Best New Mexico Auto Insurance in 2026 (Find the Top 10 Companies Here!)

State Farm, Geico, and Progressive lead as the best New Mexico auto insurance providers, starting at just $23 a month. Explore why these companies excel in coverage and value, and how they meet diverse driver needs in our comprehensive guide to the best New Mexico auto insurance options.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Dorothea Hudson has been professionally writing in many spheres since 2013. She has written on entertainment, insurance, finance, travel, technology, AI, renewable energy, crypto, fundraising, and real estate for many websites. Her work has been published for British retailer Marks and Spencer, Kroger Magazine, the Vision Group, and more. Her passions include writing, music, running, travel, te...

Dorothea Hudson

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated January 2025

Company Facts

Full Coverage for New Mexico

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for New Mexico

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for New Mexico

A.M. Best Rating

Complaint Level

Pros & Cons

The best New Mexico auto insurance providers are State Farm, Geico, and Progressive, which are known for their exceptional service and coverage options.

These companies lead the market with their comprehensive policies that cater to a wide range of driver needs across the state. See more details in our guide titled “Best Auto Insurance Companies.”

Our Top 10 Company Picks: Best New Mexico Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 17% B Comprehensive Coverage State Farm

![]()

#2 15% A++ Many Discounts Geico

![]()

#3 14% A+ Competitive Rates Progressive

#4 13% A+ Local Agents Allstate

#5 12% A+ Customizable Policies Farmers

#6 16% A++ Customer Service USAA

#7 11% A+ Safe-Driving Discounts Nationwide

#8 10% A Flexible Coverage Liberty Mutual

#9 9% A+ Excellent Coverage The Hartford

#10 9% A++ Affordable Premiums Travelers

Whether you need basic liability or full coverage, these insurers offer dependable protection and customer satisfaction. Our guide delves into why these providers stand out, ensuring you make the most informed choice for your auto insurance needs.

Explore your auto insurance options by entering your ZIP code into our free comparison tool above today.

- State Farm leads as the top choice for Best New Mexico Auto Insurance

- Coverage options cater to diverse driver profiles and needs in New Mexico

- Policies are designed for optimal value and customer satisfaction statewide

- New Mexico Auto Insurance

- Best Santa Fe, New Mexico Auto Insurance in 2026 (Compare the Top 10 Companies)

- Best Roswell, New Mexico Auto Insurance in 2026

- Best Las Cruces, New Mexico Auto Insurance in 2026

- Best Belen, New Mexico Auto Insurance in 2026 (Top 10 Companies Ranked)

- Best Aztec, New Mexico Auto Insurance in 2026 (Find the Top 10 Companies Here)

- Best Albuquerque, New Mexico Auto Insurance in 2026 (Top 10 Companies Ranked)

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage. Discover insights in our guide titled State Farm auto insurance review.

- Wide Coverage: State Farm offers a variety of coverage options tailored to different business needs.

Cons

- Limited Multi-Policy Discount: The multi-policy discount at State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Discount Diversity

Pros

- Extensive Discounts: Geico offers a wide range of discounts including those for military personnel, safe drivers, and more.

- High Customer Satisfaction: Known for excellent customer service and quick claims processing. Learn more by reading our guide titled “Geico Auto Insurance Review.”

- Technology Driven: Utilizes technology to enhance user experience, such as through their mobile app.

Cons

- Coverage Options: While offering many discounts, some niche coverage options are less comprehensive than competitors.

- Price Variability: Prices can vary significantly based on the driver’s profile and location.

#3 – Progressive: Best for Competitive Rates

Pros

- Competitive Pricing: Progressive is known for offering competitive rates, especially for high-risk drivers.

- Name Your Price Tool: This unique tool allows customers to tailor plans to their budget. Delve into our evaluation of Progressive auto insurance review.

- Loyalty Rewards: Offers loyalty rewards such as lower deductibles and small accident forgiveness over time.

Cons

- Customer Service Variability: Some customers report variability in the quality of customer service.

- Claim Resolution Speed: Some reports of slower claim resolution compared to industry leaders.

