Cheap Assigned Risk Pool Auto Insurance in 2026 (Top 10 Low-Cost Companies)

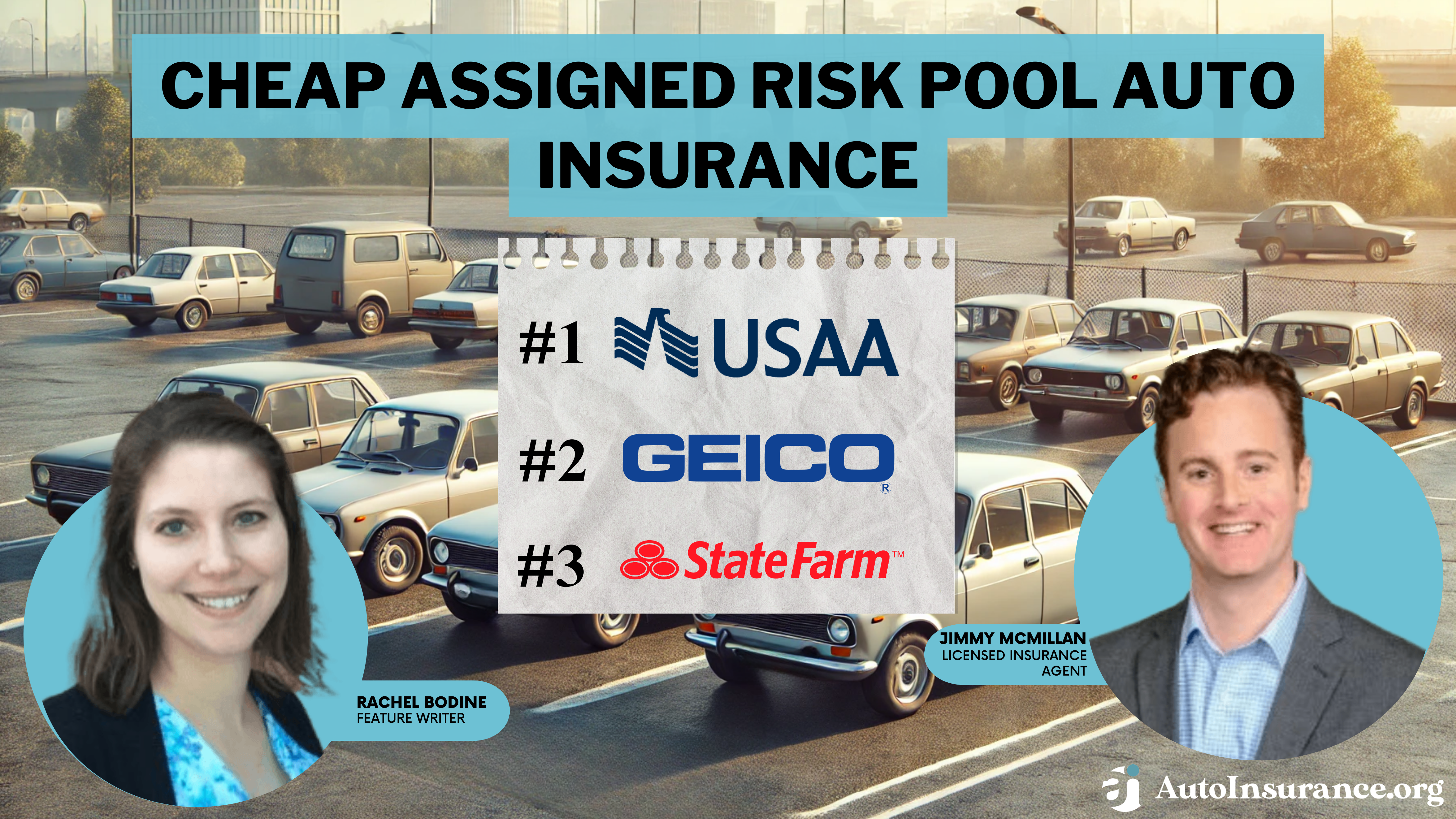

USAA, Geico, and State Farm have cheap assigned risk pool auto insurance. USAA has the cheapest rates, with minimum coverage averaging $275/mo. Assigned risk pool insurance is expensive, but if you cannot get coverage, you must join an assigned risk auto insurance plan to be guaranteed coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated January 2025

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Assigned Risk Pool

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Assigned Risk Pool

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Assigned Risk Pool

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsUSAA, Geico, and State Farm have the cheapest assigned risk pool auto insurance.

