Best San Antonio, Texas Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

Choices for the best San Antonio, Texas auto insurance are the best providers State Farm, Geico, and Allstate, with rates for only $40/mo. These companies stand out due to their military savings and personalized plans, making them top picks for affordable and dependable auto insurance in San Antonio, Texas.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated August 2025

Company Facts

Full Coverage in San Antonio Texas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in San Antonio Texas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in San Antonio Texas

A.M. Best Rating

Complaint Level

Pros & Cons

Compare auto insurance rates in San Antonio with those in other Texas cities, such as Houston, Fort Worth, and Corpus Christi, to determine how San Antonio’s rates measure up, including options for full coverage.

Our Top 10 Company Picks: Best San Antonio, Texas Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 25% B Best Service State Farm

![]()

#2 25% A++ Affordable Rates Geico

![]()

#3 20% A+ Personalized Service Allstate

#4 30% A+ Flexible Plans Progressive

#5 30% A++ Military Families USAA

#6 20% A Customer Satisfaction Farmers

#7 20% A Customized Coverage Liberty Mutual

#8 15% A++ Discounts Variety Travelers

#9 20% A+ Broad Coverage Nationwide

#10 25% A++ Young Adults Auto-Owners

Before purchasing full coverage auto insurance in San Antonio, Texas, make sure to compare quotes from various companies. Enter your ZIP code above to receive free insurance quotes for San Antonio.

- State Farm offers top auto insurance in Texas from $43/month

- Customized coverage for San Antonio’s local needs

- Rates affected by traffic, theft, and commute times

#1 – State Farm: Top Overall Pick

Pros

- Local Agent Network: Extensive network of local agents in San Antonio for personalized service, making State Farm a contender for the best San Antonio, Texas auto insurance. Read more through our State Farm auto insurance review.

- Discount Variety: Offers a wide range of discounts, including for safe driving and vehicle safety features, solidifying its position among the best San Antonio, Texas auto insurance options.

- User-Friendly App: Easy-to-use mobile app for managing policies, filing claims, and accessing ID cards, further enhancing its reputation as one of the best San Antonio, Texas auto insurance providers.

Cons

- Higher Rates for Young Drivers: Rates may be higher for younger drivers or those with less driving experience, which could be a drawback for some seeking the best San Antonio, Texas auto insurance.

- Limited High-Risk Coverage: Limited coverage options for high-risk drivers compared to specialized providers, making it less ideal for those in need of the best San Antonio, Texas auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Competitive Rates: Known for offering some of the most competitive rates in San Antonio, especially for minimal coverage, which helps it stand out as the best San Antonio, Texas auto insurance for budget-conscious drivers.

- Digital Tools: Excellent digital tools, including a highly rated mobile app and online policy management, ensuring its place among the best San Antonio, Texas auto insurance for tech-savvy customers.

- Bundling Options: Discounts for bundling multiple policies, such as auto and home insurance, make it a strong contender for the best San Antonio, Texas auto insurance for comprehensive coverage.

Cons

- Less Personal Service: Customer service may be less personal due to the lack of local agents, which could be a disadvantage for those seeking the best San Antonio, Texas auto insurance.

- Rate Increases: Some customers report increases in premiums after an initial low rate, which can diminish its appeal as the best San Antonio, Texas auto insurance. Find more details through our Geico auto insurance review.

#3 – Allstate: Best for Personalized Service

Pros

- Personalized Coverage: Strong emphasis on personalized coverage plans that can be tailored to individual needs, making Allstate a candidate for the best San Antonio, Texas auto insurance for customizable options.

- Diverse Discounts: Provides a range of discounts, including for safe driving and multiple policies, positioning it among the best San Antonio, Texas auto insurance providers for those looking to save. Dive in to more information through our Allstate auto insurance review.

- Safe Driving Rewards: Allstate Rewards program offers incentives for safe driving habits, reinforcing its standing as one of the best San Antonio, Texas auto insurance options for responsible drivers.

Cons

- Higher Premiums: Premiums can be higher than some competitors, especially for full coverage, which might deter those looking for the best San Antonio, Texas auto insurance at a lower price.

- Mixed Claim Handling Reviews: Customer satisfaction ratings are mixed, particularly regarding claim handling, which could be a drawback for those seeking the best San Antonio, Texas auto insurance.

#4 – Progressive: Best for Flexible Plans

Pros

- Flexible Coverage Options: Offers a wide range of flexible coverage options, making Progressive a strong contender for the best San Antonio, Texas auto insurance for tailored policies.

