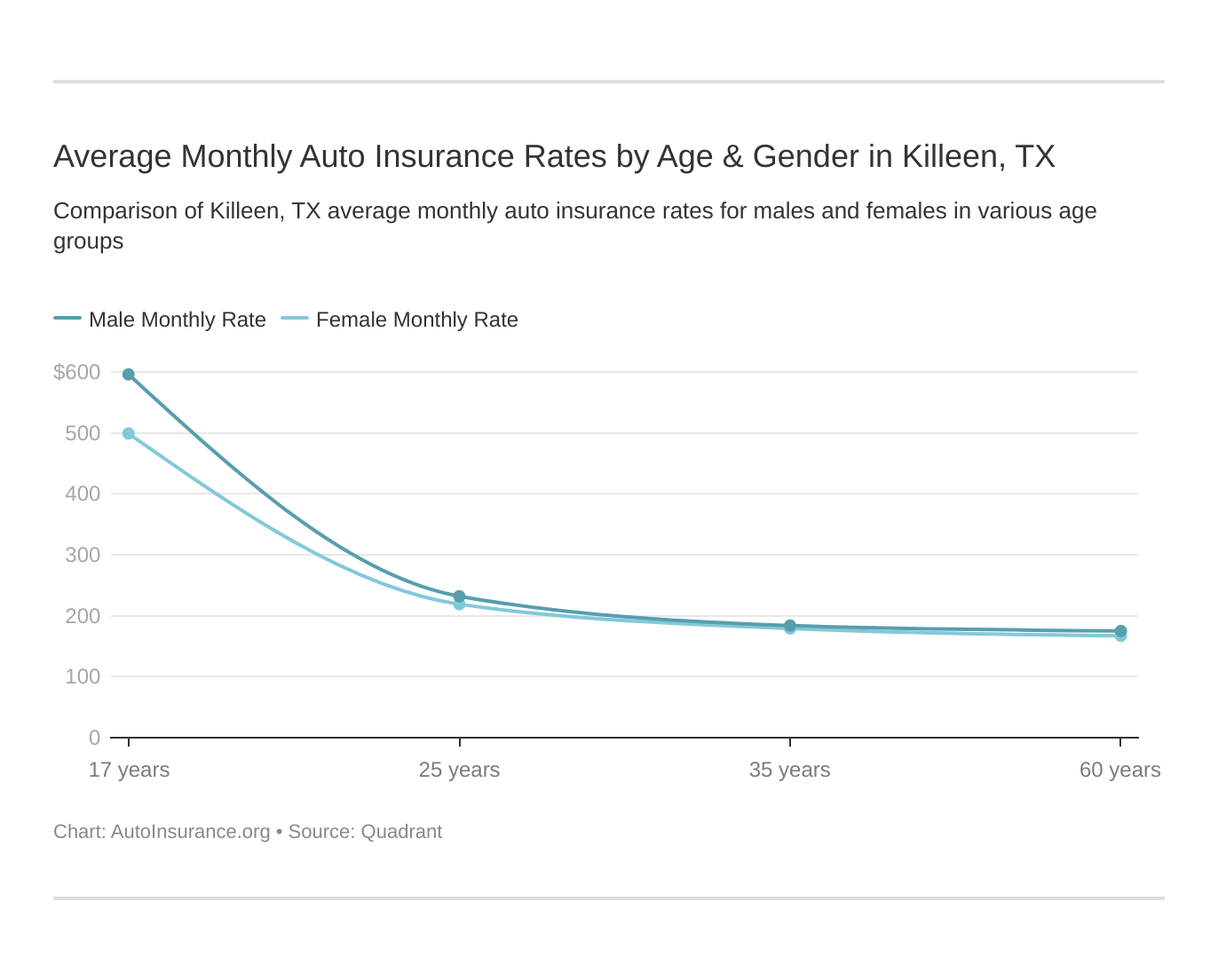

These states no longer using gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a significant factor because young drivers are often considered high-risk. Texas does use gender, so check out the average monthly auto insurance rates by age and gender in Killeen, TX.

What are the auto insurance requirements in Killeen, TX?

All Killeen drivers have to meet the Texas state law minimum requirements for auto insurance.

In Texas, you have to carry at least:

- $30,000 for bodily injury liability of one person

- $60,000 for bodily injury liability of multiple people

- $25,000 for property damage liability

Texas is an at-fault state, which means an at-fault driver must use their auto insurance policy to pay for the no-fault driver’s bodily injury and property damage from the collision.

Collision, comprehensive, and uninsured/underinsured coverages aren’t required, but they’re necessary for drivers who have a high-value vehicle or a vehicle for that being financed.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What factors affect auto insurance rates in Killeen, TX?

Auto insurance is cheaper with companies because they use various factors to determine auto insurance rates. Explore each subsection to see how car insurance is affected by different factors.

How does Killeen auto insurance compare to other Texas cities?

Your address can determine your auto insurance rates. Let’s look at the cost of auto insurance from other cities compared to Killeen.

