Best Auto Insurance for Out-of-State Drivers in 2026 (Check Out the Top 10 Companies)

Allstate, Nationwide, and Farmers offer the best auto insurance for out-of-state drivers with rates starting at $53 per month. These companies provide comprehensive coverage, flexibility, and affordability, making them the top choices for out-of-state drivers seeking reliable and cost-effective insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated December 2024

Company Facts

Full Coverage for Out-of-State Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Out-of-State Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Out-of-State Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

- Allstate is the top pick for the best auto insurance for out-of-state drivers

- Enjoy flexible and affordable policies that cater to out-of-state driving needs

- Compare quotes to find the best value and protection for out-of-state drivers

#1 – Allstate: Top Overall Pick

Pros

- Extensive Coverage Options: Allstate offers a wide range of coverage options, allowing customers to tailor their policies to their specific needs. Use our Allstate auto insurance review as your guide.

- Excellent Customer Service: Known for their responsive and helpful customer service, Allstate ensures that policyholders receive assistance promptly and efficiently.

- Innovative Technology: Allstate utilizes innovative technology, such as their Drivewise program, which can potentially lower premiums by rewarding safe driving habits.

Cons

- Higher Premiums: While Allstate provides comprehensive coverage, their premiums tend to be higher compared to some competitors, which may not be ideal for budget-conscious drivers.

- Limited Discounts: Although Allstate offers various discounts, the selection may be more limited compared to other providers, potentially resulting in fewer opportunities for savings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Multi-State Coverage

Pros

- Multi-State Coverage: Nationwide is well-suited for out-of-state drivers due to its wide coverage network, providing peace of mind for those who frequently travel or relocate.

- Discount Opportunities: Nationwide offers a variety of discounts, including multi-policy, safe driver, and accident forgiveness, allowing customers to save on their premiums.

- Strong Financial Stability: With a solid financial reputation, Nationwide provides assurance that claims will be handled promptly and efficiently, instilling confidence in policyholders. Read more through our Nationwide auto insurance review.

Cons

- Average Customer Service: While Nationwide offers reliable coverage, their customer service may not always meet the highest standards, potentially leading to frustrations for some policyholders.

- Limited Online Tools: Nationwide’s online tools and mobile app may be less user-friendly and comprehensive compared to some competitors, resulting in a less convenient experience for tech-savvy customers.

#3 – Farmers: Best for Flexible Policies

Pros

- Flexible Policies: Farmers offers flexible policy options, allowing customers to customize their coverage to suit their individual needs and preferences.

- Local Agents: With a vast network of local agents, Farmers provides personalized assistance and support, ensuring that customers receive guidance tailored to their specific circumstances.

- Additional Benefits: Farmers offers additional benefits such as roadside assistance, rental car reimbursement, and new car replacement coverage, enhancing the overall value of their policies.

Cons

- Limited Online Presence: Farmers, as mentioned in our Farmers auto insurance review, may have a less robust online platform compared to some competitors, potentially resulting in less convenience for customers who prefer managing their policies digitally.

- Potentially Higher Premiums: While Farmers offers comprehensive coverage and additional benefits, their premiums may be slightly higher compared to some other providers, which may not be suitable for budget-conscious drivers.

#4 – Geico: Best for Nationwide Coverage

Pros

- Affordable Rates: Geico is known for offering competitive rates, making it an attractive option for budget-conscious drivers seeking quality coverage at a reasonable price.

- Convenient Online Tools: Geico’s user-friendly website and mobile app provide convenient access to policy management, claims filing, and customer support, enhancing the overall customer experience.

- Wide Range of Discounts: Geico offers a variety of discounts, including multi-policy, good driver, and military discounts, allowing customers to maximize their savings potential. Read more through our Geico auto insurance review.

Cons

- Limited Coverage Options: While Geico provides basic coverage options, their offerings may be less extensive compared to some competitors, potentially limiting customization options for policyholders with specific needs.

- Mixed Customer Service Reviews: While Geico offers convenient online tools, their customer service reviews are somewhat mixed, with some customers reporting challenges in resolving issues or receiving timely assistance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Multi-Car Discount

Pros

- Multi-Car Discount: Liberty Mutual offers a significant multi-car discount, making it an appealing choice for households with multiple vehicles seeking to save on their premiums.

- Accident Forgiveness: Liberty Mutual’s accident forgiveness program ensures that policyholders won’t face rate increases after their first at-fault accident, providing peace of mind and financial protection.

- Additional Coverage Options: Liberty Mutual offers various additional coverage options, such as rental car reimbursement and roadside assistance, allowing customers to enhance their policies as needed. For further insights, refer to our Liberty Mutual auto insurance review.

