Best Palm Harbor, Florida Auto Insurance in 2026 (Compare the Top 10 Companies Here)

The best Palm Harbor, Florida auto insurance companies are Erie, Allstate, and USAA, offering affordable rates at $85/month. Erie stands out for its extensive coverage options, Allstate provides affordable rates, and USAA offers exceptional military discounts for Palm Harbor, Florida residents.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated October 2024

Company Facts

Full Coverage in Palm Harbor Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Palm Harbor Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Palm Harbor Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Erie, Allstate, and USAA have the best Palm Harbor, Florida auto insurance, with Erie emerging as the top pick for its exceptional coverage and competitive rates starting at $85/month.

These companies offer great coverage and affordability, with USAA providing extra military discounts for eligible Palm Harbor residents. For more details, check out our article titled “Best Auto Insurance for Military Families and Veterans.”

Our Top 10 Company Picks: Best Palm Harbor, Florida Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A+ Comprehensive Coverage Erie

![]()

#2 25% A+ Affordable Rates Allstate

![]()

#3 10% A++ Military Discounts USAA

![]()

#4 12% A+ Flexible Options Progressive

![]()

#5 20% B Nationwide Presence State Farm

![]()

#6 25% A++ Competitive Pricing Geico

![]()

#7 25% A Customizable Policies Farmers

![]()

#8 20% A Good Discounts American Family

![]()

#9 8% A++ Broad Coverage Travelers

#10 25% A High Customer Satisfaction Liberty Mutual

Allstate delivers great value with its flexible policies, while Erie’s extensive coverage sets it apart as the leading choice. Compare these top providers to find the best rates and coverage for your needs.

Get the best auto insurance rates possible by entering your ZIP code above into our free comparison tool today.

- Erie leads in Palm Harbor auto insurance with rates from $85/month

- Insurers provides affordable coverage options tailored for Palm Harbor residents

- These companies excels with military discounts, enhancing value for eligible drivers

#1 – Erie: Top Overall Pick

Pros

- Extensive Coverage Options: Erie provides comprehensive coverage plans in Palm Harbor, Florida, ensuring that residents receive broad protection for various scenarios.

- Affordable Comprehensive Plans: Erie offers competitive rates for comprehensive coverage in Palm Harbor, Florida, making it a cost-effective choice for extensive protection.

- Strong Reputation: Erie’s comprehensive coverage is well-regarded in Palm Harbor, Florida, offering peace of mind with robust policy options, which you can learn about in our Erie review.

Cons

- Limited Local Offices: Erie may have fewer local offices in Palm Harbor, Florida, which can make it less convenient for in-person service.

- Average Customer Service: While Erie provides good coverage, some Palm Harbor, Florida residents may find its customer service less responsive compared to other local providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Affordable Rates

Pros

- Competitive Pricing: Allstate offers affordable auto insurance rates in Palm Harbor, Florida, making it accessible for budget-conscious drivers.

- Multiple Discounts: Allstate provides various discounts for safe driving and bundling policies in Palm Harbor, Florida, further reducing costs.

- Flexible Payment Options: Allstate’s flexible payment plans in Palm Harbor, Florida, help make insurance more manageable. Find out more in our Allstate review.

Cons

- Inconsistent Claims Processing: Some Palm Harbor, Florida customers have reported delays in claims processing, affecting their experience with Allstate.

- Customer Support Inconsistency: In Palm Harbor, Florida, customer service with Allstate can be inconsistent, potentially impacting overall satisfaction.

#3 – USAA: Best for Military Discounts

Pros

- Exceptional Military Discounts: USAA offers significant discounts for military members and their families in Palm Harbor, Florida, providing excellent value.

- High Coverage Quality: USAA provides high-quality coverage options tailored to military needs in Palm Harbor, Florida, which is covered in our USAA review.

- Top-Rated Service: USAA is known for outstanding customer service in Palm Harbor, Florida, especially for those with military affiliations.

Cons

- Eligibility Restrictions: USAA’s benefits are limited to military members and their families, which excludes other drivers in Palm Harbor, Florida.

