Best Auto Insurance for Postmates Delivery Drivers in 2026 (Find the Top 10 Companies Here)

Progressive, Farmers, and Geico have the best auto insurance for Postmates delivery drivers, starting as low as $60 a month. These companies understand the unique needs of gig work and offer coverage that meets those needs ensuring drivers navigating city streets are fully protected.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joe...

Joel Ohman

Updated January 2025

Company Facts

Full Coverage for Postmates Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Postmates Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Postmates Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Progressive, Farmers, and Geico offer the best auto insurance options for Postmates delivery drivers, with rates starting as low as $60 per month. Postmates is a delivery service for food and other goods, where couriers can deliver items via cars, bikes, scooters, and on foot.

If you’re interested in working for Postmates, you’ll need proper car insurance. (Read More: What does proper auto insurance cover?)

Our Top 10 Company Picks: Best Auto Insurance for Postmates Delivery Drivers

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 9% A+ Competitive Rates Progressive

![]()

#2 8% A Customizable Policies Farmers

#3 10% A++ Affordable Rates Geico

#4 7% A Discount Availability American Family

#5 9% A+ Infrequent Drivers Allstate

#6 10% A+ Vanishing Deductible Nationwide

#7 8% B Personalized Policies State Farm

#8 11% A Add-on Coverages Liberty Mutual

#9 7% A++ Military Members USAA

#10 8% A++ Bundling Policies Travelers

Postmates provides extra auto insurance coverage to its couriers, but drivers must purchase car insurance coverage meeting their state’s requirements to drive for the company. Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

- Postmates offers some forms of liability coverage to its couriers

- Having an accident while delivering may not be covered by standard auto insurance

- A business use add-on or commercial coverage may be needed

#1 – Progressive: Top Overall Pick

Pros

- Budget-Friendly Full Coverage: At $134 monthly, Progressive offers the most economical full coverage option for Postmates couriers, allowing them to maximize earnings while maintaining comprehensive protection. Learn everything you need to know in our Progressive auto insurance review.

- Name Your Price tool: This unique feature enables Postmates drivers to find a policy that fits their budget, balancing cost with coverage needs specific to food and package delivery.

- Snapshot Program: Progressive’s usage-based insurance option can benefit Postmates drivers who maintain safe driving habits during deliveries, potentially leading to personalized discounts.

Cons

- Difficulty in Handling Frequent Policy Changes: Progressive’s policies might not easily accommodate frequent changes in delivery schedules or operational adjustments, which could be problematic for Postmates drivers with variable workloads.

- Potential Lack of Coverage for Multi-Driver Scenarios: For Postmates drivers who share their vehicle with others, Progressive might offer less comprehensive coverage or fewer options for multi-driver situations compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Farmers: Best for Customizable Policies

Pros

- Signal App Discounts: Farmers’ Signal app can help Postmates couriers earn discounts based on their safe driving habits, potentially offsetting the costs associated with increased mileage from deliveries. See our Farmers auto insurance review for complete information.

- Alternative Vehicle Coverage: For Postmates drivers using motorcycles or scooters for deliveries, Farmers offers specialized coverage options to protect these vehicles.

- Incident Forgiveness: Farmers’ incident forgiveness can prevent rate increases for Postmates drivers after their first at-fault accident or minor violation, which is valuable given the increased time spent on the road.

Cons

- Strict Underwriting Criteria: Some Postmates couriers may not qualify for Farmers’ best rates or programs due to driving history or vehicle type, which could impact overall affordability.

- Coverage Flexibility for Gig Economy Drivers: Farmers may offer less flexibility in policy terms and coverage adjustments for gig economy drivers like Postmates couriers, who require adaptable insurance solutions to match their varying work schedules and demands.

#3 – Geico: Best for Affordable Rates

Pros

- DriveEasy Program: Geico’s usage-based insurance option can benefit Postmates drivers who maintain safe driving habits during deliveries, potentially leading to significant discounts. Find all the details in our Geico auto insurance review.

- Prime Time Contract: This feature allows Postmates couriers to adjust their coverage based on delivery schedules, potentially reducing costs during periods of inactivity.

