Cheap Auto Insurance for Government Employees in 2026 (Big Savings With These 10 Companies!)

The top three companies offering cheap auto insurance for government employees are Safeco, Travelers, and State Farm. Public sector workers pay around $27 per month for auto insurance with Safeco. Federal employee auto insurance discounts can make coverage even cheaper.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated January 2025

1,278 reviews

1,278 reviewsCompany Facts

Min. Coverage for Government Employees

A.M. Best Rating

Complaint Level

Pros & Cons

1,278 reviews

1,278 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Government Employees

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Government Employees

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsOur top 3 companies for cheap auto insurance for government employees are Safeco, Travelers, and State Farm. Safeco offers the cheapest rates for civil servants, with monthly premiums starting at $27.

While finding the right car insurance for government employees can be challenging, it’s definitely not impossible. We can help you find affordable auto insurance for federal employees and other public sector workers, saving you time and money. Below, we highlight some of the cheapest government auto insurance companies.

Our Top 10 Company Picks: Cheap Auto Insurance for Government Employees

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $27 A Exclusive Discounts Safeco

#2 $33 A+ Personalized Service The Hartford

#3 $37 A++ Customizable Policies Travelers

#4 $43 B Comprehensive Coverage State Farm

#5 $44 A+ Affordable Rates Nationwide

#6 $45 A Specialized Coverage American Family

#7 $46 A+ Membership Benefits Amica

#8 $53 A Discount Options Farmers

#9 $61 A+ Enhanced Savings Allstate

#10 $68 A Customer Service Liberty Mutual

Public sector car insurance can oftentimes be more affordable because of auto insurance discounts and rebates. As they drive to, from, and at work, public sector workers need auto insurance coverage that is both reliable and affordable.

Enter your ZIP code in our free tool above to start comparing public sector car insurance right now.

- Safeco, Travelers, and State Farm offer cheap government employee insurance

- On average, public sector workers pay $27 per month for auto insurance at Safeco

- Auto insurance for public sector workers can be cheaper thanks to discounts

#1 – Safeco: Top Overall Pick

Pros

- Competitive Rates: Safeco offers affordable premiums, particularly with discounts for government employees. (Read more: Safeco auto insurance review).

- Government Employee Discounts: Safeco auto insurance discounts are tailored for government employees, which can significantly reduce premiums.

- Strong Customer Service: Safeco’s responsive and helpful customer service representatives ensure a smooth experience for public sector workers.

Cons

- Limited Availability: Safeco may not be available in all states, limiting options for some government employees.

- Coverage Restrictions: Some public sector employees may find restrictions on coverage options or eligibility criteria.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Payment Flexibility

Pros

- Extensive List of Discounts: Travelers offers various discounts beyond just being a government employee, including safe driver discount, multi-policy discount, and vehicle safety feature discount. Learn more in this Travelers auto insurance review.

- Flexible Payment Plans: Travelers allows government employees to choose from multiple payment options, e.g., monthly installments, making it easier to manage their policy.

- Convenient Mobile App: Travelers’ innovative features provides easy access to policy information, claims filing, and roadside assistance.

Cons

- Rates Can Vary: Government employees residing in regions with higher insurance costs may find that Safeco’s rates are not the cheapest option available to them.

- Limited Local Agents: In some areas, finding a local Travelers agent may be challenging, potentially impacting customer service quality.

#3 – State Farm: Best for Large Agent Network

Pros

- Large Network of Agents: State Farm works with more than 18,000 insurance agents throughout the U.S., who can help you choose the right coverage options and amounts.

- Safe Driver Rewards Programs: State Farm’s Drive Safe & Save and Steer Clear programs aim to promote safe driving practices and reduce the risk of accidents among risky drivers.

- Various Discounts: Aside from the government employee discount, State Farm offers discounts for multi-vehicle, safe driving records, and vehicle safety features. Learn more about the State Farm’s discounts in our State Farm auto insurance review.

