Best San Francisco, California Auto Insurance in 2026 (Check Out the Top 10 Companies)

To find the best San Francisco, California auto insurance, focus on companies offering superior coverage, competitive rates, and strong customer service. State Farm, Geico, and Progressive stand out for balancing affordability and full coverage, with rates starting at $80 monthly, ensuring top-notch protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated October 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in San Francisco CA

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in San Francisco CA

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in San Francisco CA

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsSecuring the best San Francisco, California auto insurance requires a careful evaluation of companies offering superior coverage, competitive rates, and reliable customer service.

This article ranks the top providers, with State Farm leading for its affordability and comprehensive full coverage auto insurance plans, making it ideal for drivers seeking value. Geico and Progressive also shine with competitive pricing and strong coverage options, ensuring you get the protection you need.

Our Top 10 Company Picks: Best San Francisco, California Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 14% | B | Reliable Coverage | State Farm | |

| #2 | 12% | A++ | Low Rates | Geico | |

| #3 | 7% | A+ | Tight Budgets | Progressive | |

| #4 | 17% | A+ | Comprehensive Coverage | Allstate | |

| #5 | 11% | A | Personalized Service | Farmers | |

| #6 | 10% | A | Flexible Policies | Liberty Mutual |

| #7 | 9% | A | Budget-Friendly | Mercury | |

| #8 | 15% | A+ | Nationwide Coverage | Nationwide |

| #9 | 12% | A++ | Broad Options | Travelers | |

| #10 | 13% | A+ | Customer Satisfaction | Amica |

Explore how these companies stack up to find the best fit for your insurance needs in San Francisco. Enter your ZIP code above to get free San Francisco, California auto insurance quotes.

- Farmers is the most expensive auto insurer for San Francisco teens

- The minimum auto insurance required in San Francisco, California is 15/30/5

- The cheapest auto insurance company in San Francisco is Geico

#1 – State Farm: Top Overall Pick

Pros

- Strong Local Presence: State Farm’s extensive network of local agents provides personalized service, which is beneficial for San Francisco drivers who prefer face-to-face interactions. This local expertise makes State Farm a top choice for those seeking the best San Francisco, California auto insurance.

- Combined Policy Savings: Offers substantial savings for bundling multiple policies, such as home and auto insurance, which can significantly reduce overall costs. By consolidating your policies with State Farm, you can enjoy some of the best San Francisco, California auto insurance rates. See State Farm auto insurance review a complete resource on their insurance plans.

- Bespoke Insurance Plans: Provides various add-ons and customizable coverage options tailored to meet individual needs, including roadside assistance and rental car reimbursement. For those seeking the best San Francisco, California auto insurance, State Farm’s tailored options stand out.

Cons

- Increased Premiums for Younger Drivers: State Farm tends to have higher premiums for younger drivers compared to some competitors, which can be a drawback for families with teenage drivers. San Francisco drivers in this demographic may find more affordable options elsewhere, affecting their search for the best San Francisco, California auto insurance.

- Limited Discounts for Safe Drivers: While State Farm offers various discounts, their offerings for safe driving records may not be as extensive as other insurers. This could be a disadvantage for San Francisco drivers who prioritize safety and expect more substantial rewards for their driving habits.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Low Rates

Pros

- Market-Leading Rates: Geico is renowned for its low rates, often making it one of the most affordable options for San Francisco drivers. With rates starting around $160 per month, Geico’s pricing helps secure some of the best San Francisco, California auto insurance deals available. Check Geico auto insurance review a meticulous review of their policy offerings.

- Extensive Savings Opportunities: Provides numerous discounts, including savings for safe driving, good students, and federal employees, which can significantly lower premiums. These discounts help San Francisco drivers find the most affordable insurance options. Geico’s extensive discount program makes it a top contender for the best San Francisco, California auto insurance.

- No Extra Fees: Geico generally avoids additional fees for policy changes or cancellations, which can save San Francisco drivers money over time. This transparent approach to fees enhances the value of their insurance offerings, making Geico a strong option for those seeking the best San Francisco, California auto insurance.

Cons

- Limited Local Agents: Geico relies heavily on digital and phone support rather than having a broad network of local agents, which may be a drawback for those who prefer in-person assistance. San Francisco drivers who value face-to-face interactions might find this aspect less appealing when searching for the best San Francisco, California auto insurance.