- Mobile Vehicle Care: Geico’s app-based maintenance tracking can help Postmates drivers keep their vehicles in top condition, reducing the risk of breakdowns during deliveries.

Cons

- Limited Rideshare Endorsements: Geico may not offer as comprehensive rideshare or delivery-specific coverage options compared to some competitors, potentially leaving gaps in protection for Postmates drivers.

- Delivery-Related Risks: Geico’s policies might not provide adequate options for addressing specific Postmates delivery-related risks, such as handling multiple delivery stops or varying delivery conditions.

#4 – American Family: Best for Discount Availability

Pros

- KnowYourDrive Program: This usage-based insurance option can help Postmates drivers earn discounts based on their safe driving habits during deliveries, potentially offsetting increased insurance costs. Gain deeper insights in our American Family auto insurance review.

- Gap Coverage: This option can protect Postmates drivers who are still paying off their vehicles, ensuring they’re not left with a loan balance if their car is totaled during a delivery.

- 24/7 Claims Service: For Postmates drivers who often work non-traditional hours, American Family’s round-the-clock claims service can be particularly valuable.

Cons

- Regional Discount Limitations: Certain discounts may not be available in all regions, which could affect Postmates drivers in locations where these specific discounts are not offered.

- Potential Limitations for Non-Standard Vehicles: American Family’s policies might not fully cover non-standard delivery vehicles like electric bikes or cargo scooters used by some Postmates drivers, limiting their coverage options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Infrequent Drivers

Pros

- Milewise Program: Allstate’s pay-per-mile insurance option can be advantageous for part-time Postmates drivers, allowing them to pay based on actual miles driven for deliveries. Read our full Allstate auto insurance review for more information.

- Rideshare Insurance: Allstate offers specific coverage for rideshare and delivery drivers, ensuring Postmates couriers have protection during both personal and delivery use.

- New Car Replacement: For Postmates drivers using newer vehicles, Allstate’s new car replacement coverage can provide valuable protection if the car is totaled during a delivery.

Cons

- Higher Base Rates: Allstate’s standard rates may be higher than some competitors, which could impact profitability for Postmates drivers looking to minimize expenses.

- Strict Eligibility for Best Rates: Some Postmates drivers may not qualify for Allstate’s most competitive rates due to factors like driving history or credit score, affecting overall affordability.

Understood. I’ll revise the content for the remaining companies to ensure uniqueness, avoiding similar content, keywords, and phrases. Each point will be tailored specifically for Postmates delivery drivers.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Plenti Rewards Program: Postmates drivers can earn points through this multi-company loyalty program, potentially offsetting fuel costs and other delivery-related expenses. Delve into the specifics in our Nationwide auto insurance review.

- Deductible Savings: Couriers can reduce Postmates delivery drivers’ collision deductible by $100 for each year of safe driving, up to $500, helping mitigate costs from frequent road exposure during deliveries.

- Total Loss Deductible Waiver: If a Postmates driver’s vehicle is deemed a total loss, Nationwide waives the deductible, easing the financial burden of replacing a crucial work tool.

Cons

- Zone-Based Pricing: Postmates drivers operating in certain urban areas may face higher premiums due to Nationwide’s location-based pricing model.

- Mandatory Binding Arbitration: This clause in Nationwide’s policies may limit Postmates drivers’ ability to pursue legal action in case of claim disputes.

#7 – State Farm: Best for Personalized Policies

Pros

- Personal Injury Protection: This optional coverage can be vital for Postmates drivers, covering medical expenses and lost wages regardless of fault in an accident during deliveries. Check out our in-depth State Farm auto insurance review for further information.

- Car Rental and Travel Expenses: If a Postmates drivers’ vehicle is disabled due to a covered loss, State Farm covers rental cars and travel expenses, minimizing delivery work disruption.

- Mutual Company Structure: As a policyholder, Postmates drivers may receive dividends in profitable years, potentially reducing overall insurance costs.

Cons

- Usage-Based Program Limitations: State Farm’s Drive Safe & Save may not fully account for the stop-and-go nature of delivery driving, potentially limiting discount opportunities for Postmates delivery drivers.