Cons

- Limited Online Service: State Farm’s online service offerings may not be as robust or user-friendly as some other government employee insurance providers.

- No 24/7 Customer Service: Customers may need to wait until the next business day to speak with a representative.

#4 – Nationwide: Best for Convenient Mobile App

Pros

- Multi-Policy Discounts: Nationwide offers significant savings for government employees who bundle their auto insurance with other policies such as homeowners or renters insurance. Learn how much you can save in our Nationwide auto insurance review.

- Excellent Customer Service and Claims Handling: J.D. Power rated Nationwide as Above average in their auto customer satisfaction study. The company also received an A+ financial strength rating from A.M. Best for its ability to pay out claims.

- Mobile App Features: Nationwide’s mobile app allows you to pay your bill, print ID cards, make policy changes, file and track claims directly from your phone.

Cons

- Pricing Discrepancy: Auto insurance rates for government employees may vary depending on location and driving history.

- Difficult Quotes Process: Nationwide may require more detailed information, such as driving history, prior insurance coverage, etc.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Positive Customer Feedback

Pros

- Customizable Policies: American Family allows government employees to tailor their coverage options to meet their specific insurance needs. Learn more in our American Family auto insurance review.

- High Customer Satisfaction: American Family consistently receives positive feedback for its attentive customer service and claims handling.

- Bundling Discount: Public sector workers who bundle their auto and home insurance policies can save up to 23% with American Family.

Cons

- Limited Availability: Government employees in some areas may need to look elsewhere for coverage as American Family car insurance is only available in 19 states.

- Limited Add-ons and Endorsements: While some competitors provide a wide range of optional coverages to choose from, American Family offers a few riders that are deemed most essential.

#6 – Allstate: Best for Usage-Based Program

Pros

- Wide Range of Coverage Options: Allstate offers a wide range of coverage options, including roadside coverage and rental car reimbursement, allowing government employees to customize their policies.

- Innovative Features: Allstate Drivewise, an innovative usage-based program, incentivizes safe driving habits and can lead to additional savings for government employees.

- Strong Financial Stability: Allstate’s reputation for financial stability provides peace of mind to government employees, knowing their claims will be handled promptly. Find more in our Allstate auto insurance review.

Cons

- Limited Availability: Allstate’s government employee insurance is only available in 21 states and Washington, D.C.

- Rates Higher Than the National Average: For example, in densely populated urban areas, prone to high rates of accidents or severe weather events, Allstate’s premiums may be higher.

#7 – Amica: Best for Customer Service

Pros

- Outstanding Financial Stability: Amica has an A+ financial strength rating from AM Best. The company also holds an A+ rating with the BBB. (Read more: Amica Auto insurance review).

- Dividend Policies: Unlike traditional policies where premiums are fixed, dividend-paying policies provide the opportunity for policyholders to receive a portion of the insurer’s surplus funds.

- High Customer Satisfaction Ratings: Amica ranks high for auto insurance claims customer satisfaction in J.D. Power’s 2023 auto insurance study.

Cons

- State Availability: Amica does not sell auto insurance coverage in Hawaii.

- No Telematics Program: Amica customers may miss out on the potential savings available through participation in a usage-based program.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Comprehensive Coverage

Pros

- Variety of Coverage Options: By selecting multiple coverage options, Farmers customers can create a comprehensive insurance policy that protects them against various risks on the road. Learn more in our Farmers auto insurance review.

- Additional Discounts: Aside from the standard Farmers car insurance discounts, there are additional discounts for receiving documents by electronic delivery, homeownership, or paying by electronic funds transfer (EFT).

- Strong Financial Stability: Farmers has a long history and solid financial standing, assuring government employees that their claims will be handled promptly.

Cons

- Rates Vary by Location: Farmers’s premiums may vary depending on geographic location, potentially resulting in higher costs for some government employees.

- No Auto Coverage in Florida: Due to the increased risk of natural disasters in the area, government employees in Florida may not be able to renew their policies upon expiry.