#4 – Allstate: Best for Local Agent

Pros

- Strong Local Presence: Allstate’s network of local agents provides personalized service. Access comprehensive insights into our guide titled Allstate auto insurance review.

- Innovative Tools: Offers tools like Drivewise to monitor driving and provide feedback for safer driving habits.

- Variety of Discounts: Provides multiple discounts, including new car and multiple policy discounts.

Cons

- Higher Rates for Some Drivers: Rates can be higher for drivers with less-than-perfect driving records.

- Complex Policy Options: Some customers find their policy options complex and difficult to customize.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Customizable Policy

Pros

- Customizable Policies: Farmers offers highly customizable policies that can be tailored to specific needs.

- Dedicated Agents: Provides personalized customer service through a network of dedicated agents.

- Disaster Response: Known for quick and effective disaster response capabilities. More information is available about this provider in our Farmers auto insurance review.

Cons

- Cost: Premiums can be higher, especially for customized or comprehensive coverage.

- Limited Discounts: Fewer discount opportunities compared to other major insurers.

#6 – USAA: Best for Customer Service

Pros

- Top-Rated Customer Service: Consistently receives high marks for customer satisfaction and service quality.

- Competitive Rates for Military: Offers some of the best rates, particularly for military members and their families.

- Comprehensive Coverage: Includes benefits like accident forgiveness and free roadside assistance. Unlock details in our guide titled USAA auto insurance review.

Cons

- Eligibility Restrictions: Only available to military members, veterans, and their families, limiting accessibility for the general public.

- Limited Physical Locations: Fewer physical locations which might affect those preferring in-person service.

#7 – Nationwide: Best for Safe-Driving Discounts

Pros

- Safe Driving Benefits: Rewards safe driving through its SmartRide program, offering substantial discounts.

- Wide Range of Products: Offers a broad array of insurance products beyond auto, allowing for convenient bundling.

- Financial Stability: Highly rated for financial strength, ensuring reliability in claims processing. Read up on the Nationwide auto insurance review for more information.

Cons

- Variable Customer Service: Customer service quality can vary widely depending on the region.

- Pricing Inconsistencies: Some customers report inconsistencies in pricing at renewal, impacting budget planning.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Flexible Coverage

Pros

- Tailored Coverage Options: Provides flexible coverage options that can be adjusted to meet individual needs.

- Accident Forgiveness: Offers accident forgiveness policies, preventing premium increases after a first accident.

- Global Reach: Extensive global presence, which is beneficial for customers who travel or move internationally. Discover more about offerings in our complete Liberty Mutual auto insurance review.

Cons

- Higher Premiums: Tends to have higher premiums compared to other insurers.

- Customer Service Complaints: Some users report dissatisfaction with claim handling and customer service responsiveness.

#9 – The Hartford: Best for Excellent Coverage

Pros

- Specialized Plans for Older Drivers: Offers tailored plans that cater specifically to the needs of older drivers.

- Bundling Options: Significant discounts for customers who bundle home and auto insurance. Learn more in our complete The Hartford auto insurance review.

- High Customer Loyalty: Known for high customer retention rates due to satisfactory coverage and service.

Cons

- Higher Costs for Younger Drivers: Generally, premiums are higher for younger drivers compared to other insurers.

- Limited Availability: Some of their specialized programs, like those for older drivers, are not as widely available.

#10 – Travelers: Best for Affordable Premiums

Pros

- Competitive Pricing: Known for offering affordable premiums across a wide range of coverage options. See more details in our guide titled “Travelers Auto Insurance Review.”

- Extensive Discount Opportunities: Offers multiple discounts, including for hybrid/electric vehicles and safe driving.

- Robust Coverage Options: Provides a variety of comprehensive coverage options, allowing for thorough customization.

Cons

- Customer Service Variability: Some customers report inconsistent experiences with customer service.

- Complex Claims Process: The claims process can be complex and time-consuming, according to some customer reviews.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparison of Monthly Auto Insurance Rates in New Mexico

Understanding the monthly rates for auto insurance in New Mexico can help you choose the right provider based on your budget and coverage needs. Below is a detailed overview of how each company’s rates stack up for both minimum and full coverage.

