Cheap Gap Insurance in California (10 Most Affordable Companies for 2026)

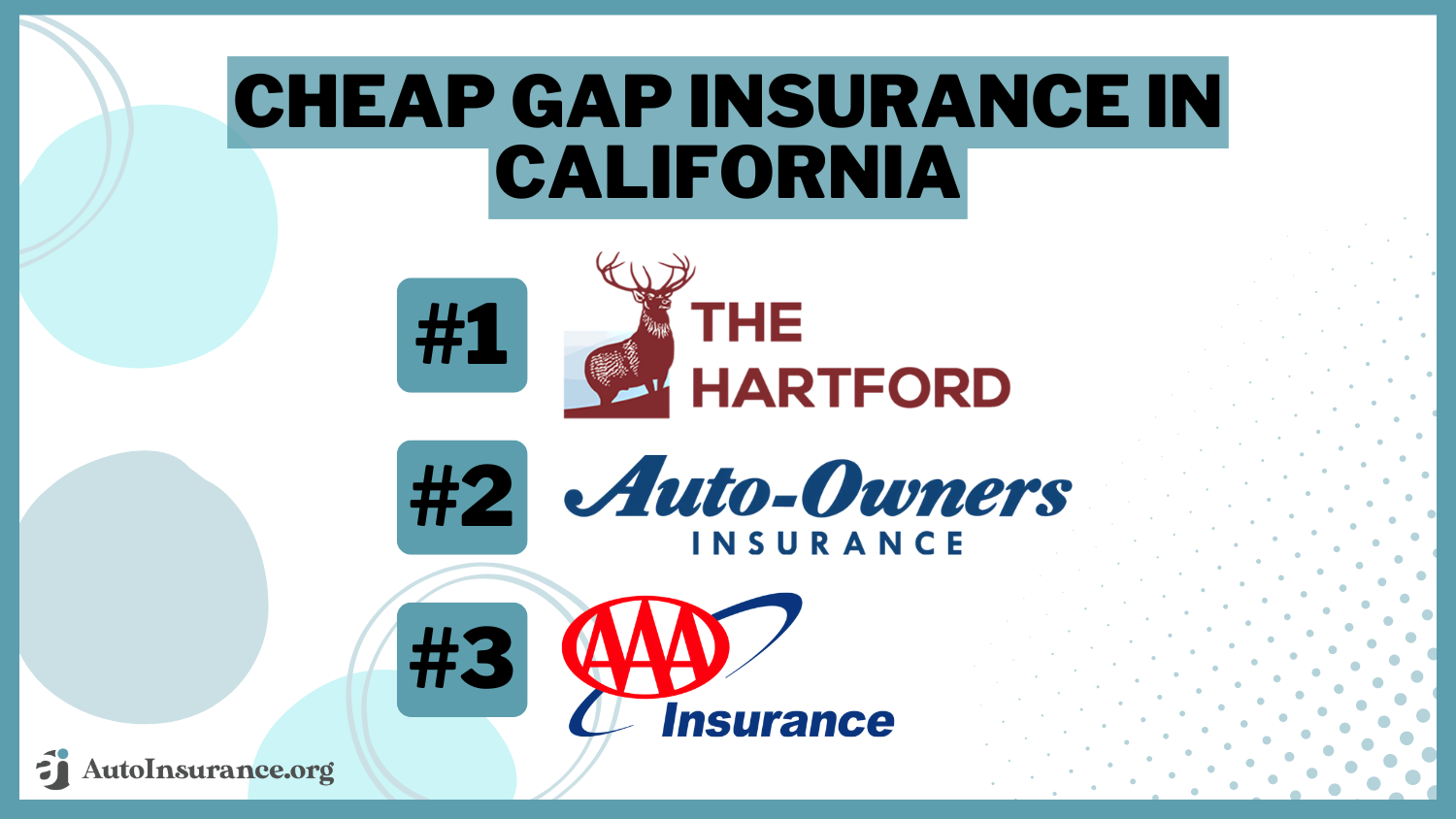

The top providers for cheap gap insurance in California are The Hartford, Auto-Owners, and AAA, with rates starting at just $27 per month. These insurers stand out for affordable rates, broad coverage options, and dependable service, making them ideal for drivers looking to save on California gap insurance rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Updated September 2024

Company Facts

Min. Coverage for Gap in California

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Gap in California

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Gap in California

A.M. Best Rating

Complaint Level

Pros & Cons

The Hartford, Auto-Owners, and AAA are the top picks for cheap gap insurance in California, offering unbeatable rates starting at just $27 per month.

