Best North Dakota Auto Insurance in 2026 (Find the Top 10 Companies Here!)

The best North Dakota auto insurance rates offer as low as $21 per month with top providers like State Farm, Progressive, and Nationwide. These companies excel due to tailored coverage options that meet North Dakota car insurance requirements, ensuring comprehensive protection and affordability.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Leslie Kasperowicz

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated January 2025

Company Facts

Full Coverage for North Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for North Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for North Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

The best North Dakota auto insurance rates, starting at $21 per month, are offered by industry leaders State Farm, Progressive, and Nationwide. Keep reading to learn more about North Dakota car insurance requirements and find the best car insurance in North Dakota that meets your needs.

North Dakota auto insurance is fairly inexpensive unless drivers have less-than-perfect driving records. The best way to find cheap car insurance in North Dakota is to compare company rates. You can also look for discounts, raise your auto insurance deductible, and follow other savings tips to reduce your North Dakota auto insurance rates.

Our Top 10 Company Picks: Best North Dakota Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 17% B Many Discounts State Farm

#2 10% A+ Customer Service Progressive

#3 20% A+ SmartRide Program Nationwide

#4 10% A++ Add-on Coverages USAA

#5 25% A+ Usage Discount Allstate

#6 25% A++ Cheap Rates Geico

#7 25% A Accident Forgiveness American Family

#8 13% A++ Student Savings Travelers

#9 25% A Local Agents Liberty Mutual

#10 20% A Customizable Polices Farmers

Stop overpaying for auto insurance. Enter your ZIP code above to find out if you can get a better deal.

- North Dakota Auto Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheap Auto Insurance in North Dakota

The first step to finding cheap auto insurance in North Dakota is comparing company rates. Companies offer different rates to different drivers, so it’s important to find and compare the best auto insurance quotes in your area rather than using a friend’s recommendation.

North Dakota Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$38 $136

$40 $145

$30 $107

$17 $61

$110 $398

$21 $77

$31 $110

![]()

$21 $76

$24 $88

$12 $44

For example, a cheap company for most drivers may be the most expensive for DUI drivers. Read on for a full breakdown of cheap companies by major driving incidents to find the cheapest company in North Dakota.

Cheapest North Dakota Auto Insurance Companies for Minimum Coverage

North Dakota drivers must legally carry minimum liability auto insurance to drive. If you’re curious about what liability auto insurance is, you’re not alone.

If you cause an accident, minimum liability insurance pays for the other parties’ accident costs, such as medical and car repair bills. Driving without minimum liability insurance can result in fines, loss of driving privileges, and other penalties.

However, just because North Dakota requires minimum liability insurance doesn’t mean you have to pay a lot for it. The average cost of minimum liability insurance in North Dakota is $37 monthly. Some insurance companies may fall below or above this average, as shown in the table below.

North Dakota Minimum Coverage Auto Insurance Average Rates From Top Providers

| Insurance Company | Monthly Rates |

|---|---|

| $38 | |

| $40 | |

| $30 | |

| $17 | |

| $110 |

| $21 |

| $31 | |

| $21 | |

| $24 | |

| $12 | |

| U.S. Average | $45 |

Some cheaper companies to get quotes from include State Farm, Geico, Nationwide, and Travelers. Companies on the more expensive side include Allstate and Progressive (you can read our Allstate Auto Insurance Review and Progressive Auto Insurance Review for more information).

We recommend getting quotes from the cheapest companies on the list, like State Farm, since saving money on required coverage leaves more funds to buy additional coverage.

Learn More: State Farm Auto Insurance Review

Cheapest North Dakota Auto Insurance Companies for Full Coverage

North Dakota doesn’t require full coverage insurance, but it provides better protection than just minimum liability insurance. Regardless of fault, full coverage auto insurance pays for your own car repairs, so you don’t have to pay out of pocket. So while it costs more, we recommend carrying full coverage insurance as it more than pays itself off after an accident.

In addition, you could find savings on a full coverage insurance policy by getting quotes from one of the companies listed below.

North Dakota Full Coverage Auto Insurance Average Rates From Top Providers

| Insurance Company | Monthly Rates |

|---|---|

| $136 | |

| $145 | |

| $107 | |

| $61 | |

| $398 |

| $77 |

| $110 | |

| $76 | |

| $88 | |

| $44 | |

| U.S. Average | $119 |

On average, full coverage insurance in North Dakota costs $133 per month. However, companies that generally fall below this average include State Farm and Travelers. Companies that cost more than the state average are Allstate and Progressive.

