Best Mechanicsburg, Pennsylvania Auto Insurance in 2026 (Find the Top 10 Companies Here)

The top three best Mechanicsburg, Pennsylvania auto insurance providers are Erie, Nationwide, and Amica. These providers stand out for their competitive rates starts at $50 monthly and tailored coverage. This article helps you find the best companies that consistently deliver exceptional value and protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated October 2024

1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Mechanicsburg Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage in Mechanicsburg Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 768 reviews

768 reviewsCompany Facts

Full Coverage in Mechanicsburg Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

768 reviews

768 reviewsOur top three best Mechanicsburg, Pennsylvania auto insurance are Erie, Nationwide, and Amica which emerge as the top auto insurance providers, each offering exceptional value through competitive rates starting at $50 per month and customized coverage options.

This article highlights why these companies excel in delivering both affordability and comprehensive protection tailored to local drivers’ needs. Discover how these leading insurers stand out and why they are the best choices for your auto insurance needs in Mechanicsburg.

Our Top 10 Company Picks: Best Mechanicsburg, Pennsylvania Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Local Excellence | Erie |

| #2 | 25% | A | Extensive Discounts | Nationwide |

| #3 | 20% | A+ | Exceptional Service | Amica | |

| #4 | 20% | A | Financial Stability | Auto-Owners | |

| #5 | 20% | A | Balanced Offerings | State Farm | |

| #6 | 8% | A++ | Military Exclusivity | USAA | |

| #7 | 20% | B | Comprehensive Tools | Progressive | |

| #8 | 8% | A++ | Broad Options | Travelers | |

| #9 | 12% | A+ | Customizable Coverage | Liberty Mutual |

| #10 | 25% | A+ | Mobile Innovation | Allstate |

Finding cheap auto insurance in Mechanicsburg can seem like a difficult task, but all of the information you need is right here. We’ll cover factors that affect auto insurance rates in Mechanicsburg, Pennsylvania, including driving record, credit, commute time, and more. Enter your ZIP code above to get free Mechanicsburg, Pennsylvania auto insurance quotes.

- The minimum auto insurance required in Mechanicsburg, Pennsylvania is 15/30/5

- The cheapest auto insurance company in Mechanicsburg is USAA

- The priciest auto insurance for teen drivers in Mechanicsburg is Travelers

#1 – Erie: Top Overall Pick

Pros

- Discounts for Bundling: Erie offers significant savings when bundling auto insurance with home or other policies. This is especially beneficial for those looking for the best Mechanicsburg, Pennsylvania auto insurance options that provide comprehensive coverage and savings. Discover additional details in our review of Erie auto insurance.

- Favorable Customer Ratings: Consistently high ratings in customer satisfaction surveys for claims handling and service. Customers appreciate Erie’s commitment to delivering the best Mechanicsburg, Pennsylvania auto insurance experience through reliable support.

- Educational Resources: Provides a range of educational materials and tools to help customers understand their coverage and insurance needs better. This transparency contributes to making Erie a leading choice for the best Mechanicsburg, Pennsylvania auto insurance.

Cons

- Limited Digital Features: Erie’s digital tools and mobile app may not be as advanced as those of competitors, potentially limiting ease of access. This could impact the overall convenience of the best Mechanicsburg, Pennsylvania auto insurance experience.

- Regional Limitations: While strong in Pennsylvania, Erie’s coverage and service might not be as robust outside the region, affecting those who relocate. This limitation could affect those seeking the best Mechanicsburg, Pennsylvania auto insurance while traveling or moving.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Extensive Discounts

Pros

- Diverse Discount Programs: Offers a wide range of discounts, including for new cars, anti-theft devices, and good driving records. Nationwide’s discount programs make it a strong contender for the best Mechanicsburg, Pennsylvania auto insurance.

- Innovative Insurance Options: Provides unique coverage options such as vanishing deductible and accident forgiveness programs. These innovations contribute to Nationwide being considered among the best Mechanicsburg, Pennsylvania auto insurance providers.

- Strong National Presence: Nationwide’s extensive network ensures reliable service and support across the country. This broad reach is a significant advantage when seeking the best Mechanicsburg, Pennsylvania auto insurance. Read more through our Nationwide auto insurance review.