#9 – The Hartford: Best for Specialized AARP Coverage

Pros

- Specialized Coverage: The Hartford offers specialized coverage options tailored to the needs of government employees who are 50 and older.

- AARP Discounts: The Hartford partners with AARP to offer exclusive discounts to government employees who are AARP members, resulting in potential savings on premiums.

- Financial Stability: The company has received an A+ (Superior) rating from A.M. Best for financial strength. Learn more in our Hartford auto insurance review.

Cons

- Higher Than Average Complaint Index: According to the NAIC, The Hartford has received a higher than usual number of complaints for insurance companies of its size.

- Not a Great Choice for Drivers Under 50: The Hartford’s insurance products are exclusive to drivers 50 and older, making it a less suitable option for younger drivers.

#10 – Liberty Mutual: Best for Intuitive Website

Pros

- 12-Month Policy: Liberty Mutual offers the option of purchasing 12-month auto insurance policies, potentially locking in lower rates for government employees over an extended period. (Read more: Liberty Mutual auto insurance review).

- Accident Forgiveness Discount: Liberty Mutual’s accident forgiveness program helps government employees avoid a rate increase following their first accident.

- User-Friendly Website: Liberty Mutual’s intuitive website makes it easy for government employees to manage their policies, file claims, and access support services

Cons

- High Premiums: At $68/mo, Liberty Mutual auto insurance rates for public sector employees are some of the highest from all the companies we’ve analyzed.

- Not All States Have Offices: While Liberty Mutual is a nationwide insurer, its physical presence may not extend to every state.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Public Sector Worker Explained

The workforce is generally divided into two parts — public sector workers and private sector workers.