- Auto Insurance in Killeen, TX – $4,849/yr

- Auto Insurance in San Antonio, TX – $5,579/yr

- Auto Insurance in Dallas, TX – $5,855/yr

Not only is Dallas more expensive, but it’s also an area that’s more populated than Killeen. However, some areas in Texas have fewer people and more expensive auto insurance.

How does your driving history affect Killeen, TX auto insurance?

The most significant factor that affects Killeen, TX car insurance rates is your driving record. If you want to secure affordable Killeen, TX car insurance quotes, you must maintain a clean driving record.

Any accident or other driving infraction can drive up your rate by at least $200 per year.

How do age and gender impact Killeen, TX auto insurance?

Age correlates to your overall driving experience. Therefore, teens and young adults are connected to more expensive rates.

Even gender can impact your rates. Males are riskier drivers, so auto insurance in Killeen is more expensive for young and single male drivers.

Can credit history affect your auto insurance in Killeen, TX?

Parents can secure affordable Killeen, TX car insurance through good credit. Car insurance providers correlate good and excellent credit to fewer chances of filing a claim.

How can commute mileage affect auto insurance in Killeen, TX?

Your car insurance provider considers how much you drive your vehicle to determine risk.

Expect your commutes to be twice as long during congested traffic. Killeen doesn’t have much traffic data, but it does have information on commute time.

According to City-Data, the average commute time in Killeen, TX is 22 minutes, which is three minutes faster than the national average.

How does a vehicle make and model year impact Killeen, TX auto insurance?

Even if you have one of the top 10 vehicles in the United States, your car insurance rates in Killeen, TX will cost at least $2,200.

However, you can get auto insurance discounts if your vehicle has anti-theft and safety features.

Can vehicle theft affect comprehensive coverage in Killeen, TX?

Your comprehensive auto insurance may be more expensive in Killeen. According to Neighborhood Scout, property crime chances are higher than the national average.

Higher property crime rates could mean higher prices for auto insurance. However, the 2019 FBI statistics reported 318 auto thefts in Killeen. It’s much less than bigger cities in Texas, but it still affects auto insurance.

Killeen, TX Auto Insurance: The Bottom Line

The best way to secure cheap Killeen, TX auto insurance is through discounts and a clean driving record. If you don’t qualify for savings, keep shopping around until you can get an affordable policy.

Before you buy Killeen, TX auto insurance, be sure you’ve checked out rates with the best companies. Enter your ZIP code below to get fast, free auto insurance quotes.

Frequently Asked Questions

What is Killeen, TX auto insurance?

Killeen, TX auto insurance refers to the insurance coverage specifically designed for vehicles registered and operated in Killeen, Texas. It provides financial protection in case of accidents, damages, theft, or other incidents involving vehicles in the Killeen area.

Is auto insurance mandatory in Killeen, TX?

Yes, auto insurance is mandatory in Killeen, TX, as it is in the state of Texas. The specific insurance requirements may vary, but drivers in Killeen must carry at least the minimum required liability insurance as mandated by the state.

What are the minimum auto insurance requirements in Killeen, TX?

In Killeen, TX, drivers are required to carry liability insurance with minimum coverage limits of 30/60/25. This means at least $30,000 bodily injury liability coverage per person, $60,000 bodily injury liability coverage per accident, and $25,000 property damage liability coverage per accident.

What other types of coverage should I consider for my auto insurance in Killeen, TX?

While liability insurance is the minimum requirement, it’s also important to consider additional coverage options for greater protection. Collision coverage can help cover repairs or replacement costs for your vehicle in case of a collision. Comprehensive coverage can protect against non-collision-related incidents such as theft, vandalism, or damage from natural disasters. Uninsured/underinsured motorist coverage is also recommended to protect you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

How can I find affordable auto insurance in Killeen, TX?

To find affordable auto insurance in Killeen, TX, it’s advisable to shop around and compare quotes from different insurance providers. Factors such as your driving record, age, type of vehicle, and coverage needs can influence the cost of insurance. Additionally, maintaining a good driving record, bundling your auto insurance with other policies, and asking about available discounts can help you secure more affordable rates.

Are there any specific discounts or programs available for auto insurance in Killeen, TX?

Insurance providers may offer various discounts and programs that can help reduce the cost of auto insurance in Killeen, TX. These may include discounts for safe driving, good student discounts, multi-policy discounts, or discounts for installing safety features in your vehicle. It’s recommended to inquire about available discounts when obtaining insurance quotes.

What should I do if I need to file an auto insurance claim in Killeen, TX?

If you need to file an auto insurance claim in Killeen, TX, you should contact your insurance provider as soon as possible. They will guide you through the claims process and provide instructions on what information or documentation is required. Be prepared to provide details about the incident, such as the date, time, location, and any necessary supporting evidence, such as photographs or police reports.

Can I use my Killeen, TX auto insurance for out-of-state travel?

Your Killeen, TX auto insurance typically provides coverage when you travel out of state. However, it’s important to review your policy or contact your insurance provider to understand any limitations or restrictions that may apply. Some policies may have certain coverage limitations or additional requirements when driving in certain states or regions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.