Best Claymont, Delaware Auto Insurance in 2026 (Check Out These 10 Companies)

The best Claymont, Delaware auto insurance companies comes from Geico, Nationwide, and Amica, with rates starting as low as $65/month. These companies offer extensive discounts, reliable coverage, and attractive dividend policies. Choose these providers for optimal value in Claymont, Delaware.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated October 2024

Company Facts

Full Coverage in Claymont DE

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Claymont DE

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Claymont DE

A.M. Best Rating

Complaint Level

Pros & Cons

The best Claymont, Delaware auto insurance providers comes from Geico, Nationwide, and Amica. Geico stands out as the top pick overall with rates starting at just $65 per month. To learn more, check out our detailed guide on insurance rate, “Auto Insurance Rates by State.”

These companies offer extensive discounts, ensuring you save on your premiums, along with reliable coverage that protects you on the road. Their appealing dividend policies provide additional financial benefits, making them a smart choice for many drivers.

Our Top 10 Company Picks: Best Claymont, Delaware Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 15% A++ Extensive Discount Geico

#2 20% A+ Reliable Coverage Nationwide

#3 15% A+ Dividend Policies Amica

#4 10% A+ AARP Members The Hartford

#5 8% A++ Potential Savings Travelers

#6 10% A+ Snapshot Program Progressive

#7 12% A+ Drivewise Program Allstate

#8 12% A Bundling Policies Liberty Mutual

#9 10% A+ Local Agents Farmers

#10 15% A++ Financial Stability Auto-Owners

For the most cost-effective and comprehensive auto insurance in Claymont, these three providers stand out, delivering a blend of affordability, quality coverage, and value-added perks that cater to diverse needs and preferences.

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool above.

- Geico leads with the best rates for Claymont, DE auto insurance, from $65/month

- Top Claymont providers offer extensive discounts and reliable coverage

- Providers offer excellent value with extensive discounts and dividend policies

#1 – Geico: Top Overall Pick

Pros

- Extensive Discounts: Geico offers a range of extensive discounts, making it a cost-effective choice for auto insurance in Claymont, Delaware. Find out more in our Geico review.

- Competitive Rates: With rates starting as low as $65 per month, Geico provides affordable auto insurance options for Claymont, Delaware residents.

- Convenient Online Tools: Geico’s online tools and mobile app make managing your auto insurance policy in Claymont, Delaware easy and accessible.

Cons

- Customer Service: Geico’s customer service may not be as personalized, which can be a drawback for Claymont, Delaware residents seeking more tailored support.

- Limited Coverage Options: While affordable, Geico’s coverage options might not be as comprehensive as those offered by other providers in Claymont, Delaware.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Reliable Coverage

Pros

- Reliable Coverage: Nationwide is known for its reliable auto insurance coverage in Claymont, Delaware, offering peace of mind on the road.

- Strong Customer Service: Nationwide provides robust customer support, which is beneficial for Claymont, Delaware drivers who need assistance, which you can learn about in our Nationwide review.

- Flexible Policy Options: Nationwide offers a variety of policy options to fit different needs, making it a versatile choice for Claymont, Delaware.

Cons

- Higher Premiums: Nationwide’s premiums may be higher compared to some competitors in Claymont, Delaware.

- Less Focused Discounts: While reliable, Nationwide may not offer as many discounts as other insurers in Claymont, Delaware.

#3 – Amica: Best for Dividend Policies

Pros

- Dividend Policies: Amica’s dividend policies provide additional financial benefits for policyholders in Claymont, Delaware, potentially reducing overall costs.

- Customer Service Variability: Amica is known for high customer satisfaction, making it a trusted choice for auto insurance in Claymont, Delaware.

- Comprehensive Coverage: Amica offers comprehensive coverage options that cater well to various needs in Claymont, Delaware. For a complete list, read our Amica review.

Cons

- Restricted Local Reach: Amica might have a limited number of local agents or offices in Claymont, Delaware, potentially affecting the presence of in-person service.

- Higher Initial Premiums: The initial premiums with Amica might be higher compared to other insurers in Claymont, Delaware.

#4 – The Hartford: Best for AARP Members

Pros

- AARP Members: The Hartford offers special benefits for AARP members, making it a great option for qualifying Claymont, Delaware residents. Read more in our review of The Hartford.

- Good Reputation: Known for strong customer service and reliable coverage, The Hartford is a trusted name for auto insurance in Claymont, Delaware.