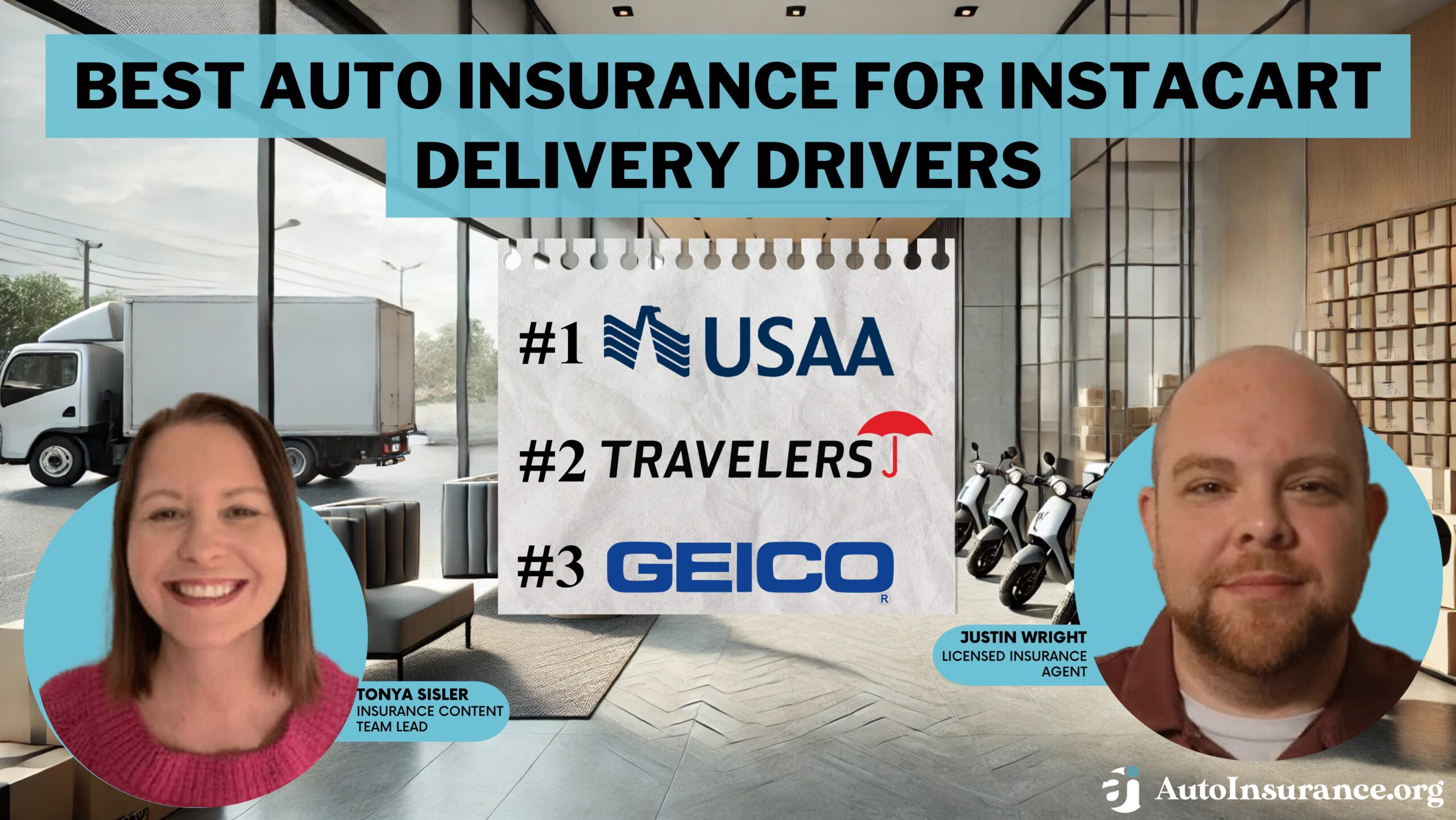

Private sector workers are people who work for private companies. The CEO of an insurance company is a private sector employee. Someone working the drive-thru window at a fast-food restaurant is also a private sector employee. Delivery drivers are also considered as employees of the private sector. Read more about delivery driver auto insurance.

Alternatively, someone who works in the public sector is someone who works for the government in some capacity.

They may be a federal employee, such as an IRS agent, or they may work for a state or local government, like a firefighter. Some other examples include FBI agents, teachers, Federal Reserve employees, postal workers, and ambassadors with the State Department. As these public sector workers go about their duties, they often need to use personal vehicles to get their jobs done.

The Importance of Public Sector Worker Insurance Discounts

The chart below breaks down insurance costs as a percentage of income according to the National Association of Insurance Commissioners (NAIC). As you can see, auto insurance takes up between 1.5 and 3 percent of a person’s income, on average.