- Snapshot Program: The Snapshot program rewards safe driving with potential discounts, helping it stand out as one of the best San Antonio, Texas auto insurance providers for tech-savvy drivers. Seek more insights through our Progressive auto insurance review.

- Strong Digital Presence: Progressive’s user-friendly website and app make it one of the best San Antonio, Texas auto insurance providers for customers who prefer online management.

Cons

- Price Inconsistencies: Some customers report varying premiums over time, which might affect its reputation as the best San Antonio, Texas auto insurance for consistency.

- Customer Service Concerns: Mixed reviews on customer service experiences could be a drawback for those seeking the best San Antonio, Texas auto insurance with reliable support.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Families

Pros

- Military Focus: Tailored specifically for military members and their families, making USAA the best San Antonio, Texas auto insurance for the military community.

- Highly Competitive Rates: Known for offering some of the lowest rates, solidifying its position as the best San Antonio, Texas auto insurance for affordability. Find relevant details through our USAA auto insurance review.

- Excellent Customer Service: Consistently high marks for customer service make USAA one of the best San Antonio, Texas auto insurance providers for customer satisfaction.

Cons

- Eligibility Restrictions: Limited to military members, veterans, and their families, which excludes many from accessing the best San Antonio, Texas auto insurance benefits USAA offers.

- Limited Local Presence: Fewer physical locations in San Antonio could be a disadvantage for those seeking the best San Antonio, Texas auto insurance with in-person service.

#6 – Farmers: Best for Customer Satisfaction

Pros

- Local Agent Access: Strong local agent presence in San Antonio, making Farmers a candidate for the best San Antonio, Texas auto insurance for personalized service.

- Customizable Coverage: Offers highly customizable coverage plans, which makes it one of the best San Antonio, Texas auto insurance options for those with specific needs.

- Solid Reputation: Farmers’ long-standing reputation for reliability positions it as one of the best San Antonio, Texas auto insurance choices for those seeking a trusted provider.

Cons

- Higher Premiums: Generally higher premiums compared to some competitors may affect its appeal as the best San Antonio, Texas auto insurance for budget-conscious customers. Learn more through our Farmers auto insurance review.

- Mixed Digital Tools: While Farmers offers an app, it may not be as advanced as others, which could be a drawback for those looking for the best San Antonio, Texas auto insurance with top-tier digital tools.

#7 – Liberty Mutual: Best for Customized Coverage

Pros

- Extensive Coverage Options: Wide variety of coverage options available, ensuring it stands out as one of the best San Antonio, Texas auto insurance providers for comprehensive protection.

- Accident Forgiveness: Offers accident forgiveness, which helps maintain its status as the best San Antonio, Texas auto insurance for drivers concerned about rate hikes after an incident.

- 24/7 Claims Assistance: Provides around-the-clock claims support, making it one of the best San Antonio, Texas auto insurance providers for immediate help when needed. Find more details through our Liberty Mutual auto insurance review.

Cons

- Higher Rates: Premiums can be higher than some other providers, which might impact its appeal as the best San Antonio, Texas auto insurance for affordability.

- Inconsistent Customer Service: Reports of inconsistent customer service experiences could be a drawback for those seeking the best San Antonio, Texas auto insurance with reliable support.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Discounts Variety

Pros

- Multi-Policy Discounts: Significant discounts for bundling policies, making Travelers a strong contender for the best San Antonio, Texas auto insurance for overall savings. Seek more information through our Travelers auto insurance review.

- Roadside Assistance: Offers comprehensive roadside assistance, which helps it stand out as one of the best San Antonio, Texas auto insurance providers for added peace of mind.

- Strong Financial Standing: Travelers’ financial stability and A++ rating from A.M. Best reinforce its position as one of the best San Antonio, Texas auto insurance choices for reliable coverage.

Cons

- Higher Rates for Some Drivers: Premiums can be higher for drivers with less-than-perfect records, which could be a disadvantage for those seeking the best San Antonio, Texas auto insurance for affordable coverage.

- Mixed Customer Reviews: Some customers report mixed experiences with claims handling, which could impact its status as the best San Antonio, Texas auto insurance for customer satisfaction.

#9 – Nationwide: Best for Broad Coverage

Pros

- Vanishing Deductible: The vanishing deductible program is a key feature that makes Nationwide one of the best San Antonio, Texas auto insurance providers for safe drivers. Read more through our Nationwide auto insurance review.

- On Your Side Review: Provides annual policy reviews to ensure customers have the right coverage, helping it stand out as the best San Antonio, Texas auto insurance for personalized service.

- Bundling Discounts: Offers discounts for bundling home, auto, and life insurance, which positions it among the best San Antonio, Texas auto insurance options for comprehensive coverage.