Cons

- Higher Premiums for New Customers: While Liberty Mutual provides comprehensive coverage, their premiums for new customers may be higher compared to some competitors, potentially making it less attractive for those seeking immediate savings.

- Limited Discount Opportunities: Despite offering some discounts, Liberty Mutual’s selection may be more limited compared to other providers, potentially resulting in fewer opportunities for savings for certain policyholders.

#6 – American Family: Best for Car Reimbursement

Pros

- Car Reimbursement Coverage: American Family offers car reimbursement coverage, which provides financial assistance for rental cars or alternative transportation while your vehicle is being repaired after a covered accident.

- Flexible Payment Options: American Family provides flexible payment options, including customizable billing schedules and automatic payment methods, accommodating various budgeting preferences. Read more through our American Family auto insurance review.

- Local Agent Support: With a network of local agents, American Family offers personalized assistance and guidance, ensuring that customers receive tailored solutions to their insurance needs.

Cons

- Limited Availability: American Family operates primarily in certain regions of the United States, which may limit access for customers residing outside of their service areas.

- Potentially Higher Rates: While American Family offers comprehensive coverage and additional benefits, their premiums may be slightly higher compared to some other providers, which may not be suitable for budget-conscious drivers.

#7 – Travelers: Best for Car Replacement

Pros

- Car Replacement Coverage: Our Travelers auto insurance review reveals that Travelers offers car replacement coverage for new vehicles, ensuring that policyholders receive compensation for the full value of their vehicle in the event of a total loss within the first five years of ownership.

- Superior Claims Handling: Travelers is known for its efficient and responsive claims handling process, providing timely assistance and support to policyholders during stressful situations.

- Wide Range of Coverage Options: Travelers provides a diverse array of coverage options, allowing policyholders to customize their insurance plans to suit their specific needs and preferences.

Cons

- Limited Discounts: While Travelers offers some discounts, their selection may be more limited compared to other providers, potentially resulting in fewer opportunities for savings for certain policyholders.

- Complex Coverage Options: Travelers’ coverage options may be more complex and less straightforward compared to some competitors, potentially leading to confusion for customers when selecting their policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – USAA: Best for Military-Friendly Coverage

Pros

- Military-Friendly Coverage: USAA specializes in providing insurance options tailored to the needs of military members and their families, offering unique benefits and discounts for service members.

- Excellent Customer Service: USAA consistently receives high ratings for its exceptional customer service, with dedicated representatives ready to assist policyholders with their insurance needs. Read more through our USAA auto insurance review.

- Financial Stability: With a strong financial reputation, USAA provides peace of mind to policyholders, ensuring that claims are handled promptly and efficiently.

Cons

- Membership Requirements: USAA membership is limited to military personnel, veterans, and their eligible family members, which may exclude some individuals from accessing their insurance offerings.

- Limited Availability: USAA operates in a limited number of states and may not be available to residents outside of their service areas, potentially restricting access for certain customers.

#9 – State Farm: Best for Personalized Service

Pros

- Personalized Service: State Farm is known for its personalized approach to insurance, with local agents providing tailored guidance and support to policyholders based on their individual needs.

- Wide Range of Discounts: State Farm offers a variety of discounts, including multi-policy, safe driver, and good student discounts, allowing customers to maximize their savings potential.

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies. Find out more in our State Farm auto insurance review.

Cons

- Potentially Higher Premiums: While State Farm offers comprehensive coverage and personalized service, their premiums may be slightly higher compared to some competitors, which may not be ideal for budget-conscious drivers.

- Limited Online Tools: State Farm’s online tools and mobile app may be less advanced compared to some competitors, potentially resulting in a less convenient digital experience for tech-savvy customers.

#10 – Progressive: Best for Online Access

Pros

- Online Access: In our Progressive auto insurance review, Progressive offers a user-friendly website and mobile app, providing convenient access to policy management, claims filing, and customer support for tech-savvy customers.

- Variety of Discounts: Progressive offers numerous discounts, including multi-policy, safe driver, and online quote discounts, allowing customers to save money on their premiums.

- Innovative Coverage Options: Progressive offers innovative coverage options such as usage-based insurance and custom coverage limits, allowing customers to tailor their policies to their specific needs.

Cons

- Mixed Customer Service Reviews: While Progressive offers convenient online tools, their customer service reviews are somewhat mixed, with some customers reporting challenges in resolving issues or receiving timely assistance.