Auto Insurance Rates as a Percentage of Income by State

| States | Annual Rate | Annual Income | Insurance as % of Income |

|---|---|---|---|

| Alabama | $837 | $33,535 | 2% |

| Alaska | $1,050 | $49,756 | 2% |

| Arizona | $962 | $34,321 | 3% |

| Arkansas | $900 | $33,929 | 3% |

| California | $952 | $43,978 | 2% |

| Colorado | $940 | $43,609 | 2% |

| Connecticut | $1,133 | $56,186 | 2% |

| Countrywide | $982 | $40,859 | 2% |

| Delaware | $1,216 | $40,256 | 3% |

| District of Columbia | $1,324 | $59,936 | 2% |

| Florida | $1,209 | $38,350 | 3% |

| Georgia | $991 | $34,558 | 3% |

| Hawaii | $858 | $41,801 | 2% |

| Idaho | $673 | $33,600 | 2% |

| Illinois | $854 | $42,256 | 2% |

| Indiana | $729 | $36,364 | 2% |

| Iowa | $684 | $39,820 | 2% |

| Kansas | $851 | $41,634 | 2% |

| Kentucky | $917 | $33,237 | 3% |

| Louisiana | $1,364 | $37,787 | 4% |

| Maine | $689 | $37,049 | 2% |

| Maryland | $1,096 | $46,875 | 2% |

| Massachusetts | $1,108 | $50,366 | 2% |

| Michigan | NA | $36,419 | 0% |

| Minnesota | $857 | $42,516 | 2% |

| Mississippi | $958 | $31,365 | 3% |

| Missouri | $845 | $36,690 | 2% |

| Montana | $869 | $36,041 | 2% |

| Nebraska | $806 | $43,277 | 2% |

| Nevada | $1,083 | $36,477 | 3% |

| New Hampshire | $796 | $48,280 | 2% |

| New Jersey | $1,379 | $49,983 | 3% |

| New Mexico | $920 | $33,358 | 3% |

| New York | $1,328 | $47,446 | 3% |

| North Carolina | $768 | $35,099 | 2% |

| North Dakota | $768 | $51,311 | 2% |

| Ohio | $767 | $37,490 | 2% |

| Oklahoma | $986 | $40,879 | 2% |

| Oregon | $894 | $36,445 | 2% |

| Pennsylvania | $950 | $42,414 | 2% |

| Rhode Island | $1,257 | $42,585 | 3% |

| South Carolina | $937 | $33,295 | 3% |

| South Dakota | $744 | $41,825 | 2% |

| Tennessee | $856 | $36,909 | 2% |

| Texas | $1,066 | $41,090 | 3% |

| Utah | $853 | $33,566 | 3% |

| Vermont | $747 | $42,267 | 2% |

| Virginia | $836 | $43,904 | 2% |

| Washington | $952 | $45,143 | 2% |

| West Virginia | $1,032 | $32,277 | 3% |

| Wisconsin | $717 | $39,433 | 2% |

| Wyoming | $844 | $49,918 | 2% |

Perhaps you’re wondering why people might be worried about a relatively small percentage like that. First, those numbers are just averages. When it comes to price, there will be people who pay much less and people who pay much more. People also have different levels of income.

In South Carolina, for example, the average person’s disposable income in 2014 was $33,295. This average includes everyone in the state, from those scraping by on a few thousand dollars a year to those earning six or seven figures annually. Learn more about South Carolina auto insurance.

The $940 average auto insurance premium for the state could be a month or more of someone's income if they are a part-time substitute teacher or it could be as little as a single day's wages for someone like the governor.Jeffrey Manola Licensed Insurance Agent

Many people need to keep their insurance costs as low as possible, so discounts can be incredibly valuable for people in public sector jobs, as they traditionally earn less than their counterparts in the private sector.

Insurance Coverage for Public Sector Workers

Public sector workers need the same basic coverages as everyone else, including:

- Liability Coverage: Liability insurance protects you by paying for damages to the other driver’s vehicle if you are at fault in an accident. It also covers medical bills in the event of bodily injury someone else sustained in an accident where you were at fault.

- Uninsured Motorist Coverage: Uninsured motorist coverage, often referred to as UM, is mandatory in some states and optional in others. It covers you at the same levels as your liability coverage if you are in an accident where an uninsured driver was at fault.

- Collision Coverage: Collision insurance protects you by paying for damages to your vehicle if you are at fault in an accident. If you have a loan on your car you may be required by the lender to have active collision insurance on your policy.

- Comprehensive Coverage: Comprehensive insurance covers damage to your car that isn’t caused by an accident. Some examples of what might be covered under a comprehensive policy are flood damage, theft, and vandalism.

These are not the only types of auto insurance coverage you may need for your vehicle, but these are the basic options almost everyone is given when signing up for a policy with any insurance company.

A public sector worker may also have specific insurance needs based on their occupation.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Companies That Offer Cheap Car insurance For Government Employees

The average cost of auto insurance can vary widely from company to company, but there are some companies that generally come in at a lower price point than others.

Government Employees Auto Insurance Monthly Rates by Coverage Level

Insurance Company Minimum Coverage Full Coverage

$61 $160

$44 $117

$46 $151

$53 $139

Hartford $33 $86

$68 $174

$44 $115

$27 $71

$43 $113

$37 $99

Safeco, Travelers, and State Farm make the list of most affordable insurance companies, but that doesn’t mean they will necessarily be the most affordable option for you.

