Best Monroe, Louisiana Auto Insurance in 2026 (Find the Top 10 Companies Here)

The leading providers for the best Monroe, Louisiana auto insurance are State Farm, Progressive, and Allstate, with rates starting at $55 per month. These companies stand out for their competitive pricing, comprehensive coverage options, and strong customer satisfaction in Monroe, Louisiana.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated August 2025

Company Facts

Full Coverage in Monroe Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Monroe Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Monroe Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, Progressive, and Allstate are the top choices for the best Monroe, Louisiana auto insurance, with rates starting as low as $55 per month.

Among these, State Farm stands out as the top pick overall, offering a combination of comprehensive coverage and competitive pricing that makes it a strong choice for many drivers. Progressive is highly regarded for its advanced online tools, which simplify the process of managing and customizing your insurance policy.

Our Top 10 Company Picks: Best Monroe, Louisiana Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 10% B Local Agents State Farm

![]()

#2 12% A+ Online Tools Progressive

#3 15% A+ Bundling Options Allstate

#4 18% A+ Unique Discounts Nationwide

#5 14% A Custom Coverage Farmers

#6 13% A Flexible Policies Liberty Mutual

#7 8% A++ Policy Savings Travelers

#8 13% A Personalized Service American Family

#9 20% A++ Customer Satisfaction Auto-Owners

#10 19% A Customizable Options Safeco

This feature is particularly appealing to those who prefer a tech-driven approach to insurance. Expand your understanding with our article called, “Where to Compare Auto Insurance Rates.”

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- Best Monroe auto insurance from State Farm, Progressive, and Allstate

- Compare multiple quotes for better coverage and savings

- Top pick: State Farm with rates starting at $55 per month

#1 – State Farm: Top Overall Pick

Pros

Pros

- Local Agents: Offers personalized service with local agents available in Monroe, Louisiana, making it easier for Monroe, Louisiana drivers to get the coverage they need. With a local presence, policyholders can receive face-to-face consultations tailored to their specific needs.

- Wide Network: Extensive network of agents and offices across Louisiana ensures Monroe, Louisiana policyholders have convenient access to assistance. This widespread availability makes it easy for policyholders to find help no matter where they are in the state.

- Reputation for Reliability: State Farm is well-known for its longstanding reputation and commitment to customer service in Monroe, Louisiana. This trustworthiness often leads to high customer satisfaction and dependable support when needed.

- Discount Options: Offers up to a 10% bundling discount along with other savings opportunities, helping Monroe, Louisiana drivers save on their overall insurance costs. This discount can be especially beneficial when combining auto with home or other types of insurance.

Cons

- Higher Premiums: May have higher premiums compared to competitors, which could be a drawback for budget-conscious Monroe, Louisiana drivers. Monroe, Louisiana policyholders might find that the personalized service comes at a slightly higher cost. Find out more by reading our article titled, “State Farm Auto Insurance Review.”

- Limited Online Features: Not as robust in online tools as some competitors, potentially inconveniencing Monroe, Louisiana policyholders who prefer digital interactions. While State Farm focuses on local agents, the lack of comprehensive online tools might be a disadvantage for tech-savvy drivers.

- Discount Restrictions: Bundling discount might not apply to all policy types, limiting savings for some Monroe, Louisiana policyholders. Certain specialized coverages may not qualify for discounts, reducing the overall savings potential.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Online Tools

Pros

Pros

- Online Tools: Excellent digital tools for policy management, making it easy for Monroe, Louisiana insurance policyholders to handle their policies online. Progressive’s user-friendly website and mobile app allow Monroe, Louisiana drivers to manage their insurance anytime, anywhere.

- Competitive Rates: Generally offers competitive pricing in Monroe, Louisiana, making it an affordable option for Monroe, Louisiana drivers. With a reputation for cost-effective policies, Progressive is a strong contender for budget-conscious drivers in the area.

- Variety of Discounts: Includes a 12% bundling discount along with other savings, giving Monroe, Louisiana drivers multiple ways to reduce their insurance costs. In addition to the bundling discount, drivers can also take advantage of safe driving and multi-car discounts.