- Comprehensive Coverage Options: The Hartford provides a range of coverage options to suit different needs in Claymont, Delaware.

Cons

- Eligibility Restrictions: The Hartford’s benefits are mainly geared towards AARP members, which might limit options for non-member Claymont, Delaware residents.

- Higher Premiums for Non-Members: Premiums might be higher for those who do not qualify for the AARP discounts in Claymont, Delaware.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Potential Savings

Pros

- Potential Savings: Travelers offers potential savings through various discounts and policy options for Claymont, Delaware drivers.

- Broad Coverage Options: Travelers provides a wide range of coverage options, allowing Claymont, Delaware residents to tailor their policies to their needs.

- Strong Financial Stability: Travelers is known for its financial stability, ensuring reliable coverage for Claymont, Delaware drivers, which is covered in our Travelers review.

Cons

- Discount Complexity: The process to qualify for all potential discounts might be complex, which could be challenging for some Claymont, Delaware residents.

- Variability in Customer Support: The customer service experience with Travelers can differ, possibly influencing the satisfaction levels of policyholders in Claymont, Delaware.

#6 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot Program offers potential savings based on driving habits, which can benefit Claymont, Delaware drivers who are safe on the road.

- Adaptable Insurance Options: Progressive provides flexible coverage options that can be tailored to individual needs in Claymont, Delaware.

- Attractive Pricing: In Claymont, Delaware, you’ll often find Progressive delivering some of the most attractive auto insurance rates, which you can check out in our Progressive review.

Cons

- Privacy Concerns: The Snapshot Program involves tracking driving habits, which may raise privacy concerns for some Claymont, Delaware residents.

- Variable Savings: The savings from the Snapshot Program can vary significantly, potentially leading to unpredictable costs for Claymont, Delaware drivers.

#7 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Allstate’s Drivewise Program offers discounts based on driving behavior, potentially reducing costs for safe drivers in Claymont, Delaware.

- Comprehensive Coverage: Allstate provides a range of coverage options to suit various needs in Claymont, Delaware. Read our Allstate review to learn what else is offered.

- Local Agents: Allstate has a strong network of local agents in Claymont, Delaware, offering personalized service and support.

Cons

- Higher Rates for Some: While the Drivewise Program can lead to savings, some drivers in Claymont, Delaware may find initial rates higher.

- Discount Limitations: The savings from the Drivewise Program may not be substantial for all Claymont, Delaware drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Bundling Policies

Pros

- Policy Bundling: Liberty Mutual delivers savings by bundling auto with other policies, ideal for Claymont, DE residents with varied insurance needs.

- Tailored Insurance Options: Liberty Mutual provides customizable coverage options, allowing for tailored policies in Claymont, Delaware.

- Wide Range of Discounts: Liberty Mutual offers various discounts to help Claymont, Delaware drivers save on premiums, which you can read more about in our review of Liberty Mutual.

Cons

- Complex Discount Structure: The variety of discounts can make it difficult for Claymont, Delaware drivers to navigate and fully understand their savings.

- Customer Service Variability: Liberty Mutual’s customer service experience can vary, impacting the satisfaction of Claymont, Delaware policyholders.

#9 – Farmers: Best for Local Agents

Pros

- Local Representatives: Farmers delivers customized support via its network of local agents, which can be advantageous for Claymont, Delaware residents who prefer face-to-face interactions.

- Tailored Coverage: Farmers provides customized coverage options based on individual needs, making it a good fit for diverse requirements in Claymont, Delaware.

- Strong Community Presence: Farmers has a strong local presence in Claymont, Delaware, which can be beneficial for community-focused drivers. Discover our Farmers review for a full list.

Cons

- Potentially Higher Rates: In Claymont, Delaware, Farmers’ rates might be higher than those offered by some other insurers.

- Limited Online Tools: Farmers may have fewer online tools compared to other insurers, which could impact convenience for Claymont, Delaware residents.

#10 – Auto-Owners: Best for Financial Stability

Pros

- Economic Resilience: Auto-Owners stands out for its robust financial health, offering trustworthy coverage for motorists in Claymont, Delaware.

- All-Inclusive Protection: Residents of Cleveland, Texas can explore a diverse array of coverage choices with Auto-Owners. Learn more in our Auto-Owners review.

- Good Customer Service: Auto-Owners provides strong customer service, contributing to positive experiences for Claymont, Delaware policyholders.

Cons

- Increased Insurance Costs: In Claymont, Delaware, Auto-Owners’ premiums might be more elevated than those offered by other insurance providers.