New Mexico Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $56 $158

Farmers $46 $131

Geico $32 $90

Liberty Mutual $56 $161

Nationwide $34 $96

Progressive $30 $86

State Farm $24 $69

The Hartford $43 $113

Travelers $32 $91

USAA $23 $65

The rates for minimum coverage range significantly across providers, with USAA offering the lowest at $23, and Allstate and Liberty Mutual at the higher end at $56. For full coverage, the trends are somewhat similar, with State Farm and USAA providing the most economical options at $69 and $65 respectively, well below the rates of other companies like Allstate and Liberty Mutual, which charge $158 and $161.

Companies like Geico, Nationwide, and Progressive offer mid-range prices, which are attractive for those seeking a balance between cost and comprehensive coverage.

These figures illustrate the competitive landscape of New Mexico auto insurance, emphasizing the importance of comparing rates to find the best fit for your insurance needs.

Read more: What are the recommended auto insurance coverage levels?

Finding Cheap Auto Insurance in New Mexico

Finding cheap New Mexico car insurance isn’t as simple as applying for the cheap company your friend recommends. While a company may be the cheapest for drivers with clean records, its rates could be higher than the most expensive companies for drivers with bad credit scores or DUIs.

So, looking at average insurance rates at the best auto insurance companies based on a driver’s record is important. To help you through the process, we’ve covered multiple examples of New Mexico rates.

Cheapest New Mexico Auto Insurance for Liability

All New Mexico drivers must carry liability auto insurance. The average cost of New Mexico minimum liability insurance is $38 per month or $456 annually, though this average varies by company.

If you’re struggling to afford the minimum liability insurance or want lower rates to afford more coverage, choosing a cheaper company can help. Below are the average rates for minimum liability insurance at major New Mexico companies.

Liability Auto Insurance Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $61 | |

| $44 | |

| $37 | |

| $53 | |

| $30 | |

| $67 |

| $44 |

| $39 | |

| $33 | |

| $38 | |

| $22 | |

| U.S. Average | $45 |

On average, one of the cheapest companies for minimum liability insurance is State Farm, followed by Geico and Travelers. However, Allstate and Farmers are more expensive, so if you’re looking for savings on basic policies, avoid these companies.

Cheapest New Mexico Auto Insurance for Full Coverage

Full coverage auto insurance in New Mexico doesn’t have to empty drivers’ wallets if they take the time to compare company rates. Full coverage also protects drivers much more than minimum liability coverage. For example, if a driver causes an accident, full coverage pays for the driver’s car repairs. The driver’s car repairs don’t have coverage under a liability-only policy, just the other parties’ costs.

Drivers looking for cheap full coverage auto insurance should consider getting quotes from the companies with the cheapest average rates on the list below.

Full vs. Minimum Coverage Monthly Insurance Rates by Provider

| Insurance Company | Rates |

|---|---|

| $160 | |

| $117 | |

| $87 | |

| $97 | |

| $87 | |

| $80 | |

| $174 |

| $115 |

| $105 | |

| $86 | |

| $99 | |

| $59 | |

| U.S. Average | $119 |

The average cost of full coverage insurance policies in New Mexico is $120 monthly or $1,440 a year. Some companies like State Farm, Geico, and Travelers usually fall below this average. However, others will be above New Mexico’s average. You can compare rates between companies, like Geico vs State Farm auto insurance, to make sure you’re getting the best price.

Cheapest New Mexico Auto Insurance for Young Drivers

Young drivers who purchase their insurance policies rather than joining an existing policy will see high rates. Auto insurance for new drivers is expensive for many reasons. Insurance companies charge them higher rates due to their inexperience, meaning they’re more likely to crash and file a claim.

However, while even the cheapest companies for insurance will still be expensive for younger drivers, they can save hundreds or thousands of dollars by choosing one of the cheapest companies compared to the most expensive ones. Look at the table below to see how rates vary by insurance company.