Cheapest North Dakota Auto Insurance Companies for Young Drivers

Regardless of the state you live in, auto insurance for teens and young drivers is the most expensive out of all types of drivers. Inexperience makes drivers more likely to crash, meaning they’re also more likely to file a claim.

Due to the higher likelihood of an expensive claim, insurance companies charge younger drivers more. However, some companies are significantly cheaper than others in North Dakota, as seen in the table below.

North Dakota Full Coverage Auto Insurance Monthly Rates for Teens

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $647 | $685 | $477 | $557 | |

| $376 | $495 | $277 | $402 | |

| $657 | $609 | $484 | $495 | |

| $218 | $258 | $161 | $209 | |

| $158 | $160 | $116 | $130 |

| $266 | $307 | $196 | $250 |

| $815 | $831 | $601 | $676 | |

| $269 | $307 | $198 | $250 | |

| $641 | $811 | $472 | $659 | |

| $203 | $222 | $149 | $181 | |

| U.S. Average | $566 | $618 | $416 | $501 |

If you’re a young driver, some better insurance companies are Geico and State Farm. Companies like Allstate and Progressive cost thousands more than these cheaper companies, making them poor choices for young drivers purchasing their own auto insurance policies. To find the best auto insurance for teens and young drivers, you must find and compare quotes from multiple providers in your area.

It’s important to note that it’s much cheaper for young drivers to join a parent’s existing auto insurance policy rather than purchasing their own. So, young drivers can join a parent’s policy if they still live at home. They may also stay on the parent’s policy when they leave for school if they don’t take one of the family cars with them.

Cheapest North Dakota Auto Insurance Companies for Drivers With Poor Credit Scores

A poor credit score increases rates at most insurance companies. To insurers, a poor credit score indicates a driver is more likely to miss payments, making them riskier to insure. Missed payments are also a big deal for the driver, as they risk being dropped by the insurance company and driving illegally without insurance.

North Dakota Full Coverage Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $162 | $180 | $200 | |

| $89 | $104 | $123 | |

| $134 | $150 | $170 | |

| $98 | $115 | $130 | |

| $124 | $140 | $155 |

| $125 | $145 | $160 |

| $134 | $150 | $165 | |

| $93 | $105 | $120 | |

| $105 | $121 | $140 | |

| $87 | $100 | $120 |

Learn More: Best Auto Insurance Companies That Use Credit Scores

However, increased auto insurance rates don’t help you get your credit score back on track if you have poor credit. The good news is that not all auto insurance companies charge the same for drivers with poor credit scores.

Companies like American Family or Liberty Mutual will likely charge you the highest rates if you have a poor credit score. Instead of these companies, you should look at companies like State Farm for cheaper auto insurance rates based on your credit score. Of course, improving your credit score will go a long way to lowering your auto insurance rates over time.

Cheapest North Dakota Auto Insurance Companies for Drivers With Traffic Tickets

Traffic tickets are another reason insurance companies raise drivers’ rates. Any moving violation indicates a driver is more likely to practice poor driving habits and get into an accident. Some violations that raise rates include speeding, improper passing, careless driving, and failure to stop.

Luckily, tickets for expired registration or parking won’t affect your auto insurance rates since they’re non-moving violations.

If you have one or more traffic tickets on your driving record, you’ve likely noticed your insurance rates increase. Look at the average rates below to see if a different North Dakota insurance company offers a cheaper car insurance rate.

North Dakota Full Coverage Auto Insurance Monthly Rates: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $153 | $136 | |

| $174 | $145 | |

| $138 | $107 | |

| $130 | $61 | |

| $478 | $398 |

| $91 | $77 |

| $134 | $110 | |

| $82 | $76 | |

| $120 | $88 | |

| $52 | $44 | |

| U.S. Average | $147 | $119 |

Some of the better auto insurance companies for drivers with traffic tickets are State Farm, Nationwide, and Travelers. Companies that charge more include Liberty Mutual and Allstate, so if you’re with one of the more expensive companies when you get a ticket, consider switching to a cheaper one.

Learn More about the best auto insurance companies for drivers with speeding tickets.