- Restricted Discount Opportunities: Auto-Owners might offer fewer discounts compared to competitors, which could impact overall savings for Claymont, Delaware drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Discover the Best Monthly Auto Insurance Rates & Savings in Claymont, DE

Explore auto insurance rates and discounts in Claymont, DE, with our guide. Compare premiums and savings from top providers like Geico, Allstate, and Amica to find the best policy for your needs and budget.

Claymont, Delaware Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $73 $155

Amica $67 $148

Auto-Owners $69 $148

Farmers $76 $165

Geico $65 $140

Liberty Mutual $74 $160

Nationwide $68 $145

Progressive $72 $150

The Hartford $70 $150

Travelers $71 $148

Compare monthly auto insurance rates in Claymont, DE, with providers like Geico offering the lowest rates at $65 for minimum coverage and $140 for full coverage auto insurance; also explore competitive options from Allstate, Amica, Farmers, and more.

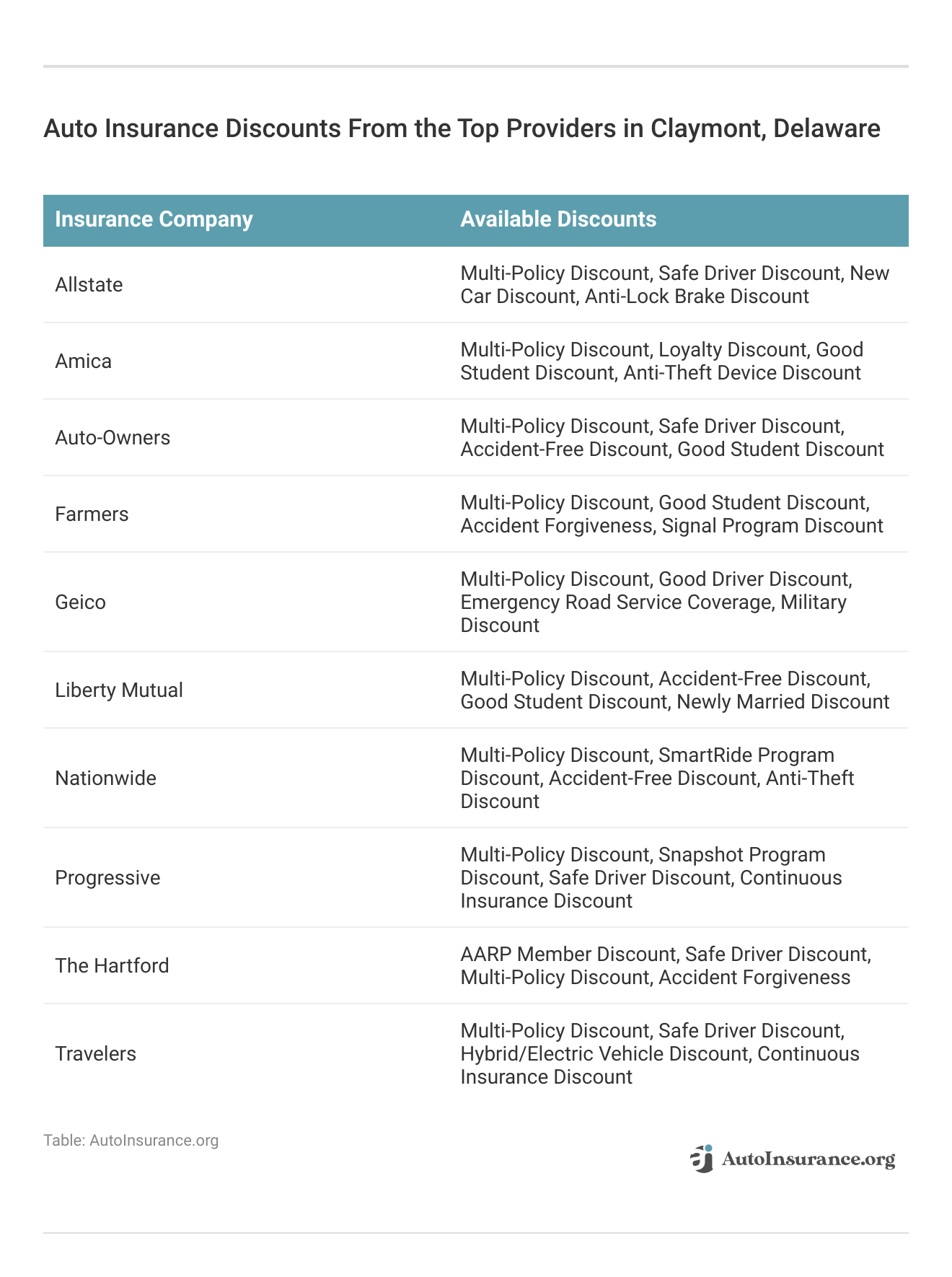

Explore the best auto insurance discounts from top providers in Claymont, Delaware. Our table highlights key discounts offered by leading insurers, including multi-policy savings, good driver rewards, and specialized discounts for new cars, students, and more.