- Credit-Based Pricing: Postmates drivers with less-than-ideal credit may face higher premiums, impacting their delivery work profitability.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Add-on Coverages

Pros

- Better Car Replacement: This feature provides Postmates drivers with a replacement vehicle a model year newer and with 15,000 fewer miles if their car is totaled during a delivery. Uncover more in our comprehensive Liberty Mutual auto insurance review.

- Rate Lock Guarantee: This option allows Postmates drivers to maintain stable insurance costs despite the increased risk associated with frequent delivery driving.

- Violation-Free Discount: Couriers who maintain a clean driving record while making deliveries can benefit from reduced premiums.

Cons

- Inconsistent State Offerings: Coverage options and rideshare endorsements for Postmates drivers may vary significantly by state.

- Accident Forgiveness Limitations: This feature may not be available to high-mileage Postmates delivery drivers or those with previous claims.

#9 – USAA: Best for Military Members

Pros

- Flexible Mileage Options: USAA offers policies that can accommodate the variable mileage patterns typical of part-time or full-time Postmates drivers. Discover additional details in our USAA auto insurance review

- Length of Membership Savings: Long-term USAA members who drive for Postmates can benefit from reduced rates, rewarding loyalty despite increased driving risks.

- Auto Insurance Calculator: This tool helps Postmates drivers estimate appropriate coverage levels based on their specific delivery work patterns.

Cons

- Sparse Gig Work Focus: USAA’s policies may not fully address the unique challenges faced by app-based Postmates delivery drivers.

- Coverage Exclusions: Certain delivery-related scenarios may not be covered under standard policies, requiring careful review by Postmates drivers.

#10 – Travelers: Best for Bundling Policies

Pros

- Premier New Car Replacement: Postmates drivers with newer vehicles can receive a brand new car of the same make and model if theirs is totaled within five years of purchase. Explore our detailed Travelers auto insurance review for more insights.

- Accident Forgiveness for Delivery Work: Eligible Postmates couriers can avoid rate increases after their first at-fault accident, even if it occurs during a delivery.

- Delivery Equipment Coverage: This optional add-on can protect items like food delivery bags, phone mounts, and other equipment used for Postmates work.

Cons

- Complex Claims Process: Postmates drivers may face challenges navigating Travelers’ claims procedures, potentially leading to longer resolution times and delivery work interruptions.

- Limited Digital Integration: Travelers’ technology may not seamlessly integrate with the app-based nature of Postmates work, potentially complicating policy management for drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Auto Insurance Postmates Offer to Its Employees

Postmates offers several types of auto insurance coverage to its delivery personnel. Some of the options for coverage include:

- Excess Auto Liability Coverage: With this coverage, Postmates provides liability coverage of up to $1 million per accident for couriers.

- General Liability Coverage: General liability with Postmates offers up to $1 million worth of liability coverage for couriers delivering food and goods on foot or by bike. This coverage also applies to a third party’s bodily injury and property damage.

- Accidental Occupational Liability: Accidental occupational liability is an uncommon coverage setting Postmates apart as a delivery service. It protects delivery personnel with up to $50,000 in medical expenses for injuries sustained during delivery.