Cheapest North Dakota Auto Insurance Companies for Drivers With At-Fault Accidents

Like traffic tickets, at-fault accidents raise drivers’ auto insurance rates. The amount your rates increase after an accident depends on your car insurance company. Below, you can see average rates for North Dakota drivers with an at-fault accident.

North Dakota Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $153 | $136 | |

| $216 | $145 | |

| $148 | $107 | |

| $130 | $61 | |

| $473 | $398 |

| $128 | $77 |

| $167 | $110 | |

| $88 | $76 | |

| $124 | $88 | |

| $60 | $44 | |

| U.S. Average | $173 | $119 |

State Farm is one of the cheaper car insurance companies for drivers with an at-fault accident on their record. Companies to avoid, as they have much higher auto insurance rates, include Liberty Mutual and Progressive.

One tip for saving on car insurance rates before you get into an at-fault accident is to look for a company with an accident forgiveness perk. With accident forgiveness, your rates won’t increase after your first at-fault accident at a company. You may have to pay extra to join the accident-forgiveness plan, or you may just have to be accident-free for a few years at the same company to qualify.

Cheapest North Dakota Auto Insurance Companies for Drivers With DUIs

Drivers with DUIs can expect their car insurance rates to increase substantially. Rates may increase by hundreds of dollars annually, if not more, after a DUI. So if you have a DUI on your record, it’s important to shop around for the best auto insurance for drivers with a DUI.

State Farm is a good choice for drivers with DUIs, though they should avoid Liberty Mutual and Allstate.

In addition, while Progressive is normally one of the most expensive companies for most drivers, it has some of the better rates for drivers with DUIs. This example shows how important it is to consider companies based on rates for different driving records rather than average rates for most drivers.

Cheapest North Dakota Auto Insurance Cities

Where you live in North Dakota impacts how much you pay for auto insurance. Insurance companies look at the following factors in your area to determine how much to charge you for auto insurance:

- Crashes: Some areas have higher crashes due to difficult intersections, more wildlife, and other location factors.

- Crime: Some areas have higher levels of vandalism and stolen vehicles than others.

- Traffic: Some areas have more traffic, increasing the risk of getting into an accident with another driver.

- Weather: Some areas have more extreme weather, making driving more dangerous and increasing the risk of crashing.

Below, we’ve listed average auto insurance rates for different cities in North Dakota so you can see how rates change as you move around the state, from car insurance in Fargo, ND, to car insurance in Minot, ND.

The average Fargo car insurance rates show it’s one of the cheaper cities for car insurance. However, you could save beyond the average rates for auto insurance by getting quotes from different companies in Fargo, ND.

Anytime you move to a new area, we recommend you get a few car insurance quotes in North Dakota from different companies. Even if your insurer is the cheapest for you currently, a different auto insurance company may be cheaper after you move.

Explore the Cost of Auto Insurance in Your City

Discover the local landscape of auto insurance costs with our breakdown for Bismarck and Fargo, ND. Compare average rates to gauge potential savings and ensure you’re getting the best deal in your city.

North Dakota Auto Insurance Cost by City

Understanding the cost of auto insurance in Bismarck and Fargo helps you make informed decisions to secure the best coverage at competitive rates.

Other Ways to Save on North Dakota Auto Insurance Coverage

While shopping for the cheapest rates based on your driving profile is the best way to find savings, there are other things you can do. See our best tips for finding savings on ND car insurance below.

- Apply for Discounts at Your Insurance Company: Sometimes insurance companies offer auto insurance discounts you must request to apply the discount to your rates, like a defensive driving discount.

- Choose Cheaper Cars to Insure: Picking a cheaper car to insure will help lower your rates. Look for cars with good safety ratings and parts that are easy and cheap to replace.

- Drive Safely and Keep a Clean Driving Record: Keeping a clean driving record helps reduce your auto insurance rates.

- Get rid of any Unnecessary Insurance Coverages: Eliminating extra coverages like rental car reimbursement will lower your rates. You can also drop full coverage and only carry liability if your car is older and no longer worth much.

- Raise Your Insurance Deductible: You can raise your auto insurance deductibles to lower your auto insurance rates, though you should never raise it beyond an amount you can’t pay out of pocket.

- Non-Owner Car Insurance: If you travel to North Dakota and borrowing car insurance, consider adding non-owner car insurance to your policy. This can help cover any liability costs in case of an accident while driving a car that you don’t own.