Teen Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $608 | $638 | $448 | $519 | |

| $452 | $456 | $333 | $371 | |

| $778 | $742 | $573 | $603 | |

| $298 | $312 | $220 | $254 | |

| $716 | $778 | $528 | $633 |

| $411 | $476 | $303 | $387 |

| $801 | $814 | $591 | $662 | |

| $311 | $349 | $229 | $284 | |

| $709 | $897 | $523 | $729 |

Companies offering cheaper rates to young drivers include State Farm, Geico, and Nationwide. While their average rates in NM for young drivers are well above the state average, they’re still a few thousand dollars less annually than companies like Farmers, Allstate, and Progressive.

It’s best to join a parent’s policy if drivers can, as rates will be much cheaper than buying a separate policy as a young driver. If young drivers like with their parents or are away at school without a family car, they can join their parent’s policy. There are also discounts parents and young drivers can qualify for, like discounts for good students and student-away discounts.

Cheapest New Mexico Auto Insurance for Drivers With Bad Credit

Often, bad credit scores affect your insurance rates. To insurers, bad credit scores indicate a driver is more likely to miss car insurance payments, so those drivers see higher rates. Missed payments can also lead to issues like canceled insurance and driving illegally, resulting in future rate increases.

If you have bad credit, look at the companies below to see if there are cheaper companies to get quotes from than your current provider. Finding the best auto insurance companies for bad credit doesn’t have to be difficult.

Full Coverage Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $166 | $197 | $296 | |

| $116 | $136 | $203 | |

| $140 | $161 | $269 | |

| $82 | $100 | $148 | |

| $177 | $226 | $355 |

| $120 | $133 | $166 |

| $109 | $138 | $206 | |

| $91 | $118 | $200 | |

| $107 | $128 | $194 | |

| $71 | $90 | $136 |

Allstate has some of the most expensive rates for drivers with bad credit, so those drivers should avoid the company. After all, it’s harder to fix a credit score if you pay higher rates. A cheaper company like Geico or State Farm will help bad-credit drivers save money and improve their scores, which goes a long way to lowering rates.

Cheapest New Mexico Auto Insurance Companies for Drivers With Traffic Tickets

In any state, a traffic ticket will raise your insurance rates. Traffic tickets like speeding tickets place drivers in a higher risk category at their insurance company, as reckless driving behaviors increase the risk of crashing and filing a claim. How a speeding ticket affects your auto insurance rates depends on the company you’re insured with.

Take a look at the best auto insurance companies for drivers with speeding tickets. Below, you can see the average rates at different New Mexico insurance companies for drivers with traffic tickets.

Full Coverage Auto Insurance Monthly Rates by Provider: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $108 | $86 |

| $188 | $160 | |

| $136 | $117 | |

| $105 | $87 | |

| $119 | $97 | |

| $58 | $70 |

| $173 | $139 | |

| $106 | $80 | |

| $212 | $174 |

| $137 | $115 |

| $140 | $105 | |

| $96 | $86 | |

| $277 | $232 | |

| $136 | $112 |

| $134 | $99 | |

| U.S. Average | $147 | $119 |

Does a speeding ticket affect your car insurance? If you have one or more traffic tickets on your driving record, you could get quotes from a few companies to see if you can reduce your auto insurance rates.

Cheapest New Mexico Auto Insurance Companies for Drivers With At-Fault Accidents

At-fault accidents always increase your auto insurance rates unless you have accident forgiveness at your insurance company. Like traffic tickets, at-fault accidents place you in a higher risk category of drivers more likely to crash and file a claim.

Learning how to file an auto insurance claim is important for every insurance customer. If you recently had an at-fault accident and noticed a huge rate increase, looking at new companies may help you reduce them.

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $180 | $220 |

| $166 | $225 | |

| $116 | $176 | |

| $119 | $97 | |

| $140 | $198 | |

| $95 | $132 | |

| $177 | $234 |

| $140 | $161 |

| $120 | $186 | |

| $105 | $150 | |

| $175 | $230 |

| $160 | $200 | |

| U.S. Average | $123 | $172 |

State Farm has some of the cheapest rates on average for drivers with at-fault accidents, so if you aren’t already with State Farm, you may want to get a quote to see if State Farm offers you a cheaper rate.