Maximize savings with our Claymont, DE auto insurance comparison. Compare rates and discounts from top insurers to find the best coverage for your needs.

Navigating Claymont, Delaware’s Minimum Insurance Requirements

In Claymont, Delaware, state regulations stipulate that drivers must maintain a minimum level of auto insurance to ensure financial responsibility in case of an accident.

This required coverage includes liability insurance with defined limits: $25,000 per individual for bodily injury, $50,000 per accident for bodily injury, and at least $10,000 for property damage. Check out our ranking of the top providers: Cheapest Liability-Only Auto Insurance

Factors Influencing Auto Insurance Rates in Claymont, Delaware

Auto insurance rates in Claymont, Delaware, can vary significantly from those in other cities because of specific local factors such as traffic conditions and vehicle theft rates.

Geico offers the best overall value in Claymont with its low rates and extensive discounts, making it the top choice for affordable auto insurance.Justin Wright Licensed Insurance Agent

Claymont’s unique environment, including its traffic patterns and crime statistics, plays a crucial role in determining insurance premiums.

- Driving History: A clean driving record with no accidents or traffic violations typically results in lower insurance rates. Conversely, a history of accidents or violations can increase premiums.

- Vehicle Type: The make, model, and age of your vehicle can influence rates. High-performance or luxury vehicles often cost more to insure, while older or less expensive models may be cheaper.

- Coverage Levels: The amount and type of coverage you choose will impact your premium. Opting for higher coverage limits or additional coverage options can increase your rates.

- Location: The specific area where you live in Claymont can affect your rates. Areas with higher rates of accidents or theft might lead to higher premiums. For additional details, explore our comprehensive resource titled “Factors That Affect Auto Insurance Rates.”

- Credit Score: In many cases, a higher credit score can help lower your insurance rates, as insurers often use credit information to assess risk.

Auto insurance rates in Claymont are influenced by your driving history, vehicle type, coverage levels, location, and credit score. Understanding these factors can help you manage your premiums and ensure adequate coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Claymont Auto Insurance Insights: How Age, Gender, and Marital Status Shape Your Rates

In Claymont, DE, auto insurance rates vary based on age, gender, and provider. Comparing quotes is key to finding the best coverage for you. Explore our list of the leading providers: Cheap Auto Insurance for Teens After an Accident

Claymont, Delaware Auto Insurance Monthly Rates by Age, Gender & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $1,178 | $1,369 | $342 | $360 | $328 | $321 | $289 | $304 |

| Geico | $628 | $656 | $269 | $261 | $256 | $285 | $247 | $288 |

| Liberty Mutual | $2,557 | $3,873 | $1,149 | $1,592 | $1,149 | $1,149 | $1,135 | $1,135 |

| Nationwide | $738 | $935 | $343 | $366 | $309 | $306 | $282 | $280 |

| Progressive | $958 | $1,058 | $230 | $224 | $188 | $174 | $165 | $169 |

| State Farm | $756 | $976 | $295 | $307 | $263 | $263 | $243 | $243 |

| Travelers | $835 | $1,281 | $154 | $165 | $144 | $144 | $142 | $138 |

| USAA | $488 | $574 | $163 | $179 | $129 | $127 | $120 | $119 |

In Claymont, Delaware, auto insurance rates vary by age, gender, and provider. For example, a 17-year-old female might pay $1,178 with Allstate or $628 with Geico. Rates generally decrease with age, and USAA often offers the lowest premiums across all age groups.

Teen Driver Auto Insurance in Claymont: Tailored Coverage for Young Drivers in Delaware

Auto insurance rates for 17-year-old drivers in Claymont, Delaware, differ based on gender and insurance provider. Understanding these rates can help you make informed decisions and find the most cost-effective coverage for young drivers. To learn more, explore our comprehensive resource on insurance titled “Reasons Auto Insurance Costs More for Young Drivers.”