The article breaks down the advantages of each provider, focusing on affordability, coverage options, and reliability. The Hartford stands out as the best auto insurance for seniors in California with its competitive pricing and exceptional customer service.

Our Top 9 Company Picks: Cheap Gap Insurance in California

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $3 | A+ | Flexible Options | Progressive | |

| #2 | $5 | A++ | Reliable Service | Auto-Owners | |

| #3 | $6 | A++ | Customizable Policies | Travelers | |

| #4 | $7 | A | Innovative Tools | Liberty Mutual |

| #5 | $8 | B | Affordable Rates | State Farm | |

| #6 | $9 | A+ | Strong Coverage | Nationwide |

| #7 | $11 | A+ | Extensive Discounts | Allstate | |

| #8 | $12 | A+ | Senior Drivers | The Hartford |

| #9 | $13 | A | Personalized Service | Farmers |

Whether you’re seeking the cheapest rates or the best value, these companies offer comprehensive protection at a price that fits your budget.

Keep reading to explore how each provider compares to find the perfect gap insurance for your needs. Start saving on your cheap California auto insurance by entering your ZIP code above and comparing free quotes.

- Find cheap gap insurance in California at The Hartford for $27/month

- AAA members get free roadside assistance with California gap insurance

- California gap insurance rates go up for luxury vehicles and sports cars

#1 – The Hartford: Top Overall Pick

Pros

- Cheap California Gap Insurance: The Hartford has the cheapest gap insurance in California with minimum rates as low as $27/month. See quotes in our review of The Hartford.

- Exclusive Senior Discounts: Senior drivers in California over 65 who are AARP members earn exclusive discounts and auto insurance benefits with The Hartford gap insurance.

- Multi-Vehicle Savings: California drivers who insure more than one vehicle with The Hartford save 25% on gap insurance rates.

Cons

- Limited Availability: Auto insurance is only available to AARP members, so younger drivers can’t buy California gap insurance from The Hartford.

- Mixed Customer Service Reviews: The Hartford has varied customer reviews when it comes to gap insurance claims in California.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Auto-Owners: Best for Reliable Service

Pros

- Reliable Service: Auto-Owners is praised for its consistent customer service, making it a solid choice for gap insurance in California. See our review of Auto-Owners auto insurance for more details.

- Competitive Rates: With a monthly minimum coverage rate of $30, Auto-Owners provides cheap gap insurance in California, balancing affordability with quality service.

- High Financial Rating: The A++ rating from A.M. Best ensures that California drivers are backed by a financially secure insurance provider for gap insurance.

Cons

- Limited Online Tools: Auto-Owners lacks comprehensive online tools, which could be inconvenient for tech-savvy customers managing their gap insurance in California.

- Strict Eligibility: The eligibility criteria might be stricter, potentially limiting access to cheap gap insurance for some California drivers.

#3 – AAA: Best for Membership Benefits

Pros

- Membership Benefits: AAA offers unique membership perks on CA gap insurance, including discounts and roadside assistance. Learn more in our review of AAA insurance.

- Affordable Minimum Coverage: At $35 per month for minimum coverage, AAA provides reasonably priced gap insurance for California drivers.

- Trusted Reputation: AAA’s A rating from A.M. Best reassures policyholders that they are choosing a reliable provider for their gap insurance needs in California.

Cons

- Membership Requirement: AAA memberships are required to access its insurance policies, which might add to the cost for those looking for the cheapest gap insurance in California.

- Limited Coverage Customization: The coverage options might not be as flexible as those offered by other providers for gap insurance in California.

#4 – State Farm: Best for Affordable Rates

Pros

- Affordable Rates: State Farm offers cheap gap insurance in California with a monthly rate of $46 for minimum coverage. Compare quotes in our State Farm auto insurance review.

- Wide Network: With a vast network of agents across California, State Farm ensures that drivers have easy access to personalized support and gap insurance services.

- Strong Customer Satisfaction: State Farm consistently ranks high in customer satisfaction, which is an advantage for those seeking reliable gap insurance for California drivers.

Cons

- Lower Financial Rating: The B rating from A.M. Best is lower than some competitors, which might be a concern for those seeking long-term gap insurance in California.

- Limited Discounts: State Farm’s discounts might not be as extensive, potentially affecting overall savings on gap insurance for California drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 –Progressive: Best for Flexible Options

Pros

- Flexible Options: Progressive excels in offering customizable policy options, making it a top choice for drivers looking for gap insurance in California tailored to their needs.

- Competitive Minimum Coverage Rates: With a monthly rate of $57 for minimum coverage, Progressive provides relatively cheap gap insurance in California.