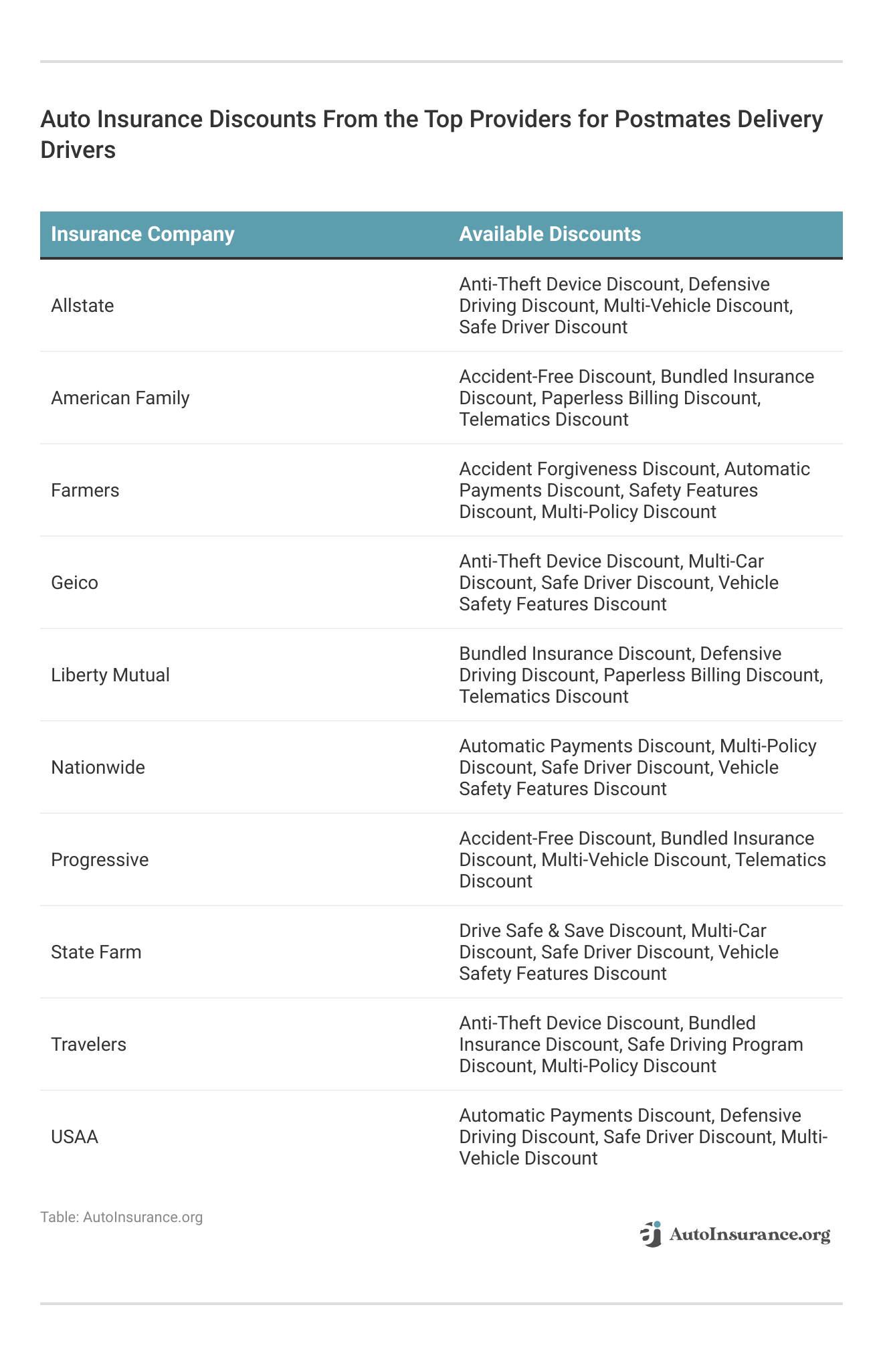

Postmates’ coverages are helpful for all delivery employees, particularly since not all delivery companies offer insurance to drivers. See table below for the monthly rates by coverage level:

Postmates Delivery Driver Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $75 $153

American Family $70 $147

Farmers $65 $140

Geico $65 $142

Liberty Mutual $75 $156

Nationwide $70 $154

Progressive $60 $134

State Farm $70 $155

Travelers $80 $167

USAA $80 $162

However, anyone using their car to deliver must purchase car insurance meeting their state’s minimum coverage requirements.

Postmates Insurance Coverage

Postmates doesn’t offer car insurance to its drivers when they’re not working for the company. So anyone who works for Postmates must carry a separate car insurance policy.

Required liability coverages vary by location. Each state sets its own laws for car insurance requirements. The table below shows requirements in each state for liability coverage.