When seeking auto insurance, drivers are assessed according to their risk factors. However, sometimes, drivers can only obtain auto insurance through an assigned risk policy for high-risk auto insurance.

Our Top 10 Company Picks: Cheap Assigned Risk Pool Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $275 | A++ | Military Savings | USAA | |

| #2 | $288 | A++ | Low Deductibles | Geico | |

| #3 | $315 | B | Student Savings | State Farm | |

| #4 | $315 | A+ | Deductible Savings | Nationwide |

| #5 | $328 | A+ | Loyalty Rewards | Progressive | |

| #6 | $330 | A++ | Unique Coverage | Travelers | |

| #7 | $341 | A+ | Usage-Based Discount | Allstate | |

| #8 | $355 | A | Customer Service | American Family | |

| #9 | $355 | A | Diverse Coverage | Liberty Mutual |

| #10 | $368 | A | Great Add-ons | Farmers |

While purchasing an assigned-risk auto insurance policy may sound daunting, there are some benefits to be had in this situation. By entering your ZIP code into the free quote tool on this page, you will be on your way to saving a bundle on your assigned risk car insurance.

- USAA has the cheapest assigned risk pool auto insurance

- When seeking auto insurance, drivers are assessed according to their risk factor

- It’s better to pay more for an assigned-risk auto policy than drive without insurance

#1 – USAA: Top Pick Overall

Pros

- Military Savings: High-risk military drivers and veterans will likely find the most affordable assigned risk pool insurance rates at USAA.

- Customer Service: USAA provides excellent service according to reviews left by customers.

- Coverage Options: High-risk drivers can purchase add-ons if in their budget. Learn what’s offered in our USAA review.

Cons

- Eligibility Requirements: USAA insurance is only available to military members and veterans.

- Office Availability: Local offices with agents are limited.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Low Deductibles

Pros

- Low Deductibles: Geico offers low-deductible options to customers.

- Online Services: User-friendly tools can help high-risk drivers adjust coverages to lower rates. Read our Geico review to learn more.

- Discount Opportunities: High-risk customers may be able to reduce their rates with some of Geico’s discounts.

Cons

- Claim Handling: Customers have left mixed reviews on Geico’s claims handling.

- Coverage Options: Compared to its competitors, Geico’s coverage options are slightly more limited.

#3 – State Farm: Best for Student Savings

Pros

- Student Savings: Even if young drivers are assigned risk drivers, they can still save with good student discounts.

- Local Agents: Assigned risk drivers can get personalized support. Learn more in our State Farm review.

- Coverage Options: High-risk drivers will still be able to purchase multiple types of coverage.

Cons

- Online Services: Some services may require in-person visits to State Farm Agents.

- Financial Management: The financial rating from A.M. Best is low and could be greatly improved.

#4 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Assigned risk pool drivers will still be able to reduce their deductibles if they stay claims-free in the future.

- Financial Stability: Nationwide’s management of finances is rated well. Read our Nationwide review for more information.

- Usage-Based Coverage: Pay-per-mile insurance through SmartMiles may help some assigned risk pool drivers save.

Cons

- Customer Reviews: There are some complaints, such as customers reporting rate increases.

- Local Offices: Some locations have more limited physical offices available.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Loyalty Rewards

Pros

- Loyalty Rewards: Progressive’s rewards for loyal customers may help assigned risk poll drivers decrease rates over time.

- Online Tools: Free budgeting tools and more are provided by Progressive.

- Snapshot Program: Risky drivers who prove their safe driving skills may get a discount. Learn more in our Progressive Snapshot review.

