Best Auto Insurance After a DUI in Indiana (10 Most Affordable Companies for 2026)

State Farm, Progressive, and Allstate offer the best auto insurance after a DUI in Indiana, leading with top-rated coverage starting at $24 per month. State Farm, the top pick, offers specialized DUI forgiveness programs, making it ideal for those seeking affordable and reliable Indian auto insurance after a DUI.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated October 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage After a DUI in Indiana

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage After a DUI in Indiana

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage After a DUI in Indiana

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsState Farm, Progressive, and Allstate are the top picks for the best auto insurance after a DUI in Indiana, offering unmatched coverage and customer support.

State Farm stands out for its specialized DUI forgiveness programs, making it the overall best choice.

Progressive offers flexible policy options tailored to individual needs, while Allstate provides extensive discounts on Indiana high-risk car insurance after a DUI.

Our Top 10 Company Picks: Best Auto Insurance After a DUI in Indiana

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | B | Affordable Rates | State Farm | |

| #2 | 12% | A+ | Flexible Policies | Progressive | |

| #3 | 10% | A+ | Diverse Discounts | Allstate | |

| #4 | 14% | A | Tailored Coverage | Farmers | |

| #5 | 13% | A | Easy Reinstatement | Liberty Mutual |

| #6 | 11% | A+ | Discount Options | Nationwide |

| #7 | 12% | A++ | Strong Support | Travelers | |

| #8 | 10% | A+ | Special Programs | The Hartford |

| #9 | 13% | A | Customizable Plans | American Family | |

| #10 | 14% | A++ | Coverage Flexibility | Auto-Owners |

These companies provide the most reliable and comprehensive DUI coverage in Indiana. Find the best auto insurance rates no matter how much coverage you need after a DUI in Indiana by entering your ZIP code above into our comparison tool today.

- State Farm is the top pick for the best auto insurance after a DUI in Indiana

- Allstate has diverse discounts that cater specifically to those with a DUI in Indiana

- Specialized DUI forgiveness programs are crucial to getting cheap IN DUI insurance

#1 – State Farm: Top Overall Pick

Pros

- Affordable Rates: State Farm offers some of the lowest DUI premiums in Indiana, making it an excellent choice for budget-conscious drivers.

- DUI Forgiveness: State Farm’s specialized forgiveness programs can significantly ease the financial burden of DUI insurance in Indiana. Learn more in our State Farm insurance review.

- Bundling Options: State Farm provides a 15% discount for bundling policies, ideal for those with multiple coverage needs after a DUI in Indiana.

Cons

- Limited A.M. Best Rating: With an A.M. Best rating of B, State Farm may raise concerns about financial stability after a DUI in Indiana.

- Smaller Discounts: Other Indiana auto insurance companies offer bigger bundling and multi-vehicle discounts after a DUI.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Flexible Policies

Pros

- Flexible Policies: Progressive offers adaptable coverage options, which is particularly beneficial for drivers dealing with a DUI in Indiana.

- Superior Rating: Boasting an A+ A.M. Best rating, Progressive ensures financial reliability, essential for those with a DUI in Indiana. Get complete ratings in our Progressive auto insurance review.

- Snapshot Program: Progressive’s Snapshot program allows Indiana drivers to potentially lower their DUI insurance rates based on safe driving habits. Learn how in our Snapshot review.

Cons

- Lower Bundling Discount: The 12% bundling discount at Progressive is lower compared to other DUI auto insurance companies in Indiana.

- Complex Policy Structure: Progressive’s multiple policy options can be overwhelming for DUI drivers in Indiana, making it harder to choose the best fit.

#3 – Allstate: Best for Diverse Discounts

Pros

- Diverse Discounts: Allstate provides a variety of discount options, which can help reduce premiums for those with a DUI in Indiana. Dive into our analysis of Allstate auto insurance review.

- Financial Strength: Allstate’s A+ rating from A.M. Best reflects its strong financial stability, which is important for securing coverage after a DUI in Indiana.

- Safe Driving Bonus: Allstate offers a safe driving bonus program, which can help IN drivers with DUIs earn discounts over time.