- Limited Local Presence: USAA’s physical presence in Palm Harbor, Florida, may be limited, affecting face-to-face interactions.

#4 – Progressive: Best for Flexible Options

Pros

- Customizable Policies: Progressive offers flexible and customizable insurance options in Palm Harbor, Florida, allowing drivers to tailor coverage to their needs.

- Snapshot Program: Progressive’s Snapshot program in Palm Harbor, Florida, can provide additional discounts based on driving habits.

- Wide Range of Coverage: Progressive’s diverse coverage options in Palm Harbor, Florida, cater to various driver preferences, which you can check out in our Progressive review.

Cons

- Higher Rates for Some Drivers: Progressive’s flexible options might come with higher rates for some Palm Harbor, Florida drivers, particularly those with less-than-ideal driving records.

- Inconsistent Customer Service: Some customers in Palm Harbor, Florida, report inconsistent experiences with Progressive’s customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Nationwide Presence

Pros

- Discount Opportunities: State Farm offers various discounts that can benefit Palm Harbor, Florida residents, such as safe driver and multi-policy discounts.

- Customer Service: With a strong nationwide presence, State Farm provides consistent and reliable customer service, available to Palm Harbor, Florida policyholders.

- Wide Range of Coverage Options: State Farm offers diverse coverage options to meet various needs in Palm Harbor, Florida. For a complete list, read our State Farm review.

Cons

- Complex Policy Options: Palm Harbor, Florida consumers may find State Farm’s extensive range of policies overwhelming and challenging to navigate without proper guidance.

- Customer Service Variability: The quality of customer service at State Farm can vary depending on the local Palm Harbor, Florida, agent.

#6 – Geico: Best for Competitive Pricing

Pros

- Low Premiums: Geico offers competitive pricing for auto insurance in Palm Harbor, Florida, making it a budget-friendly option for many drivers, which you can read more about in our review of Geico.

- User-Friendly Platform: Geico provides a user-friendly online platform for managing policies and claims in Palm Harbor, Florida.

- Effective Discounts: Geico’s discounts for safe driving and bundling are available to Palm Harbor, Florida, residents, potentially lowering overall costs.

Cons

- Limited Local Presence: Geico has fewer physical offices in Palm Harbor, Florida, which may affect convenience for in-person service.

- Customer Service Challenges: Some Palm Harbor, Florida, customers report issues with Geico’s customer service, particularly with claims handling.

#7 – Farmers: Best for Customizable Policies

Pros

- Highly Customizable Policies: Farmers offers a range of customizable policies in Palm Harbor, Florida, allowing drivers to tailor coverage according to their specific needs.

- Multiple Discounts Available: Farmers provides various discounts, including for safe driving and bundling, which can be beneficial for Palm Harbor, Florida, residents.

- Responsive Customer Service: Farmers is known for its responsive customer service in Palm Harbor, Florida, helping residents manage their policies and claims efficiently.

Cons

- Limited Online Services: Some Palm Harbor, Florida, residents may find Farmers’ online services less robust, requiring more in-person visits to local agents.

- Complex Policy Options: The extensive range of policy options can be overwhelming and complex for Palm Harbor, Florida, customers to navigate.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Good Discounts

Pros

- Attractive Discounts: American Family offers good discounts on auto insurance in Palm Harbor, Florida, including for safe drivers and multi-policy holders.

- Comprehensive Coverage Options: American Family provides a range of coverage options to suit different needs in Palm Harbor, Florida.

- Local Presence: With a local network of agents, American Family offers accessible customer service in Palm Harbor, Florida. Learn more in our American Family review.

Cons

- Average Pricing: While discounts are available, the overall pricing for American Family in Palm Harbor, Florida, might not be as competitive as some other providers.

- Mixed Customer Service Reviews: Some Palm Harbor, Florida, customers report mixed experiences with American Family’s customer service.

#9 – Travelers: Best for Broad Coverage

Pros

- Customizable Policies: Travelers allows for policy customization, helping drivers in Palm Harbor, Florida get exactly the coverage they need. Discover our Travelers review for a full list.