Liability Auto Insurance Coverage Requirements by State

State Bodily Injury Liability

(Per Person)

Bodily Injury Liability

(Per Accident)Property Damage Liability

Alabama $25,000 $50,000 $25,000

Alaska $50,000 $100,000 $25,000

Arizona $25,000 $50,000 $15,000

Arkansas $25,000 $50,000 $25,000

California $15,000 $30,000 $5,000

Colorado $25,000 $50,000 $15,000

Connecticut $25,000 $50,000 $25,000

Delaware $25,000 $50,000 $10,000

Florida $10,000 (PIP only) N/A $10,000

Georgia $25,000 $50,000 $25,000

Hawaii $20,000 $40,000 $10,000

Idaho $25,000 $50,000 $15,000

Illinois $25,000 $50,000 $20,000

Indiana $25,000 $50,000 $25,000

Iowa $20,000 $40,000 $15,000

Kansas $25,000 $50,000 $25,000

Kentucky $25,000 $50,000 $25,000

Louisiana $15,000 $30,000 $25,000

Maine $50,000 $100,000 $25,000

Maryland $30,000 $60,000 $15,000

Massachusetts $20,000 $40,000 $5,000

Michigan $50,000 $100,000 $10,000

Minnesota $30,000 $60,000 $10,000

Mississippi $25,000 $50,000 $25,000

Missouri $25,000 $50,000 $25,000

Montana $25,000 $50,000 $20,000

Nebraska $25,000 $50,000 $25,000

Nevada $25,000 $50,000 $20,000

New Hampshire* $25,000 $50,000 $25,000

New Jersey $15,000 $30,000 $5,000

New Mexico $25,000 $50,000 $10,000

New York $25,000 $50,000 $10,000

North Carolina $30,000 $60,000 $25,000

North Dakota $25,000 $50,000 $25,000

Ohio $25,000 $50,000 $25,000

Oklahoma $25,000 $50,000 $25,000

Oregon $25,000 $50,000 $20,000

Pennsylvania $15,000 $30,000 $5,000

Rhode Island $25,000 $50,000 $25,000

South Carolina $25,000 $50,000 $25,000

South Dakota $25,000 $50,000 $25,000

Tennessee $25,000 $50,000 $15,000

Texas $30,000 $60,000 $25,000

Utah $25,000 $65,000 $15,000

Vermont $25,000 $50,000 $10,000

Virginia $30,000 $60,000 $20,000

Washington $25,000 $50,000 $10,000

West Virginia $25,000 $50,000 $25,000

Wisconsin $25,000 $50,000 $10,000

Wyoming $25,000 $50,000 $20,000

In an at-fault accident, your insurance rates and responsibilities are impacted. Most states require property damage and bodily injury coverage, but some require additional coverage like personal injury protection, medical payments, and uninsured/underinsured motorist coverage. These ensure compensation for all parties, regardless of fault.

However, the above coverages may be inadequate if you drive with Postmates. So it’s a good idea to consider additional coverage options if you work as a courier or delivery person in your state.

How to Drive for Postmates

If you’re considering applying for Postmates work, there are some Postmates driver requirements you may want to consider. Postmates says its employees must have the following:

- A high school diploma

- A valid U.S. driver’s license

- A working vehicle (some areas allow for other methods of transportation)

- A smartphone

Requirements for Postmates drivers are relatively relaxed. There are no Postmates driving requirements, as some cities and areas allow Postmates couriers to deliver by foot, bike, or scooter. Still, Postmates drivers should consider the coverage that’ll work best for them.

Read More: Best Motorcycle Insurance Discounts

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Requirements for Postmates Driver Insurance

You may want to lean on three options as a Postmates driver: your personal auto policy, standard commercial coverage, and a business-use policy.

While personal auto insurance policies are the most obvious solution because they’re already mandatory for anyone who owns a vehicle, depending on your personal car insurance for coverage as a delivery driver can be risky. Many insurance companies have exclusions for the business use of your car.

Insurers could deny your claim if you get in an accident while driving for Postmates. Additionally, the insurer could cancel your policy if it was unaware you used your car for work before the accident.

People who drive for work should consider commercial coverage. If you deliver for Postmates — particularly if you’re full-time — a commercial policy offers extensive coverage on your vehicle in the event of an accident. Commercial car insurance can be expensive, but it provides peace of mind to delivery drivers.