Your age, driving record, ZIP code, and many other things can impact your premiums, as well as any discounts that may be available.

Some Auto Insurance Considerations for Public Sector Workers

Public sector workers can be defined as people who work for a governmental body in some way. While all civil servants are public sector workers, not all public sector workers are necessarily civil servants.

Some common roles filled by public sector workers include the following:

- Foreign Service civil servants

- Firefighters

- Emergency Medical Technicians

- Police personnel

- Teachers

- Postal workers

- Politicians and their staff members

Many of these jobs are low paying; some are even partly staffed by volunteers. Many towns have volunteer firefighters, for example.

Because these jobs are all essential to keeping society going, many companies offer perks to people who perform them. For instance, coffee shops often give discounts to teachers or firefighters for this reason. Insurance companies offer discounts to give back to people who are providing an essential service, but also because it is a smart financial choice. Find the best auto insurance for firefighters.

Public sector employees have been shown to be very responsible drivers, filing fewer claims and saving insurance companies money in the long run.

Public sector employees perform their duties in many different environments and thus may have unique auto insurance coverage needs. For example, public sector employees who work abroad for governmental bodies such as the State Department may need to arrange for auto insurance coverage in the countries in which they work.

Public sector workers are also often members of unions or trade groups. An example of this could be police personnel who are also members of the police union, or teachers who are members of the largest union in the U.S., the National Education Association.

Many companies offer auto insurance discounts for union members and other similar groups.

Public sector workers who wish to take advantage of such money-saving opportunities should be sure to consult their union representatives and auto insurance agents for advice and guidance.

Another tried and true method for finding the most appropriate auto insurance coverage with the least effort involves using auto insurance comparison shopping websites. Auto insurance comparison shopping sites can save you many hours of online searching, identify the most beneficial policies, and save you a considerable amount of cash.

Government Employees With Special Insurance Needs

Every public sector employee will have individual needs, but some groups may have needs that are specific to their work situation.

For example, public sector employees who are deployed overseas for years at a time may find that they need a policy to cover their vehicle while it's in storage during their deployment.Travis Thompson Licensed Insurance Agent

Postal workers are another group who may have special insurance needs. Those who deliver mail in urban or suburban neighborhoods are typically given an official vehicle by their employer. That vehicle will have a postal service car insurance policy taken out by the government for its fleet.

Postal workers in rural areas who use their personal cars for work will need to arrange for special insurance coverage because personal policies don’t cover accidents that happen while you’re on the clock. Learn how to get cheap auto insurance after an accident.

According to the CDC, shift work can have an impact on your sleep habits and that can, in turn, impact your safety behind the wheel. Government employees who perform shift work may find that these statistics could impact their insurance rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Discounts for State Employees

If you’re driving a government-owned vehicle such as a postal delivery van or a garbage truck, those vehicles will be insured by a commercial policy held by the state.

Employees who don’t drive for the government won’t be covered under a commercial insurance plan, but they may be offered a discount through the state for their auto insurance.

Each state offers different benefits and discount programs to their employees, but one of the most common discounts provided is auto insurance for state employees.

For example, the state of New Jersey offers discounts on auto insurance with Liberty Mutual and NJM Insurance Group to their employees. Some states don’t have anything specific on their website, such as the state of Florida. Employee auto insurance discounts aren’t listed, but that doesn’t mean they don’t offer them.

If you work for a state government and want to know if discounted insurance is available to you, reach out to your human resources representative.

Discounts By Company

Discounts offered by insurance companies vary widely. Each company has a specific set of discounts that they provide based on their own internal underwriting standards.

If you believe you qualify for specific discounts such as a federal employee auto insurance discount or a homeowner discount, it may be worth your time to seek out quotes from companies that offer those specific discounts to their customers.

Don’t limit the companies you get quotes from, though. Just because a company offers a discount you’re entitled to, that doesn’t necessarily mean they will have the lowest rates or the best coverage for you.