- Strong Claims Handling: Travelers is known for effective claims handling in Palm Harbor, Florida, ensuring timely and fair resolutions.

- Variety of Discounts: Travelers provides a variety of discounts for Palm Harbor, Florida, residents, including for bundling and safe driving.

Cons

- Limited Local Agents: Travelers has fewer local agents available in Palm Harbor, Florida, which may be inconvenient for those who prefer in-person assistance.

- Complex Policy Details: The extensive coverage options can be complex and challenging to understand for Palm Harbor, Florida, drivers.

#10 – Liberty Mutual: Best for High Customer Satisfaction

Pros

- Excellent Customer Satisfaction: Liberty Mutual enjoys high customer satisfaction ratings in Palm Harbor, Florida, due to its responsive service.

- Competitive Rates: Liberty Mutual offers competitive rates for auto insurance in Palm Harbor, Florida, making it an appealing option for many drivers.

- Comprehensive Coverage: Liberty Mutual provides a broad range of coverage options in Palm Harbor, Florida, catering to various needs. Read more in our review of Liberty Mutual.

Cons

- Mixed Reviews on Claim Settlements: Some Palm Harbor, Florida customers have reported delays or issues with claim settlements.

- Variable Policy Terms: The terms and conditions of Liberty Mutual’s policies can vary, which may be confusing for Palm Harbor, Florida, customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Palm Harbor, Florida Auto Insurance: Compare Rates and Unlock Discounts

Discover how auto insurance rates and discounts vary among top providers in Palm Harbor, Florida. This guide compares monthly rates for minimum and full coverage, along with available discounts, helping you make an informed decision.

Palm Harbor, Florida Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $95 $290

American Family $100 $270

Erie $100 $265

Farmers $110 $300

Geico $85 $260

Liberty Mutual $95 $275

Progressive $105 $280

State Farm $100 $275

Travelers $105 $285

USAA $90 $250

Compare monthly auto insurance rates in Palm Harbor, Florida by coverage level and provider. Rates for minimum coverage start at $85 with Geico and go up to $110 with Farmers, while full coverage ranges from $250 with USAA to $300 with Farmers.

Explore auto insurance discounts from top Palm Harbor, Florida providers. Companies like Allstate, Erie, and USAA offer a range of savings including multi-policy, safe driver, and good student discounts. The table below details available discounts from each insurer, helping you find the best deal. Check out our ranking of the top providers: Best Good Student Auto Insurance Discounts

Erie delivers top-notch coverage and affordability, making it the best choice for auto insurance in Palm Harbor.Daniel Walker Licensed Auto Insurance Agent

By comparing rates and discounts from leading insurers like Geico, USAA, and Erie, you can find the best auto insurance deal tailored to your needs in Palm Harbor, Florida. Use the information to secure affordable coverage and maximize your savings.

Your Guide to Basic Auto Insurance in Palm Harbor, Florida

In Palm Harbor, Florida, drivers must meet the state’s minimum auto insurance requirements to be financially accountable in case of an accident. The mandated coverage includes bodily injury liability with a minimum of $10,000 per person and $20,000 per accident.

Additionally, property damage liability coverage must be at least $10,000. This ensures that drivers are adequately protected and can cover damages resulting from accidents. To dive deeper, check out our extensive guide titled “Does auto insurance cover interior damage?”

Palm Harbor, Florida Auto Insurance Rates: A Breakdown by Age, Gender, and Marital Status

Understanding auto insurance rates in Palm Harbor, Florida, can help you find the best coverage for your needs. Rates differ widely based on age, gender, and provider, making it essential to compare options.