Cons

- Limited Local Agents: Fewer local agents in San Antonio might limit its appeal as the best San Antonio, Texas auto insurance for those who prefer face-to-face service.

- Average Digital Tools: Nationwide’s digital tools are good but not as advanced as some competitors, which could be a drawback for those seeking the best San Antonio, Texas auto insurance with top-tier online management options.

#10 – Auto-Owners: Best for Young Adults

Pros

- Strong Customer Service: Auto-Owners is known for excellent customer service, making it one of the best San Antonio, Texas auto insurance providers for those who value personalized attention. Dive in for more details through our Auto-Owners auto insurance review.

- Comprehensive Coverage Options: Offers a wide range of coverage options, including rare add-ons like rental car insurance, reinforcing its position as one of the best San Antonio, Texas auto insurance providers for comprehensive protection.

- Discount Opportunities: Provides various discounts, including for multi-policy bundling, safe driving, and paperless billing, making it a top choice for the best San Antonio, Texas auto insurance for savings.

Cons

- Availability: Auto-Owners is not available in all states, which may limit its accessibility as the best San Antonio, Texas auto insurance for some potential customers.

- Lack of Online Tools: The company’s digital tools are not as advanced as some competitors, which could be a disadvantage for those looking for the best San Antonio, Texas auto insurance with robust online management options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