- A+ Rating: High financial strength rating, ensuring Monroe, Louisiana policyholders can trust in the company’s ability to pay claims. This top-tier rating from A.M. Best reflects Progressive’s robust financial health and reliability in the industry. Explore further details in our article titled, “Progressive Auto Insurance Review.”

Cons

- Customer Service: May have less personalized service due to the online focus, which could be a drawback for Monroe, Louisiana insurance policyholders who prefer dealing with a local agent. The emphasis on digital interaction might leave some customers feeling disconnected.

- Rate Increases: Some customers report rate increases over time, which could affect Monroe, Louisiana drivers who are looking for stable long-term pricing. Even with initial low rates, drivers should be aware of potential premium hikes in the future.

- Claims Process: Mixed reviews on the ease and speed of the claims process, which might be a concern for Monroe, Louisiana policyholders needing quick resolutions. While some drivers experience smooth claims handling, others report delays and complications.

#3 – Allstate: Best for Bundling Options

Pros

Pros

- Bundling Options: Offers up to a 15% discount for bundling multiple policies, enhancing savings for Monroe, Louisiana drivers. This discount can be particularly advantageous when combining auto insurance with home or renters insurance.

- Strong Financial Rating: Rated A+ by A.M. Best, providing Monroe, Louisiana policyholders with confidence in the company’s ability to handle claims. This high rating indicates strong financial stability and reliability.

- Local Presence: Provides access to local agents in Monroe, Louisiana, ensuring personalized service and support. This local presence allows for tailored advice and support based on individual needs.

- Comprehensive Coverage: Wide range of coverage options available, allowing Monroe, Louisiana drivers to customize their policies to fit their specific needs. This flexibility helps ensure adequate protection for various scenarios. Uncover additional insights in our article called, “Allstate Auto Insurance Review.”

Cons

- Higher Costs: May have higher premiums for younger or high-risk drivers in Monroe, Louisiana. This could make it less affordable for certain demographics.

- Limited Discounts: Fewer discount options compared to other providers, which may affect overall savings for Monroe, Louisiana policyholders. Drivers looking for multiple types of discounts might find this limiting.

- Customer Reviews: Some negative feedback on customer service, which could be a concern for Monroe, Louisiana drivers who value responsive and helpful support.

#4 – Nationwide: Best for Unique Discounts

Pros

Pros

- Unique Discounts: Offers various discounts not available from other insurers, which can benefit Monroe, Louisiana policyholders looking for additional savings. These unique discounts may include savings for specific behaviors or affiliations.

- Customizable Policies: Flexibility in policy options allows Monroe, Louisiana drivers to tailor their coverage to their needs. This customization can help ensure that drivers only pay for the coverage they actually need.

- Strong Financial Rating: A+ rating by A.M. Best indicates a solid financial standing, providing reassurance to Monroe, Louisiana insurance policyholders. This rating reflects Nationwide’s reliability and ability to meet its financial obligations.

- Bundling Discount: Up to 18% savings when bundling multiple policies, which can be advantageous for Monroe, Louisiana drivers looking to combine auto with other types of insurance. Discover more by delving into our article entitled, “Nationwide Auto Insurance Review.”

Cons

- Complex Pricing: Some customers find the pricing structure confusing, which could be a drawback for Monroe, Louisiana policyholders seeking straightforward rates. The complexity of pricing may require more effort to understand.

- Fewer Local Agents: Limited local presence in Monroe, Louisiana compared to some competitors, which might affect those who prefer in-person interactions. This can limit direct support and guidance.

- Claim Processing: Reports of slower claim processing times, which could be a concern for Monroe, Louisiana drivers needing timely resolutions. Some policyholders might experience delays when filing claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Custom Coverage

Pros

Pros

- Custom Coverage: Highly customizable policy options to suit the unique needs of Monroe, Louisiana drivers. This allows policyholders to build a policy that matches their specific requirements.

- Strong Customer Service: Generally positive reviews on customer interaction, ensuring Monroe, Louisiana policyholders receive good support. Customer service is often rated highly for responsiveness and assistance.

- Multiple Discounts: Offers a 14% bundling discount and additional savings opportunities, helping Monroe, Louisiana policyholders reduce their insurance costs. Discounts can be applied to multiple types of coverage.