Cons

- Snapshot Rate Changes: Poor scores harm rates, so only good drivers should join the program.

- Customer Service: Customers’ reviews are mixed, which you can learn more about in our review of Progressive.

#6 – Travelers: Best for Unique Coverage

Pros

- Unique Coverage: Travelers offer less common coverages, which may be useful to riskier drivers.

- 24/7 Support: Assistance is available 24/7 from representatives. Learn more in our Travelers review.

- Safety Features: Discounted rates are given if a vehicle has the required safety features.

Cons

- UBI Rate Changes: High-risk drivers should only participate in the UBI program if they can prove safe driving skills.

- Customer Reviews: Customer service could still be made better.

#7 – Allstate: Best for Pay-Per-Mile Rates

Pros

- Pay-Per-Mile Rates: Milewise by Allstate could reduce rates for higher-risk drivers who rarely drive.

- Online Convenience: Allstate’s app is convenient for customers wanting to manage policies online.

- Discount Options: Learn about your saving options at Allstate in our Allstate review.

Cons

- Claim Satisfaction: Claim complaints focus on issues with processing.

- Young Driver Rates: Assigned risk drivers who are younger will have higher rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Customer Service

Pros

- Customer Service: Most customers are happy with the service provided. Read our American Family review to learn more.

- Young Driver Services: American Family has monitoring programs and discounts for young drivers.

- Loyalty Discount: Assigned risk pool drivers could see rate drops if they stick with the company.

Cons

- Availability: American Family sales are limited to certain states.

- Online Resources: American Family’s online tools are less comprehensive.

#9 – Liberty Mutual: Best for Diverse Coverage

Pros

- Diverse Coverage: Assigned risk pool customers will have a full coverage selection. See what’s sold in our Liberty Mutual review.

- 24/7 Support: Representative assistance is constantly available to assigned risk pool customers.

- Discount Opportunities: Even higher-risk drivers should be able to apply one or two discounts to their policies.

Cons

- Coverage Rates: Some coverage options will come with much higher premiums.

- Customer Service: Mixed reviews from customers show room for improvement.

#10 – Farmers: Best for Great Add-Ons

Pros

- Great Add-Ons: While it costs more to add on extras, they offer more protection to high-risk drivers.

- Local Agents: Assigned risk pool customers can get more hands-on assistance from local agents.

- Usage Discount: Farmers has a usage-based discount opportunity. Find out more in our review of Farmers.

Cons

- Online Functions: Online tools are more limited in what online changes customers can make.

- Customer Satisfaction: Customer reviews remark on inconsistent service from representatives.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost of Assigned Risk Auto Insurance

Assigned risk car insurance will be more expensive, but the most affordable rates are available at the companies listed below.

Assigned Risk Pool Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $341 | $405 |

| American Family | $355 | $410 |

| Farmers | $368 | $435 |

| Geico | $288 | $345 |

| Liberty Mutual | $355 | $420 |

| USAA | $275 | $340 |

| Nationwide | $315 | $380 |

| Progressive | $328 | $395 |

| State Farm | $315 | $360 |

| Travelers | $330 | $400 |

Companies also offer discounts that can further lower rates, so make sure you apply for all applicable discounts at your company.

One of the auto insurance discounts that typically save high-risk drivers the most money is bundling discounts.

What to Know About Assigned Risk Auto Insurance Policies

Every licensed driver in the country is required by law to carry auto insurance on the vehicle they are driving. Nevertheless, just because you are a licensed driver does not always mean that you can obtain auto insurance.

Insurance agencies have the right to deny auto insurance coverage to any driver who has been deemed as an undesirable driver.

A person can be considered too high of a risk to be insured if they have excessive traffic violations, speeding tickets, or a long list of auto accidents. Insurance agencies do not want to offer coverage for what they would consider an unsafe or careless driver and will assign these drivers a poor auto insurance score.

This type of driver is too risky to take on. A sure way to land yourself in the high-risk category is to be convicted of driving under the influence (DUI). A DUI goes beyond just raising your premiums (learn more: DUI Defined).