- Complex Claims Process: Progressive’s claims process may be more complex compared to some competitors, potentially leading to frustrations for policyholders during the claims filing process.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Auto Insurance Rates for Out-of-State Drivers

If you move to or register a car in another state, you’ll almost certainly see new rates since location is one of the key factors that affect auto insurance rates. Use this table to see how much drivers pay for insurance by state:

Auto Insurance for Out-of-State Drivers: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $58 | $128 |

| American Family | $60 | $129 |

| Farmers | $57 | $126 |

| Geico | $56 | $126 |

| Liberty Mutual | $58 | $127 |

| Nationwide | $54 | $124 |

| Progressive | $53 | $123 |

| State Farm | $55 | $125 |

| Travelers | $61 | $130 |

| USAA | $63 | $133 |

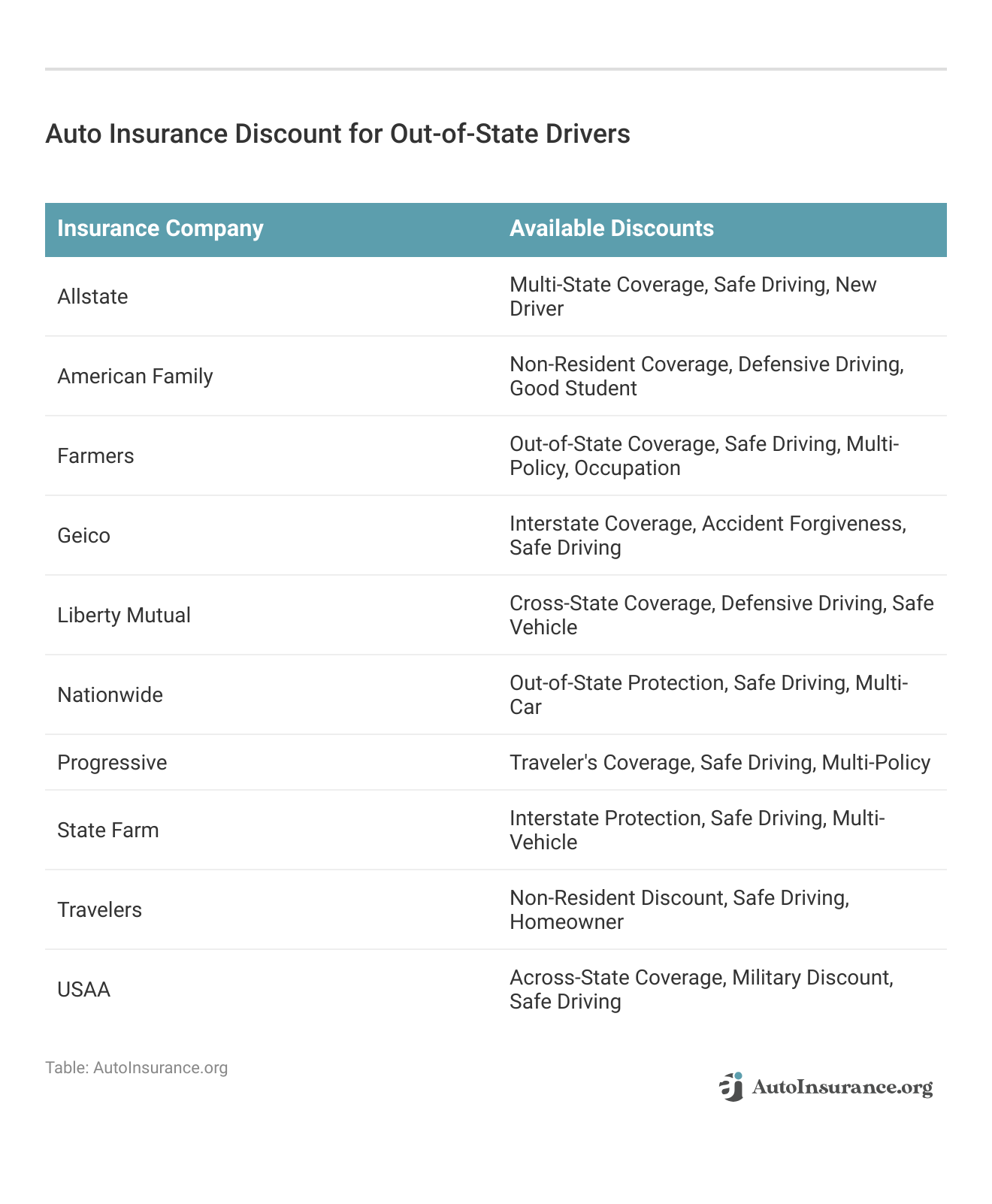

Auto insurance for out-of-state drivers is eligible for discounts if you’re only driving in the state for part of the year. For example, low-mileage auto insurance discounts are available to those who drive less than 10,000 miles annually. You can also earn an additional garaging and storing discount if you park or store your vehicle in a safe place when you’re not driving it.