Cons

- Lower Bundling Savings: Allstate’s 10% bundling discount is the lowest among the top Indiana DUI insurance companies, which might not be ideal for drivers seeking comprehensive savings.

- Potential Premium Hikes: Allstate’s premiums can rise significantly after a DUI in Indiana, especially if no discounts apply.

#4 – Farmers: Best for Tailored Coverage

Pros

- Tailored Coverage: Farmers specializes in customizing policies, making it a strong option for unique Indiana DUI insurance needs,

- Solid Financial Rating: With an A rating from A.M. Best, Farmers is one of the most dependable Indiana DUI insurance companies. Get more details in our complete Farmers Insurance review.

- Accident Forgiveness: Farmers’ accident forgiveness can be a valuable feature for those with a DUI in Indiana, preventing premium increases after the first accident.

Cons

- Average Bundling Discount: The 14% bundling discount at Farmers is decent, but not the highest available from IN auto insurance companies.

- Limited Discount Availability: Auto insurance discounts after a DUI in Indiana may be harder to qualify for, potentially reducing overall savings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Easy Reinstatement

Pros

- Easy Reinstatement: Liberty Mutual makes it easier for Indiana drivers to reinstate their policies after a DUI, providing a seamless transition.

- Financial Strength: An A rating from A.M. Best ensures that Liberty Mutual is a stable choice for DUI coverage in Indiana. Read our full Liberty Mutual auto insurance review.

- Quick Claims Process: Liberty Mutual offers a fast and efficient claims process, crucial for Indiana policyholders needing prompt assistance after a DUI.

Cons

- Moderate Bundling Discount: Liberty Mutual’s 13% bundling discount is moderate, potentially limiting savings on Indiana DUI car insurance.

- Higher Premiums: Despite its benefits, Liberty Mutual’s premiums can be on the higher side, particularly for Indiana DUI auto insurance.

#6 – Nationwide: Best for Discount Options

Pros

- Diverse Discounts: Nationwide offers a variety of discount options to save money on IN auto insurance after a DUI. See more details in our Nationwide auto insurance review.

- Dependable Rating: With an A+ A.M. Best rating, Nationwide ensures strong financial stability for DUI insurance claims in Indiana.

- Bundling Savings: Nationwide provides an 11% discount for bundling, which can lower DUI car insurance costs significantly in Indiana.

Cons

- Lower Bundling Rate: The 11% bundling discount is on the lower end, which might not be the best for Indiana drivers looking to save money on car insurance after a DUI.

- Limited Customization: Nationwide may offer fewer customization options for DUI insurance in Indiana compared to its competitors.

#7 – Travelers: Best for Strong Support

Pros

- Superior Financial Strength: Travelers’ A++ A.M. Best rating reflects its exceptional financial stability, which is crucial for DUI insurance in Indiana.

- Comprehensive Support: Travelers excels in providing robust customer support, especially vital for Indiana drivers dealing with complex DUI insurance claims. Find out more in our Travelers review.

- Bundling Advantage: Travelers offers a 12% discount on bundled policies, making it a solid choice DUI car insurance in Indiana looking to save.

Cons

- Less Flexible Discounts: Despite the bundling advantage, Travelers DUI insurance discount options in Indiana may be less flexible compared to others.

- Higher Premiums: Travelers DUI car insurance rates might be higher for Indiana drivers, even with discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Special Programs

Pros

- Unique Programs: The Hartford offers specialized programs tailored for older Indiana drivers after a DUI, providing targeted support.

- Strong Financials: With an A+ rating from A.M. Best, The Hartford is one of the most reliable IN car insurance companies after a DUI. More information is available in The Hartford insurance review.

- Bundling Discount: A 10% discount for bundling policies can benefit DUI drivers in Indiana drivers needing multiple coverages.

Cons

- Lower Discount Rate: The Hartford’s 10% bundling discount is relatively modest, potentially limiting savings for Indiana DUI coverage.

- Program Availability: The Hartford DUI auto insurance is only available to senior drivers in Indiana.