Cons

- Higher Cost for Some Drivers: Premiums can be higher for drivers with less-than-perfect records compared to other providers. This might make Nationwide less appealing for those seeking the most affordable option in the best Mechanicsburg, Pennsylvania auto insurance.

- Complex Discounts: The variety of discount programs can be overwhelming, making it challenging to identify all potential savings. This complexity can detract from Nationwide’s overall appeal as a provider of the best Mechanicsburg, Pennsylvania auto insurance.

#3 – Amica: Best for Exceptional Service

Pros

- Loyalty Rewards: Offers rewards and discounts for long-term customers, providing financial benefits for maintaining a policy with them. This loyalty program helps Amica stand out as a top choice for the best Mechanicsburg, Pennsylvania auto insurance.

- High Quality Mobile App: The mobile app is user-friendly, offering easy access to policy management and claims tracking. Amica’s digital tools enhance the experience of securing the best Mechanicsburg, Pennsylvania auto insurance. Try to check more on our Amica auto insurance review.

- Generous Coverage Add-Ons: Provides valuable add-ons like identity theft protection and enhanced roadside assistance. These options make Amica a strong contender for those seeking the best Mechanicsburg, Pennsylvania auto insurance with extra benefits.

Cons

- Limited Regional Discounts: Some regional discounts and benefits might not be as extensive as those offered by larger national insurers. This could affect the overall value of the best Mechanicsburg, Pennsylvania auto insurance.

- Higher Rates for Younger Drivers: Premiums for younger or less experienced drivers can be relatively high compared to competitors. This could make Amica less attractive for younger drivers seeking the best Mechanicsburg, Pennsylvania auto insurance.

#4 – Auto-owners: Best for Financial Stability

Pros

- Financial Strength: Boasts a high A.M. Best rating, reflecting strong financial stability and reliability in claims payment. This financial stability supports Auto-Owners’ position as a provider of the best Mechanicsburg, Pennsylvania auto insurance.

- Local Agent Network: Provides access to a network of local agents who can offer personalized advice and service. This local presence enhances Auto-Owners’ reputation for the best Mechanicsburg, Pennsylvania auto insurance, as noted in our Auto-Owners auto insurance review.

- Good For High Risk Drivers: Provides competitive rates and coverage options for drivers with higher risk profiles. This makes Auto-Owners a viable option for those looking for the best Mechanicsburg, Pennsylvania auto insurance despite having a higher risk.

Cons

- Limited Online Services: Digital tools and online service options might not be as robust or user-friendly as those offered by other insurers. This limitation can impact the ease of accessing the best Mechanicsburg, Pennsylvania auto insurance.

- Complex Claims Process: Some customers report that the claims process can be more complicated compared to other insurers. This complexity may detract from Auto-Owners’ appeal as a provider of the best Mechanicsburg, Pennsylvania auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