- A Rating: Strong financial backing with an A rating from A.M. Best, providing confidence to Monroe, Louisiana insurance policyholders. This rating signifies financial stability and reliability. Deepen your understanding with our article called, “Farmers Auto Insurance Review.”

Cons

- Premiums: Prices may be higher than average for certain demographics, which could be a disadvantage for Monroe, Louisiana drivers seeking more affordable options. Higher premiums might affect those on a tight budget.

- Limited Online Features: Website and app may not be as advanced as others, which might inconvenience tech-savvy Monroe, Louisiana policyholders. Online tools may lack some functionalities found in competitors’ platforms.

- Claim Satisfaction: Mixed feedback on the claims process, with some policyholders experiencing difficulties. Monroe, Louisiana drivers might face challenges with the speed or ease of claims handling.

#6 – Liberty Mutual: Best for Flexible Policies

Pros

Pros

- Flexible Policies: Wide range of flexible policy options suitable for Monroe, Louisiana insurance policyholders with varied needs. This flexibility allows for adjustments as personal circumstances change.

- Discount Opportunities: Offers a 13% bundling discount and additional savings, providing Monroe, Louisiana drivers with several ways to lower their insurance costs. Discounts can apply to multiple policy types.

- Strong Financial Health: Rated A by A.M. Best, indicating solid financial health and reliability for Monroe, Louisiana policyholders. This rating reflects Liberty Mutual’s ability to meet its financial obligations.

- Online Resources: User-friendly online tools and mobile app make it easier for Monroe, Louisiana drivers to manage their policies. This convenience enhances the overall customer experience. For further details, consult our article named, “Liberty Mutual Auto Insurance Review.”

Cons

- Premium Increases: Some customers report unexpected premium hikes, which could be an issue for Monroe, Louisiana drivers looking for stable rates. Premiums may increase over time despite initial savings.

- Customer Service: Mixed reviews on the quality of customer service, which may be a concern for Monroe, Louisiana policyholders needing reliable support. Experiences with customer service can vary widely.

- Local Agents: Fewer local agents in Monroe, Louisiana compared to other providers, potentially limiting face-to-face support for policyholders. This could be a drawback for those who prefer in-person interactions.

#7 – Travelers: Best for Policy Savings

Pros

Pros

- Policy Savings: Offers significant savings opportunities, especially for bundling, which can benefit Monroe, Louisiana drivers looking to lower their insurance costs. Discounts can be applied to multiple policies.

- Top Financial Rating: A++ rating by A.M. Best, reflecting superior financial strength and reliability for Monroe, Louisiana insurance policyholders. This high rating ensures trust in the company’s ability to handle claims.

- Wide Coverage Options: Provides comprehensive and customizable coverage, allowing Monroe, Louisiana drivers to tailor their policies to their needs. Flexibility in coverage helps address various personal requirements.

- Established Reputation: Long-standing and reputable insurer with a solid track record, providing Monroe, Louisiana policyholders with confidence in their choice. Travelers is known for its reliability and customer service.

Cons

- Higher Premiums: Rates may be higher for some drivers, which could be a concern for Monroe, Louisiana policyholders seeking more affordable options. Premiums can vary based on individual risk factors.

- Claims Experience: Mixed reviews regarding the claims process, which might affect Monroe, Louisiana drivers who need prompt resolutions. Some customers report delays or complications with claims. Gain insights by reading our article titled, “Travelers Auto Insurance Review.”

- Complex Discounts: Discount structure can be complex, potentially confusing Monroe, Louisiana policyholders who are trying to maximize their savings. Understanding all available discounts might require additional effort.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Personalized Service

Pros

Pros

- Personalized Service: Known for providing tailored customer service, making it easier for Monroe, Louisiana drivers to get assistance suited to their individual needs. This personalized approach enhances customer satisfaction.

- Discounts Available: Offers a 13% bundling discount along with other savings, helping Monroe, Louisiana policyholders reduce their insurance costs. Various discounts are available for safe driving and other factors.

- Strong Financial Rating: Rated A by A.M. Best, providing reassurance of financial stability for Monroe, Louisiana insurance policyholders. This rating indicates that American Family is financially secure and reliable.