Palm Harbor, Florida Auto Insurance Monthly Rates by Age, Gender & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $1,598 | $1,742 | $450 | $454 | $459 | $438 | $401 | $407 |

| Geico | $566 | $711 | $350 | $356 | $318 | $320 | $297 | $297 |

| Liberty Mutual | $734 | $1,137 | $342 | $468 | $342 | $342 | $312 | $312 |

| Nationwide | $677 | $834 | $310 | $322 | $281 | $277 | $251 | $259 |

| Progressive | $964 | $1,038 | $407 | $379 | $342 | $318 | $292 | $313 |

| State Farm | $593 | $760 | $222 | $237 | $199 | $199 | $180 | $180 |

| USAA | $539 | $621 | $192 | $206 | $154 | $151 | $146 | $144 |

Auto insurance rates in Palm Harbor, Florida, vary by age, gender, and provider. Teen males face the highest premiums, while USAA and State Farm offer the best deals for older drivers. Comparing rates ensures you find the most cost-effective option. To find out more, view our guide, “Auto Insurance Rates by Age.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Teen Driver Coverage: Auto Insurance Solutions in Palm Harbor, Florida

Teen auto insurance rates in Palm Harbor, Florida, show notable differences based on gender and provider, reflecting the varying risks associated with young drivers.

Palm Harbor, Florida Teen Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $1,598 | $1,742 |

| Geico | $566 | $711 |

| Liberty Mutual | $734 | $1,137 |

| Nationwide | $677 | $834 |

| Progressive | $964 | $1,038 |

| State Farm | $593 | $760 |

| USAA | $539 | $621 |

In Palm Harbor, Florida, auto insurance rates for 17-year-olds vary by gender and provider. USAA offers the lowest rates, with females paying $539 and males $621. Allstate is the most expensive, with $1,598 for females and $1,742 for males. Male drivers consistently face higher premiums.

Erie offers the best overall value with its extensive coverage and competitive rates, making it the top choice for Palm Harbor drivers.Michelle Robbins Licensed Insurance Agent

These rates highlight the importance of comparing providers to find the most cost-effective options for teen drivers in Palm Harbor. To explore further, check out our detailed report titled “Should I add my teenager to my auto insurance policy?”

Senior Auto Insurance Solutions in Palm Harbor: Tailored Coverage for Golden Years

Discover the landscape of auto insurance for 60-year-olds in Palm Harbor, Florida. We’ve broken down the monthly rates by gender and provider to help you find the best deal. For a thorough understanding, refer to our detailed analysis titled “What is the average auto insurance cost per month?“

Palm Harbor, Florida Senior Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $401 | $407 |

| Geico | $297 | $297 |

| Liberty Mutual | $312 | $312 |

| Nationwide | $251 | $259 |

| Progressive | $292 | $313 |

| State Farm | $180 | $180 |

| USAA | $146 | $144 |

Rates span from $144 with USAA to $407 with Allstate, with Geico and Liberty Mutual maintaining consistent prices. State Farm is the most affordable option. This overview simplifies your insurance search, helping you make an informed decision for savings or stability.

Rev Up Your Savings: Palm Harbor Auto Insurance Tailored to Your Driving History

To uncover how auto insurance premiums are affected by driving records in Palm Harbor, Florida, from accident-free to DUI, see how these factors impact monthly rates across leading insurers.

Palm Harbor, Florida Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $640 | $770 | $853 | $711 |

| Geico | $281 | $358 | $531 | $437 |

| Liberty Mutual | $352 | $465 | $686 | $490 |

| Nationwide | $342 | $376 | $508 | $380 |

| Progressive | $401 | $590 | $499 | $536 |

| State Farm | $293 | $349 | $321 | $321 |

| USAA | $209 | $260 | $387 | $220 |

Compare Palm Harbor auto insurance rates based on driving records. Monthly premiums range from USAA’s $209 for a clean record to Allstate’s $640. Rates vary for accidents, DUIs, and tickets, with providers like Geico, Liberty Mutual, and Progressive offering different pricing.

By comparing rates from companies like USAA, Allstate, and Geico, you can find the best deal tailored to your driving history. Use this information to make an informed decision and potentially save on your auto insurance premiums.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Revving Up the Costs: Navigating Auto Insurance Rates in Palm Harbor, Florida After a DUI

Navigating auto insurance rates after a DUI in Palm Harbor, FL can be challenging. Rates vary widely depending on the provider, so it’s essential to compare options to find the best deal.