#9 – American Family: Best for Customizable Plans

Pros

- Customizable Coverage: American Family allows extensive customization on Indiana auto insurance policies after a DUI.

- Solid Financial Rating: An A rating from A.M. Best ensures AmFam’s dependability after a DUI in Indiana. Learn more in our American Family auto insurance review.

- Bundling Perks: American Family offers a 13% discount for bundling policies, providing decent savings on IN auto insurance after a DUI.

Cons

- Complex Customization: The extensive customization options may overwhelm DUI drivers in Indiana who prefer simpler plans.

- Discount Limitations: Some DUI drivers in Indiana may find it challenging to qualify for all available discounts.

#10 – Auto-Owners: Best for Coverage Flexibility

Pros

- Flexible Coverage: Auto-Owners provides highly flexible coverage options, ideal for DUI drivers in Indiana with varying needs.

- Excellent Financial Strength: With an A++ rating from A.M. Best, Auto-Owners ensures stability after a DUI in Indiana.

- Top Bundling Discount: A 14% discount for bundling makes Auto-Owners a top choice for DUI insurance in Indiana. See how you can save in our Auto-Owners review.

Cons

- Higher Costs: Despite the bundling discount, Auto-Owners DUI auto insurance quotes can be on the higher side for Indiana coverage.

- Limited Program Availability: Some specialized programs may not be available for all DUI drivers in Indiana, limiting flexibility.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

A Breakdown of DUI Insurance Rates in Indiana

Understanding the costs associated with high-risk auto insurance in Indiana is crucial. Monthly rates can vary significantly depending on the coverage level and the provider, making it essential to compare options carefully.

Below, we provide a detailed breakdown of the monthly rates for both minimum and full coverage from various insurance companies in Indiana, giving you a clear picture of what to expect.

Indiana DUI Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $63 | $184 |

| American Family | $71 | $207 |

| Auto-Owners | $74 | $146 |

| Farmers | $37 | $108 |

| Liberty Mutual | $157 | $454 |

| Nationwide | $48 | $140 |

| Progressive | $32 | $92 |

| State Farm | $24 | $71 |

| The Hartford | $79 | $154 |

| Travelers | $35 | $103 |

The monthly rates in Indiana auto insurance after a DUI vary widely, with State Farm offering the most competitive rates at $24/month for minimum coverage and $71/month for full coverage. On the other end, Liberty Mutual presents the highest monthly rates at $157 for minimum coverage and $454 for full coverage.

Can you beat our competitors at their own game?

Check out some of our favorite questions from last week’s trivia challenge and drop your answers in the comments 👇

📺: Watch the replay of the Gamerhood: Neo City episode 2 on the official State Farm Twitch or YouTube channels. pic.twitter.com/R592nIgTuj

— State Farm (@StateFarm) August 15, 2024

Progressive and Farmers also provide affordable options, with Progressive monthly insurance rates starting at $32 for minimum coverage and $92 for full coverage, and Farmers offering $37 and $108, respectively.

Learn More: How much car insurance do I need?

Key Factors Influencing DUI Insurance Costs in Indiana

Why is it so hard to find cheap auto insurance after a DUI in Indiana? Several critical factors can significantly impact your rates, and your driving history will have the biggest impact. A DUI is a major factor, but other violations or accidents on your record can further increase your rates.

Other factors go beyond just the DUI itself and can either mitigate or exacerbate the overall cost of your Indiana car insurance:

- Coverage Level: Opting for full coverage versus minimum coverage will significantly alter your monthly premiums, with full coverage naturally costing more. Get Indiana DUI auto insurance requirements here.

- Insurance Provider: Different companies assess risk differently, leading to wide variations in rates for the same coverage levels across providers.

- Credit Score: In Indiana, your credit score can influence your rates, and bad credit leads to higher premiums due to perceived risk.

- Vehicle Type: The make, model, and age of your vehicle also affect insurance costs, as some vehicles are more expensive to insure than others.

By knowing what influences your rates, you can take strategic steps to manage your DUI auto insurance costs and find the best possible coverage for your situation.