Below you’ll find information on some of the largest insurance companies and whether or not they offer a public employee discount.

It is important to remember, however, that companies can and do change their rules and procedures regularly. You’ll need to contact a company directly to verify you have the most up-to-date information.

AAA Auto Insurance Federal Employee Discount

AAA insurance does offer a federal employee discount, but it doesn’t offer the discount as part of its online quoting system.

To get a federal employee discount through AAA, call directly for a quote. Be aware, though, that some people have reported that you can only get the AAA auto insurance discount the first time you call, so be prepared to buy when you call or potentially lose the discount.

Geico Government Employee Discounts

What discounts does Geico provide? Is Geico cheaper for government employees? Geico does provide discounts to some federal employees, along with many other discounts.

According to the Geico website, the company offers discounts to the following federal groups:

- American Society of Military Comptrollers

- Armed Forces Benefit Association

- Association of the U.S. Army

- Fleet Reserve Association

- Navy Federal Credit Union

- Navy League of the United States

- Blacks in Government

- FAA Managers Association

- Federal Asian Pacific American Council

- Federal Law Enforcement Officers Association

- Federal Managers Association

- Federally Employed Women

- National Air Traffic Controllers Association

- National Association of Assistant United States Attorneys

- National Association of Government Contractors

- National Council of Social Security Management Associations

- National Institutes of Health Recreation & Welfare Association

- Organization of Professional Employees of the U.S. Dept. of Agriculture

- Professional Managers Association

- Young Government Leaders

As time passes Geico may add or change available discounts, so be sure to reach out to the company for the most current options. Currently, the Geico discount for government employees is listed on their website as eight percent. These discounts are not to be confused with the ones offered to Geico’s own employees, such as the Geico employee discount Enterprise offers on rental cars.

Progressive Federal Employee Discount

Progressive Direct auto insurance doesn’t offer a federal employee discount at this time.

It does, however, offer a number of other discounts according to its website, including:

- Multi-policy

- Multi-car

- Continuous insurance

- Teen driver

- Good student

- Distant student discount

- Homeowner

- Online quote

- Sign online

- Paperless

- Pay in full

- Automatic payment

Be sure to check with the company to make sure you are taking advantage of any discounts that may apply to you.

State Farm Federal Employee Discount

State Farm doesn’t offer a federal employee discount at this time. You can read our State Farm auto insurance review for more information.

According to the State Farm website, the company does offer a number of other discounts, including:

- Anti-Lock Brakes

- Anti-Theft

- Claim Free

- Defensive Driver

- Distant Student

- Driver’s Ed

- Driving Device/App

- Good Credit

- Good Student

- Homeowner

- Low Mileage

- Multiple Policies

- Multiple Vehicles

- Newer Vehicle

- Paperless/Auto Billing

- Passive Restraint

- Safe Driver

- Vehicle Recovery

The website makes it clear that the available discounts vary by state, so you will need to get a quote based on your address and ZIP code to find out exactly what discounts are available to you.

Liberty Mutual Federal Employee Discount

Liberty Mutual does offer a federal employee discount in addition to reducing your rates based on your driving history.

According to the company’s website, they also offer a number of other discounts, including:

- Homeowner

- Military (active, retired, or reserve personnel)

- Early Shopper

- Good Student

- Student-Away-At-School

You may want to contact the company directly to find out if they have any additional discounts that might apply to you.

Farmers Federal Employee Discount

Farmers does offer a federal employee discount to its customers. What discounts does Farmers provide?

According to Farmers’ website, the company also offers several other discounts, including:

- Defensive Driver

- Distant Student

- Driver’s Ed

- Good Student

- Federal Employee

- Homeowner

- Military

- Occupation

- Senior Driver

- Safe Driver

Check the company website or contact them directly to make sure you are up-to-date on any and all available discounts.