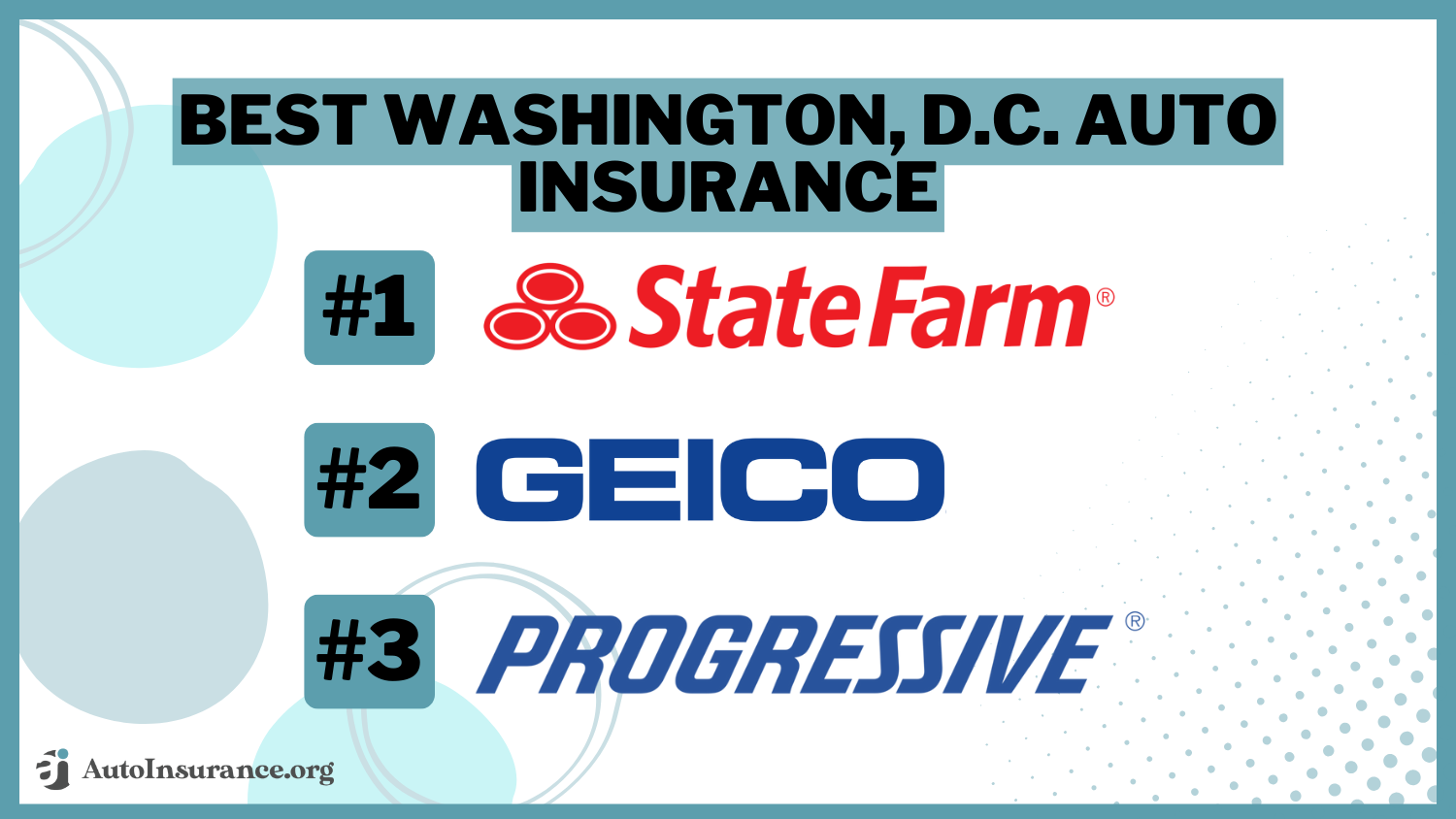

#5 – State Farm: Best for Balanced Offerings

Pros

- Strong Local Presence: Extensive network of local agents ensures personalized service and community support. This local presence is a key factor in State Farm’s reputation for the best Mechanicsburg, Pennsylvania auto insurance. Gain additional insights in our State Farm review.

- Good for Multi-Vehicle Policies: Offers substantial savings for customers with multiple vehicles insured under one policy. This discount is particularly beneficial for those seeking the best Mechanicsburg, Pennsylvania auto insurance with multiple vehicles.

- Transparent Pricing: Clear and straightforward pricing structure with no hidden fees or surcharges. This transparency ensures that customers receive the best Mechanicsburg, Pennsylvania auto insurance without unexpected costs.

Cons

- Customer Service Variability: Service quality can vary depending on the local agent and office, leading to inconsistent customer experiences. This variability may affect the overall perception of State Farm as the best Mechanicsburg, Pennsylvania auto insurance provider.

- Higher Costs for High-Risk Drivers: Rates for high-risk drivers or those with poor driving records can be on the higher side. This might make State Farm less ideal for those seeking affordable rates within the best Mechanicsburg, Pennsylvania auto insurance.

#6 – USAA: Best for Military Exclusivity

Pros

- Exclusive Military Benefits: As outlined in USAA auto insurance review, USAA offers specialized benefits and discounts for military members and their families. This makes USAA a standout option for the best Mechanicsburg, Pennsylvania auto insurance for those eligible.

- Positive Customer Feedback: Highly rated for customer service, with a reputation for efficient and friendly support. USAA’s service excellence contributes to its status as a top choice for the best Mechanicsburg, Pennsylvania auto insurance.

- Diverse Coverage Alternatives: Offers a wide range of coverage options, including high liability limits and extensive add-ons. These options help USAA meet the needs of those seeking the best Mechanicsburg, Pennsylvania auto insurance.