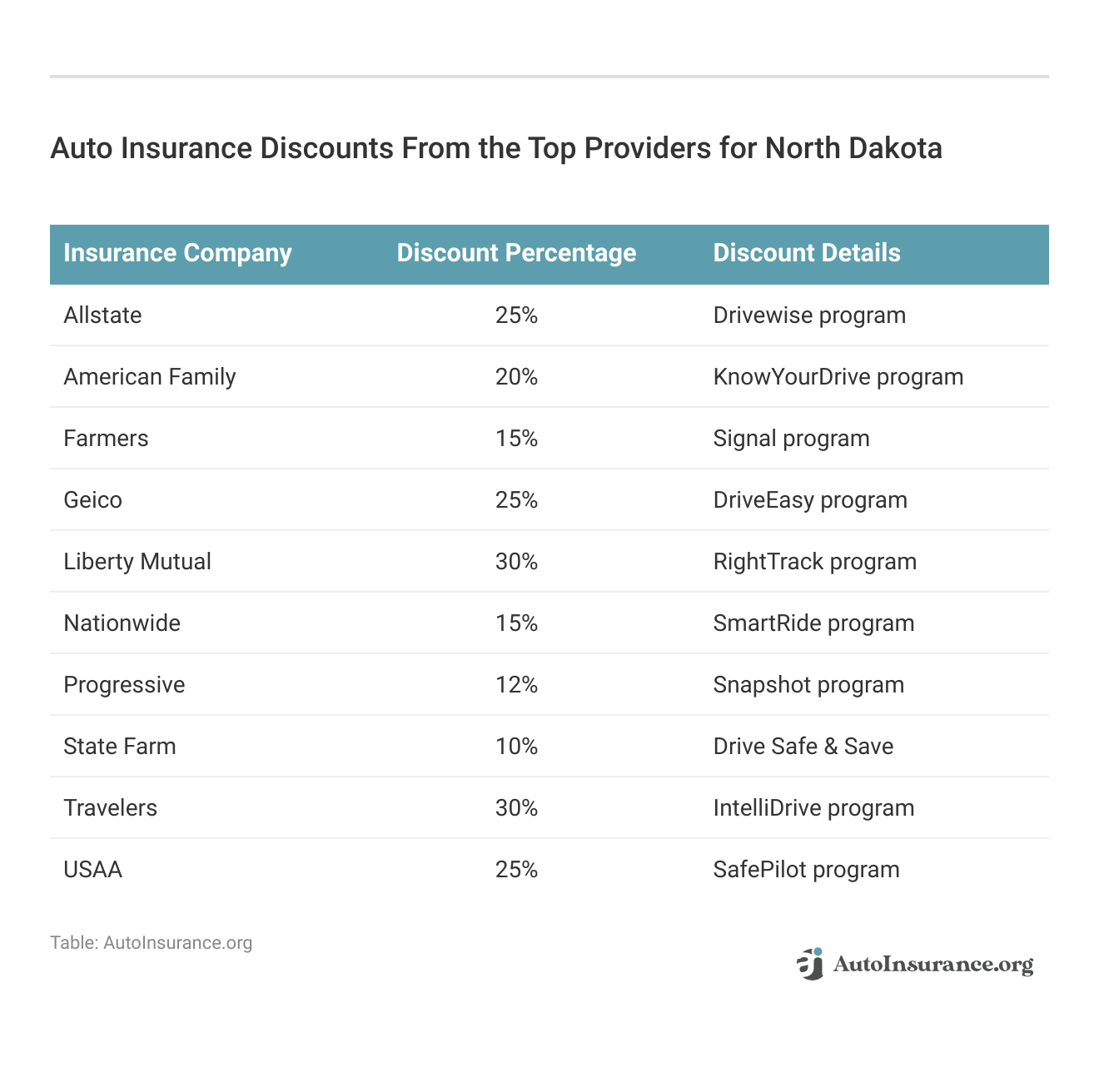

Here’s an exclusive auto insurance discounts offered by leading providers in North Dakota:

Compare discount percentages and program details to maximize savings on your car insurance premiums. Follow the tips above and shop around to reduce your auto insurance rates further.