Saving Money on Auto Insurance for Government Employees

Public sector workers come in all shapes and sizes. Many of these workers spend long hours driving for work and for personal reasons, which means they’re constantly exposed to the potential dangers of the open road.

In order to mitigate such dangers, public sector workers need the best auto insurance coverage they can find.

Luckily, public sector workers who take a few moments to peruse auto insurance comparison shopping websites can count on finding the best auto insurance companies with the least effort for the best prices. In addition, many individuals can receive price reductions by asking companies about discounts related to their field of work.

There’s always a chance for you to save money while finding the coverage you need. Enter your ZIP code below to find the best rate for auto insurance for public sector workers.

Frequently Asked Questions

Is there any special auto insurance available for public sector workers?

Yes, some insurance companies offer specific auto insurance policies tailored to public sector workers. These policies may include unique benefits or discounts that cater to the needs of individuals working in the public sector.

Enter your ZIP code below to compare government employees insurance quotes from the top providers near you.

What are the advantages of auto insurance for public sector workers?

The advantages of auto insurance for public sector workers include:

- Specialized coverage: These policies may provide additional coverage options specific to public sector professionals, such as coverage for work-related equipment or liability protection for on-duty accidents.

- Exclusive discounts: Some insurance providers offer discounted rates exclusively to public sector workers as a way to acknowledge their contributions and low-risk profiles.

- Convenient payment options: Public sector workers might have access to flexible payment plans or payroll deduction options, making it easier to manage auto insurance premiums.

Who qualifies as a public sector worker for these specialized auto insurance policies?

Public sector workers generally include individuals employed by government agencies at various levels, such as federal, state, or municipal employees. This can include professions like police officers, firefighters, teachers, social workers, public administrators, and more.

How can public sector workers find auto insurance policies designed for them?

Public sector workers can find auto insurance policies designed for them by following these steps:

- Research: Look for insurance companies that explicitly mention coverage options for public sector employees.

- Contact insurance providers: Reach out to insurance companies and inquire about any special policies or discounts available for public sector workers.

- Seek recommendations: Ask colleagues or professional associations within the public sector for recommendations on insurance companies that cater to their specific needs.

What documentation is typically required to prove eligibility for auto insurance designed for public sector workers?

The documentation required may vary among insurance providers, but commonly requested documents include:

- Proof of employment: This can include a letter from the employer or a recent pay stub.

- Identification: Valid identification documents such as a driver’s license or passport.

- Professional association membership: Some insurers may require proof of membership in a relevant professional association.

Are there any potential drawbacks to auto insurance for public sector workers?

While there are advantages, there can also be potential drawbacks:

- Limited availability: Not all insurance companies offer specialized policies for public sector workers, limiting the options available to choose from.

- Cost considerations: While discounts may be available, there are certain factors that affect auto insurance rates. Therefore, the overall cost of premiums may still vary depending on your driving history, location, and type of vehicle.

- Coverage restrictions: It’s important to review the policy details thoroughly, as specialized policies may come with specific limitations or exclusions.

Can public sector workers combine specialized auto insurance with other discounts or benefits?

Yes, public sector workers may be able to combine specialized auto insurance with other discounts or benefits. It is advisable to check with the insurance provider to understand the available options for stacking discounts and maximizing benefits.

Is there an MTA auto insurance discount?

While we did not uncover any specific discounts for MTA employees, that doesn’t mean there are no discounts available.

Smaller insurance companies in your state might offer a discount for MTA employees, while larger companies may include MTA employees in their overall discounts for state and federal government employees.

What is the best auto insurance for postal workers?

When it comes to auto insurance for postal employees, those who are issued a vehicle are covered by their employer-provided auto insurance in the U.S. while driving that vehicle. Postal workers who are using their own vehicles, which is more common in some rural areas, will need to have proper insurance for their vehicle.

They may need to look into purchasing a business owner’s policy or other policy designed to protect people using their personal vehicles for work purposes.

Use our free online quote tool to get the cheapest auto insurance for postal workers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.