State Farm consistently offers the most competitive rates for both minimum and full coverage in New Mexico.

Kristen Gryglik Licensed Insurance Agent

You could also consider companies with at-fault accident programs for the future. Some companies only require you to be accident-free with them for a few years, while others may require a small annual fee to join. Regardless, accident-forgiveness programs won’t raise your rates for your first at-fault accident.

Cheapest New Mexico Auto Insurance Companies for Drivers With DUIs

Driving impaired is a huge red flag for insurance companies since they’re at higher risk of causing accidents. Drivers with a DUI conviction will also find it harder to get cheap auto insurance, as companies charge them higher rates.

Therefore, drivers with DUIs will benefit from shopping around to see if a different New Mexico insurance company can offer cheaper rates.

If you’re looking for the best auto insurance for drivers with a DUI, State Farm is one of the best companies. While Progressive is usually one of the most expensive companies for auto insurance, its average rates after a DUI are some of the cheapest in New Mexico. On the other hand, while Geico is normally a cheap insurance company, they’re one of the most expensive for DUI drivers.

These two companies are great examples of how rates can change drastically at different companies depending on a driver’s record. A cheap company for most drivers may hike rates for certain driving infractions relative to other companies. So, shopping around and comparing rates based on your driving record is vital.

Cheapest New Mexico Cities for Auto Insurance

Insurance rates change as drivers move around New Mexico, even if they stick with the same provider. For example, car insurance in Las Cruces, NM, may cost more than if you move to a rural area. Some of the reasons for the average rate changes based on location are as follows:

- Crime: Areas with high crime levels will see higher insurance rates, as your car is more likely to be vandalized or stolen.

- Local Traffic and Accidents: Insurance companies will examine the history of accidents and claims in an area. Insurers also consider traffic patterns, as heavier traffic means a higher risk of accidents.

- Weather: Areas prone to extreme weather have higher insurance rates. For example, if your county frequently has heavy snow or rain, your rates will be higher than in an area with mild weather.

One of the cities with the most expensive average insurance rates is Albuquerque, New Mexico, making it harder to find cheap Albuquerque, NM auto insurance. However, as the city with the largest population in New Mexico, this higher average rate makes sense.

If an area has more drivers, there’s a higher likelihood of accidents and filing claims. So if you’re moving to this city, get car insurance quotes to find the best cheap auto insurance in Albuquerque.

Exploring the Cost of Auto Insurance in Your City

Explore the diverse pricing of auto insurance in various New Mexico cities with our detailed analysis. From the lively areas of Albuquerque to the tranquil settings of Santa Fe, see how location influences insurance costs. Assess the rates in cities such as Las Cruces and Roswell to choose the best auto insurance in New Mexico wisely.

New Mexico Auto Insurance Cost by City

Understanding the varied auto insurance rates across New Mexico cities enables you to make the most informed and financially sensible coverage decisions for your specific location.