Claymont, Delaware Teen Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $1,178 | $1,369 |

| Geico | $628 | $656 |

| Liberty Mutual | $2,557 | $3,873 |

| Nationwide | $738 | $935 |

| Progressive | $958 | $1,058 |

| State Farm | $756 | $976 |

| Travelers | $835 | $1,281 |

| USAA | $488 | $574 |

In Claymont, Delaware, monthly auto insurance premiums for 17-year-olds differ depending on their gender and the insurance provider. For female drivers, rates range from $488 with USAA to $2,557 with Liberty Mutual. Male drivers face higher premiums, with rates from $628 with Geico to $3,873 with Liberty Mutual.

Premiums for 17-year-old drivers in Claymont vary by provider and gender, with rates ranging from affordable options like USAA to higher costs with Liberty Mutual. Comparing these rates can help find the best coverage for your needs.

Claymont Senior Auto Coverage: Tailored Insurance Solutions for Your Golden Years

This overview presents the monthly auto insurance rates for senior drivers, aged 60, in Claymont, Delaware. The rates are broken down by gender and insurance provider, highlighting how premiums can vary across different companies. See our list of the leading providers: Best Auto Insurance for Seniors in California

Claymont, Delaware Senior Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $289 | $304 |

| Geico | $247 | $288 |

| Liberty Mutual | $1,135 | $1,135 |

| Nationwide | $282 | $280 |

| Progressive | $165 | $169 |

| State Farm | $243 | $243 |

| Travelers | $142 | $138 |

| USAA | $120 | $119 |

This table shows the monthly auto insurance rates for senior drivers, age 60 in Claymont, Delaware, categorized by gender and insurance provider. Rates vary by company, with USAA offering the lowest rates for both female and male drivers, while Liberty Mutual has the highest.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Claymont Auto Insurance: Tailored Rates Based on Your Driving Record

Your driving history significantly influences your auto insurance premiums. Compare the yearly insurance rates for drivers with a poor record versus those with a clean driving history in Claymont, Delaware.

Claymont, Delaware Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $475 | $570 | $662 | $539 |

| Geico | $276 | $384 | $471 | $314 |

| Liberty Mutual | $1,374 | $1,579 | $2,510 | $1,407 |

| Nationwide | $354 | $354 | $651 | $419 |

| Progressive | $341 | $452 | $388 | $402 |

| State Farm | $378 | $458 | $418 | $418 |

| Travelers | $320 | $321 | $526 | $335 |

| USAA | $195 | $195 | $336 | $223 |

In Claymont, auto insurance rates range from $195 with USAA for a clean record to $2,510 with Liberty Mutual for a DUI. Comparing rates from providers like Geico and Progressive can help you find the best option. To delve deeper, refer to our in-depth report titled “How Auto Insurance Companies Check Driving Records.”

Navigating Auto Insurance Costs in Claymont, DE: What to Expect After a DUI

Finding cheap auto insurance after a DUI in Claymont, Delaware is not easy. Compare the annual rates for DUI auto insurance in Claymont, Delaware to find the best deal.

Claymont, Delaware DUI Auto Insurance Cost

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $662 |

| Geico | $471 |

| Liberty Mutual | $2,510 |

| Nationwide | $651 |

| Progressive | $388 |

| State Farm | $418 |

| Travelers | $526 |

| USAA | $336 |

In Claymont, Delaware, auto insurance rates can vary significantly after a DUI conviction. Monthly premiums range from $336 with USAA to $2,510 with Liberty Mutual. Other insurers, such as Geico, Progressive, and State Farm, offer rates between $388 and $662. For a thorough understanding, refer to our detailed analysis titled “Does a criminal record affect auto insurance rates?“

Claymont Auto Coverage: Tailored Rates Based on Your Credit Profile

Auto insurance rates in Claymont, Delaware can differ greatly depending on your credit history and the insurance provider. Understanding these variations can help you find the best rates available. Explore our list of the top-rated providers: Best Auto Insurance Companies That Don’t Use Credit Scores

Claymont, Delaware Auto Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| Allstate | $452 | $510 | $721 |

| Geico | $212 | $310 | $561 |

| Liberty Mutual | $1,261 | $1,565 | $2,327 |

| Nationwide | $389 | $428 | $517 |

| Progressive | $358 | $387 | $442 |

| State Farm | $261 | $352 | $640 |

| Travelers | $362 | $346 | $419 |

| USAA | $135 | $188 | $390 |

In Claymont, auto insurance rates vary widely by provider and credit history. For example, USAA offers rates from $135 to $390 based on credit, while Liberty Mutual ranges from $1,261 to $2,327. Geico and Progressive typically provide lower rates across credit levels.