Palm Harbor, Florida DUI Auto Insurance Cost

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $853 |

| Geico | $531 |

| Liberty Mutual | $686 |

| Nationwide | $508 |

| Progressive | $499 |

| State Farm | $321 |

| USAA | $387 |

In Palm Harbor, FL, DUI auto insurance rates vary significantly. State Farm is the most affordable at $321/month, while Allstate is the most expensive at $853. Progressive and Nationwide offer rates of $499 and $508, respectively, and USAA provides a rate of $387. Liberty Mutual and Geico charge $686 and $531, respectively.

Whether you’re looking for the lowest rate or simply trying to understand your options, exploring different insurance providers can help you manage costs effectively after a DUI. Explore our list of the leading insurance providers: Cheapest Auto Insurance Companies

Palm Harbor, Florida: Tailored Auto Insurance Solutions Based on Credit Profiles

Auto insurance rates in Palm Harbor, FL vary widely based on credit history. Understanding these differences can help you find the best deal. Here’s a quick look at how insurance rates vary based on your credit score. Discover our selection of the top-rated insurance providers: Best Auto Insurance Companies That Don’t Use Credit

Palm Harbor, Florida Auto Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| Allstate | $529 | $656 | $1,045 |

| Geico | $267 | $355 | $583 |

| Liberty Mutual | $379 | $471 | $645 |

| Nationwide | $333 | $369 | $502 |

| Progressive | $390 | $470 | $660 |

| State Farm | $235 | $288 | $442 |

| USAA | $157 | $215 | $435 |

Auto insurance rates in Palm Harbor, FL differ based on credit history. Those with bad credit may pay between $435 with USAA and $1,045 with Allstate. With fair credit, USAA offers rates as low as $215, while Liberty Mutual charges $471. For good credit, USAA has the lowest rate at $157, with Geico offering $267.

Palm Harbor Commute: Unlocking the Secrets of Auto Insurance Rates

In Palm Harbor, Florida, auto insurance rates vary with commute length and annual mileage. To find the best deal, compare rates based on your driving habits. To expand your knowledge, refer to our comprehensive handbook titled “How Vehicle Year Affects Auto Insurance Rates.”

Palm Harbor, Florida Auto Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $722 | $765 |

| Geico | $400 | $404 |

| Liberty Mutual | $482 | $515 |

| Nationwide | $401 | $401 |

| Progressive | $507 | $507 |

| State Farm | $310 | $333 |

| USAA | $266 | $272 |

Discover Palm Harbor’s auto insurance rates based on mileage. For 6,000 miles, USAA leads at $266, while State Farm is $310. For 12,000 miles, Allstate costs $765, and Geico stays at $404. Find the best coverage for your driving needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Decoding Auto Insurance Pricing: What Shapes Rates in Palm Harbor, Florida

Knowing what affects your auto insurance rates is essential for finding affordable coverage. In Palm Harbor, Florida, factors like annual mileage and vehicle type significantly impact premiums. Understanding these elements helps you make informed choices and potentially lower your insurance costs.

- Annual Mileage: The total distance you drive each year plays a crucial role in determining your insurance rates. Higher mileage increases the likelihood of accidents, leading insurers to charge higher premiums to cover the added risk.

- Commute Length: The distance of your daily commute affects your insurance costs. Longer commutes expose you to more traffic and potential accidents, which can result in higher rates.

- Driving Record: Your driving history, including any traffic violations, accidents, or claims, impacts your insurance rates. A clean driving record generally results in lower premiums, while a history of incidents can lead to higher costs due to the perceived increased risk.

- Vehicle Type and Value: The make, model, and value of your vehicle significantly influence your insurance rates. High-value, luxury, or high-performance vehicles typically cost more to insure due to their higher repair or replacement costs and increased risk of theft. To gain profound insights, consult our extensive guide titled “How to Check if a Vehicle Has Auto Insurance Coverage.”