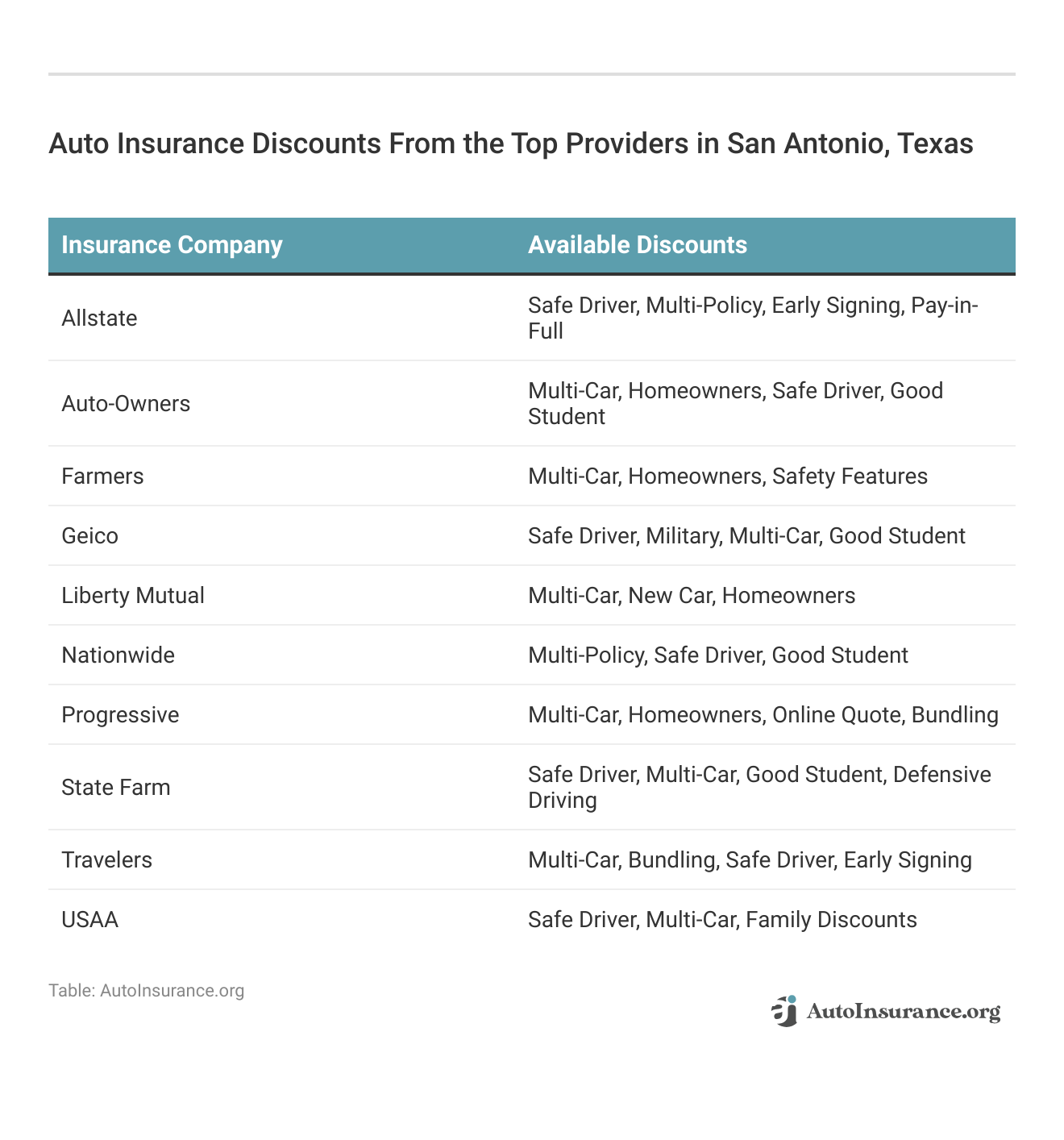

Monthly Auto Insurance Rates and Discounts in San Antonio, Texas

In San Antonio, Texas, monthly auto insurance rates can vary significantly depending on the types of auto insurance coverage chosen, such as liability, collision, and comprehensive.

San Antonio, Texas Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $55 $130

Auto-Owners $50 $119

Farmers $54 $127

Geico $40 $115

Liberty Mutual $57 $132

Nationwide $52 $124

Progressive $59 $120

State Farm $45 $125

Travelers $48 $122

USAA $43 $110

On average, residents might expect to pay between $43 and $59 per month. Factors like driving history, vehicle type, and local accident rates also influence these rates.

To find the best deal, it’s advisable to compare quotes from different insurers, explore available discounts, and consider bundling policies for additional savings.

Minimum Auto Insurance in San Antonio, Texas

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare San Antonio, Texas Auto Insurance Quotes

Before purchasing auto insurance in San Antonio, Texas, it’s essential to compare rates from multiple providers. By comparing auto insurance quotes, you can uncover significant differences in premiums and coverage options.

Michelle Robbins

Licensed Insurance Agent

This process allows you to identify a policy that offers the protection you need at a competitive price. By comparing these quotes, you can ensure you find the best deal and secure the most cost-effective coverage for your vehicle.

To make this easier, enter your ZIP code below to receive free, no-obligation auto insurance quotes specific to San Antonio.

Frequently Asked Questions

What are the minimum auto insurance requirements in San Antonio, Texas?

San Antonio, Texas auto insurance laws require a minimum coverage of 30/60/25 to comply with financial responsibility laws.

How can I find cheap auto insurance in San Antonio, Texas?

To find the best cheap auto insurance in San Antonio, Texas, it is recommended to compare quotes from multiple insurance companies.

This allows you to compare rates and choose the most affordable option. Enter your ZIP code now to begin comparing.

How much are the average auto insurance rates in San Antonio, TX?

How does age, gender, and marital status affect auto insurance rates in San Antonio, Texas?

Demographic factors such as age, gender, and marital status can impact auto insurance rates in San Antonio, Texas. Rates may vary depending on these factors.

What are the auto insurance rates for teen drivers in San Antonio, Texas?

Auto insurance rates for teen drivers in San Antonio, Texas are typically higher due to their lack of driving experience.

The rates may vary depending on other factors as well. Enter your ZIP code now to begin comparing.

What are the top three auto insurance companies in San Antonio, Texas, mentioned in the article?

In San Antonio, Texas, the top auto insurance companies—State Farm, Geico, and Allstate—offer competitive rates and discounts.

For seniors seeking auto insurance, these providers offer tailored options: State Farm has senior discounts, Geico provides competitive rates and easy online tools, and Allstate offers customizable coverage and safe-driving discounts.

How much can rates start at per month for auto insurance in San Antonio, Texas?

Auto insurance rates in San Antonio, Texas, can start as low as $43 per month. The article highlights these low rates as a key reason to consider these providers.

What is the benefit of comparing auto insurance rates by ZIP code in San Antonio, Texas?

Comparing auto insurance rates by ZIP code in San Antonio is beneficial because rates can vary significantly based on local factors like traffic patterns and crime rates.

This comparison helps you find the most affordable coverage for your specific location. Enter your ZIP code now to begin comparing.

Which insurance company is highlighted as the best for military families in San Antonio?

USAA stands out as the best insurance company for military families in San Antonio, Texas, offering tailored coverage and discounts.

Key factors affecting auto insurance rates, such as military-specific discounts, make USAA a top choice for those in the armed forces.

What are the state-mandated minimum auto insurance coverage requirements in San Antonio, Texas?

The state-mandated minimum auto insurance coverage in San Antonio, Texas, is 30/60/25 for bodily injury and property damage liability. This ensures drivers meet the financial responsibility laws in the event of an accident.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.