Cons

- Eligibility Restrictions: Only available to military personnel, veterans, and their families, limiting access for others. This exclusivity affects those outside this group looking for the best Mechanicsburg, Pennsylvania auto insurance.

- Limited Local Agent Network: Primarily operates through online and phone services, which might limit personal interaction for some customers. This can impact the overall experience for those seeking the best Mechanicsburg, Pennsylvania auto insurance.

#7 – Progressive: Best for Comprehensive Tools

Pros

- Advanced Online Tools: Provides advanced online tools and resources, including the Name Your Price® tool and coverage comparison features. These innovations help Progressive offer the best Mechanicsburg, Pennsylvania auto insurance with enhanced digital tools.

- All-Encompassing Policy Options: Offers a variety of customizable policy options and endorsements to fit diverse needs. Progressive’s flexibility is a key factor in providing the best Mechanicsburg, Pennsylvania auto insurance. Uncover more information in our Progressive auto insurance review.

- Strong Innovation Focus: Known for innovative features such as Snapshot® for usage-based insurance and other tech-forward solutions. These features contribute to Progressive’s reputation for the best Mechanicsburg, Pennsylvania auto insurance.

Cons

- Complex Policy Details: The wide array of coverage options and discounts can be overwhelming, making it challenging to navigate. This complexity can affect the overall experience of finding the best Mechanicsburg, Pennsylvania auto insurance.

- Higher Rates for Poor Credit: Rates can be significantly higher for drivers with poor credit histories, which may limit affordability for some customers seeking the best Mechanicsburg, Pennsylvania auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Broad Options

Pros

- Extensive Coverage Choices: Offers a broad spectrum of coverage options, including unique add-ons like new car replacement and accident forgiveness. These choices help Travelers provide the best Mechanicsburg, Pennsylvania auto insurance with tailored solutions.

- Discount Opportunities: Provides various discounts such as multi-policy, safe driver, and good student discounts. These discounts enhance Travelers’ appeal as a provider of the best Mechanicsburg, Pennsylvania auto insurance. Get more details in our Travelers auto insurance review.

- Excellent Financial Stability: Maintains high ratings from A.M. Best, indicating financial stability and reliability in paying claims. This financial strength supports Travelers’ position as a top choice for the best Mechanicsburg, Pennsylvania auto insurance.

Cons

- Mixed Customer Reviews: Some customers report mixed experiences with customer service and claims handling. This variability can affect Travelers’ overall reputation as a provider of the best Mechanicsburg, Pennsylvania auto insurance.

- Higher Premiums for Certain Drivers: May charge higher premiums for drivers with poor credit or high-risk profiles. This could impact the affordability of the best Mechanicsburg, Pennsylvania auto insurance for those in higher-risk categories.

#9 – Liberty Mutual: Best for Customizable Coverage

Pros

- Modifiable Coverage Choices: Liberty Mutual offers a range of customizable coverage options including new car replacement and accident forgiveness. This flexibility ensures that you can tailor your policy to fit your specific needs, making it a strong option for the best Mechanicsburg, Pennsylvania auto insurance.

- Extensive Network of Repair Shops: Partners with a large network of repair shops, ensuring that repairs are done to high standards. This network supports Liberty Mutual’s position as a reliable choice for the best Mechanicsburg, Pennsylvania auto insurance, as mentioned in our Liberty Mutual auto insurance review.

- High Customer Satisfaction Scores: Consistently receives high marks for customer satisfaction, particularly for its claims process and customer service. These positive ratings contribute to Liberty Mutual’s reputation for offering the best Mechanicsburg, Pennsylvania auto insurance.

Cons

- Higher Premiums for Some Drivers: May charge higher premiums for drivers with poor credit or multiple claims. This can affect the affordability of Liberty Mutual’s policies, impacting its overall appeal as the best Mechanicsburg, Pennsylvania auto insurance provider.

- Limited Regional Discounts: Some discounts and benefits may not be available in all regions, which can limit the cost-saving opportunities for Mechanicsburg, Pennsylvania drivers. This could make Liberty Mutual less competitive for the best Mechanicsburg, Pennsylvania auto insurance.

#10 – Allstate: Best for Mobile Innovation

Pros

- Unique Coverage Options: Offers specialized coverage options like vanishing deductible and accident forgiveness, providing additional peace of mind. These unique features make Allstate a notable choice for the best Mechanicsburg, Pennsylvania auto insurance.