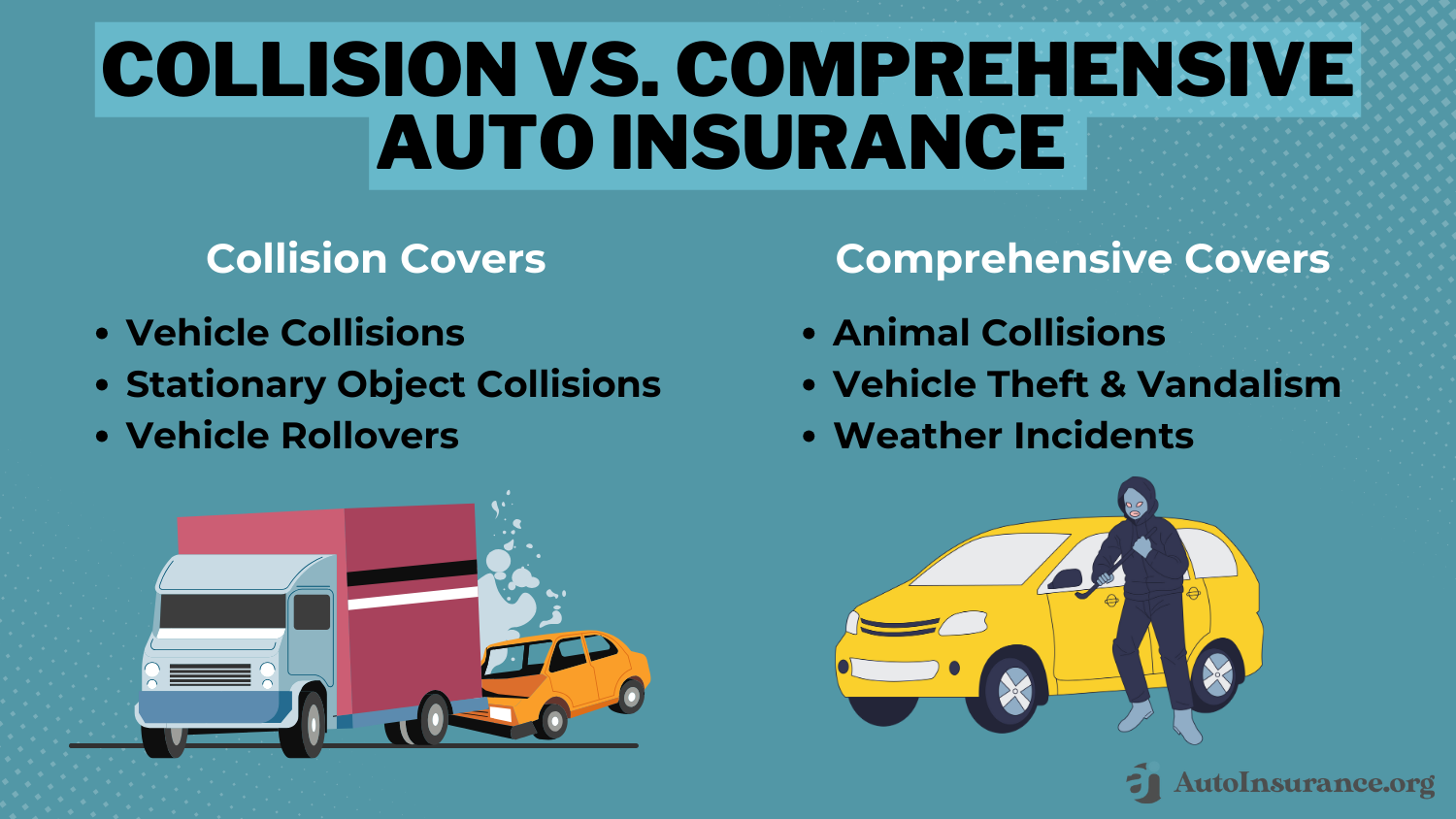

- Coverage Levels and Deductibles: The extent of coverage you choose and the size of your deductibles affect your insurance premiums. Opting for higher coverage limits, additional coverages like comprehensive or collision, or lower deductibles can increase your overall insurance costs.