- Strong Online Presence: Convenient online tools make it easy for California drivers to manage their Progressive gap insurance policies digitally. Learn how in our Progressive auto insurance review.

Cons

- Higher Rates for Full Coverage: Progressive’s full coverage rates are higher than some competitors, which could be a drawback for those looking for more extensive gap insurance in California.

- Moderate Financial Rating: While still strong, Progressive’s A+ rating from A.M. Best is slightly lower than the highest-rated providers of gap insurance for California drivers.

#6 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers is known for providing personalized insurance services, ensuring that California drivers receive gap insurance solutions tailored to their needs.

- Decent Minimum Coverage Rates: At $76 per month, Farmers offers competitive rates for those seeking cheap gap insurance in California.

- Long-Standing Reputation: With an A rating from A.M. Best, Farmers provides reliable and secure gap insurance for California drivers. Find more details in our review of Farmers auto insurance.

Cons

- Higher Premiums: Farmers’ rates are higher compared to some other providers, which might be a concern for budget-conscious California drivers looking for cheap gap insurance.

- Limited Discounts: The discount options available might be fewer, potentially affecting the overall cost of gap insurance in California.

#7 – Travelers: Best for Customizable Policies

Pros

- Customizable Policies: Travelers is ideal for California drivers who want to tailor their gap insurance policies to fit their specific needs.

- Competitive Minimum Coverage Rates: With a monthly rate of $83, Travelers offers a reasonably priced option for gap insurance in California.

- Top Financial Rating: The A++ rating from A.M. Best ensures that Travelers is a financially secure provider for gap insurance in California. Read our full review of Travelers insurance for more information.

Cons

- Higher Full Coverage Rates: The full coverage rates at Travelers are on the higher end, which might not suit those looking for more comprehensive yet affordable gap insurance in California.

- Average Customer Service: Travelers’ customer service is considered average, which could be a drawback for those seeking more personalized attention for their gap insurance needs in California.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Strong Coverage

Pros

- Strong Coverage Options: Nationwide is known for its robust coverage, providing comprehensive gap insurance for California drivers.

- Competitive Minimum Coverage Rates: At $96 per month, Nationwide offers competitive California gap insurance. Find the lowest rates for you in our Nationwide auto insurance review.

- Solid Financial Rating: With an A+ rating from A.M. Best, Nationwide provides California drivers with secure and reliable gap insurance.

Cons

- Higher Premiums: Nationwide’s premiums are on the higher side, which could be a drawback for California drivers seeking cheap gap insurance.

- Limited Local Agents: Nationwide may have fewer local agents in some areas, which could impact personalized service for gap insurance in California.

#9 – Allstate: Best for Extensive Discounts

Pros

- Extensive Discounts: Allstate offers a variety of discounts, making it possible for California drivers to significantly reduce their gap insurance costs.

- Competitive Minimum Coverage Rates: With a rate of $110 per month, Allstate provides affordable gap insurance in California, especially when discounts are applied.

- Strong Financial Rating: An A+ rating from A.M. Best underscores Allstate’s reliability as a provider of gap insurance for California drivers. Read more about this provider in our Allstate auto insurance review.

Cons

- Higher Base Rates: Allstate’s base rates for both minimum and full coverage are higher than some competitors, which could be a concern for those seeking cheap gap insurance in California.

- Limited Online Tools: Allstate’s online tools are not as advanced, which might be a disadvantage for tech-savvy customers looking to manage their gap insurance in California digitally.

#10 – Liberty Mutual: Best for Innovative Tools

Pros

- Innovative Tools: Liberty Mutual is recognized for its digital tools and resources, which make managing gap insurance in California more convenient for drivers.

- Comprehensive Coverage Options: Liberty Mutual offers a range of options, ensuring that California drivers have access to tailored gap insurance. To see honest rankings, read our Liberty Mutual review.

- Strong Financial Rating: With an A rating from A.M. Best, Liberty Mutual provides secure gap insurance for California drivers.

Cons

- Higher Premiums: Liberty Mutual’s rates are among the highest, with a minimum coverage rate of $127 per month, which might not be affordable for everyone seeking California gap insurance.

- Limited Discounts: The discounts available might be fewer, leading to higher overall costs for gap insurance in California.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Evaluating California Gap Insurance Rates by Company

Monthly rates for gap insurance in California vary significantly depending on the insurance company and the level of coverage you need:

California Gap Insurance Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $10 | |

| $11 | |

| $13 | |

| $14 |

| $12 |

| $13 | |

| $10 | |

| $11 |

| $15 | |

| U.S. Average | $12 |

Minimum coverage ranges from as low as $27/month with The Hartford to as high as $127/month with Liberty Mutual.