- Basic Coverage Options: Geico’s coverage options may be more basic compared to some competitors, potentially lacking some specialized features. This could be a disadvantage for San Francisco drivers who want comprehensive and customizable insurance solutions.

#3 – Progressive: Best for Tight Budget

Pros

- Budget-Friendly Options: Progressive offers various low-cost insurance plans, making it a great choice for San Francisco drivers on a tight budget. Their competitive pricing helps ensure that you can find some of the best San Francisco, California auto insurance without stretching your finances.

- Name Your Price Tool: Features a unique tool that allows drivers to customize coverage options based on their budget, providing flexibility in choosing the right plan. This tool is particularly useful for San Francisco residents who need to balance cost with coverage. It helps find some of the best San Francisco, California auto insurance solutions tailored to your budget.

- Personalized Coverage Solutions: Offers a wide range of coverage options, including liability, collision, and comprehensive coverage, ensuring extensive protection for all driving needs. Progressive’s diverse options cater to San Francisco drivers looking for comprehensive insurance plans. Our complete Progressive review goes over this in more detail.

Cons

- Higher Insurance Costs for Young Drivers: Progressive may have higher rates for drivers with certain risk factors, such as those with poor credit or driving records. San Francisco drivers in these categories might find more competitive rates elsewhere when seeking the best San Francisco, California auto insurance.

- Complex Coverage Options: The variety of coverage options can be overwhelming for some drivers, potentially leading to confusion during the selection process. This complexity might detract from finding the best San Francisco, California auto insurance for those who prefer a more straightforward approach.

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Diverse Coverage Solutions: Allstate offers a broad range of coverage options, including unique features like accident forgiveness and new car replacement. This extensive selection helps San Francisco drivers find the best San Francisco, California auto insurance tailored to their needs.

- Robust Claims Process: Allstate’s well-regarded claims process is efficient and user-friendly, providing a smooth experience for drivers dealing with accidents or damage. This efficiency contributes to offering some of the best San Francisco, California auto insurance available.

- Local Agent Network: Offers a large network of local agents across San Francisco, providing personalized service and advice. This accessibility enhances the overall experience for those seeking the best San Francisco, California auto insurance through direct agent interactions. Find more information about Allstate’s rates in our review of Allstate insurance.

Cons

- Higher Premiums: Allstate’s comprehensive coverage options may come with higher premiums compared to other insurers. This cost could be a consideration for San Francisco drivers looking for more budget-friendly options in their search for the best San Francisco, California auto insurance.

- Limited Discount Programs: While Allstate offers some discounts, their range may not be as extensive as other providers, which might impact savings opportunities for certain drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Personalized Service

Pros

- Customized Insurance Plans: Farmers excels in offering personalized insurance plans that cater specifically to individual needs and preferences. This level of customization helps San Francisco drivers secure some of the best San Francisco, California auto insurance tailored to their unique situations.

- Varied Coverage Alternative: Provides a wide array of coverage options, including specialty coverage for high-value vehicles and unique situations. This extensive range ensures that San Francisco drivers can find the right protection. Take a look at our Farmers insurance company review to learn more.

- Outstanding Customer Service: Known for attentive and personalized customer service, Farmers provides dedicated support to assist with policy management and claims. This focus on customer care contributes to the best San Francisco, California auto insurance experience.

Cons

- Potentially Higher Rates: Farmers’ personalized service and extensive coverage options may come with higher premiums compared to some competitors. This aspect could be a drawback for San Francisco drivers seeking the most cost-effective solution for the best San Francisco, California auto insurance.

- Less Competitive for Basic Coverage: Farmers may not be as competitive for basic auto insurance plans, which might make them less ideal for those seeking minimal coverage options.

#6 – Liberty Mutual: Best for Flexible Policies

Pros

- Highly Flexible Coverage Options: Liberty Mutual offers a variety of policy options that can be tailored to fit specific needs and preferences. This flexibility allows San Francisco drivers to find coverage that best suits their requirements, contributing to the best San Francisco, California auto insurance experience.

- Discounts for Multiple Policies: Provides significant savings when bundling auto insurance with other types of coverage, such as home or renters insurance. These discounts help San Francisco drivers reduce overall costs and find affordable options. To see monthly premiums and honest rankings, read our Liberty Mutual review.