North Dakota Auto Insurance Laws

North Dakota car insurance laws affect how much you’ll pay for auto insurance since states requiring drivers to carry more coverage will naturally see higher rates. DUI penalties are also relevant to auto insurance costs because your rates will increase after a DUI, along with the additional financial repercussions issued by North Dakota.

North Dakota Auto Insurance Requirements

All North Dakota drivers must carry bodily injury liability insurance, property damage liability insurance, uninsured motorist insurance, underinsured motorist insurance, and personal injury protection. North Dakota’s requirements are higher than most states, so drivers will spend more to meet the state’s insurance requirements.

The required auto insurance limit amounts are listed below:

- Bodily Injury Liability Limit: $25,000 per person and $50,000 per accident

- Property Damage Liability Limit: $25,000 per accident

- Uninsured Motorist Limit: $25,000 per person and $50,000 per accident

- Underinsured Motorist Limit: $25,000 per person and $50,000 per accident

- Personal Injury Protection: $30,000 per person

Mandatory bodily injury liability insurance in North Dakota ensures that drivers are financially responsible for any injuries they cause to others in an accident. You must carry the above auto insurance coverages and minimum limits to drive in North Dakota.

Optional Auto Insurance in North Dakota

Besides the auto insurance coverages in the previous section, all other coverages are optional in North Dakota. One exception is if you have a car lease or loan — your lender will likely require you to carry collision and comprehensive insurance in your contract.

However, in all other cases, you can choose whether you want the following auto insurance coverages:

- Collision auto insurance

- Comprehensive auto insurance

- Gap insurance

- Modified car insurance

- New car insurance

- Rental car reimbursement coverage

- Roadside assistance coverage

- Umbrella insurance

Not all car insurance companies offer the above coverages, such as rental car reimbursement. However, all car insurance companies should offer collision and comprehensive insurance since entities besides the state may require them.

Though these coverages aren’t required, we recommend carrying them both for a full coverage insurance policy.

Though optional, collision and comprehensive insurance provide crucial protection beyond state requirements, ensuring peace of mind for drivers facing unexpected vehicle damage.Brad Larson LICENSED INSURANCE AGENT

Collision insurance pays for your accident costs if you crash into another car or an object like a fence. On the other hand, comprehensive insurance pays for your accident costs if you crash into an animal or your vehicle gets damaged by falling objects, vandalism, or weather.

North Dakota DUI Auto Insurance Penalties

The penalties for a DUI conviction in North Dakota are steep. You may face all or some of the following penalties depending on the severity and amount of DUIs.

For example, you may not face jail time for a first DUI, but you must spend a few months in jail for a second DUI. The possible penalties you might face include the following:

- Addiction Evaluation

- Fines

- Imprisonment

- License Suspension

- Probation

- Sobriety Treatment Program

- Sr-22 Certificates

In addition to the penalties listed above, DUI drivers will also pay much higher auto insurance rates than before their DUI. Rates may increase by hundreds of dollars per year after a DUI or even well over a thousand dollars.

North Dakota SR-22 Auto Insurance Certificates

An SR-22 certificate simply proves that a driver abides by North Dakota’s insurance laws and carries the required coverages. Drivers considered high-risk must get SR-22 certificates to get back a suspended license. While multiple companies may be willing to offer you the necessary coverage, it could be difficult to find affordable SR-22 auto insurance.

Some reasons drivers might need an SR-22 certificate include driving impaired, driving with a suspended/expired license, driving without auto insurance, and similar offenses. To get an SR-22 certificate, you must contact your auto insurance company.

If an insurance provider considers you high-risk, you will pay high premiums💰. You might have a hard time finding 🔎coverage. https://t.co/27f1xf131D has the information you need to lower your costs as much as possible. Check it out here👉: https://t.co/J52mqqaRQj pic.twitter.com/N2kOV5uYXY

— AutoInsurance.org (@AutoInsurance) September 27, 2023

If you don’t own a car and don’t have insurance, you’ll need to purchase a non-owner SR-22 auto insurance policy.

Your insurance company may charge a small fee for filing the SR-22 paperwork. Additionally, the company may drop you as a customer if you’re an extremely high-risk driver, though companies must first give you notice.

If this is the case, you’ll have to find a new insurance company as fast as possible to avoid an insurance coverage lapse. When applying to new insurance companies, you must tell them you need SR-22 insurance. Otherwise, you risk getting dropped if the insurance company finds out you lied.