- Local Agents: Availability of local agents in Monroe, Louisiana for personalized consultations and support. Having local representatives ensures better accessibility for face-to-face interactions. Explore further with our article entitled, “American Family Auto Insurance Review.”

Cons

- Premium Costs: Premiums can be higher compared to some competitors, which might be a disadvantage for Monroe, Louisiana drivers seeking lower rates. Costs may be less competitive for certain demographics.

- Limited Online Features: Online tools and resources may not be as comprehensive as those offered by other insurers, potentially inconveniencing tech-savvy Monroe, Louisiana policyholders. Digital interactions might be less efficient.

- Customer Service Issues: Some reports of inconsistent customer service, which could affect Monroe, Louisiana policyholders needing reliable support. Service experiences can vary among individual agents.

#9 – Auto-Owners: Best for Customer Satisfaction

Pros

Pros

- Customer Satisfaction: High customer satisfaction ratings, reflecting positive experiences for Monroe, Louisiana policyholders. Known for excellent service and claims handling, making it a reliable choice.

- Generous Discounts: Offers a 20% bundling discount and other savings opportunities, which can significantly lower insurance costs for Monroe, Louisiana drivers. Discounts are applied to various types of coverage.

- Excellent Financial Rating: A++ rating from A.M. Best, indicating superior financial strength and reliability. Monroe, Louisiana insurance policyholders can trust in the company’s ability to fulfill its financial obligations.

- Customizable Policies: Flexible policy options allow Monroe, Louisiana drivers to tailor their coverage to their specific needs. This customization ensures that policyholders get the protection they require.

Cons

- Availability: Limited availability in some areas, which might affect Monroe, Louisiana drivers who do not have easy access to local agents or offices. Coverage might not be as widely accessible. Broaden your knowledge with our article named, “Auto-Owners Auto Insurance Review.”

- Premium Variability: Premiums can vary based on individual risk factors, potentially making it less predictable for Monroe, Louisiana policyholders. Drivers might experience fluctuations in their insurance costs.

- Complex Policies: Some customers find the policy options and discount structures complex, which might be a challenge for Monroe, Louisiana drivers trying to understand their coverage. Navigating the various options may require additional effort.

#10 – Safeco: Best for Customizable Options

Pros

Pros

- Customizable Options: Offers a range of customizable coverage options, allowing Monroe, Louisiana drivers to tailor their insurance to their specific needs. This flexibility ensures that policyholders get precisely the coverage they want.

- High Discount Potential: Provides up to a 19% bundling discount and additional savings opportunities, helping Monroe, Louisiana insurance policyholders reduce their overall costs. Bundling can lead to substantial savings.

- Strong Financial Rating: Rated A by A.M. Best, indicating reliable financial stability and strength. Monroe, Louisiana drivers can trust Safeco to meet its financial obligations and handle claims effectively. Enhance your knowledge by reading our article called, “Safeco Auto Insurance Review.”

- Flexible Policies: Wide range of policy options suitable for various needs, making it easier for Monroe, Louisiana policyholders to find coverage that fits their requirements. Flexibility in policy selection allows for better customization.

Cons

- Higher Rates for Certain Drivers: May have higher premiums for high-risk drivers or those with less favorable profiles, which could be a drawback for some Monroe, Louisiana drivers. Rates can be less competitive for certain demographics.

- Mixed Customer Feedback: Some reports of inconsistent customer service experiences, which could affect Monroe, Louisiana policyholders needing reliable support. Service quality may vary among different agents.

- Complex Discount Structure: The discount system can be complicated, potentially confusing Monroe, Louisiana policyholders who are trying to maximize their savings. Understanding all available discounts may require additional effort.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance in Monroe, Louisiana

When selecting auto insurance coverage in Monroe, Louisiana, it’s crucial to understand the minimum coverage required by law and the variety of options available. Monroe’s regulations necessitate that drivers maintain at least the state minimum auto insurance coverage to ensure financial responsibility in case of an accident.

For those seeking economical rates, companies like Progressive and Auto-Owners offer some of the most competitive premiums for minimum coverage, starting at $55 and $56 respectively. On the other hand, Liberty Mutual and Allstate have higher rates, with minimum coverage starting at $64 and $62.