Common Exceptions to Auto Insurance for Out-of-State Drivers

While your vehicle’s coverage and registration should be in the same state, there are a few situations where you might be able to get car insurance in another state. These include:

- Military Members: Since military members are often on deployment, registration rules are a little different for them. Usually, you register your car in the state you plan to return to once your deployment is over. Find out the best auto insurance companies for veterans and military personnel.

- Temporary Moves: The amount of time you can live in a state before you need to register your car varies, but you usually don’t need to update your registration for a short stay.

- College Students: The best auto insurance for college students has different rules. Although you’ll probably need to register your car if you bring your vehicle to an out-of-state school, you might be able to stay on a parent or guardian’s policy.

No matter your situation, you should contact an insurance representative from your company. They know all your options for out-of-state insurance and can make sure your car is always covered. Enter your ZIP code to start.

You Don’t Need Auto Insurance in Different States

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get the Best Auto Insurance for Out-of-State Drivers

Even if you have an existing insurance policy, comparing rates with other companies is still beneficial to ensure you’re getting the best price.

Case Studies: Finding the Best Auto Insurance for Out-of-State Drivers

Navigating auto insurance as an out-of-state driver can be complex. To illustrate how the top providers meet unique needs, here are three case studies that highlight the advantages of Allstate, Nationwide, and Farmers.

- Case Study #1 – Comprehensive Coverage for Seasonal Travelers: Jane spends half the year in Florida and the other half in New York. She needs an insurance policy that covers her car in both states without constant changes. Allstate offers a comprehensive policy that ensures her vehicle is protected year-round in both locations.

- Case Study #2 – Multi-State Coverage for Frequent Movers: John frequently relocates for his job, staying in different states for several months at a time. He needs an insurance plan that adapts to his frequent moves and provides continuous coverage. Nationwide offers a multi-state coverage plan that seamlessly transitions with John’s relocations.

- Case Study #3 – Flexible Policies for Multi-Car Households: The Smith family owns two cars, one in California and the other in Arizona. They need a flexible insurance policy that covers both vehicles without complexity. Farmers offers a flexible policy that covers both cars under one plan, ensuring both vehicles are protected. Dive into our guide titled “Best Arizona Auto Insurance.”

These case studies illustrate how Allstate, Nationwide, and Farmers effectively meet the diverse needs of out-of-state drivers.

Allstate is the top choice for out-of-state drivers, offering comprehensive and affordable coverage starting at $53 per month.Dani Best Licensed Insurance Producer

By choosing the right provider, drivers can enjoy comprehensive, flexible, and affordable coverage tailored to their unique situations. Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Frequently Asked Questions

Will your auto insurance cover you in another state?

For the most part, your insurance will cover you when you travel between states, no matter where you’re from. You won’t be able to find multi state car insurance that lists two or more states as the home location for your policy. Read more: Do you need auto insurance if you don’t drive your car?

Can you have car insurance in a different state than your registration?

No, you generally cannot have car insurance in a different state than your registration as insurance companies require the vehicle to be insured in the state it is registered. Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Can you have out of state car insurance?

Yes, but it typically means you must insure the car in the state where it is registered. However, specific out of state car insurance policies can cover temporary needs.

How long do you have to register your car in a new state?

The amount of time you can stay in a state before you need to register your car varies. For example, popular states for snowbirds during the winter often let people stay for several months before requiring registration.

- Alaska: 10 days

- Arizona: Seven months

- Arkansas: Six months

- Florida: 10 days

- New Mexico: Six months

- Oregon: Six months

- Washington D.C.: 30 days or seven months after a fee

- Wyoming: Six months

Many states — such as Delaware, Maine, Illinois, and Pennsylvania — only require you to register your car if you accept employment within the state or enroll a child in a public school. Other states like Colorado or Idaho are more generous.

Can you have car insurance in another state?

Yes, but it must align with the state’s regulations where the car is registered.

Can you have insurance from another state?

Insurance must match the state in which the vehicle is registered. To gain profound insights, consult our extensive guide titled “How to Manage Your Auto Insurance Policy.”

Can my car be registered in one state and insured in another?

No, typically your car should not be registered in one state and insured in another. Insurance and registration should be in the same state.

Can I be on my parents’ car insurance if I live in a different state?

Yes, you can be on your parents’ car insurance if you live in a different state, provided you are still considered a dependent.

Can I have car insurance from another state?

Yes, but it must be compliant with the state’s requirements where the vehicle is registered.

Can I insure my car in another state?

No, you generally cannot insure your car in another state different from where it is registered. To expand your knowledge, refer to our comprehensive handbook titled “How to Check if a Vehicle Has Auto Insurance Coverage.”

Can I be on my parents’ car insurance if I live in a different state?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.