North Dakota Automobile Insurance Plan

If you’re a high-risk driver and can’t find a company willing to insure you, your only option is the North Dakota Automobile Insurance Plan, or NDAIP. Insurance through the NDAIP is more expensive, but it’s guaranteed insurance if you can’t find anyone willing to insure you.

To be eligible for NDAIP insurance coverage, you must meet the following requirements:

- Be a resident of North Dakota.

- Have your vehicle registered in North Dakota.

- Have a valid North Dakota driver’s license.

- Have zero unpaid auto insurance bills within the last 12 months.

So if you find yourself running out of insurance options, you could get your auto insurance through the NDAIP. However, once your driving record improves, you should apply to other companies to see if you can get cheaper rates.

How to Contact the North Dakota Automobile Insurance Plan

If you need to get insurance through the NDAIP, you can contact the department for assistance in a few different ways:

- Email: [email protected]

- Phone: (888) 706-6100

- Fax: (800) 827-6260

- Address: Central Region

P.O. Box 6530

Providence, Rhode Island 02940-6530

Remember, only reach out to the NDAIP if you can’t get auto insurance coverage through normal companies, as insurance through the NDAIP is usually much more expensive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

More About how to Buy a Cheap Auto Insurance Policy in North Dakota

North Dakota requires drivers to carry more auto insurance coverage than most states, meaning most drivers will pay a little more to drive legally. However, drivers can still find affordable auto insurance policies by looking at company rates based on major driving factors.

If you’re ready to start finding savings on car insurance in North Dakota, enter your ZIP code into our free quote comparison tool below. It will help you find the best North Dakota auto insurance company in your area based on your personal driving record and more.

Frequently Asked Questions

How much is car insurance in North Dakota?

If you’re purchasing a minimum liability insurance policy, the average auto insurance cost in North Dakota is $37 monthly. On the other hand, a full coverage insurance policy in North Dakota costs $133 per month on average.

What is the cheapest car insurance in North Dakota?

The cheapest company depends on the individual driver’s record and coverage needs. However, a good starting point for cheap auto insurance rates in North Dakota includes companies like State Farm and Geico. In most cases, drivers should avoid companies like Allstate or Progressive.

What can a driver do to lower their insurance rates?

There are several things a driver can do to lower their North Dakota insurance rates. Some of the most common include raising an insurance deductible, dropping coverages, and applying for discounts. Also, keeping a clean driving record goes a long way to reducing a driver’s ND auto insurance rates.

Is insurance mandatory in North Dakota?

The minimum auto insurance requirements in North Dakota are as follows:

- $25,000 Bodily Injury Liability Coverage per Person

- $50,000 Bodily Injury Liability Coverage per Accident

- $25,000 Property Damage Liability Coverage per Accident

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Are there any additional optional coverages that I can consider?

Yes, there are several optional coverages you can consider to enhance your auto insurance policy in North Dakota. These include:

- Collision Coverage: Pays for damage to your vehicle caused by a collision with another vehicle or object.

- Comprehensive Coverage: Covers damage to your vehicle caused by incidents other than collisions, such as theft, vandalism, fire, or natural disasters.

- Medical Payments Coverage: Provides coverage for medical expenses resulting from an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Uninsured motorist (UM) coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage.

Can my auto insurance rates increase if I file a claim?

It is possible for your North Dakota auto insurance rates to increase if you file a claim, especially if you’re found at fault for an accident. However, the specific impact on your rates can vary depending on your insurance provider and the circumstances of the claim.

Are there any discounts available for auto insurance in North Dakota?

Yes, there are various discounts available that can help you save on auto insurance in North Dakota. Common discounts include safe driver discounts, multi-policy discounts (if you have multiple policies with the same insurer), good student discounts, and discounts for completing defensive driving courses. It’s best to check with your insurance provider to see which discounts you may qualify for.

Is it illegal to drive without auto insurance in North Dakota?

Yes, if you are a North Dakota resident you must meet North Dakota’s auto insurance requirements to drive legally.

Is North Dakota a no-fault state?

Yes, North Dakota is a no-fault auto insurance state.

What is PIP auto insurance in North Dakota?

North Dakota PIP auto insurance is coverage that pays for you and your passenger’s medical bills if you are injured in an accident.

Is auto insurance more expensive in North Dakota?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.