By considering these factors, you can better navigate the landscape of auto insurance in Palm Harbor, Florida, and find a policy that suits your needs and budget.

Whether it’s adjusting your annual mileage, selecting the right coverage, or choosing a vehicle that aligns with your insurance goals, understanding these elements helps you make smarter choices.

Navigating Palm Harbor’s Auto Insurance: Unveiling the Best Rates and Coverage Options

Top auto insurance providers include Erie, Allstate, and USAA, with rates starting around $85 per month. Erie stands out for its comprehensive coverage options, Allstate offers flexible policies, and USAA provides excellent military discounts.

To find the best rates and coverage, drivers should compare quotes from various companies. Insurance costs can be influenced by factors such as age, driving record, credit history, and commute length. For a comprehensive overview, explore our detailed resource titled “Auto Insurance for Different Types of Drivers.”

Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

Frequently Asked Questions

What are the best ways to find affordable auto insurance in Palm Harbor, Florida?

To find affordable auto insurance in Palm Harbor, Florida, compare quotes from multiple providers, consider discounts for safe driving and bundling policies, and evaluate your coverage needs to avoid paying for unnecessary extras.

How can I get accurate auto insurance quotes in Palm Harbor, Florida?

To get accurate auto insurance quotes in Palm Harbor, Florida, provide detailed information about your vehicle, driving history, and coverage preferences. Using an online comparison tool can help gather quotes from multiple insurers.

Start comparing affordable insurance options by entering your ZIP code below into our free quote comparison tool today.

Are there specific insurance discounts available in Palm Harbor, Florida?

Yes, in Palm Harbor, Florida, you can find discounts for safe driving, multi-policy bundles, good student status, and more. Each insurance provider offers different discounts, so it’s worth inquiring about all available options.

To enhance your understanding, explore our comprehensive resource on insurance titled “Best Auto Insurance Companies for Multiple Vehicles.”

What should I look for in Palm Harbor auto insurance companies?

When choosing Palm Harbor auto insurance companies, look for providers with competitive rates, good customer service, comprehensive coverage options, and strong financial ratings. Consider reading customer reviews and comparing the pros and cons of each company.

How does my driving record impact auto insurance rates in Palm Harbor, Florida?

Your driving record significantly impacts your auto insurance rates in Palm Harbor, Florida. A clean driving record typically results in lower premiums, while a history of accidents or violations can lead to higher rates.

What are the minimum auto insurance requirements in Palm Harbor, Florida?

In Palm Harbor, Florida, the minimum auto insurance requirements include $10,000 in bodily injury liability per person, $20,000 per accident, and $10,000 in property damage liability.

For detailed information, refer to our comprehensive report titled “Bodily Injury Liability (BIL) Auto Insurance Defined.”

Can I find cheap auto insurance in Palm Harbor, Florida for teen drivers?

Yes, while insurance rates for teen drivers in Palm Harbor, Florida are generally higher due to increased risk, comparing quotes from different insurers and asking about discounts can help find more affordable options.

What factors affect commercial vehicle insurance rates in Palm Harbor, Florida?

For commercial vehicle insurance in Palm Harbor, Florida, factors like the type of business, vehicle usage, driving history, and coverage levels can affect rates. It’s essential to assess these factors when obtaining quotes.

Are there specific auto insurance companies that specialize in commercial liability insurance in Palm Harbor, Florida?

Yes, some insurance companies in Palm Harbor, Florida specialize in commercial liability insurance. These providers offer tailored coverage options for businesses, including protection against liability claims and property damage.

Take a look at our list of the top-rated providers: Cheapest Liability-Only Auto Insurance

How can I reduce my auto insurance premiums in Palm Harbor, Florida?

To reduce your auto insurance premiums in Palm Harbor, Florida, consider increasing your deductible, maintaining a clean driving record, taking advantage of discounts, and shopping around for the best rates. Regularly reviewing your policy and coverage options can also help in managing costs.

Don’t let expensive insurance rates hold you back. Enter your ZIP code below and shop for affordable premiums from the top companies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.