- Unique Add-On Features: Offers add-ons like accident forgiveness and new car replacement, which can enhance coverage and provide additional peace of mind. These features are valuable for drivers seeking comprehensive protection in San Francisco.

Cons

- Elevated Costs for Youthful Drivers: Liberty Mutual may offer higher premiums for younger drivers, which can be a disadvantage for San Francisco families with teenage drivers. This factor might affect their search for the best San Francisco, California auto insurance.

- Complex Policy Details: The range of options and features can be complex, potentially leading to confusion when selecting the most appropriate coverage. This complexity might hinder drivers from easily finding the best San Francisco, California auto insurance solution.

#7 – Mercury: Best for Budget-Friendly

Pros

- Affordable Premiums: Mercury is known for offering budget-friendly rates, making it an excellent choice for San Francisco drivers looking for cost-effective insurance solutions. Their competitive pricing ensures that you can secure some of the best San Francisco, California auto insurance without breaking the bank.

- Diverse Coverage Alternatives: Offers a variety of coverage options, including liability, collision, and comprehensive coverage, allowing San Francisco drivers to customize their insurance plans. This wide range of choices helps ensure that you can find the best San Francisco, California auto insurance tailored to your specific needs.

- Additional Discounts: Provides a range of discounts for safe drivers, multi-car policies, and more, which can further lower insurance costs. These discounts are particularly beneficial for San Francisco drivers seeking to maximize their savings while obtaining reliable coverage. Explore further information in our Mercury auto insurance review.

Cons

- Limited Local Presence: Mercury has fewer local agents and offices compared to larger insurers, which may be a drawback for those who prefer in-person interactions. San Francisco drivers seeking face-to-face service might find this aspect less convenient when searching for the best San Francisco, California auto insurance.

- Basic Coverage Options: While affordable, Mercury’s coverage options may be more basic compared to some competitors, which could limit customization opportunities. This might be a consideration for San Francisco drivers looking for more specialized coverage features.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Nationwide Coverage

Pros

- Broad National Presence: Nationwide offers extensive coverage options across the U.S., ensuring consistency and reliability regardless of where you drive. This national reach makes it easier for San Francisco drivers to find some of the best San Francisco, California auto insurance with comprehensive coverage options.

- Variety of Coverage Options: Provides a wide range of coverage types, including liability, collision, comprehensive, and specialized add-ons. This variety helps San Francisco drivers tailor their insurance plans to meet specific needs, ensuring they secure the best San Francisco, California auto insurance. Uncover additional insights in our Nationwide review.

- Insurance Bundle Discounts: Offers substantial discounts for bundling multiple insurance policies, such as home and auto, which can lead to significant savings. This discount opportunity is especially beneficial for San Francisco drivers looking to maximize their savings while obtaining quality coverage.

Cons

- Increased Rates for Young Policyholders: Nationwide’s rates may be higher for drivers with poor credit or driving records, which could impact affordability for certain San Francisco residents. This factor might make it less accessible for those with higher risk profiles seeking the best San Francisco, California auto insurance.

- Complex Policy Options: The range of coverage and policy options can be overwhelming, potentially making it challenging for drivers to navigate and select the best plan. This complexity could complicate finding the best San Francisco, California auto insurance for some San Francisco drivers.

#9 – Travelers: Best for Broad Options

Pros

- Varied Coverage Alternatives: Travelers provides a wide array of coverage options, including specialized add-ons such as gap insurance and new car replacement. This extensive selection ensures that San Francisco drivers can find the best San Francisco, California auto insurance tailored to their specific needs and preferences.

- High Credit Ratings: Travelers has robust financial ratings, indicating strong reliability in handling claims and providing consistent coverage. This financial stability contributes to offering some of the best San Francisco, California auto insurance available.

- Flexible Payment Plans: Provides various payment plan options, allowing drivers to choose a schedule that fits their financial situation. This flexibility is advantageous for San Francisco drivers who need to manage their insurance expenses effectively.

Cons

- Complex Policy Options: The variety of coverage and add-on options can be overwhelming, potentially making it challenging for drivers to select the most appropriate plan. This complexity might impact the search for the best San Francisco, California auto insurance.

- Higher Costs for Targeted Drivers: Travelers may have higher premiums for drivers with higher risk factors, such as those with poor credit or driving records. This aspect might affect affordability for some San Francisco drivers. Get more details in our Travelers auto insurance review.