Monroe, Louisiana Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $62 | $160 |

| American Family | $61 | $157 |

| Auto-Owners | $56 | $148 |

| Farmers | $59 | $155 |

| Liberty Mutual | $64 | $165 |

| Nationwide | $57 | $145 |

| Progressive | $55 | $140 |

| Safeco | $60 | $152 |

| State Farm | $60 | $150 |

| Travelers | $58 | $170 |

For those interested in comprehensive protection, full coverage auto insurance offers additional benefits and comes at varying costs. Progressive provides the most affordable full coverage option at $140 per month, while Travelers has a higher premium at $170.

To find the best auto insurance coverage for your needs in Monroe, using tools like PKW can help you compare these rates effectively and ensure you secure the best deal tailored to your requirements. Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Auto Insurance Rates After a DUI in Monroe, Louisiana

In Monroe, Louisiana, the cost of car insurance can differ significantly depending on the provider, especially for drivers with a DUI. For those seeking affordable options, auto insurance rates in Monroe vary widely. Monthly rates for DUI drivers are as follows: Allstate charges $543, Geico $671, Progressive $683, State Farm offers a lower rate at $384, and USAA charges $473.

These variations underscore the importance of comparing quotes from various car insurance companies in Monroe to find the best insurance Monroe offers.

View this post on Instagram

When looking for the best car insurance in Monroe or exploring auto insurance options in nearby areas like Bossier City or West Monroe, it’s essential to consider how credit history impacts premiums. Better credit scores generally lead to lower rates. For personalized assistance, car insurance agents in Monroe, Bossier City, Walker, and West Monroe can provide valuable guidance.

Whether you’re searching for car insurance Monroe LA or auto insurance Bossier City, comparing car insurance quotes from different companies will help you find the most cost-effective coverage. Uncover additional insights in our article called, “DWI vs. DUI Differences Explained.“

Auto Insurance Rates by Company in Monroe, Louisiana

Auto insurance rates in Monroe, Louisiana, can be impacted by various local factors. In Monroe, higher rates may result from increased vehicle theft and longer commute times. The city’s auto theft statistics contribute to elevated premiums as insurance companies anticipate more claims. Additionally, longer commutes are generally linked to higher insurance costs due to the greater chance of accidents.

This trend is similar to what’s observed with auto insurance in West Monroe, where local conditions can also affect rates. When looking for the best deals, it’s crucial to compare auto insurance quotes in Monroe with those from nearby areas. For instance, you should consider auto insurance quotes in Bossier City, auto insurance quotes in Houma, and auto insurance quotes in Slidell.

Exploring auto insurance quotes in many cities, including auto insurance quotes in Walker and auto insurance quotes in West Monroe, can help you find the most competitive rates. By reviewing these quotes and understanding local factors, such as those impacting auto insurance in Monroe, you can make an informed decision and potentially save on your premiums.

Additionally, considering specifics like total loss car insurance coverage and rental car reimbursement coverage with PKW, the best auto insurance provider in Monroe, Louisiana, can help you choose a policy that better meets your needs and offers comprehensive financial protection in the event of a significant loss.

Gain deeper insights by perusing our article named, “Best Auto Insurance Companies.” Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monthly Auto Insurance Rates by Age, Gender, and Marital Status

In Monroe, Louisiana, the monthly auto insurance rates vary greatly depending on age, gender, and marital status. For a married 35-year-old female, monthly costs range from about $225.25 with USAA to $360.08 with Allstate, while married 60-year-olds pay between $215.83 with State Farm and $372.33 with Allstate.

Single 17-year-olds experience the highest auto insurance rates in Monroe, with Geico charging around $1,029.08 for females and $1,084.33 for males. For single 25-year-olds, Geico offers the most affordable rates at approximately $259.33 for males and $267.83 for females.

State Farm is the top choice for auto insurance in Monroe, Louisiana, offering comprehensive coverage starting at just $55 per month.Scott W. Johnson Licensed Insurance Agent

Finding affordable auto insurance in Monroe, LA, can be challenging, and this trend also applies to car insurance in West Monroe, LA, as well as car insurance in Houma and other areas. Car insurance quotes in Bossier City and car insurance rates in Monroe reflect significant variations across different providers, highlighting the disparity in car insurance rates from Monroe to West Monroe and beyond.