A business use policy, or a business use add-on to a policy, is the middle ground between your personal auto insurance policy and commercial coverage. With business use, you acknowledge that you use your car occasionally for work purposes and could add limited commercial coverage to your personal policy.

Before you become a Postmates driver, ask a representative with your insurance company which option might work best for you. Clarify that you work as a delivery driver and ask whether your personal policy covers you while making deliveries.

Postmates Auto Insurance: The Bottom Line

If you want to learn how to drive for Postmates, it’s not too complicated — you can apply with the company if you meet its requirements. If you plan to drive your car to make deliveries, you must carry a policy meeting your state’s minimum requirements for car insurance coverage.

Postmates drivers should consider carrying extra coverage outside of what the company offers.Jimmy McMillan LICENSED INSURANCE AGENT

A commercial insurance policy or a business-use add-on to a policy may work well for you if you work for Postmates. To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

What are the drive for Postmates requirements?

To drive for Postmates, you need to meet certain Postmates driver requirements. These include having a valid driver’s license, insurance, and a vehicle that meets Postmates vehicle requirements. Different cities may have specific requirements, so it’s best to check the Postmates driver car requirements for your location.

Does Postmates provide insurance coverage for accidents that occur while making deliveries?

Yes, Postmates insurance coverage includes some protection for drivers, such as excess auto liability coverage up to $1 million per accident for couriers. However, it’s important to note that the Postmates insurance policy may not be sufficient for all situations, and drivers should consider additional coverage options.

Read our article titled “Motorcycle vs. Car Accident Statistics” for more information.

What happens if I get into an accident while delivering for Postmates and my personal auto insurance denies the claim?

If your personal auto insurance denies a claim related to a Postmates car accident, you may need to rely on the Postmates accident insurance provided by the company. However, it’s essential to review the terms and conditions of the coverage to understand the extent of protection it offers.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Can I use my personal auto insurance policy for Postmates deliveries if I have a business use add-on?

Having a business use add-on to your personal auto insurance policy can provide limited commercial coverage for using your car occasionally for work purposes. However, it’s crucial to consult with your insurance company to ensure that your policy covers you adequately while making deliveries for Postmates. This aligns with Postmates insurance requirements and helps avoid issues.

Does Postmates provide coverage for damage to my vehicle caused by accidents or theft?

Postmates insurance primarily focuses on liability protection for drivers. It may not provide coverage for damage to your vehicle resulting from accidents or theft. You may need to consider comprehensive or collision coverage through your personal auto insurance policy to protect against such damages. Understanding the Postmates vehicle requirements can help you determine the best insurance coverage.

Read More: Does auto insurance pay if my car is stolen?

Do you need your own car for Postmates?

Yes, to deliver for Postmates using a vehicle, you must meet the Postmates driver requirements and have a car that meets the Postmates car requirements. However, you can also deliver using other means, such as a bike or on foot, depending on the city.

Does Postmates check insurance?

Yes, Postmates checks insurance to ensure that all drivers meet their Postmates insurance requirements. This ensures that drivers have adequate coverage while working and helps protect them in case of an accident.

What are the vehicle requirements for Postmates?

The Postmates vehicle requirements vary by location and delivery method. Generally, there are no specific Postmates driver car requirements for make or model, but your vehicle must be insured according to state laws.

What types of insurance does Postmates offer its drivers?

While Postmates insurance includes some liability coverage, it does not provide a comprehensive Postmates commercial insurance policy. If you use your vehicle primarily for deliveries, you might want to consider a commercial insurance policy or a business-use add-on for extra coverage.

Read More: What are the recommended auto insurance coverage levels?

What is a Postmates carrier, and does it differ from a driver?

A Postmates carrier is the term used for individuals delivering goods via various methods, such as on foot, bike, or scooter, while a driver typically refers to someone using a car to make deliveries. The insurance needs might differ based on the delivery method.

Can I use rideshare insurance for Postmates deliveries?

What steps should I take if I’m involved in an accident while delivering for Postmates?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.