#10 – Amica: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Amica consistently receives high ratings for customer service and satisfaction, making it a standout choice for drivers who prioritize excellent support. This strong customer focus contributes to offering some of the best San Francisco, California auto insurance available.

- Generous Discounts: Provides multiple discounts, including those for safe driving, bundling policies, and having multiple vehicles, which can help reduce overall insurance costs. These discounts are particularly advantageous for San Francisco drivers looking to save on their insurance premiums.

- Annual Dividend Payments: Amica offers a unique benefit with potential annual dividend payments, which can reduce the cost of coverage over time. This feature adds value to the best San Francisco, California auto insurance, providing a financial benefit to policyholders. Try to check more on our Amica auto insurance review.

Cons

- Limited Physical Locations: Amica has fewer local offices compared to some competitors, which might be less convenient for drivers who prefer in-person service. This limitation could impact San Francisco drivers seeking face-to-face interactions while searching for the best San Francisco, California auto insurance.

- Increased Insurance Costs for Some Drivers: While Amica offers strong customer service, its rates may be higher for drivers with certain risk factors, such as poor driving records or credit histories. This could affect affordability for some San Francisco drivers seeking the best San Francisco, California auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

San Francisco Auto Insurance: Requirements, Rate Factors, and City Comparisons

San Francisco, California auto insurance requirements are 15/30/5 according to California auto insurance laws. Finding the cheapest auto insurance in San Francisco can seem like a difficult task, but all of the information you need is right here. We’ll cover factors that affect auto insurance rates in San Francisco, California, including driving record, credit, commute time, and more.

San Francisco, California Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $90 | $180 |

| Amica | $90 | $180 |

| Farmers | $100 | $190 |

| Geico | $80 | $170 |

| Liberty Mutual | $95 | $185 |

| Mercury | $85 | $160 |

| Nationwide | $88 | $178 |

| Progressive | $85 | $175 |

| State Farm | $95 | $185 |

| Travelers | $92 | $182 |

Compare auto insurance in San Francisco to other California cities, including Long Beach auto insurance rates, Bakersfield auto insurance rates, and San Francisco auto insurance rates to see how San Francisco, California auto insurance rates stack up.

Minimum Auto Insurance in San Francisco, California

The Cost of Car Insurance in San Francisco

To find the best price for your car insurance policy in San Francisco, you need to understand the key factors that affect your rates. Car insurance companies consider several elements, including your driving history, marital status, and credit score.

While California does not allow gender-based pricing, insurance rates vary by age, with drivers around the median age of 38 seeing the lowest monthly rates.

Additionally, your ZIP code can impact your insurance costs, as the difference between the most and least expensive ZIP codes in San Francisco can be substantial, averaging around $1,160.

Comparing rates in San Francisco to other major cities and understanding these factors can help you secure the best insurance deal.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