Discover more by delving into our article entitled, “How to Compare Auto Insurance Quotes.” Start comparing affordable insurance options by entering your ZIP code below into our free quote comparison tool today.

Minimum Required Auto Insurance Coverage in Monroe, Louisiana

Navigating the world of auto insurance can be challenging, especially with varying requirements and rates. For those residing in Monroe, Louisiana, understanding the basics of auto insurance coverage and how personal factors impact insurance costs is essential. Whether you’re a new driver or looking to reassess your current policy, having clear information can help you make informed choices.

This guide provides a simplified overview of the minimum insurance requirements and how different factors affect auto insurance rates in Monroe, LA.

- Know the Minimum Coverage Requirements: Bodily Injury Liability: $15,000 per person, $30,000 per accident. Property Damage Liability: $25,000 minimum.

- Consider the Influence of Age: Younger drivers often encounter higher auto insurance rates in Monroe due to increased risk.

- Account for Gender Variations: Auto insurance rates in Monroe can differ between males and females, with variations in premiums based on gender.

- Assess the Impact of Marital Status: Married drivers may experience lower auto insurance Monroe LA rates compared to single drivers.

- Explore Insurance Options: It’s beneficial to compare different providers and policies to find the most cost-effective auto insurance West Monroe LA coverage suited to your demographic profile.

By familiarizing yourself with these essentials, you can better navigate the landscape of auto insurance Monroe and make informed decisions about your coverage. Get a better grasp by reading our article titled, “Auto Insurance Coverage Requirements.“

