Best Caldwell, Texas Auto Insurance in 2026 (Top 10 Companies Ranked)

Farmers, USAA, and Allstate offer the best Caldwell, Texas auto insurance, offering minimum rates $82/month. These companies excels with local agents, provides exclusive military benefits and rewards safe driving, making them the top choices for affordable coverage in Caldwell, Texas.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated August 2024

Company Facts

Full Coverage in Caldwell Texas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Caldwell Texas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Caldwell Texas

A.M. Best Rating

Complaint Level

Pros & Cons

The best Caldwell, Texas auto insurance comes from Farmers, USAA, and Allstate, each offering competitive rates starting as low as $82/month.

Farmers is the top choice for full coverage auto insurance in Caldwell, Texas, offering excellent local service and affordability, while USAA provides exclusive benefits for military families and Allstate rewards safe driving.

Our Top 10 Company Picks: Best Caldwell, Texas Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 15% A Local Agents Farmers

![]()

#2 10% A++ Military Benefits USAA

#3 25% A+ Safe Driving Allstate

#4 17% B Comprehensive Coverage State Farm

#5 12% A+ Flexible Policies Progressive

#6 20% A++ Flexible Coverage Travelers

#7 18% A Membership Perks AAA

#8 12% A Discount Opportunities Liberty Mutual

#9 15% A+ Vanishing Deductible Nationwide

#10 22% A+ AARP Discounts The Hartford

This article explores how these companies deliver the best value based on various factors, ensuring you find the right coverage for your needs and offering the most value in Caldwell, Texas.

Avoid expensive auto insurance premiums by entering your ZIP code above to see the cheapest rates for you.

- Farmers provides top Caldwell, Texas auto insurance with rates from $82/month

- Provides exclusive benefits for military members and competitive rates

- Rewards safe driving with discounts and tailored policies in Caldwell, Texas

#1 – Farmers: Top Overall Pick

Pros

- Local Knowledge: Farmers offers strong local agent support in Caldwell, Texas, providing personalized service and familiarity with local insurance needs. Read more in our review of Farmers.

- Community Presence: Farmers has a well-established presence in Caldwell, Texas, which means they are likely to understand local regulations and requirements better.

- Tailored Solutions: With local agents in Caldwell, Texas, you can receive insurance solutions specifically tailored to the unique needs of the community.

Cons

- Limited National Perks: Farmers’ local focus in Caldwell, Texas may mean fewer national perks compared to larger insurers.

- Potentially Higher Rates: In some cases, local agents may not have access to the most competitive rates available nationally, potentially leading to higher premiums in Caldwell, Texas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Benefits

Pros

- Exclusive Military Benefits: USAA provides exclusive benefits for military families residing in Caldwell, Texas, including specialized coverage options and discounts.

- Community Support: As a company focused on military families, USAA has a strong understanding of the needs of military personnel living in Caldwell, Texas.

- Competitive Rates: USAA often offers competitive rates for its members in Caldwell, Texas, making it an attractive option for military families, which you can learn about in our USAA review.

Cons

- Eligibility Limitations: USAA’s services are only available to military members and their families, so residents of Caldwell, Texas who don’t meet this criterion are excluded.

- Less Local Presence: USAA’s national focus may result in less personalized local service in Caldwell, Texas compared to companies with a strong local agent network.

#3 – Allstate: Best for Safe Driving

Pros

- Safe Driving Rewards: Allstate offers rewards for safe driving, which can benefit residents of Caldwell, Texas who maintain a clean driving record.

- Local Discounts: Allstate’s programs for safe driving can help Caldwell, Texas residents lower their insurance premiums, which you can check out in our Allstate review.

- Comprehensive Coverage Options: Allstate provides extensive coverage options that can be tailored to the needs of drivers in Caldwell, Texas.

Cons

- Customer Service Issues: Some Caldwell, Texas, customers may experience issues with customer service or claims processing, which could affect their overall satisfaction with Allstate.

- Complex Discount Structures: The various discount programs might be confusing for Caldwell, Texas residents to navigate, potentially complicating the insurance purchasing process.

#4 – State Farm: Best for Comprehensive Coverage

Pros

- Wide Coverage Options: State Farm offers comprehensive coverage options in Caldwell, Texas, addressing a variety of insurance needs.

- Strong Local Agent Network: State Farm’s local agents in Caldwell, Texas can provide tailored advice and support for comprehensive insurance needs.

- Reputation for Reliability: State Farm has a solid reputation for reliable and extensive coverage in Caldwell, Texas. Read our State Farm review to learn what else is offered.

Cons

- Higher Premiums: Comprehensive coverage with State Farm might result in higher premiums for Caldwell, Texas residents compared to more basic options.

- Complex Policy Options: The variety of coverage options available in Caldwell, Texas can make it difficult for some residents to choose the best comprehensive plan.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Flexible Policies

Pros

- Customizable Policies: Progressive offers flexible policy options for residents of Caldwell, Texas, allowing for customization based on individual needs.

- Discount Opportunities: Progressive provides various discounts that can help reduce premiums for Caldwell, Texas residents, such as safe driver discounts, multi-policy savings, and more.

- Roadside Assistance: Progressive provides roadside assistance in Caldwell, Texas, offering extra peace of mind for drivers, which is covered in our Progressive review.

Cons

- Coverage Limitations: Despite its flexibility, Progressive’s policies in Caldwell, Texas may have coverage limitations or exclusions for unique needs.

- Potential for Hidden Costs: The flexibility of policies could sometimes lead to unexpected costs or coverage gaps for drivers in Caldwell, Texas.

#6 – Travelers: Best for Flexible Coverage

Pros

- Variety of Coverage Options: Travelers provides a range of flexible coverage options suitable for diverse needs in Caldwell, Texas. Find out more in our Travelers review.

- Customizable Plans: Caldwell, Texas residents can tailor their insurance plans with Travelers to fit specific requirements and budgets.

- Local Expertise: Travelers’ flexibility allows local agents in Caldwell, Texas to offer personalized coverage solutions.

Cons

- Potential Complexity: The range of flexible coverage options might be complex for Caldwell, Texas residents to understand fully.

- Higher Costs for Extensive Coverage: Comprehensive and flexible coverage options with Travelers might be more expensive for residents of Caldwell, Texas.

#7 – AAA: Best for Membership Perks

Pros

- Membership Benefits: AAA members in Caldwell, Texas enjoy additional perks such as roadside assistance and discounts on various services.

- Community Focus: AAA’s membership perks can be particularly beneficial for residents of Caldwell, Texas, adding value beyond basic insurance coverage.

- Discount Opportunities: AAA offers numerous discounts that can help lower insurance premiums for Caldwell, Texas drivers, which you can read more about in our review of AAA.

Cons

- Membership Fees: The cost of AAA membership might add an extra expense for Caldwell, Texas residents, potentially offsetting some insurance savings.

- Limited Coverage Options: AAA’s insurance options might be less comprehensive compared to other providers for specific needs in Caldwell, Texas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Discount Opportunities

Pros

- Variety of Discounts: Liberty Mutual provides a range of discount opportunities for Caldwell, Texas residents, helping to reduce insurance costs.

- Local Agent Assistance: Liberty Mutual’s local agents in Caldwell, Texas can assist in finding and applying the right discounts for individual needs.

- Tailored Solutions: The discount options available can be tailored to the unique requirements of drivers in Caldwell, Texas. For a complete list, read our Liberty Mutual review.

Cons

- Complex Discount System: The numerous discount options might be complicated for Caldwell, Texas residents to navigate effectively.

- Claims Processing Delays: There have been reports of longer claims processing times with Liberty Mutual, which could be a concern for Caldwell, Texas residents who need quick resolutions.

#9 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible Program: Nationwide’s vanishing deductible program can benefit Caldwell, Texas residents by reducing out-of-pocket costs over time.

- Comprehensive Coverage: Nationwide offers comprehensive coverage options that cater to various needs in Caldwell, Texas. Discover our Nationwide review for a full list.

- Local Presence: Nationwide’s local agents in Caldwell, Texas can provide personalized assistance with the vanishing deductible program.

Cons

- Eligibility for Vanishing Deductible: The vanishing deductible program may have specific eligibility criteria that could limit its availability for some Caldwell, Texas residents.

- Potentially Higher Costs: Nationwide’s focus on unique programs like the vanishing deductible might result in higher premiums for Caldwell, Texas drivers.

#10 – The Hartford: Best for AARP Discounts

Pros

- AARP Discounts: The Hartford offers AARP discounts for Caldwell, Texas residents, which can lead to significant savings for eligible members.

- Senior-Focused Services: The Hartford’s services are tailored to the needs of seniors, benefiting older residents of Caldwell, Texas.

- Comprehensive Coverage Options: The Hartford provides comprehensive coverage that suits the needs of AARP members in Caldwell, Texas. Learn more in our The Hartford review.

Cons

- AARP Membership Requirement: To benefit from discounts, Caldwell, Texas residents must be AARP members, which might exclude some potential customers.

- Limited Appeal for Younger Drivers: The Hartford’s focus on AARP discounts may not be as appealing to younger drivers in Caldwell, Texas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Analyzing Auto Insurance Rates and Discounts in Caldwell, Texas: A Monthly Comparison

Navigating auto insurance in Caldwell, Texas can be overwhelming, especially with the variety of coverage options and pricing from different providers.

Farmers offers unbeatable local service and competitive rates, making it the top choice for auto insurance in Caldwell, Texas.Jeff Root Licensed Insurance Agent

This approach not only helps you find the most affordable coverage that meets your needs but also ensures you’re taking advantage of potential savings opportunities.

Caldwell, Texas Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $91 $230

Allstate $90 $225

Farmers $88 $215

Liberty Mutual $89 $218

Nationwide $86 $212

Progressive $84 $205

State Farm $85 $210

The Hartford $88 $217

Travelers $87 $220

USAA $82 $202

In Caldwell, Texas, auto insurance monthly rates vary by coverage level and provider. For minimum coverage, rates range from $82 with USAA to $91 with AAA. For full coverage, the rates go from $202 with USAA to $230 with AAA. Notable providers include Progressive with the lowest full coverage rate at $205, and Farmers with the lowest minimum coverage rate at $88.

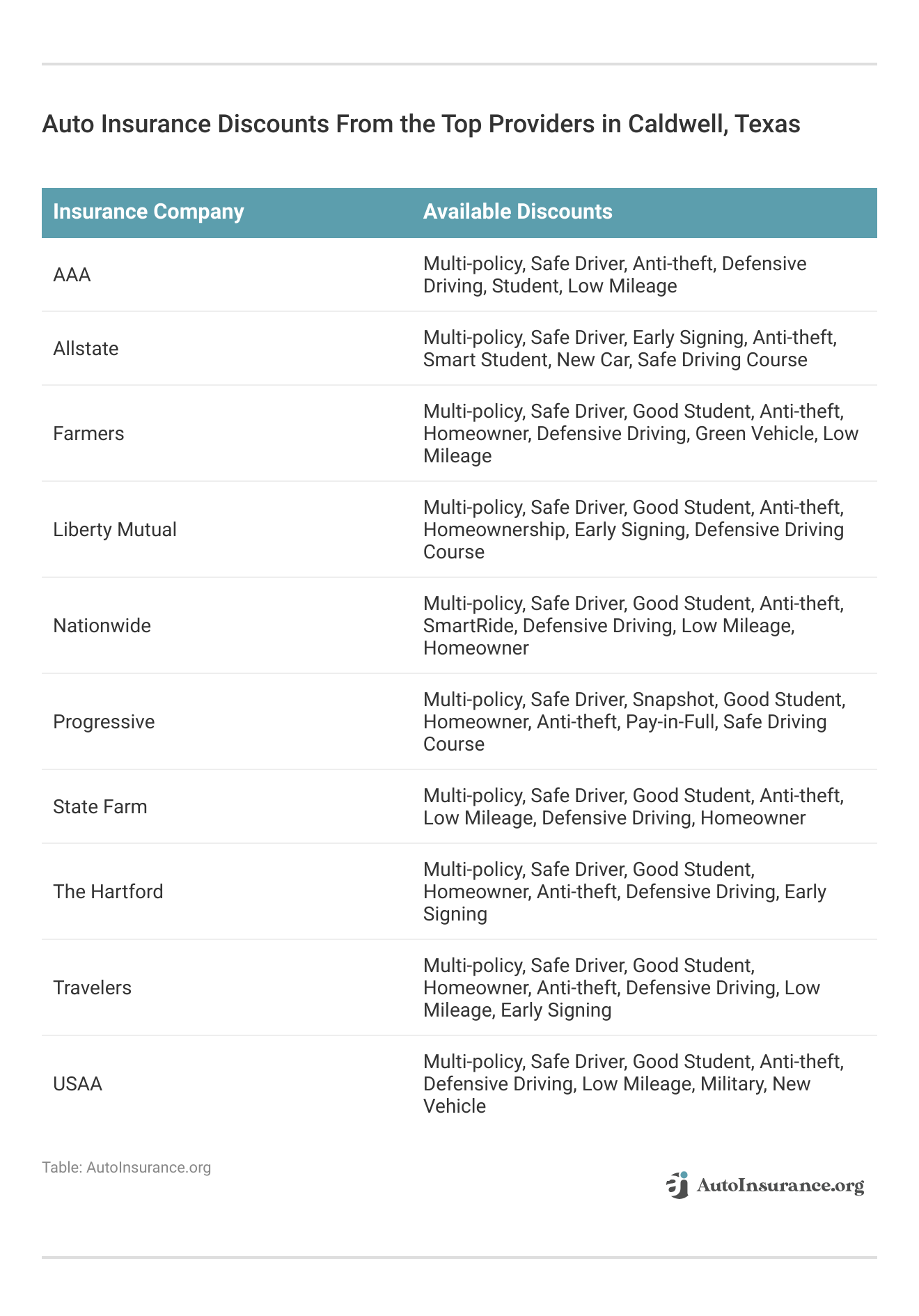

Explore auto insurance discounts in Caldwell, Texas from top providers like AAA, Allstate, Farmers, USAA, and Progressive to find affordable coverage with savings for multi-policy holders, safe drivers, good students, and more. Check out our ranking of the top providers: Best Auto Insurance Companies for Multiple Vehicles

Navigating Auto Insurance Basics in Caldwell, Texas: A Comprehensive Guide

Tailored Auto Insurance Trends in Caldwell, TX: Analyzing Coverage by Age, Gender, and Marital Status

Auto insurance rates in Caldwell vary significantly depending on age, gender, and insurance provider. Understanding these differences can help you choose the most cost-effective option for your needs. For additional details, explore our comprehensive resource titled “Factors That Affect Auto Insurance Rates.”

Caldwell, Texas Auto Insurance Monthly Rates by Age, Gender & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $711 | $858 | $328 | $342 | $265 | $267 | $261 | $261 |

| American Family | $579 | $754 | $313 | $355 | $217 | $242 | $204 | $234 |

| Geico | $430 | $449 | $212 | $212 | $196 | $212 | $190 | $217 |

| Nationwide | $632 | $813 | $260 | $282 | $221 | $225 | $195 | $207 |

| Progressive | $887 | $986 | $243 | $244 | $206 | $194 | $184 | $187 |

| State Farm | $386 | $492 | $177 | $182 | $163 | $163 | $145 | $145 |

| USAA | $353 | $385 | $169 | $181 | $127 | $128 | $121 | $120 |

Insurance rates in Caldwell vary by age, gender, and provider. USAA typically offers the lowest rates for all ages, while Geico and State Farm also provide competitive pricing. Rates are generally higher for younger drivers and lower for older ones.

By comparing rates from providers like USAA, Geico, and State Farm, you can find the best coverage at the most affordable price. Evaluating your options based on your age and gender will ensure you get the best deal for your auto insurance in Caldwell.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Teen Driver Coverage in Caldwell: Your Ultimate Auto Insurance Guide

For 17-year-old drivers, monthly auto insurance rates differ significantly by gender and insurance provider. Here’s a snapshot of how premiums vary across major insurers. Take a look at our list of the leading providers: Companies With the Cheapest Teen Auto Insurance

Caldwell, Texas Teen Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $711 | $858 |

| American Family | $579 | $754 |

| Geico | $430 | $449 |

| Nationwide | $632 | $813 |

| Progressive | $887 | $986 |

| State Farm | $386 | $492 |

| USAA | $353 | $385 |

Monthly auto insurance rates for 17-year-olds vary by gender and provider. Female drivers see rates from $353 with USAA to $887 with Progressive, while male drivers face rates from $385 with USAA to $986 with Progressive. Insurance companies like Allstate, American Family, Geico, Nationwide, Progressive, State Farm, and USAA offer these varying premiums.

Prime Protection: Tailored Auto Insurance for Seniors in Caldwell, Texas

For senior drivers in Caldwell, Texas, auto insurance rates can vary widely depending on factors such as gender and the insurance provider. Female drivers and male drivers may see different premiums, and different companies offer varying rates based on these factors.

Farmers delivers the top auto insurance in Caldwell, Texas, with exceptional local service and affordable rates starting at $82/month.Kristen Gryglik Licensed Insurance Agent

By understanding these differences, you can make a more informed choice about which policy offers the best coverage and value for your needs. To delve deeper, refer to our in-depth report titled “What are the recommended auto insurance coverage levels?”

Caldwell, Texas Senior Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $261 | $261 |

| American Family | $204 | $234 |

| Geico | $190 | $217 |

| Nationwide | $195 | $207 |

| Progressive | $184 | $187 |

| State Farm | $145 | $145 |

| USAA | $121 | $120 |

In Caldwell, Texas, auto insurance monthly rates for senior drivers vary by gender and provider. For a 60-year-old female, rates range from $121 with USAA to $261 with Allstate. For a 60-year-old male, rates also span from $120 with USAA to $261 with Allstate. Providers such as State Farm offer the lowest rates for both genders, while Allstate presents the highest.

Custom Auto Insurance in Caldwell, TX: Tailored by Your Driving Record

Auto insurance rates can differ significantly based on your driving record and the insurance provider you choose. Understanding these variations can help you find the most cost-effective coverage. To learn more, explore our comprehensive resource on insurance titled “Driving Without Auto Insurance.”

Caldwell, Texas Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $318 | $493 | $517 | $318 |

| American Family | $330 | $421 | $369 | $330 |

| Geico | $225 | $298 | $247 | $289 |

| Nationwide | $307 | $307 | $457 | $347 |

| Progressive | $341 | $443 | $397 | $384 |

| State Farm | $206 | $236 | $278 | $206 |

| USAA | $148 | $218 | $257 | $169 |

Auto insurance rates vary by driving record, with USAA offering the lowest rates for clean records and Progressive the highest. Rates increase with accidents or DUIs, but USAA and State Farm often remain the most affordable. Comparing rates based on your driving history can help you find the best plan.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Recalibrating Your Coverage: Auto Insurance Rates in Caldwell, Texas Post-DUI

A DUI conviction can drastically raise your auto insurance premiums. Here’s a snapshot of how monthly rates are impacted by such an offense. For a thorough understanding, refer to our detailed analysis titled “Is not having auto insurance a criminal offense?”

Caldwell, Texas DUI Auto Insurance Cost

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $517 |

| American Family | $369 |

| Geico | $247 |

| Nationwide | $457 |

| Progressive | $397 |

| State Farm | $278 |

| USAA | $257 |

Auto insurance rates increase significantly after a DUI. Rates vary from Geico at $247 and USAA at $257 to Allstate at $517 and Nationwide at $457. State Farm charges $278, while Progressive costs $397.

These increased rates highlight the financial consequences of a DUI. It’s crucial to shop around and consider all options to manage insurance costs effectively.

Tailored Auto Coverage in Caldwell, TX: Insurance Options Based on Your Credit History

Auto insurance premiums can fluctuate based on your credit history and the provider you choose. Understanding these differences can help you find the most affordable coverage. For detailed information, refer to our comprehensive report titled “Auto Insurance Premium Defined.”

Caldwell, Texas Auto Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| Allstate | $329 | $384 | $522 |

| American Family | $275 | $316 | $496 |

| Geico | $155 | $232 | $409 |

| Nationwide | $296 | $341 | $426 |

| Progressive | $354 | $381 | $438 |

| State Farm | $163 | $204 | $328 |

| USAA | $135 | $168 | $291 |

Auto insurance rates fluctuate based on credit history, with rates for poor credit ranging from $291 with USAA to $522 with Allstate and rates for good credit ranging from $135 with USAA to $329 with Allstate. Comparing these rates can lead to substantial savings.

Affordable Auto Insurance in Caldwell, Texas: Rates Based on Your Commute

When choosing auto insurance in Caldwell, Texas, it’s essential to consider how annual mileage impacts your monthly premium. Different insurance providers offer varying rates based on how much you drive each year. Understanding these differences can help you select the best policy for your needs and budget.

Caldwell, Texas Auto Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $402 | $422 |

| American Family | $362 | $362 |

| Geico | $260 | $270 |

| Nationwide | $354 | $354 |

| Progressive | $391 | $391 |

| State Farm | $232 | $232 |

| USAA | $195 | $200 |

The monthly auto insurance rates in Caldwell, Texas vary by provider and annual mileage. For those driving 6,000 miles annually, USAA offers the lowest rate at $195, while Allstate is the highest at $402. For 12,000 miles, USAA remains the most affordable at $200, with Allstate again being the most expensive at $422.

Some providers, like American Family and State Farm, offer the same rates regardless of mileage. Comparing rates based on your annual mileage can help you choose the best auto insurance in Caldwell, Texas, and potentially save on your premium. Review our ranking of the top providers: Best Low-Mileage Auto Insurance Discounts

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unraveling the Drivers Behind Auto Insurance Rates in Caldwell, Texas

Auto insurance rates in Caldwell, Texas can vary significantly compared to other cities due to several local factors. These include traffic patterns, which can influence accident rates, and the prevalence of vehicle theft, which can affect insurance premiums. For a comprehensive overview, explore our detailed resource titled “At-Fault Accident.”

Farmers Insurance stands out in Caldwell for its exceptional local service and competitive rates, making it the top choice for affordable coverage.Michelle Robbins Licensed Insurance Agent

Additionally, local regulations, the density of drivers, and regional claim histories play a role in determining insurance rates. Each of these factors contributes to the overall cost of auto insurance in Caldwell, making it essential to consider these variables when shopping for coverage.

Caldwell Auto Theft

More theft means higher auto insurance rates because auto insurance companies are paying more in claims. According to the FBI’s annual Caldwell, Texas auto theft statistics, there have been 0 auto thefts in the city.

Caldwell Commute Time

Cities in which drivers have a longer average commute time tend to have higher auto insurance costs. The average Caldwell, Texas commute length is 20.5 minutes according to City-Data.

A Unique Guide to Caldwell, Texas Auto Insurance Quotes

For affordable auto insurance in Caldwell, Texas, the top providers are Farmers, USAA, and Allstate, with rates starting around $82/month. Farmers offers excellent local service, USAA provides special benefits for military families, and Allstate rewards safe driving.

For full coverage, rates range from $202 to $230. Discounts are available for various factors such as safe driving and multi-policy holders. Insurance costs also vary by age, driving record, and ZIP code. Texas requires minimum coverage of $30,000 per person for bodily injury insurance, $60,000 per accident, and $25,000 for property damage.

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool below.

Frequently Asked Questions

What are the top auto insurance providers in Caldwell, Texas?

The top auto insurance providers in Caldwell, Texas include Farmers Insurance and State Farm. Both companies offer competitive rates and a range of coverage options.

How can I get a quote from Farmers Insurance in Caldwell, Texas?

To get a quote from Farmers Insurance in Caldwell, Texas, you can visit their website, contact a local agent, or use a comparison tool by entering your ZIP code to view personalized rates.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

What coverage options does State Farm offer in Caldwell, Texas?

State Farm in Caldwell, Texas offers various coverage options including liability, collision, comprehensive, and rental reimbursement. They also provide discounts for safe driving and bundling policies.

To enhance your understanding, explore our comprehensive resource on insurance titled “Collision Auto Insurance Defined.”

How does Farmers Insurance compare to State Farm in Caldwell, Texas?

Farmers Insurance and State Farm are both well-regarded in Caldwell, Texas. Farmers is known for its local service and affordable rates, while State Farm offers extensive coverage options and discounts.

What is the minimum auto insurance requirement in Caldwell, Texas?

In Caldwell, Texas, the minimum auto insurance requirements are $30,000 per person for bodily injury liability, $60,000 per accident for bodily injury liability, and $25,000 for property damage liability.

Are there specific discounts available for auto insurance in Caldwell, Texas?

Yes, discounts available in Caldwell, Texas can include safe driving discounts, multi-policy discounts, good student discounts, and discounts for having anti-theft devices.

To expand your knowledge, refer to our comprehensive handbook titled “Best Good Student Auto Insurance Discounts.”

How do I find the best auto insurance rates in Caldwell, Texas?

To find the best auto insurance rates in Caldwell, Texas, compare quotes from multiple providers like Farmers Insurance and State Farm. Enter your ZIP code into comparison tools to see the most competitive rates.

What impact does my ZIP code have on my auto insurance rates in Caldwell, Texas?

Your ZIP code in Caldwell, Texas can affect your auto insurance rates due to factors like local traffic conditions, crime rates, and the number of claims in the area.

To gain profound insights, consult our extensive guide titled “Does a criminal record affect auto insurance rates?”

How can I lower my auto insurance premium with Farmers Insurance in Caldwell, Texas?

To lower your premium with Farmers Insurance in Caldwell, Texas, consider increasing your deductible, bundling policies, maintaining a clean driving record, and taking advantage of available discounts.

What should I do if I have a complaint about my auto insurance policy in Caldwell, Texas?

If you have a complaint about your auto insurance policy in Caldwell, Texas, contact your insurance provider’s customer service department directly. For unresolved issues, you can escalate the complaint to the Texas Department of Insurance for further assistance.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.