- Strong Financial Performance: Maintains strong ratings from A.M. Best, indicating a solid financial foundation and reliable claim payments. This financial stability is a key reason why Allstate is considered a top provider for the best Mechanicsburg, Pennsylvania auto insurance.

- Wide Selection of Savings: Offers a wide array of discounts including safe driver, multi-vehicle, and bundling discounts. These opportunities for savings help make Allstate a competitive option for the best Mechanicsburg, Pennsylvania auto insurance, which you can discover more about in our Allstate review.

Cons

- Higher Rates for Younger Drivers: Tends to have higher rates for younger drivers or those with less driving experience. This can make Allstate less appealing for younger Mechanicsburg, Pennsylvania drivers seeking the best auto insurance.

- Mixed Customer Service Reviews: Some customers report inconsistent experiences with customer service, particularly regarding claims handling. This variability may impact Allstate’s overall reputation as the best Mechanicsburg, Pennsylvania auto insurance provider.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance in Mechanicsburg, Pennsylvania

In Mechanicsburg, Pennsylvania, auto insurance laws require drivers to carry at least the minimum coverage to be financially responsible in case of an accident. This includes $15,000 per person and $30,000 per accident for bodily injury liability, and $5,000 for property damage liability.

For those wondering, what are the benefits of auto insurance?, cheap usage-based options in Mechanicsburg vary by age, gender, and marital status. For example, a married 35-year-old pays about $173 with Allstate or $108 with Geico, while a single 17-year-old faces higher rates, such as $578 with Allstate or $310 with Geico.

Mechanicsburg, Pennsylvania Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $71 | $153 |

| Amica | $64 | $142 |

| Auto-Owners | $61 | $135 |

| Erie | $55 | $133 |

| Liberty Mutual | $70 | $158 |

| Nationwide | $60 | $138 |

| Progressive | $63 | $143 |

| State Farm | $65 | $148 |

| Travelers | $67 | $150 |

| USAA | $50 | $128 |

For senior drivers, such as married 60-year-old females and males, rates vary, with Geico offering lower premiums at $119 and $103 respectively, compared to higher rates with Liberty Mutual and Progressive.

On average, monthly auto insurance rates across companies in Mechanicsburg vary considerably, with USAA providing the lowest average monthly rate at $130 and Travelers the highest at $559.

Cheap Mechanicsburg, Pennsylvania Auto Insurance By Driving Record

Geico’s rates are lower, starting at $117 per month with a clean record, rising to $198 per month with one accident and $156 per month with a DUI. Liberty Mutual shows a significant increase from $331 per month with a clean record to $381 per month with one accident and $372 per month with a DUI.

Individuals with poor credit see even higher rates; Allstate charges $353 per month, Geico $236, and USAA offers the lowest at $162 per month for poor credit. For those seeking cheap usage-based auto insurance, rates can also vary by ZIP code and commute length, with monthly averages of $342 for ZIP code 17050 and $343 for ZIP code 17055.

Commute length impacts rates as well, with a 10-mile commute costing $270 per month with Allstate compared to $281 per month for a 25-mile commute. Coverage levels also affect premiums; a high coverage level with Allstate costs $286 per month, while Geico charges $172 per month for high coverage.

The Cheapest Mechanicsburg, Pennsylvania Auto Insurance Companies

Among the cheapest options, USAA offers the lowest average monthly rate at $130, making it an excellent choice for those seeking budget-friendly coverage. Do points affect auto insurance rates? Considering that, USAA remains a strong option for those looking to manage their premiums effectively.

Geico follows closely with an average rate of $158 per month, providing competitive pricing. Nationwide also presents a reasonable rate of $188 per month. State Farm and Progressive come next, with average rates of $198 and $323 per month, respectively.

On the higher end, Allstate and Liberty Mutual average $275 and $364 per month, while Travelers has the highest average rate at $559 per month. Comparing these options can help you find the best monthly rates for auto insurance in Mechanicsburg.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects auto insurance rates in Mechanicsburg, Pennsylvania?

For instance, the average commute time in Mechanicsburg is 20.9 minutes, according to City-Data. Cities with longer average commutes often see higher auto insurance costs, as extended driving times can increase the likelihood of accidents and overall wear and tear on vehicles.