It can lead to your insurance company labeling you as too high of a risk and terminating your auto insurance policy altogether.

Usually a motorist is considered an assigned risk by the Department of Motor Vehicles (DMV) in the state in which they reside.

The DMV is responsible for actually assigning that high-risk driver to an auto insurance agency to obtain an auto insurance policy.

High-Risk Drivers Still Need Insurance

It is a bit of a catch-22 scenario. All drivers are required by law to carry insurance, but the law does not guarantee that all drivers will be able to obtain an insurance policy.

Even if you are considered a good driver, you could be an assigned risk because of other factors such as belonging to a high-risk group such as teenage drivers or because of the neighborhood in which you live where there is a high rate of auto theft.

Read more: Factors That Affect Auto Insurance Rates

But a driver, whether considered a good driver or a bad driver, is still just a driver and is required to carry auto insurance. Most states across the United States have some type of assigned risk auto insurance that is provided to high-risk drivers. They all have similarities but check with your local DMV to find out more details about your state’s particular policies.

Insurance companies know that they are practically guaranteed to lose money on an assigned risk auto policy due to the nature of the policy itself.

A driver who is considered to be that high of a risk is not a healthy addition to their clientele, which is why that type of risk policy must be assigned to that particular driver. A high-risk driver is more likely to file a claim with their insurance carrier, which will cost the insurance agency money.

Your Insurance Agent Does the Paperwork Making You an Assigned Risk

In order to become an assigned risk, you must apply for auto insurance at least three times to three different auto insurance agencies. After each of them has refused to offer you coverage, the third one should complete a standard form that is sent to the state government.

This form will state that you have been deemed to belong to a high-risk category and are in need of an assigned-risk auto insurance policy.

Obtaining auto insurance through an assigned risk auto insurance agency is not a bad thing.

That type of agency is simply an auto agency that offers the same type of auto insurance as any other carrier, but they are considered the last resort for high-risk drivers who cannot get insured by any other means.

Assigned Risk Auto Insurance Does Not Last Forever

Just because you happen to land in the high-risk category of assigned-risk auto insurance does not mean that you will stay in that category forever.

If you can maintain a clean driving record without traffic violations or tickets and avoid accidents for at least three consecutive years, you can apply for auto insurance through another carrier and request a lower rate.Dani Best Licensed Insurance Producer

Your assigned risk is what determines your insurance rates. So, the better your driving record is, the lower your premiums are likely to be.

Another way to help lower your auto insurance rates and make it easier to purchase an insurance policy is to have a decent credit score. Your credit score reflects your responsibility to pay your bills on time.

Read more: How Credit Scores Affect Auto Insurance Rates

Every auto insurance carrier has its own set of requirements when deciding which drivers they will offer coverage to and which ones they will refuse.

Be diligent in your search and shop around for different policies and eventually you may find one that will not label you as an assigned risk auto insurance policyholder.

Remember, some auto insurance agencies review the last three years of your driving record, while others may be required to review the last five years.

An Assigned Risk Insurance Policy has Some Benefits

Since all drivers are required to carry auto coverage of some type, one benefit of having an assigned auto insurance policy is simply that you are at least carrying some coverage. This makes it legal for you to be on the road.

Having an assigned-risk auto insurance policy is better than not having any insurance policy at all. Sometimes, it is the only type of policy that a high-risk driver can get.

An assigned risk insurance policy will often only offer the absolute minimum coverage to the driver in order to be considered legal. This is a benefit because you do not have to worry about having many non-essential items on your policy that you do not require and do not want.

An assigned risk auto insurance policy offers you and your vehicle insurance coverage. The premiums may be higher than you would like them to be, but that can all come out in the wash later on.

Pay your monthly premiums on time and stay out of trouble, which will be reflected on your driving record.

By purchasing and maintaining an assigned risk auto insurance policy, you can always change insurance carriers later on and end up paying much lower premiums than before.