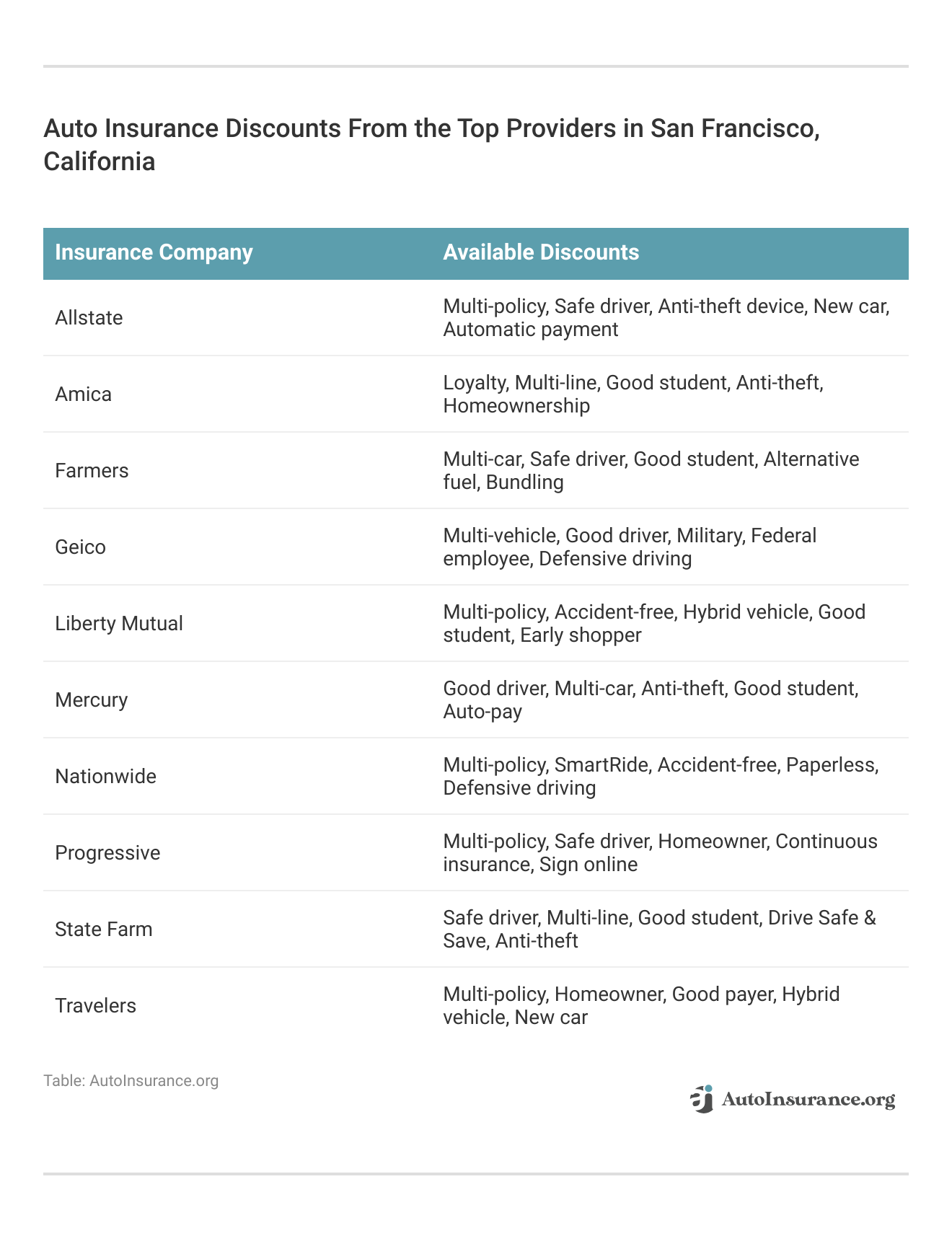

Best By Category: Cheapest Auto Insurance in San Francisco, California

Compare the cheapest auto insurance companies in San Francisco, California, in each category to find the company with the best rates for your personal needs. To get the best deal, compare cheap online auto insurance quotes to ensure you find the most affordable option.

Best Monthly Auto Insurance Rates by Company in San Francisco, California

| Category | Insurance Company |

|---|---|

| Teenagers | USAA |

| Seniors | Geico |

| Clean Record | Progressive |

| With 1 Accident | USAA |

| With 1 DUI | Liberty Mutual |

| With 1 Speeding Violation | USAA |

Determining the best car insurance company in San Francisco involves navigating a range of options to find the most suitable coverage for your needs.

The cheapest San Francisco, CA auto insurance is often offered by Geico and Progressive, though rates can vary significantly based on factors like driving record, commute distance, and coverage levels.

For instance, a 17-year-old male driver might face significantly higher premiums with Farmers compared to Geico. To find the best rates, consider comparing insurance quotes from multiple companies and evaluating factors such as your driving habits and the minimum auto insurance coverage requirements.

Additionally, San Francisco’s auto insurance rates can be influenced by its unique demographics, including high median incomes and the impact of a booming tech industry.

Driving in San Francisco

Understanding the factors that affect auto insurance rates in San Francisco involves examining more than just personal details. Key aspects include the city’s poor road conditions, with around 71% classified as bad, and prevalent speed traps, although the city lacks speeding cameras.

Summary Overview of San Francisco, Ca

| Summary | Details |

| Population | 884,363 |

| Density | 18,939 people per square mile |

| Average Cost of Insurance in San Francisco | $5,939.82 |

| Cheapest Car Insurance Company | Geico |

| Road Conditions | Poor: 71% Mediocre: 16% Fair: 6% Good: 6% |

Major highways like U.S. 101 and Interstate 80 intersect in the city, affecting traffic and vehicle theft rates. San Francisco’s busy roads, including landmarks like Lombard Street, attract millions of visitors.