Compare Mechanicsburg, Pennsylvania Auto Insurance Quotes

Before purchasing auto insurance in Mechanicsburg, Pennsylvania, it’s crucial to compare rates from various insurance providers to find the best deal, especially considering factors like the most expensive commutes in America.

To find the best deal on auto insurance, compare quotes from different companies, as premiums vary based on your driving record, credit history, and coverage levels.Heidi Mertlich Licensed Insurance Agent

To start, enter your ZIP code below to receive free auto insurance quotes tailored to your specific location and needs.

Frequently Asked Questions

What happens if I drive without insurance in Mechanicsburg, Pennsylvania?

Driving without insurance in Mechanicsburg is illegal and can lead to severe penalties, including fines, license suspension, and vehicle impoundment.

Pennsylvania law requires drivers to carry at least the minimum coverage to be financially responsible in case of an accident. Non-compliance can also result in higher insurance rates in the future. For guidance on how to file an auto insurance claim, consult your insurance provider’s resources or contact their customer service.

Can I cancel my auto insurance policy in Mechanicsburg, Pennsylvania?

Yes, you can cancel your auto insurance policy in Mechanicsburg, but you should review your policy for any cancellation fees or penalties. Ensure that you have alternative coverage in place to avoid legal issues and potential fines.

Notify your insurance provider in advance to facilitate a smooth cancellation process. Enter your ZIP code below to start comparing your quotes today.

What should I do in case of an accident or insurance claim in Mechanicsburg, PA?

First, ensure everyone is safe and seek medical attention if needed. Report the at-fault accident to your insurance provider as soon as possible and follow their instructions for filing a claim.

Document the accident scene, gather witness information, and keep records of all communications with your insurer.

Can I choose any auto insurance provider in Mechanicsburg, Pennsylvania?

Do I need more than the minimum coverage in Mechanicsburg, Pennsylvania?

While Pennsylvania’s minimum coverage meets legal requirements, additional coverage is often recommended for better protection.

Consider options like comprehensive and collision coverage to safeguard against various risks beyond the basics. Assess your personal circumstances and vehicle value to determine if extra coverage is necessary.

Are there discounts available for auto insurance in Mechanicsburg, Pennsylvania?

Yes, various discounts may be available, including those for safe driving, multi-vehicle policies, and bundling with other insurance types. Many insurers offer additional savings for features like vehicle safety equipment or low-mileage driving.

It’s beneficial to inquire about all possible discounts when obtaining quotes. To start, enter your ZIP code below to receive free auto insurance quotes.

How do traffic patterns in Mechanicsburg, Pennsylvania, influence auto insurance rates compared to other cities with similar traffic conditions?

Traffic patterns in Mechanicsburg can affect insurance rates by influencing accident risk and vehicle wear. Areas with heavy traffic or frequent congestion may see higher premiums due to increased likelihood of accidents.

This situation raises questions such as, “Is mandatory auto insurance unconstitutional?” because local traffic conditions can significantly impact the perceived fairness of insurance requirements.

Compared to cities with similar traffic conditions, Mechanicsburg’s rates may vary based on local risk factors and insurer policies.

What are the implications of having a poor credit score on auto insurance premiums in Mechanicsburg, Pennsylvania, and how does this compare to other regions?

A poor credit score typically results in higher auto insurance premiums in Mechanicsburg, as insurers often view it as a higher risk.

This trend is consistent with many other regions, where how credit scores affect auto insurance rates impacts insurance costs. Improving your credit score can help lower your premiums and improve overall insurance affordability.

How do commute lengths in Mechanicsburg, Pennsylvania, impact auto insurance rates, and what strategies can drivers use to mitigate these costs?

Longer commutes generally lead to higher insurance rates due to increased exposure to potential accidents. To mitigate these costs, consider reducing your commute distance if possible or carpooling to lower mileage.

Additionally, opting for usage-based insurance programs may help save on premiums based on actual driving patterns. To begin, enter your ZIP code below to compare your auto insurance quotes today.

What additional coverage options should Mechanicsburg, Pennsylvania drivers consider beyond the minimum state requirements to ensure comprehensive protection?

Beyond minimum requirements, drivers should consider comprehensive and collision coverage to protect against non-collision damages and vehicle repairs.

Additional options like uninsured motorist coverage and roadside assistance can further enhance protection. Evaluating personal needs and vehicle value helps determine the most suitable coverage levels.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.