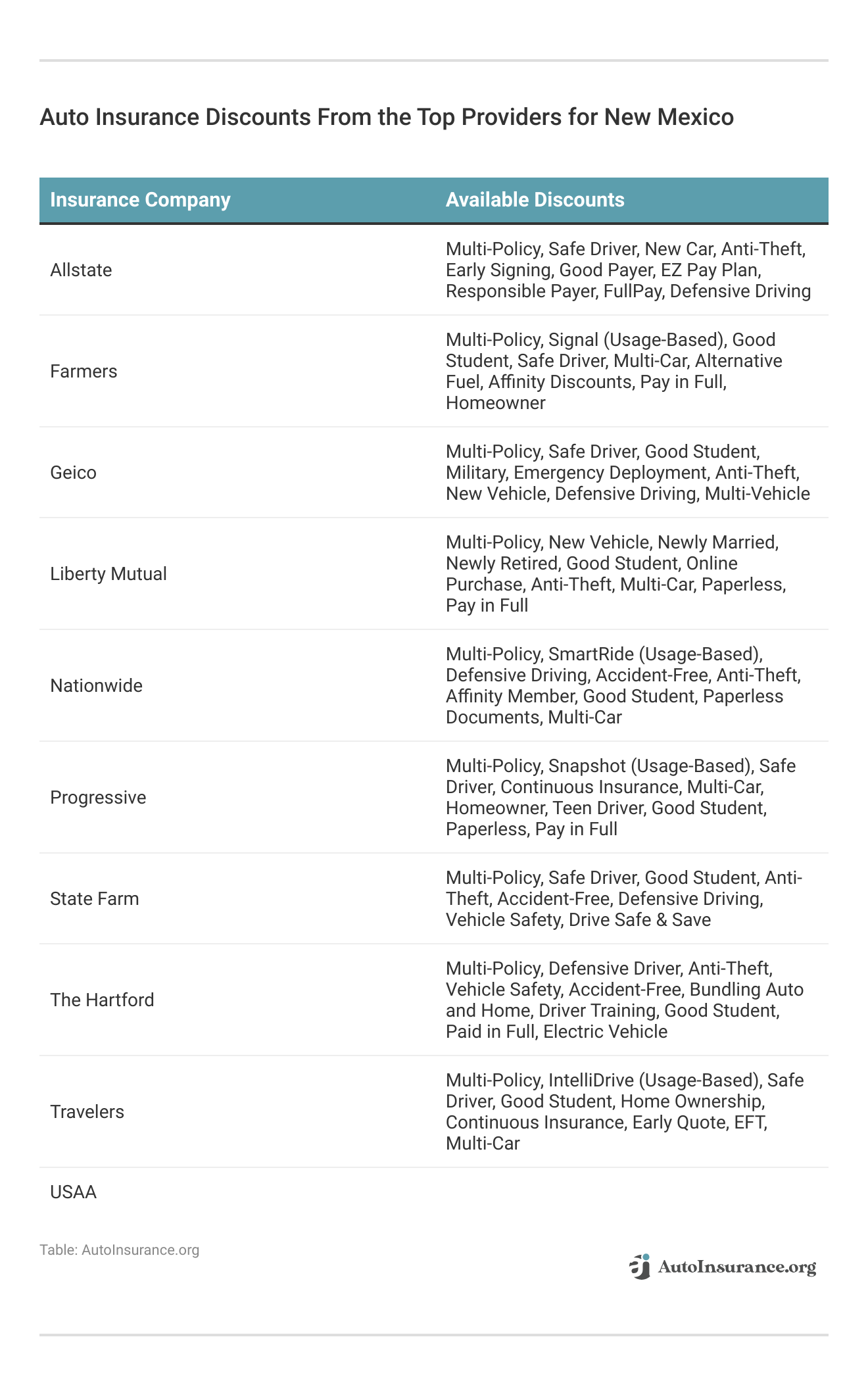

Tips for Saving on New Mexico Auto Insurance

So far, we’ve examined numerous factors that affect auto insurance rates and discussed the companies with the cheapest rates for each factor. If you’re already with the most affordable company based on your driving record but need to save more, there are other ways to save.

Below, we’ve listed several tips for reducing your auto insurance rates beyond shopping at different insurers in New Mexico.

- Look for Discounts: Your insurance company may offer more auto insurance discounts you need to apply for to get. For example, you must show a report card to get a good student discount.

- Improve Your Credit Score: Auto insurance and your credit score are connected. Since bad credit scores raise your insurance rates, improving your credit score can greatly reduce your rates over time.

- Drive Safely: Fewer tickets and accident claims will result in cheaper rates. If you have any infractions on your record, your rates will go down over time if you maintain a clean driving record. Learn about how auto insurance companies check driving records so you can be a smarter insurance customer.

- Increase Your Deductible: Increasing your auto insurance deductible will reduce your rates. However, don’t increase it beyond an amount you can’t pay out-of-pocket for after an accident.