High vehicle theft rates contribute to elevated insurance costs, prompting the question, “Does auto insurance cover stolen vehicles?” Despite robust public transit, many households still own cars, with the Toyota Prius being popular for its safety and low maintenance costs.

Non-owner policies are available for those without cars, and traffic congestion and higher-than-average commute times further complicate the driving experience.

Unique City Laws

Frequently Asked Questions

What are the minimum auto insurance requirements in San Francisco, CA?

In San Francisco, CA, the minimum auto insurance requirements include $15,000 for bodily injury liability per person, $30,000 for bodily injury liability per accident, and $5,000 for property damage liability per accident. Collectively, these coverage limits are commonly known as 15/30/5 coverage.

Is auto insurance mandatory in San Francisco, CA?

Yes, auto insurance is mandatory in San Francisco, CA, as well as throughout the state of California. The law requires all drivers to carry a minimum amount of liability insurance coverage to legally operate a vehicle. Compare your quotes by entering your ZIP code in our tool below.

What does liability insurance cover?

Liability insurance covers the cost of injuries or property damage that you cause to others in an accident where you are at fault. It typically includes both bodily injury liability, which pays for medical expenses and lost wages of the other party, and property damage liability, which covers the repair or replacement costs of their vehicle or other property.

What is collision coverage?

Collision coverage is an optional insurance component that pays for the repair or replacement of your own vehicle if it is damaged in a collision, regardless of fault. It is subject to a deductible, which is the amount you must pay out of pocket before the insurance coverage kicks in.

What is comprehensive coverage?

Comprehensive coverage is another optional insurance component that provides coverage for damage to your vehicle caused by non-collision events, such as theft, vandalism, fire, falling objects, or natural disasters.

It also covers the cost of replacing your vehicle if it is stolen. Like collision coverage, comprehensive coverage is subject to a deductible. Start to compare your quotes by entering your ZIP code in our tool below.

What is uninsured/underinsured motorist coverage?

Uninsured/underinsured motorist (UM/UIM) coverage is designed to protect you if you are involved in an accident with a driver who either has no insurance or does not have enough insurance to cover your damages.

It can help pay for medical expenses, lost wages, and property damage resulting from such accidents.

What factors can affect my auto insurance premiums in San Francisco, CA?

Several factors can impact your auto insurance premiums in San Francisco, CA, including your driving record, age, gender, marital status, the type of vehicle you drive, your credit history, the coverage limits you choose, and the deductible amounts. Insurance companies also consider the local crime rates and the frequency of accidents in your area.

How can I save money on auto insurance in San Francisco, CA?

To save money on auto insurance in San Francisco, CA, start by comparing quotes from multiple insurance companies to secure the most competitive rate. Maintaining a clean driving record and avoiding traffic violations can also help keep your premiums lower.

Consider raising your deductibles, but ensure you can afford them in the event you need to file a claim. Additionally, bundling your auto insurance with other policies, like homeowners or renters insurance, can qualify you for valuable discounts.

Don’t forget to inquire about any available discounts from your insurance company, such as those for good students, completing safe driving courses, or installing anti-theft devices in your vehicle. Start getting your quotes by entering your ZIP code in our tool below.

Can I use my auto insurance policy to cover rental cars in San Francisco, CA?

It depends on your policy. Some auto insurance policies provide coverage for rental cars, but the extent of coverage may vary. Review your policy or contact your insurance provider to understand the rental car coverage options available to you.

Do I need additional coverage if I use my personal vehicle for ridesharing services in San Francisco, CA?

Yes, you typically need additional coverage if you use your personal vehicle for ridesharing services like Uber or Lyft in San Francisco, CA. Most personal auto insurance policies do not cover accidents or incidents that occur while using your vehicle for commercial purposes, and the question, “Does my auto insurance cover rental cars?” is also relevant here.

Rental car coverage often differs from rideshare coverage, and many personal policies do not extend to rental vehicles used for business purposes either.

Rideshare companies usually offer their own insurance coverage during specific periods, but it’s essential to understand these details and consider additional coverage options to ensure adequate protection.

Can my auto insurance policy be canceled by the insurance company in San Francisco, CA?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.