In Claymont, comparing providers is crucial as rates vary significantly based on credit history. By examining options like USAA, Geico, and Liberty Mutual, you can secure the most affordable insurance for your situation.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Claymont Commute: Discover Unique Auto Insurance Rates in Delaware

Auto insurance rates in Claymont, Delaware, differ by provider and mileage. Understanding these variations can help you choose the best coverage for your driving habits.

Claymont, Delaware Auto Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $561 | $561 |

| Geico | $356 | $367 |

| Liberty Mutual | $1,670 | $1,765 |

| Nationwide | $445 | $445 |

| Progressive | $396 | $396 |

| State Farm | $404 | $432 |

| Travelers | $376 | $376 |

| USAA | $235 | $240 |

In Claymont, Delaware, auto insurance monthly rates vary by provider and mileage. For 6,000 miles, rates range from $235 with USAA to $1,670 with Liberty Mutual, and for 12,000 miles, they range from $240 with USAA to $1,765 with Liberty Mutual. To expand your knowledge, refer to our comprehensive handbook titled “What is the average auto insurance cost per month?“

Monthly auto insurance rates for 6,000 to 12,000 miles in Claymont range from $235 with USAA to $1,765 with Liberty Mutual. Reviewing these rates can guide you in finding the most cost-effective option for your needs.

Explore the Best Auto Insurance Quotes in Claymont, DE

In Claymont, Delaware, the best auto insurance companies such as Geico, Nationwide, and Amica offer rates starting at $65 per month, known for their extensive discounts and reliable coverage.

The minimum required auto insurance coverage in Claymont is 25/50/10, and rates can be influenced by factors such as age, driving record, and credit history. For the best deals, it’s recommended to compare quotes from multiple insurers.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code below into our comparison tool today.

Frequently Asked Questions

What are the minimum auto insurance requirements in Claymont, Delaware?

The minimum required coverage in Claymont is 25/50/10. This means $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage.

How can I find the cheapest auto insurance in Delaware?

To find the cheapest auto insurance in Delaware, compare quotes from multiple providers. Use online comparison tools to see which companies offer the best rates based on your specific details.

Enter your ZIP code below to get personalized insurance quotes tailored to your needs and budget.

What factors affect auto insurance rates in Claymont?

Rates in Claymont can be influenced by factors such as your driving record, age, gender, marital status, credit history, ZIP code, and the length of your commute.

For a comprehensive overview, explore our detailed resource titled “Auto Insurance Rates for Married vs. Single Drivers.”

Are there any specific discounts available for auto insurance in Claymont?

Yes, many insurers offer discounts for safe driving, bundling policies, having anti-theft devices, and more. Check with individual providers for specific discount opportunities.

How do I get an auto insurance quote in Claymont?

To get a quote, you can use online comparison tools by entering your ZIP code. You can also contact insurance providers directly or visit their websites for personalized quotes.

What are the top private auto insurance companies near Claymont?

Some top private auto insurance companies in and around Claymont include Geico, Nationwide, Amica, and Allstate. These companies are known for their competitive rates and reliable coverage.

To enhance your understanding, explore our comprehensive resource on insurance titled “What are the recommended auto insurance coverage levels?“

How does my credit history affect my auto insurance rates in Claymont?

In Claymont, a poor credit history can lead to higher insurance rates, while a good credit history can help you secure lower premiums. Insurers often use credit scores as a factor in determining rates.

What is the difference between full coverage and minimum coverage in auto insurance?

Full coverage includes liability insurance, collision, and comprehensive coverage, protecting you from various types of damage. Minimum coverage only meets the state’s legal requirements and typically offers less protection.

Can I get cheap auto insurance if I have a DUI on my record?

Yes, but rates will likely be higher. Shopping around and comparing quotes from different insurers can help you find the best rate despite having a DUI on your record.

Discover our list of the leading insurance providers: Best States for Affordable DUI Auto Insurance

How can I find the best vehicle insurance in Claymont?

To find the best vehicle insurance, compare coverage options, rates, and discounts from multiple providers. Consider factors like customer service, claims handling, and coverage types to determine which insurer offers the best value for your needs.

Don’t let expensive insurance rates hold you back. Enter your ZIP code below and shop for affordable premiums from the top companies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.