Several factors influence these rates, including how auto insurance companies check driving records and the specific terms of your loan or lease. Additionally, the car’s make, model, and year can affect the cost, as well as the geographical location and the insurer’s competitive pricing strategies within California.

For instance, a company like Liberty Mutual, which charges higher premiums, may offer broader coverage options or additional perks that justify the increased cost compared to more affordable providers like The Hartford or AAA.

Exploring Discounts on California Gap Insurance Rates

When shopping for gap insurance in California, knowing which auto insurance discounts you can ask for can significantly reduce monthly premiums. Many insurance companies offer discounts for factors such as bundling policies, maintaining a good driving record, or being a loyal customer.

Safe driving discounts are common with providers like State Farm and Progressive rewarding drivers who have clean driving histories. Companies like AAA and Allstate may also offer discounts if you combine your gap insurance with other types of coverage.

Additionally, discounts for paying auto insurance premiums in full, setting up automatic payments, or being affiliated with certain organizations or employers can further lower your California gap insurance costs.

Examining Cheap Gap Insurance Quotes in California

Obtaining gap insurance quotes in California is a straightforward process that can help drivers find the best coverage at the most affordable rates.

To begin, you can visit the websites of insurance providers like The Hartford, where online quote tools allow you to enter your vehicle’s details, such as the make, model, year, and personal driving history.

These tools often provide an estimate within minutes. You may explore and compare auto insurance rates by vehicle make and model for more information.

By comparing multiple quotes from different insurers, you can ensure that you are getting the best possible deal on California gap insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Best Gap Insurance in California

Gap insurance, which covers the difference between the value of a vehicle and the balance still owed on a loan or lease in the event of a total loss, is an essential aspect of auto insurance for many drivers in California with new cars. Shop with The Hartford, Auto-Owners, or AAA if you want cheap gap insurance in California.

Learn more information with our guide on “Can I keep my car if the insurance company totals it?”

Read the terms of your auto loan or lease agreement, or reach out to your lender, to find out if gap insurance is required in California.Eric Stauffer Licensed Insurance Agent

Each company offers unique benefits that cater to different needs, so consider your priorities — whether it’s cost, service, or customization — when making your decision. Then enter your ZIP code below to compare free gap insurance quotes from California providers near you.

Frequently Asked Questions

What is the new California gap insurance law?

The new gap insurance law in California caps gap waivers at 4% and requires lenders to return any unearned amounts that car buyers pay for gap waivers if they pay off their loans early or cancel their gap insurance coverage.

How much is gap insurance in California?

Gap insurance in California costs an average of $2 to $30 per month, depending on whether you buy it from a dealership, a car manufacturer, or your insurance provider.

Who has the cheapest gap insurance in California?

The Hartford, Auto-Owners, and AAA are the top three cheap gap insurance companies in California, according to our research. The cost of minimum coverage auto insurance in California is from $27-$35 for these three providers. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Does Tesla sell gap insurance in California?

Yes, Tesla sells gap insurance to California drivers, and it’s automatically included for policyholders who finance their loans or leases through Tesla. Explore more coverage options in our Tesla auto insurance review.

How much is minimum auto insurance in California?

California state minimum auto insurance requirements are liability insurance of $15,000 for injury/death to one person, $30,000 for injury/death to more than one person, and $5,000 for damage to property.

Is gap insurance mandatory in California?

The minimum auto insurance in California includes liability coverage only, not gap coverage. However, if you financed or leased your vehicle, your lender may require you to purchase gap insurance in case your car is stolen or totaled.

What is the most gap insurance will pay in California?

When you submit a total loss claim, your insurer will pay a maximum of the actual cash value of your vehicle (ACV). In some cases, the amount you still owe in car payments can exceed your car’s ACV. This is known as having negative equity or being upside down on your loan.

Will California gap insurance cover a blown engine?

No. Gap insurance in California only pays the difference left over on your auto loan after a total loss.

What is the penalty for a gap in auto insurance in California?

The penalty for driving without auto insurance in California is a fine of up to $200 and a license suspension.

Which California insurance company is usually the cheapest?

The best California auto insurance companies with cheap rates are typically Geico, State Farm, and USAA. However, Geico doesn’t sell gap insurance, State Farm only offers gap coverage to policyholders who finance with the insurer, and USAA is only available to military members. The Hartford and Auto-Owners remain the cheapest CA gap insurance companies for most drivers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.