Each agency wants to widen its customer base, so it has developed its own set of requirements for its policyholders. This can help tremendously when a high-risk driver searches for an auto policy. Just because one insurance agency denies you does not mean that another one will.

Driving Without Insurance is Not an Option

Many high-risk drivers try to avoid having auto insurance because they have difficulty finding a policy that will cover them, or they do not want to pay such high premiums.

For drivers who are toying with the idea of purchasing a high-risk insurance policy and then canceling it afterward because the premiums are too high, you may want to rethink that thought. The DMV knows this, and it has developed a system that tracks those drivers who may be on the road illegally due to being uninsured.

So rather than canceling your policy, shop around and see if a company like Geico might offer a cheaper rate.

The Insurance Information and Enforcement System was designed to track all insurance policy cancellations. So, if you purchase a policy and then cancel it soon after registering your vehicle, the DMV is notified of those actions.

For example, New York State utilizes this system to help ensure that all uninsured drivers are restricted from driving in that state in the hopes of decreasing the number of accidents that could end up costing all those involved thousands of dollars.

The Final Word on Cheap Assigned Risk Pool Auto Insurance

It is better to pay higher premiums for an assigned-risk auto policy than driving without auto insurance at all. This is because it could lead to an enormous amount of debt if you are involved in an accident or the loss of your driver’s license if you are caught driving while uninsured.

To find high risk car insurance quotes today, enter your ZIP code into our free search tool now.

Frequently Asked Questions

What is assigned risk pool auto insurance?

Assigned risk pool auto insurance, also known as the high-risk or residual market, is a type of auto insurance provided to drivers who are unable to obtain coverage through traditional insurance companies. It is designed to ensure that all drivers have access to insurance, regardless of their driving history or other risk factors.

Who is eligible for assigned risk pool auto insurance?

Eligibility for assigned risk pool auto insurance varies by state, but generally, it is available to drivers who have been denied coverage by multiple insurance companies due to their driving record, past accidents, or other high-risk factors. Each state has its own criteria for determining eligibility.

How does assigned risk pool auto insurance work?

When a driver is unable to find coverage in the regular insurance market, they can apply for assigned risk pool auto insurance (learn more: Can an auto insurance company deny you coverage?). The application is then submitted to the state’s assigned risk pool or an organization designated by the state. The driver is assigned to an insurance company that participates in the pool, and that company is required to provide coverage to the driver.

Is assigned risk pool auto insurance more expensive?

Assigned risk pool auto insurance typically comes with higher premiums compared to regular insurance policies, making it nearly impossible to get cheap assigned risk pool car insurance. Since drivers in the assigned risk pool are considered high-risk, insurance companies charge higher rates to compensate for the increased likelihood of claims. However, the exact cost will vary based on individual factors such as driving history, location, and the state’s regulations.

Can I improve my driving record while in the assigned risk pool?

Yes, you can improve your driving record while in the assigned risk pool. If you maintain a clean driving history over time, it can help you transition back to the regular insurance market and potentially secure coverage at better rates. It is important to practice safe driving habits and follow all traffic laws to gradually improve your record (read more: How to Lower Your Auto Insurance Rates).

What is risk pooling in car insurance?

A car insurance pool is when drivers are grouped together into a high-risk insurance pool and charged higher premiums. If a claim is filed, the premiums paid by the drivers in the pool will help pay off the claim.

Is risk pooling good or bad?

Risk pooling usually allows companies to keep rates lower, but it can backfire if multiple claims are filed within the group.

Who has the cheapest assigned risk pool car insurance?

USAA, Geico, and State Farm usually have the cheapest automobile-assigned risk plans. Compare insurance rates with our free tool to find the best high-risk insurance rates today.

How long do you have to be in an assigned risk pool?

It depends upon state requirements. Typically, drivers have to be in a pool for three years before they can be reevaluated (read more: How Auto Insurance Companies Check Driving Records).

What causes a driver to have to join a state-assigned risk pool?

Typically, drivers who have multiple accidents, DUIs, tickets, or similar infractions must join state-assigned risk pools.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.