- Drop Unnecessary Coverage: If you have add-on coverages like rental car reimbursement, you can eliminate them to reduce your costs. You can also carry just minimum liability insurance if your car greatly depreciates.

- Get Usage-Based Insurance: If you drive less than 10,000 miles per year, signing up for usage-based auto insurance may be your cheapest option

Following the tips above can help you find savings and maintain cheap rates. Remember that even if car insurance becomes too expensive, you should never drop it. Driving without insurance is illegal and increases your insurance rates substantially in the future. Instead, talk to your insurance company if you can’t make a payment and see if you can work out a payment plan.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

New Mexico Auto Insurance Laws and DUI Penalties

A state’s insurance laws and DUI penalties can affect drivers’ auto insurance rates. Read on to learn how much insurance New Mexico requires and its DUI penalties.

New Mexico Minimum Auto Insurance Requirements

You must meet New Mexico minimum auto insurance requirements to drive legally in the state. Not carrying the required coverages carries several penalties, such as higher insurance rates, fines, possible loss of driving privileges, and more.

In New Mexico, drivers must have bodily injury liability insurance and property damage liability insurance. If you cause an accident, these coverages pay for other parties’ medical and property damage bills.

The minimum amounts for these two coverages in New Mexico are as follows:

- Bodily Injury Liability Insurance: $25,000 per person and $50,000 per accident

- Property Damage Liability Insurance: $10,000 per accident

These limits refer to the maximum amount insurance will pay on a covered claim. For example, if you cause $15,000 worth of damages in an accident, your insurer will only pay out $10,000. So you’re responsible for the remaining $5,000.

If you drive🚗, you must carry liability coverage. Your state requires it. Lucky for you, it’s the cheapest option🤑, but you can save even more by following the tips https://t.co/27f1xf131D has for you. Check it out here👉: https://t.co/WkPBfwJgdw pic.twitter.com/Qqt4bjcHlH

— AutoInsurance.org (@AutoInsurance) September 28, 2023

As a result, we recommend purchasing a higher liability amount than New Mexico requires if you can afford it. Higher limits help you avoid high out-of-pocket costs after an accident.

New Mexico Optional Auto Insurance Coverages

Besides property damage and bodily injury liability (BIL) auto insurance, New Mexico doesn’t require other coverages. However, if you have a vehicle lease or loan, your lender’s contract will likely require you to purchase comprehensive and collision insurance for a full coverage policy.

These coverages protect the lender’s assets. For example, collision insurance pays for the car’s repairs if the driver crashes into another vehicle or object, and comprehensive insurance covers repairs from non-collision events like weather, crime, and animal-related accidents.

However, if you have no lender, the following coverages are optional in New Mexico:

- Collision Auto Insurance

- Comprehensive Auto Insurance

- Gap Insurance

- Medical Payments Coverage

- Modified Car Insurance

- New Car Insurance

- Personal Injury Protection Insurance

- Rental Car Reimbursement Coverage

- Roadside Assistance

- Uninsured Motorist (UM) Coverage

Remember that not all of the above coverages are available at all insurance companies in New Mexico since they’re optional. If optional coverage is important to you when looking for a new company, see which companies offer the coverage you want before committing to one.

New Mexico DUI Auto Insurance Penalties

In any state, a DUI charge comes with several penalties. In New Mexico, drivers can expect some or all of the following penalties after a DUI conviction:

- Alcohol Screening

- Alcohol Counseling

- Community Service

- Ignition Interlock Device

- Jail Time

- Multiple Fines and Fees

- Probation

- License Suspension

- SR-22 Certificate

These penalties increase in severity depending on the nature of the offense and the number of DUIs. For example, penalties are harsher for an aggravated DUI, where another person gets injured or the level of alcohol in the blood is extremely high. Read more about auto insurance for drivers with a DUI.

Penalties will also be harsher for each subsequent DUI, eventually resulting in a lifetime revocation and years of jail time. Penalties for drinking and driving will hopefully create a future without drunk driving.