Summary: Best Auto Insurance in Monroe, Louisiana

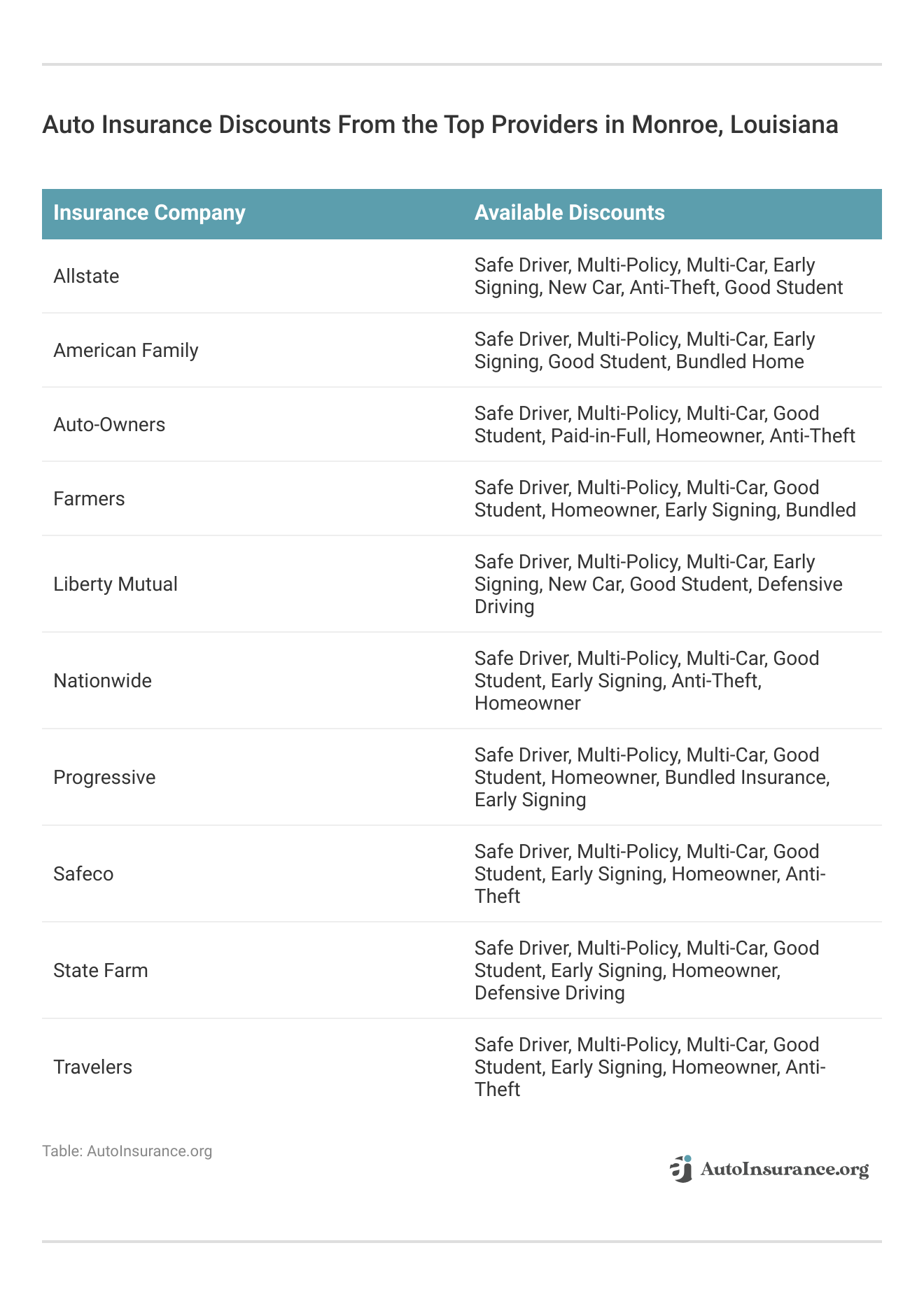

In Monroe, Louisiana, the top auto insurance providers are State Farm, Progressive, and Allstate, with rates starting around $55 per month. State Farm is praised for its comprehensive coverage and competitive pricing, Progressive is noted for its advanced online tools, and Allstate offers attractive bundling options and auto insurance discounts.

To find the best rates, compare quotes from various providers, considering factors such as age, driving record, and ZIP code, to secure the most affordable and suitable coverage for your needs. You can also enter your ZIP code below into our free comparison tool to start comparing rates now.

Frequently Asked Questions

Which companies offer the best auto insurance in Monroe, LA?

The best auto insurance providers in Monroe are State Farm, Progressive, and Allstate, known for their competitive pricing and comprehensive coverage. Gain insights by reading our article titled, “Louisiana Minimum Auto Insurance Requirements.“

What is the starting monthly rate for auto insurance in Monroe, LA?

Rates for auto insurance in Monroe start as low as $55 per month with providers like State Farm, Progressive, and Allstate. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

How does State Farm rank among auto insurance providers in Monroe?

State Farm is the top overall pick for Monroe, LA, offering a combination of competitive pricing and comprehensive coverage.

What makes Progressive a standout option for auto insurance in Monroe?

Progressive is noted for its advanced online tools that make managing and customizing your insurance policy easier. For further details, consult our article named, “Best New Orleans, Louisiana Auto Insurance.“

What are the benefits of choosing Allstate for auto insurance in Monroe?

Allstate is recognized for its bundling options and various discounts, which can provide additional savings.

How Do DUI Rates Compare Across Insurance Providers in Monroe?

Rates for DUI drivers in Monroe vary, with State Farm offering the lowest at $384 per month and other providers like Allstate charging up to $543 per month.

Which insurance provider offers the most affordable full coverage in Monroe?

Progressive provides the most affordable full coverage option in Monroe, starting at $140 per month. Get a better grasp by reading our article titled, “Best Hammond, Louisiana Auto Insurance.“

What Are the Minimum Auto Insurance Requirements in Monroe, LA?

The minimum coverage required includes $15,000 for one person’s injury, $30,000 for multiple people, and $25,000 for property damage.

How Do Age and Gender Affect Auto Insurance Rates in Monroe, LA?

Auto insurance rates in Monroe vary significantly by age and gender, with younger drivers, especially single 17-year-olds, facing the highest rates. Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Can I Compare Auto Insurance Quotes in Monroe, LA?

Yes, you can compare quotes from multiple providers using a free comparison tool by entering your ZIP code to find the best rates available in Monroe. Uncover additional insights in our article called, “Best Deridder, Louisiana Auto Insurance.“

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.

Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros