Best Chattanooga, Tennessee Auto Insurance in 2026 (Find the Top 10 Companies Here)

Allstate, Travelers, and USAA stand out as the best auto insurance providers in Chattanooga, Tennessee, offering strong local service, competitive coverage options, and starting rates as low as $70/mo. With these top choices, Chattanooga drivers can find affordable and reliable coverage that meets their needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated August 2025

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Chattanooga Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage in Chattanooga Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Chattanooga Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsFor the best auto insurance in Chattanooga, Tennessee, Geico, Erie, and Travelers offer the most competitive rates, starting at around $70 per month.

However, when considering comprehensive coverage and customer satisfaction, Allstate stands out as the top pick.

It combines affordability with exceptional local service and robust insurance options.

Our Top 10 Company Picks: Best Chattanooga, Tennessee Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Comprehensive Coverage | Allstate | |

| #2 | 8% | A++ | Affordable Rates | Travelers | |

| #3 | 10% | A++ | Military Focus | USAA | |

| #4 | 20% | A | Personalized Service | American Family | |

| #5 | 25% | A | Flexible Options | Liberty Mutual |

| #6 | 25% | A | Broad Coverage | Farmers | |

| #7 | 10% | A+ | Strong Reputation | Erie |

| #8 | 25% | A++ | Competitive Pricing | Geico | |

| #9 | 20% | B | Nationwide Network | State Farm | |

| #10 | 12% | A+ | Innovative Tools | Progressive |

Explore how Allstate and other top providers can meet your insurance needs in Chattanooga. Read through this guide to learn how to find cheap auto insurance in Chattanooga, TN.

- Allstate provides the best combination of coverage and customer satisfaction

- Top picks balance cost, coverage, and local expertise for Chattanooga drivers

- Explore top providers for the most effective insurance solutions in Chattanooga

#1 – Allstate: Top Overall Pick

Pros

- Comprehensive Discounts: The company offers a variety of discounts tailored to Tennessee drivers, including multi-policy discounts (combining auto with home or other types of insurance), safe driving discounts, and discounts for vehicles equipped with advanced safety features in Chattanooga, Tennessee, as highlighted in our Allstate auto insurance review.

- Advanced Online Tools: Their digital platform and mobile app are user-friendly and provide convenient features for managing policies, filing claims, and accessing customer service in Chattanooga, Tennessee, complementing their strong local presence.

- Ride Share Coverage: Allstate offers specialized coverage options for ride-share drivers in Chattanooga, Tennessee, which is advantageous in the city’s growing gig economy and can provide additional peace of mind for those participating in this sector.

Cons

- Higher Premiums: Allstate’s premiums can be higher than those of some competitors, especially for younger drivers or individuals with less-than-perfect driving records in Chattanooga, Tennessee. This can be a drawback for cost-conscious consumers seeking lower rates.

- Optional Coverage Costs: Some optional coverages, such as accident forgiveness or new car replacement, can be relatively expensive in Chattanooga, Tennessee. These add-ons might significantly increase the overall cost of insurance if chosen.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Competitive Rates

Pros

- Competitive Rates: Travelers offers some of the most competitive rates in Chattanooga, Tennessee, making it a solid choice for budget-conscious drivers. Their pricing strategy helps keep insurance affordable for a wide range of policyholders, according to Travelers auto insurance review.

- Extensive Coverage Options: Travelers provides a broad array of coverage options, including specialized coverages like new car replacement and enhanced rental car coverage, catering to various needs and preferences in Chattanooga, Tennessee.

- Comprehensive Roadside Assistance: Their roadside assistance program is robust and provides support in case of breakdowns or other emergencies, which is particularly valuable for drivers in the rural areas surrounding Chattanooga, Tennessee.

Cons

- Limited Local Agent Network: Travelers has fewer local agents in Chattanooga, Tennessee compared to some competitors. This can be a disadvantage for those who prefer in-person interactions and personalized service from a local expert.

- Mixed Customer Service Reviews: While generally positive, there are some mixed reviews regarding customer service in Chattanooga, Tennessee, with reports of delays or issues with the handling of claims and other service-related concerns.

#3 – USAA: Best for Military-Focused Benefits

Pros

- Military-Focused Benefits: USAA is ideal for military personnel and their families living in Chattanooga, Tennessee. They offer specialized benefits and services tailored to this group, including tailored coverage options and dedicated support.

- Exceptional Rates: USAA consistently provides some of the lowest premiums available for eligible drivers in Chattanooga, Tennessee, which can result in significant savings compared to other providers.

- Comprehensive Coverage: USAA offers a wide range of coverage options in Chattanooga, Tennessee, including comprehensive and collision coverage, as well as additional benefits like rental reimbursement and roadside assistance, ensuring robust protection.

Cons

- Eligibility Restrictions: USAA’s services are exclusively available to military members, veterans, and their families in Chattanooga, Tennessee. This exclusivity means that non-military individuals cannot benefit from their competitive rates or specialized services.

- Limited Physical Presence: With few physical branches in Chattanooga, Tennessee, members might find in-person support less accessible compared to companies with a larger local footprint, as mentioned in our USAA auto insurance review.

#4 – American Family: Best for Affordable Premiums

Pros

- Affordable Premiums: American Family Insurance offers competitive pricing for comprehensive coverage in Chattanooga, Tennessee. Their rates are appealing to those looking for cost-effective insurance solutions without compromising on coverage.

- Diverse Discounts: American Family provides several discounts in Chattanooga, Tennessee, including those for good students, safe drivers, and multi-policy holders. These discounts can help reduce overall insurance costs, as highlighted in our American Family auto insurance review.

- Customizable Coverage Options: American Family allows customers in Chattanooga, Tennessee to tailor their policies with various add-ons and endorsements, ensuring they get coverage suited to their unique requirements.

Cons

- Availability Concerns: American Family may not have as extensive a presence in Tennessee as some larger providers, potentially limiting options for residents in Chattanooga, Tennessee seeking local agents or specific policy features.

- Digital Experience: Their online platform and mobile app are less advanced compared to some competitors, which could affect customers in Chattanooga, Tennessee who prefer managing their insurance digitally.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Customizable Insurance Policies

Pros

- Customizable Insurance Policies: Liberty Mutual offers highly customizable insurance policies, allowing Chattanooga, Tennessee drivers to tailor their coverage based on specific needs and preferences, including optional coverages like accident forgiveness and new car replacement, as mentioned in our Liberty Mutual auto insurance review.

- Discounts and Savings: Liberty Mutual provides a wide range of discounts in Chattanooga, Tennessee, including those for bundling home and auto insurance, new cars, and safe driving. These discounts can significantly lower the cost of coverage.

- Comprehensive Coverage Options: Liberty Mutual’s coverage options are extensive in Chattanooga, Tennessee, allowing customers to add various endorsements and extras to their policies to better suit their needs.

Cons

- Premium Costs: Liberty Mutual’s premiums can be relatively high compared to some competitors, particularly for comprehensive coverage in Chattanooga, Tennessee. This may be a consideration for those seeking more budget-friendly options.

- Mixed Customer Service Reviews: There are mixed reviews regarding customer service in Chattanooga, Tennessee, with some customers reporting slower response times or issues with the claims process, which could impact overall satisfaction.

#6 – Farmers: Best for Variety of Coverage Options

Pros

- Variety of Coverage Options: They offer a wide range of coverage options in Chattanooga, Tennessee, including specialized choices like rideshare coverage and protection for high-value items, catering to diverse needs.

- Discount Opportunities: Farmers provides a good selection of discounts in Chattanooga, Tennessee, including those for safety features in vehicles, multi-policy holders, and good driving records. These discounts can help reduce insurance costs.

- Customizable Plans: The company offers flexible and customizable insurance plans in Chattanooga, Tennessee, allowing drivers to adjust their coverage based on their specific requirements and preferences.

Cons

- Higher Premiums: Farmers’ premiums tend to be on the higher side in Chattanooga, Tennessee, which might be a disadvantage for those looking for more affordable insurance solutions, especially for comprehensive coverage.

- Claims Processing Issues: Some customers in Chattanooga, Tennessee report that the claims process can be slower compared to other providers, which might be a concern during urgent situations, as noted in our Farmers auto insurance review.

#7 – Erie: Best for Competitive Pricing

Pros

- Competitive Pricing: Erie Insurance is known for offering some of the most affordable premiums in Chattanooga, Tennessee. Their competitive pricing makes it a strong option for drivers looking to save on insurance costs, as highlighted in our Erie auto insurance review.

- Extensive Coverage Options: Erie provides a wide range of coverage options in Chattanooga, Tennessee, including unique add-ons like pet coverage and guaranteed replacement cost, ensuring that drivers can tailor their policies to their specific needs.

- Local Agent Network: The company maintains a solid network of local agents in Chattanooga, Tennessee, providing personalized assistance and expertise.

Cons

- Limited Availability: Erie has a more limited presence in Chattanooga, Tennessee compared to larger providers, with fewer agents and offices, which might affect accessibility for some customers.

- Less Advanced Digital Tools: Their online tools and mobile app are not as advanced as those of some larger competitors, which could impact the convenience of managing policies online in Chattanooga, Tennessee.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Geico: Best for Broad Discount Options

Pros

- Broad Discount Options: Geico provides a wide range of discounts in Chattanooga, Tennessee, including those for safe driving, vehicle safety features, and multi-policy holders, which can help reduce overall insurance costs.

- Low Premiums: Geico is renowned for offering some of the lowest rates in Chattanooga, Tennessee, making it a highly attractive option for drivers seeking cost-effective insurance, as highlighted in our Geico auto insurance review.

- User-Friendly Digital Experience: Their mobile app and online services are highly rated in Chattanooga, Tennessee for ease of use, allowing policyholders to manage their insurance efficiently from anywhere.

Cons

- Customer Service Concerns: While generally good, there are mixed reviews about customer service in Chattanooga, Tennessee, particularly for handling more complex claims or issues, which might affect overall satisfaction.

- Limited Local Agent Presence: Geico has a fewer number of local agents in Chattanooga, Tennessee, which can be a drawback for those preferring in-person interactions and personalized service.

#9 – State Farm: Best for Reliable Claims Handling

Pros

- Reliable Claims Handling: The company is known for a reliable and efficient claims process in Chattanooga, Tennessee, which is particularly important in the city’s variable weather conditions that can lead to frequent claims.

- Competitive Discounts: State Farm offers a range of discounts in Chattanooga, Tennessee, including safe driving discounts, multi-policy discounts, and discounts for vehicles equipped with safety features, helping to lower overall insurance costs.

- Comprehensive Coverage Options: State Farm provides a broad selection of coverage options in Chattanooga, Tennessee, including customizable plans that can be tailored to meet specific needs and preferences.

Cons

- Premiums Can Be Higher: State Farm’s premiums can be higher compared to some competitors in Chattanooga, Tennessee, especially for comprehensive coverage, which might be a consideration for cost-conscious drivers, as noted in our State Farm auto insurance review.

- Mixed Customer Service Reviews: While generally positive, there are some mixed reviews regarding customer service in Chattanooga, Tennessee, with occasional reports of slower response times or issues with handling complex claims.

#10 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive is known for offering competitive rates in Chattanooga, Tennessee, particularly for drivers with clean records and those who qualify for multiple discounts, as highlighted in our Progressive auto insurance review.

- Flexible Coverage Options: The company provides a range of customizable coverage options in Chattanooga, Tennessee, including add-ons and endorsements that allow drivers to tailor their policies based on individual needs.

- Snapshot Program: Their Snapshot program rewards safe driving with potential discounts in Chattanooga, Tennessee, which can be advantageous for those who consistently maintain a clean driving record.

Cons

- Higher Rates for Certain Drivers: While rates are competitive for some, drivers with less-than-perfect records in Chattanooga, Tennessee might face higher premiums compared to other providers, which can be a drawback.

- Customer Service Concerns: Some customers have reported issues with customer service in Chattanooga, Tennessee, particularly with claims handling and support, which could impact overall satisfaction.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monthly Chattanooga, TN Car Insurance Rates by ZIP Code

Discover the monthly car insurance rates for Chattanooga, TN, tailored by ZIP code. This guide breaks down how rates vary across different areas, helping you find the best value for your insurance coverage. Explore the insights to better understand how your specific location impacts your premium.

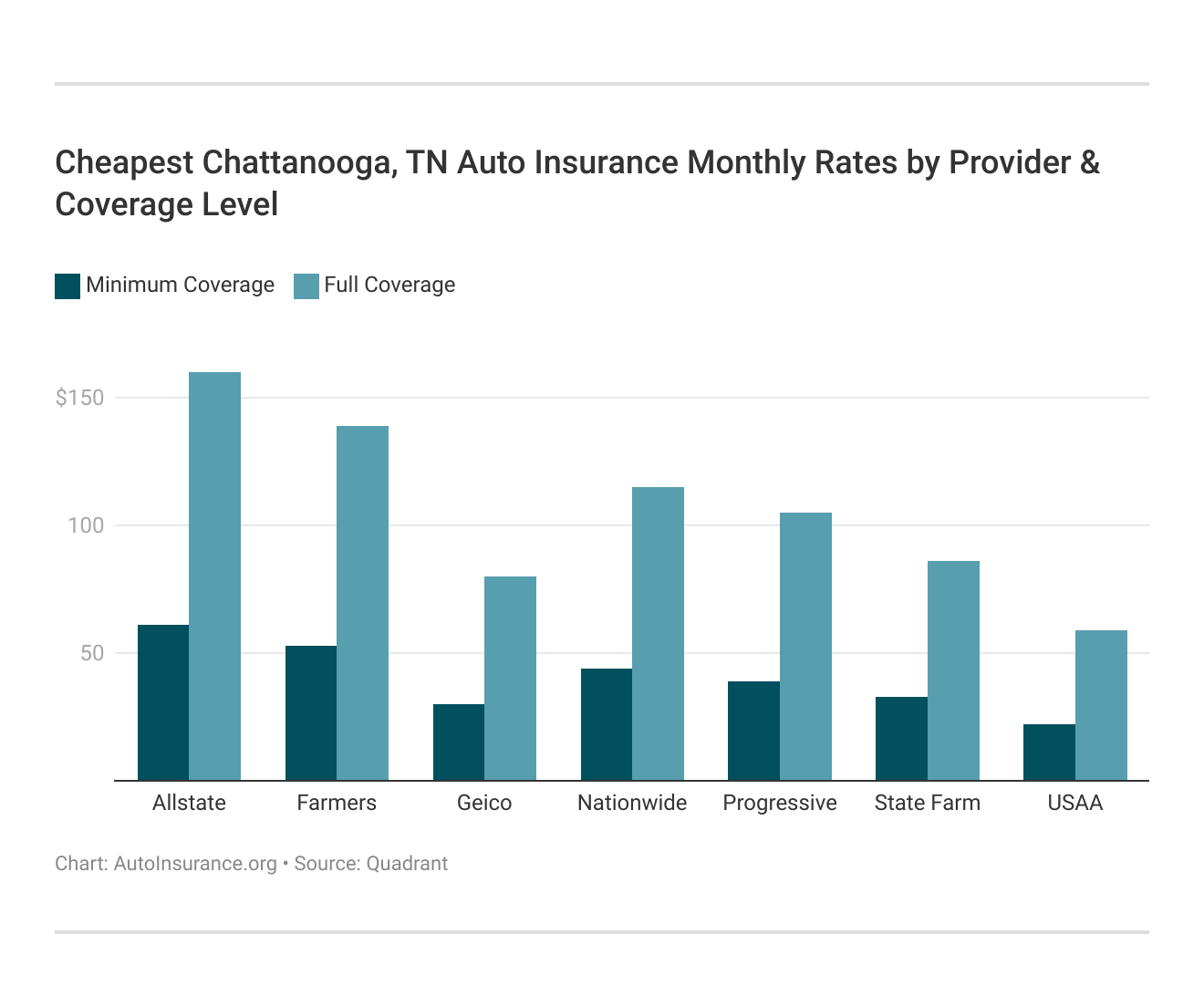

Chattanooga, Tennessee Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $80 | $190 |

| American Family | $85 | $200 |

| Erie | $76 | $185 |

| Farmers | $78 | $188 |

| Geico | $70 | $170 |

| Liberty Mutual | $80 | $195 |

| Progressive | $72 | $175 |

| State Farm | $75 | $180 |

| Travelers | $75 | $185 |

| USAA | $70 | $180 |

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Chattanooga, TN auto insurance rates by ZIP code below:

Understanding the variations in monthly car insurance rates by ZIP code in Chattanooga, TN, can help you make informed decisions. For the most accurate rates and coverage options, contact local agents and compare quotes based on your ZIP code to secure the best deal. For more details, see auto insurance rates by ZIP code: what you need to know.

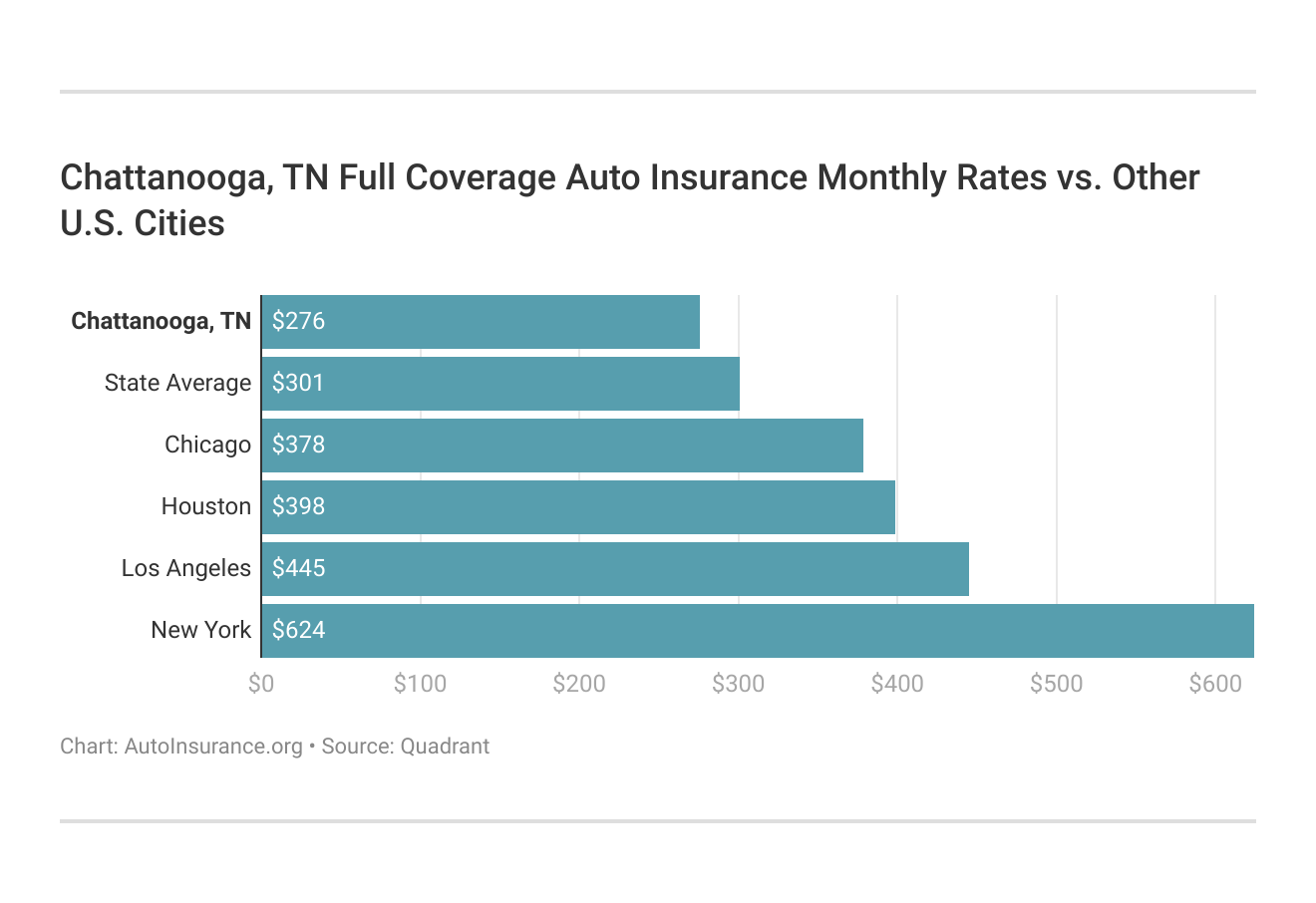

Chattanooga, TN Car Insurance Rates vs. Top US Metro Car Insurance Rates

Compare car insurance rates in Chattanooga, TN, with those in top U.S. metropolitan areas. This analysis highlights how Chattanooga’s rates stack up against major cities, offering a clearer picture of regional insurance costs and helping you assess your options more effectively.

What city you reside in will impact your car insurance. That’s why it’s essential to compare Chattanooga, TN against other top US metro areas’ auto insurance costs. Discover our comprehensive guide to “How to Compare Auto Insurance Quotes” for additional insights.

By examining Chattanooga, TN, car insurance rates alongside those in leading U.S. metro areas, you gain valuable perspective on how local rates compare to national trends. Use this information to make well-informed choices and find the best insurance coverage for your needs. If you’re ready to find affordable Chattanooga, TN auto insurance? Enter your ZIP code above to get started.

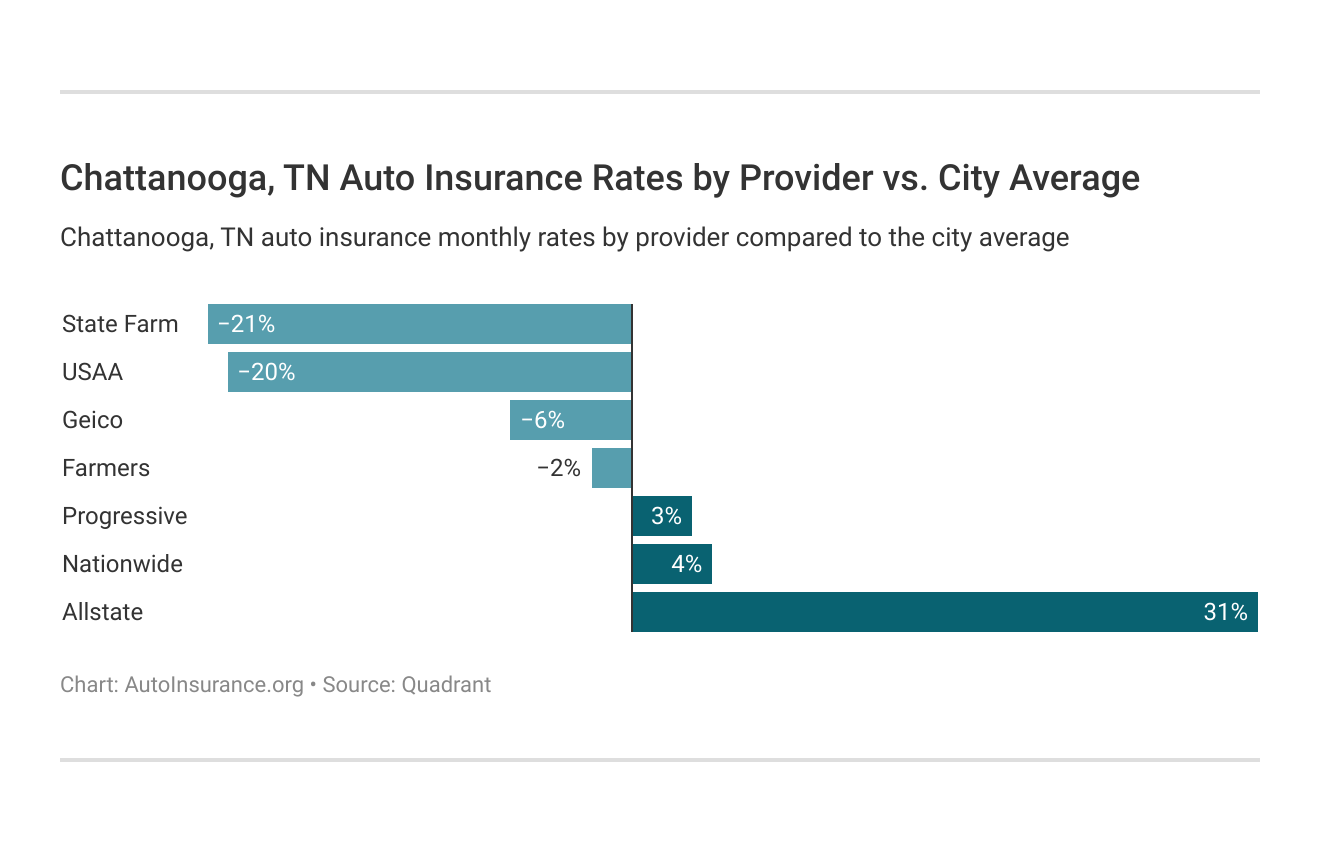

The Auto Insurance Company with the Lowest Rates in Chattanooga, TN

State Farm is recognized as the most affordable auto insurance company in Chattanooga, Tennessee, providing the lowest average rates in the region. This makes it a top choice for budget-conscious drivers seeking cost-effective coverage in the area.

To find out more about the best auto insurance companies options in Chattanooga, TN, you can explore the detailed list of the best providers below.

Additionally, we compare these local rates with the average car insurance costs across Tennessee, offering a comprehensive view of how Chattanooga’s rates stack up against broader state trends.

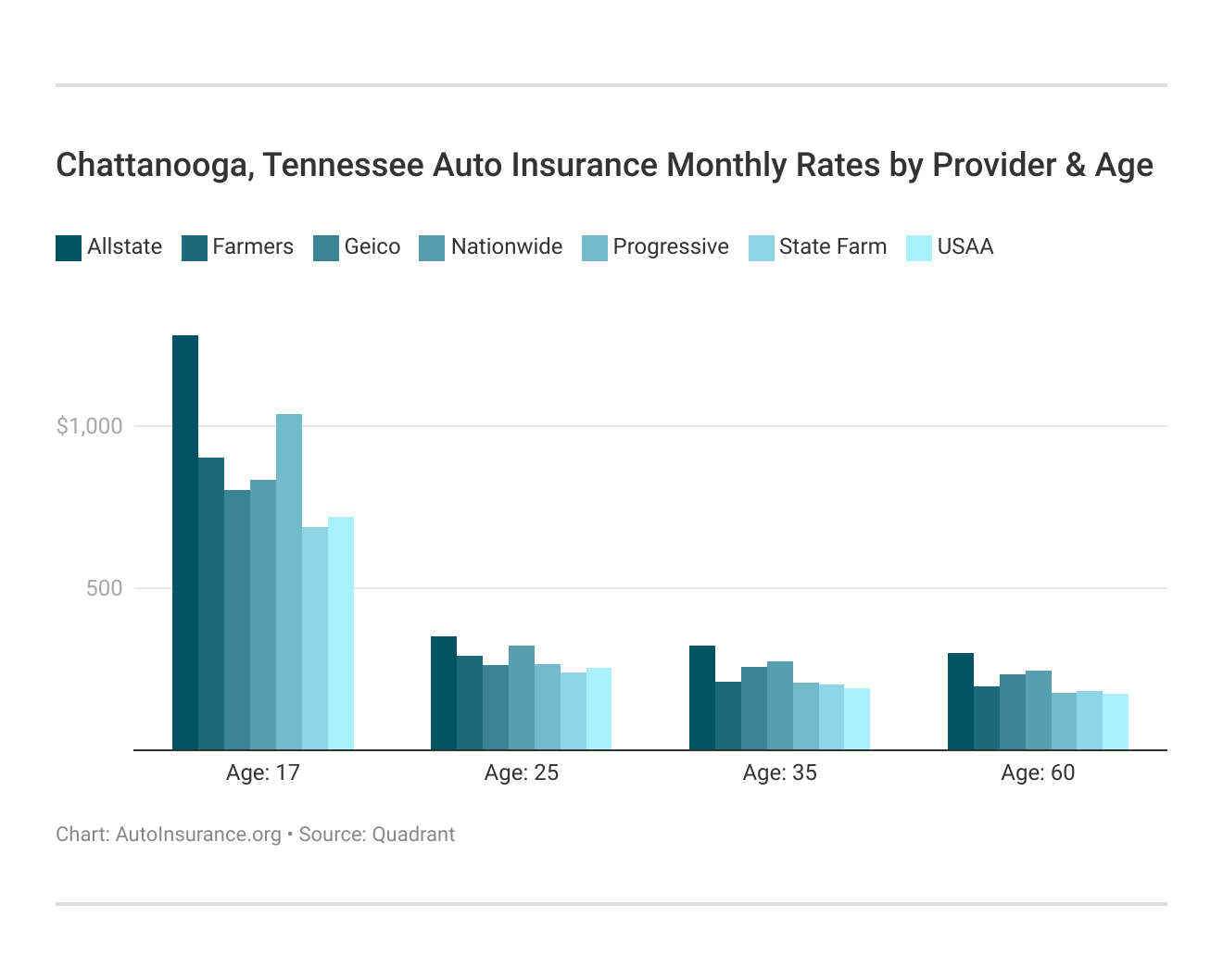

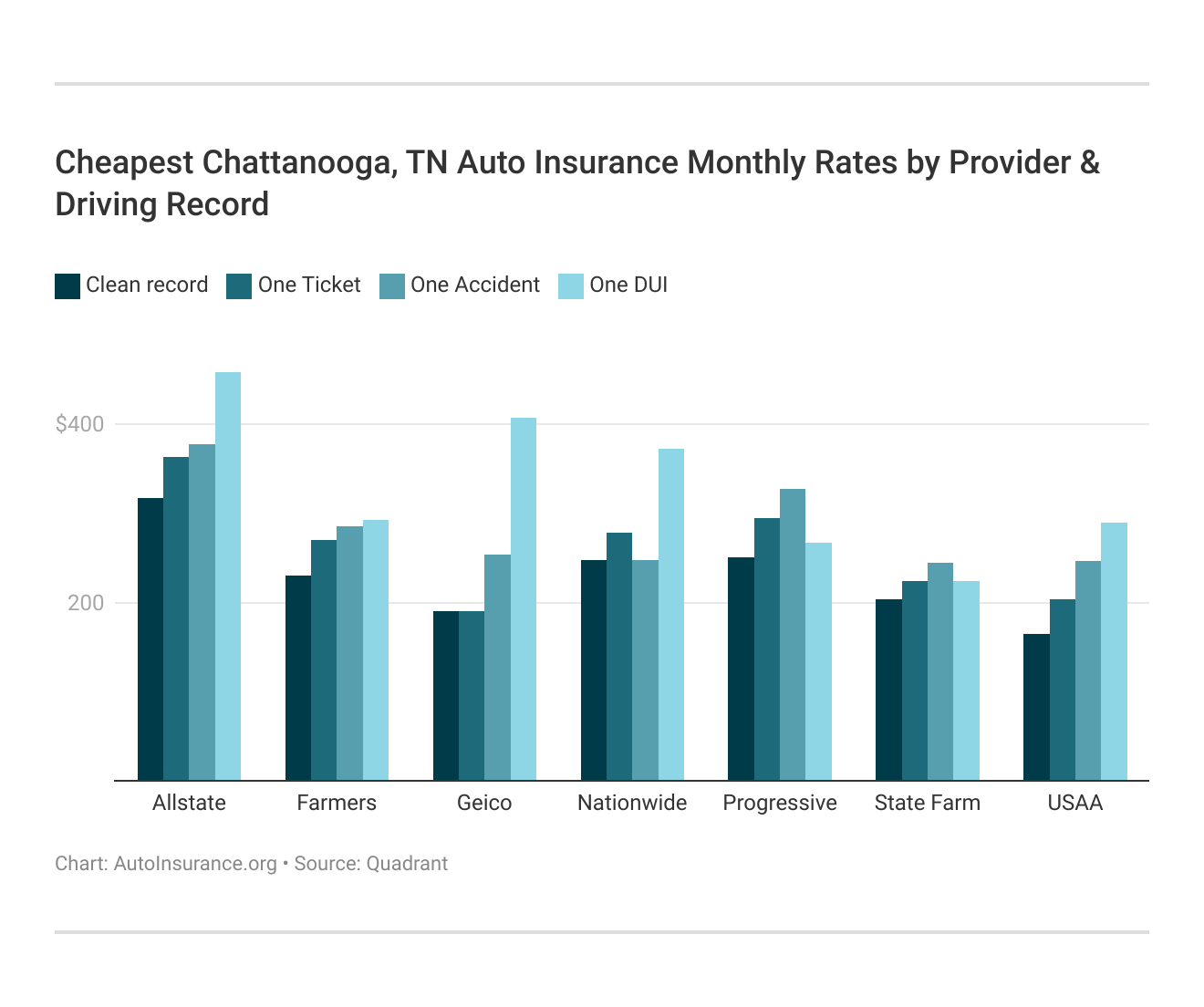

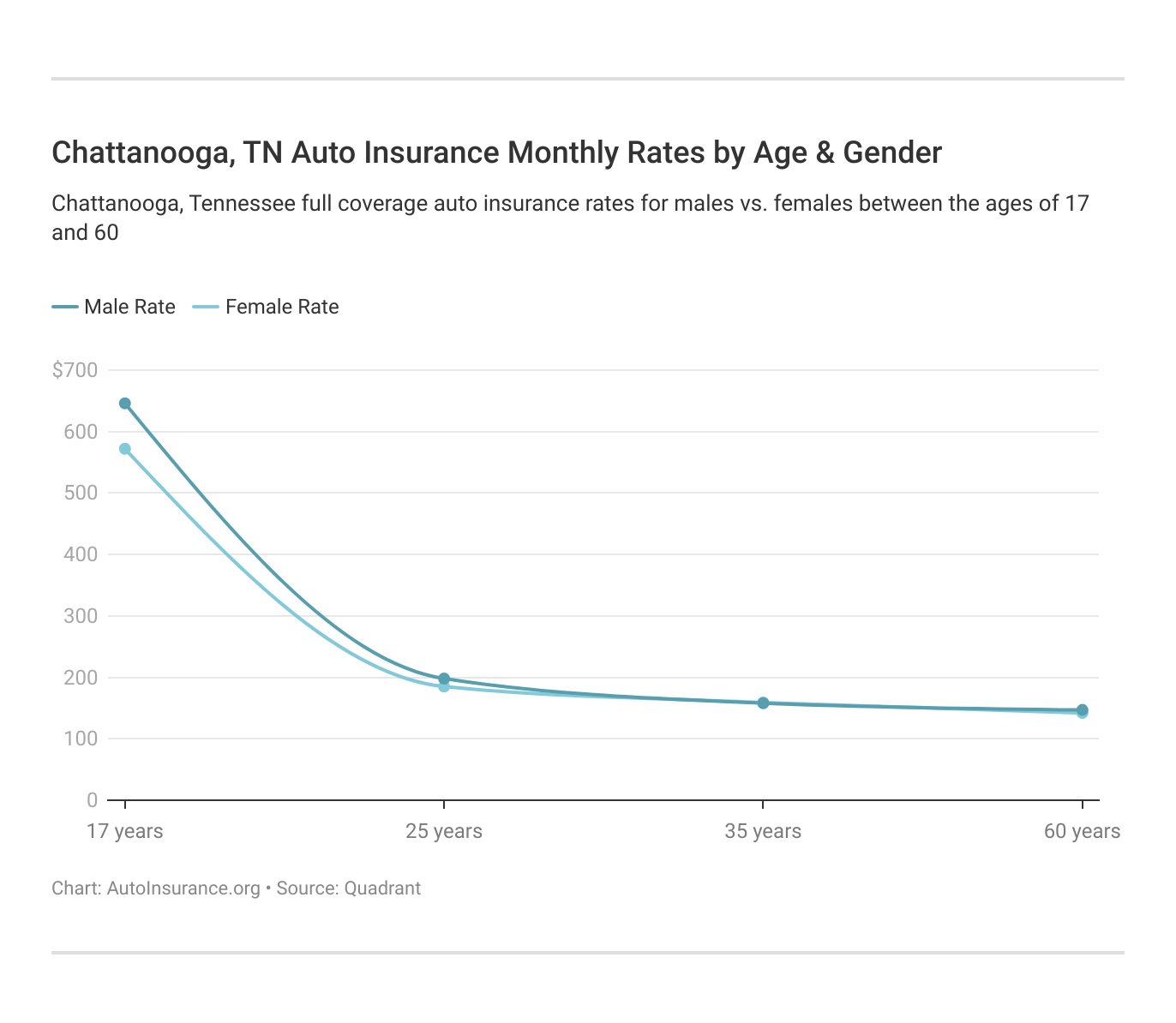

Several factors determine your auto insurance rates. The cheapest company depends on personal factors. One of the most significant factors is driving record. A clean driving history can save you at least 20 percent on auto insurance rates. Even your age is a factor. Young and single drivers pay the most car insurance. So, a teen or young adult driver in Chattanooga, TN, may pay more for auto insurance.

Married drivers between 35 and 60 years old pay significantly less. However, you can qualify for cheaper rates when you have good credit. Chattanooga, Tennessee car insurance costs by company and age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

For more details, see auto insurance rates for married vs. single drivers.

Your coverage level will play a major role in your Chattanooga, Tennessee car insurance costs. Find the cheapest Chattanooga, Tennessee car insurance costs by coverage level below:

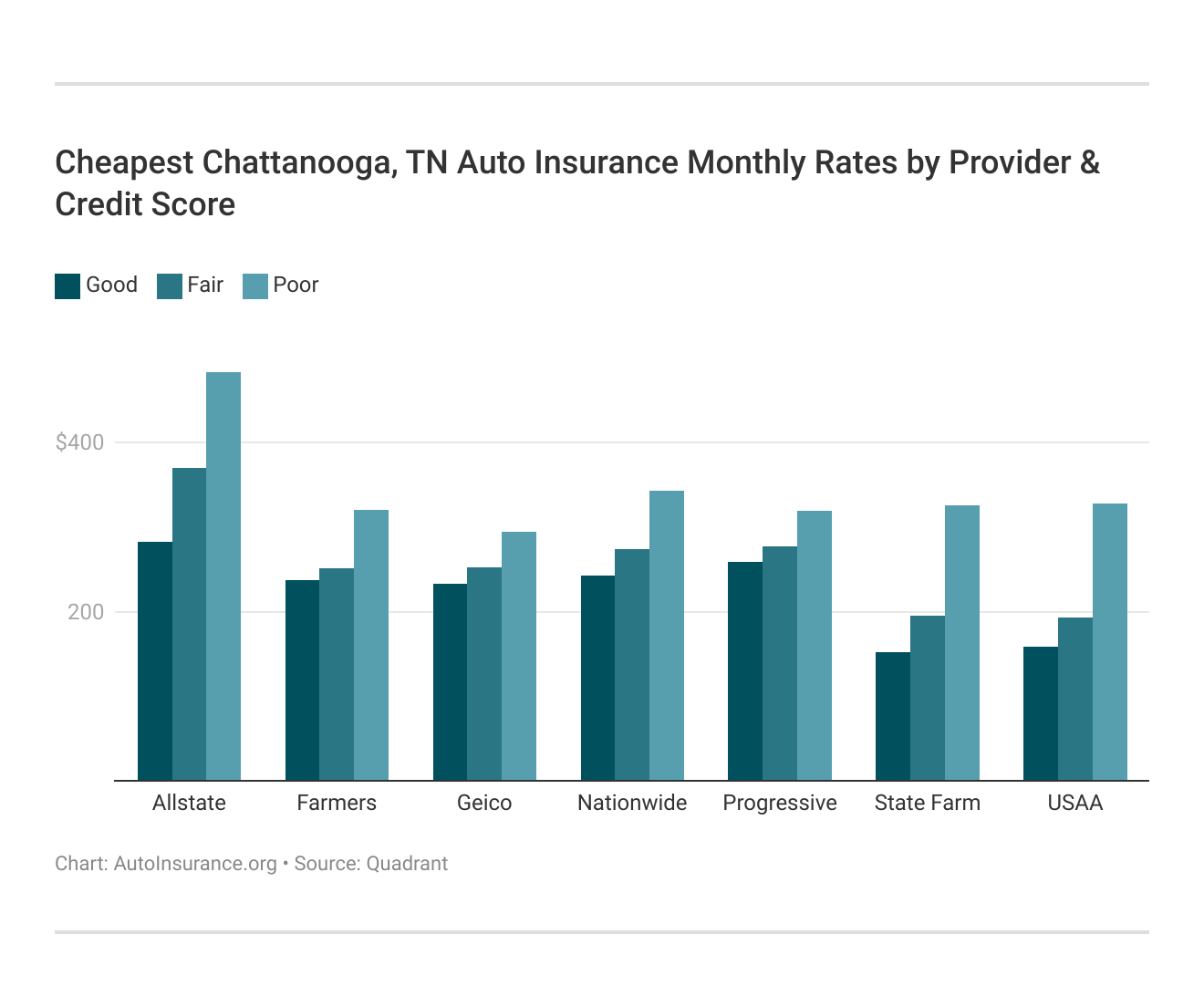

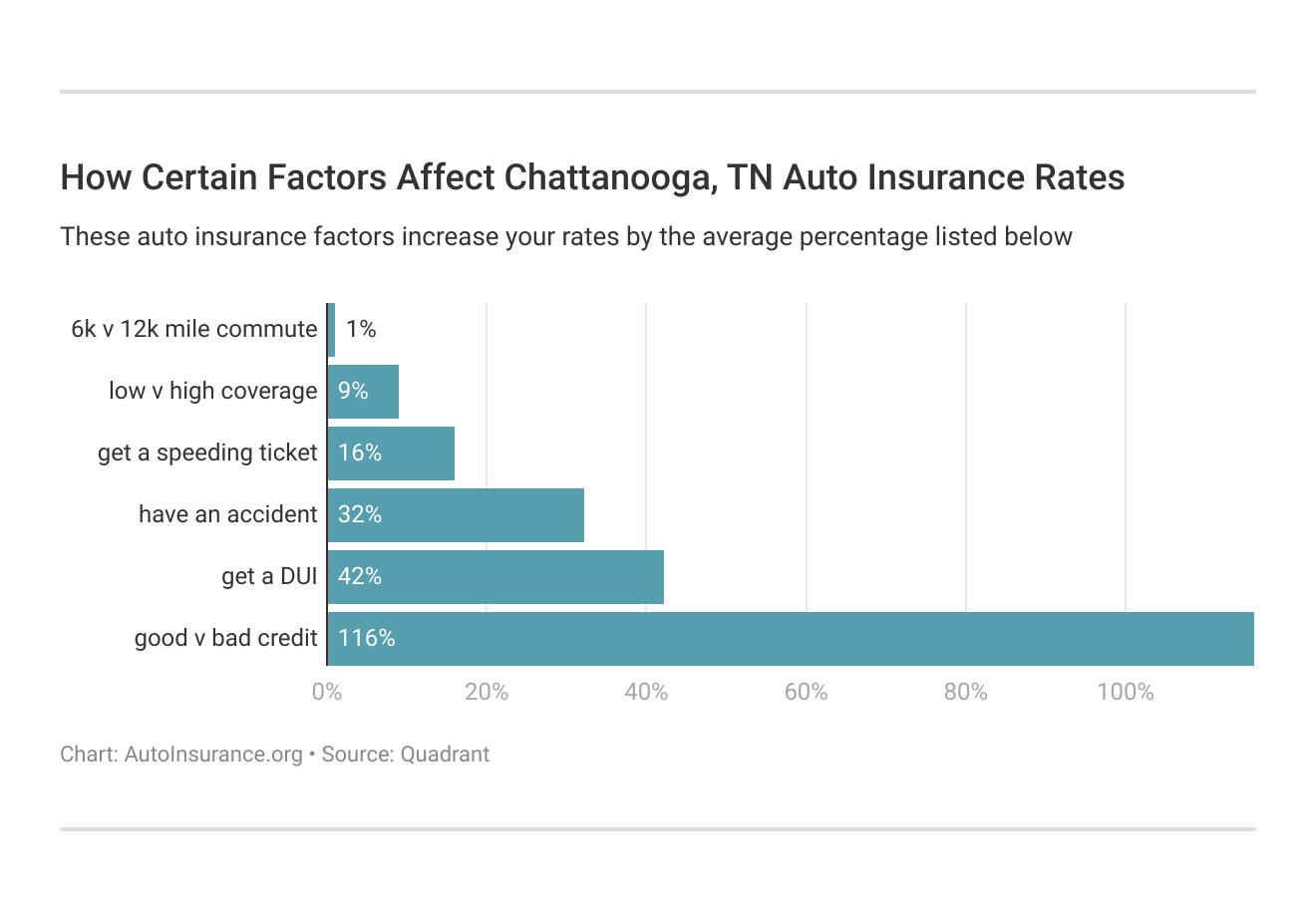

Your credit score will play a major role in your Chattanooga, TN car insurance costs unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. See details at auto insurance and your credit score.

Find the cheapest Chattanooga, Tennessee car insurance costs by credit score below.

Your driving record will affect your Chattanooga, TN car insurance costs. For example, a Chattanooga, Tennessee DUI may increase your car insurance costs 40 to 50 percent. Find the cheapest Chattanooga, Tennessee car insurance costs by driving record.

Controlling these risk factors will ensure you have the cheapest Chattanooga, Tennessee car insurance. Factors affecting car insurance rates in Chattanooga, TN may include your commute, coverage level, tickets, DUIs, and credit.

Age plays a crucial role in determining car insurance rates in Chattanooga, TN. Insurance companies typically regard young drivers as high-risk due to their inexperience and statistically higher likelihood of accidents, leading to increased premiums for this age group.

Additionally, while age is a primary factor, it’s important to note that gender is also considered in Chattanooga, Tennessee when setting insurance rates.

To get a clearer picture of how these factors impact your insurance costs, review the average monthly auto insurance rates categorized by age and gender in Chattanooga, TN. This detailed breakdown can help you understand how these variables influence your premium and guide you in making informed decisions about your coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Requirements in Chattanooga, TN

All Chattanooga drivers have to meet the minimum Tennessee auto insurance requirements. This means that regardless of where you drive in Chattanooga, you need to ensure your coverage meets the state’s baseline standards for liability insurance.

In Tennessee, you have to carry at least:

- $25,000 per person and $50,000 per accident for bodily injury liability (BIL) insurance

- $15,000 per accident for property damage liability

- $25,000 per person and $50,000 per accident for uninsured motorist coverage (UIM) auto insurance

These requirements are designed to ensure that all drivers are financially protected in the event of an accident, providing coverage for bodily injury and property damage. Understanding and maintaining the minimum insurance levels is crucial for compliance and to avoid any legal or financial repercussions.

Factors Influencing Auto Insurance Rates in Chattanooga, TN

According to Data USA, the average commute time in Chattanooga is 19 minutes. That’s six minutes faster than the national average. But driving less than the Chattanooga, TN commute average could mean big savings on your auto insurance policy. Vehicle theft in Chattanooga, TN, also affects car insurance rates. The most recent annual statistics list 1,314 auto thefts in Chattanooga.

Auto thefts affect comprehensive auto insurance most. If you happen to have a vehicle on the low theft rate list, you may be able to save a few hundred dollars on car insurance. What about Chattanooga, TN weather? According to City-Data, Chattanooga had ten floods and ten storms that caused natural disasters.

Chattanooga, TN Auto Insurance: What You Need to Know

Chattanooga drivers often have more opportunities to secure affordable auto insurance compared to the average motorist across the United States. The best way to secure cheap car insurance in Chattanooga is to keep a clean driving record and maintain good credit. If your vehicle has any anti-theft or safety features, you can qualify for auto insurance discounts.

Allstate stands out in Chattanooga for its extensive local agent network and personalized service, which makes it a top choice for tailored auto insurance solutions.Scott W. Johnson Licensed Insurance Agent

Additionally, having a vehicle equipped with anti-theft or safety features can make you eligible for various discounts, further reducing your insurance costs. By leveraging these factors, you can maximize your chances of finding budget-friendly car insurance in Chattanooga.

Before you buy Chattanooga, TN auto insurance, be sure you’ve checked out rates from multiple companies. Enter your ZIP code below to get fast, free auto insurance quotes.

Frequently Asked Questions

What are the current car insurance rates in Chattanooga, Tennessee?

Car insurance rates in Chattanooga, Tennessee can vary significantly based on several factors including age, driving history, and the type of coverage selected. Rates may be influenced by local regulations and personal risk factors.

Which is the most trusted car insurance company in Chattanooga, Tennessee?

The most trusted car insurance company in Chattanooga, Tennessee is often determined by analyzing customer reviews and satisfaction surveys. Companies with high ratings for reliability and customer service typically earn this distinction.

How do Geico vs. Progressive insurance rates compare in Chattanooga?

Comparing Geico vs. Progressive insurance rates in Chattanooga reveals that each company offers different pricing based on individual driving records, coverage options, and risk assessments. Personal circumstances and preferences will influence which provider is more cost-effective.

Explore our detailed analysis on “Where to Compare Auto Insurance Rates” for additional information.

What insurance options are considered better than Geico?

Insurance options considered better than Geico may include providers that offer more competitive rates, enhanced coverage options, or additional benefits tailored to specific needs. It’s worth comparing multiple providers to find the best fit.

Are high car insurance rates common in Chattanooga, Tennessee?

High car insurance rates in Chattanooga, Tennessee can be relatively common due to local risk factors, driving conditions, and individual driver profiles. Various elements such as accident rates and vehicle types can contribute to these higher costs.

What is the required car insurance coverage in Chattanooga, Tennessee?

The required car insurance coverage in Chattanooga, Tennessee includes minimum liability limits for bodily injury and property damage. These requirements are set by state law to ensure that drivers have adequate financial protection in case of an accident.

Get more insights by reading our expert “Cheapest Liability-Only Auto Insurance” advice.

Who offers the cheapest car insurance in Chattanooga, Tennessee?

The cheapest car insurance in Chattanooga, Tennessee is typically provided by insurers who offer competitive pricing and various discounts. Companies with lower base rates and special offers may be the most affordable options for many drivers.

What is considered the best insurance company for car insurance in Chattanooga, Tennessee?

The best insurance company for car insurance in Chattanooga, Tennessee is usually one that excels in customer service, offers favorable rates, and provides comprehensive coverage. Customer satisfaction and coverage options are key factors in determining the best provider.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Which insurance company has the highest customer satisfaction in Chattanooga, Tennessee?

The highest customer satisfaction insurance company in Chattanooga, Tennessee is often recognized through positive customer reviews and high satisfaction ratings. Companies that consistently meet or exceed customer expectations in service and claims handling are typically noted for their high satisfaction.

Continue reading our full “Where can I compare online auto insurance companies?” guide for extra tips.

How do Allstate vs. Geico insurance costs compare in Chattanooga?

Comparing Allstate vs. Geico insurance costs in Chattanooga shows that each company offers distinct pricing structures. Costs can vary based on individual factors such as coverage needs, driving history, and available discounts, making it important to evaluate both options.

What are the differences in Allstate vs. Progressive insurance costs?

Who is the best insurance provider in Chattanooga, Tennessee?

Which company is the cheapest car insurance provider in Chattanooga, Tennessee?

What are the minimum insurance requirements in Chattanooga, Tennessee?

What is the average cost of auto insurance in Chattanooga, Tennessee?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.