New Mexico SR-22 Auto Insurance Certificate Requirements

Certain drivers must provide proof of insurance to drive and get their licenses back. They’ll need an SR-22 auto insurance certificate from their insurance company proving they have the mandatory coverage required in New Mexico. Common types of drivers needing an SR-22 certificate are those caught driving under the influence, without licenses, or with multiple points on their driving records.

For comprehensive protection at affordable rates, State Farm is the go-to provider in New Mexico.Jeffrey Manola Licensed Insurance Agent

If you already have an insurer, you’ll need to inform your company that you need an SR-22 certificate. Your company may require a small fee to file the SR-22 certificate. Since you’re a high-risk driver, they may also choose to drop you as a customer. However, your company must give you ample notice of termination, so you have time to find a new company.

When applying, drivers who need a new insurance company with an SR-22 certificate must let them know. Failure to do so could result in policy termination. If you don’t have a car, you’ll still need an SR-22 certificate. So, you’ll need to purchase cheap non-owner auto insurance to fulfill your New Mexico insurance obligation.

Find Cheap New Mexico Auto Insurance Coverage Today

New Mexico auto insurance doesn’t have to break the bank. Drivers can often find cheaper New Mexico auto insurance rates by shopping for quotes from different companies, applying for discounts, comparing different types of auto insurance, and keeping a clean driving record.

If your New Mexico auto insurance rates are too expensive, compare auto insurance rates by make and model from different auto insurance companies to find savings. Today, you can use our free quote comparison tool to shop for the best New Mexico auto insurance quotes.

Frequently Asked Questions

How much is car insurance in New Mexico?

In New Mexico, the average monthly cost for comprehensive insurance is about $109. Conversely, the basic auto insurance necessary to comply with New Mexico auto insurance standards typically costs around $39 per month.

For additional details, explore our comprehensive resource titled “What is the average auto insurance cost per month?“

Which company has the cheapest auto insurance rates in New Mexico?

State Farm has some of the cheapest average rates for most New Mexico drivers. Other cheap options are Geico and Travelers. However, your cheapest company depends on personal coverage needs and driving record.

Are auto insurance policies cheaper in New Mexico?

Average insurance rates in New Mexico fall somewhere around the middle. You may be able to find cheaper rates by shopping around for quotes at different New Mexico companies.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Is New Mexico a no-fault auto insurance state?

No, New Mexico is not a no-fault state. New Mexico is an at-fault state, meaning whichever driver caused the accident is liable for other parties’ medical and property damage bills. So, it’s important to carry good liability insurance in New Mexico.

Is it illegal to drive without auto insurance in New Mexico?

Yes, driving without auto insurance is illegal in New Mexico. All drivers must meet New Mexico auto insurance requirements.

What options are available for affordable auto insurance in Albuquerque?

Several providers offer affordable auto insurance in Albuquerque, with competitive rates and various discounts for safe drivers, multiple policies, and more.

How can I find affordable auto insurance in New Mexico?

To discover cheap auto insurance in New Mexico, it’s advisable to evaluate rates from various insurers and look for applicable discounts.

Where can I get Albuquerque auto insurance?

Albuquerque auto insurance is available from numerous national and local providers, offering a range of coverage options suited to different driving needs.

What are the top auto insurance companies in New Mexico?

Top auto insurance companies in New Mexico include State Farm, Geico, and Allstate, known for their comprehensive coverage and customer service.

For additional details, explore our comprehensive resource titled “Cheapest Auto Insurance Companies.”

What should I know about auto insurance policies?

An auto insurance policy often encompasses a range of coverages, including liability, collision, and comprehensive damages, along with options for personal injury protection and coverage for uninsured motorists.

What is the average cost of auto insurance in New Mexico?

Which companies are considered the best home insurance companies in New Mexico?

How can I find car insurance agents in New Mexico?

What are my options for car insurance for drivers with accidents?

How do I get car insurance quotes in Albuquerque?

Where can I find cheap auto insurance in NM?

What are the options for cheap car insurance in Las Cruces?

What do Dairyland auto insurance reviews typically say?

What is drive insurance, and how does it work?

What are the best options for home and car insurance in New Mexico?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.