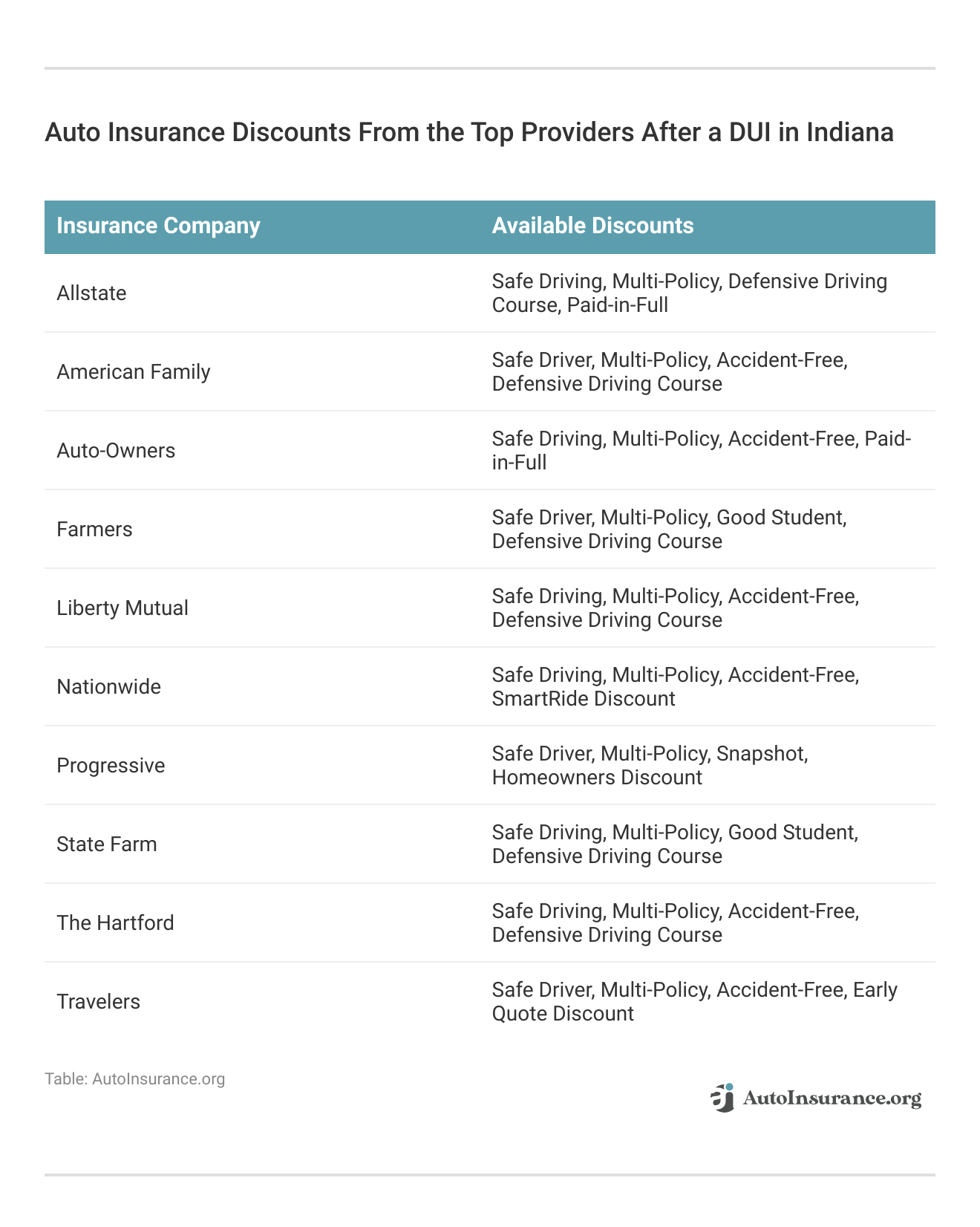

How to Lower Indiana Auto Insurance Costs After a DUI

To effectively reduce your auto insurance premiums after a DUI in Indiana, consider taking advantage of various discounts, such as bundling your policies or maintaining a clean driving record post-DUI.

Opting for a higher deductible can also lower your monthly rates, though this comes with the risk of higher out-of-pocket expenses in the event of a claim.

Participating in a defensive driving course not only demonstrates your commitment to safer driving but may also qualify you for additional discounts.Brad Larson Licensed Insurance Agent

Furthermore, shopping around and comparing quotes from multiple insurers is crucial, as rates can vary significantly between providers. Compare the best Indiana auto insurance companies here.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Best Auto Insurance After a DUI in Indiana

The following case studies highlight how State Farm, Progressive, and Allstate provide tailored solutions to meet the specific needs of drivers with DUIs.

- Case Study #1 – Affordable Coverage With State Farm: After receiving a DUI, Mike faced steep insurance premiums. State Farm’s DUI forgiveness program allowed him to secure affordable IN auto insurance coverage at $24/month.

- Case Study #2 – Flexible Options With Progressive: Lisa needed customizable insurance after her DUI to fit her tight budget. Progressive’s flexible policy options enabled her to choose a plan that cost $32/month.

- Case Study #3 – Discounts With Allstate: David was worried about the high costs of DUI insurance in Indiana, but Allstate’s extensive discount offerings helped reduce his premiums while maintaining comprehensive insurance.

Finding the right auto insurance after a DUI in Indiana can make a significant difference in both cost and coverage. Learn how to ask an auto insurance company for quotes to see which Indiana car insurance company matches your coverage needs.

The Top Indiana Auto Insurance Companies After a DUI

State Farm, Progressive, and Allstate sell the best auto insurance after a DUI in Indiana. State Farm dominates with its DUI forgiveness programs and attractive pricing starting at $24/month.

State Farm’s DUI forgiveness program makes it the top choice for affordable and reliable coverage after a DUI in Indiana.Michelle Robbins Licensed Insurance Agent

Progressive delivers adaptability in its policy offerings, addressing varied requirements while keeping premiums manageable. Allstate is recognized for its numerous auto insurance discounts that appeal to Indiana drivers with higher rates post-DUI.

Find your cheapest auto insurance quotes after a DUI in Indiana by entering your ZIP code below into our free comparison tool.

Frequently Asked Questions

What’s the best insurance for a DUI in Indiana?

The best insurance for a DUI in Indiana is often with companies like State Farm, Progressive, or Allstate, which offer specialized coverage and DUI forgiveness programs.

What is the best insurance for high-risk drivers in Indiana?

State Farm is the best high-risk auto insurance company for Indiana drivers who have DUIs or other traffic citations on their record because it raises rates less than other companies in the state after a DUI or claim.

Does insurance cover DUI accidents in Indiana?

Yes, insurance generally covers DUI accidents in Indiana, but expect significant rate increases afterward. Find out how long an accident stays on your driving record.

How long does a DUI affect insurance in Indiana?

A DUI in Indiana typically affects your insurance rates for 3 to 5 years, depending on the insurance company’s policies.

How long does a DUI stay on your background check in Indiana?

A DUI in Indiana usually stays on your background check for life unless it is expunged.

How do I file for expungement of a DUI in Indiana?

To file for expungement of a DUI in Indiana, you need to petition the court, typically with the assistance of an attorney, after meeting certain eligibility requirements.

What is the best company for high-risk drivers with a DUI in Indiana?

For high-risk auto insurance in Indiana, State Farm, and Progressive are top choices due to their tailored coverage and competitive rates.

Can a DUI in Indiana be dismissed?

A DUI in Indiana can potentially be dismissed, but it requires a strong legal defense and specific circumstances that favor dismissal.

Will insurance cover my car if I get a DUI in Indiana?

Yes, insurance will cover your car if you get a DUI in Indiana, but your rates will likely increase. To find out if you can get cheaper auto insurance rates after a DUI in Indiana, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

How much does car insurance go up after a DUI in Indiana?

After a DUI in Indiana, car insurance rates can increase by 50% to 80%, depending on the insurance provider (Learn More: Factors That Affect Auto Insurance Rates).

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.