Cheap Auto Insurance for Teens After an Accident in 2026 (Save Money With These 9 Companies!)

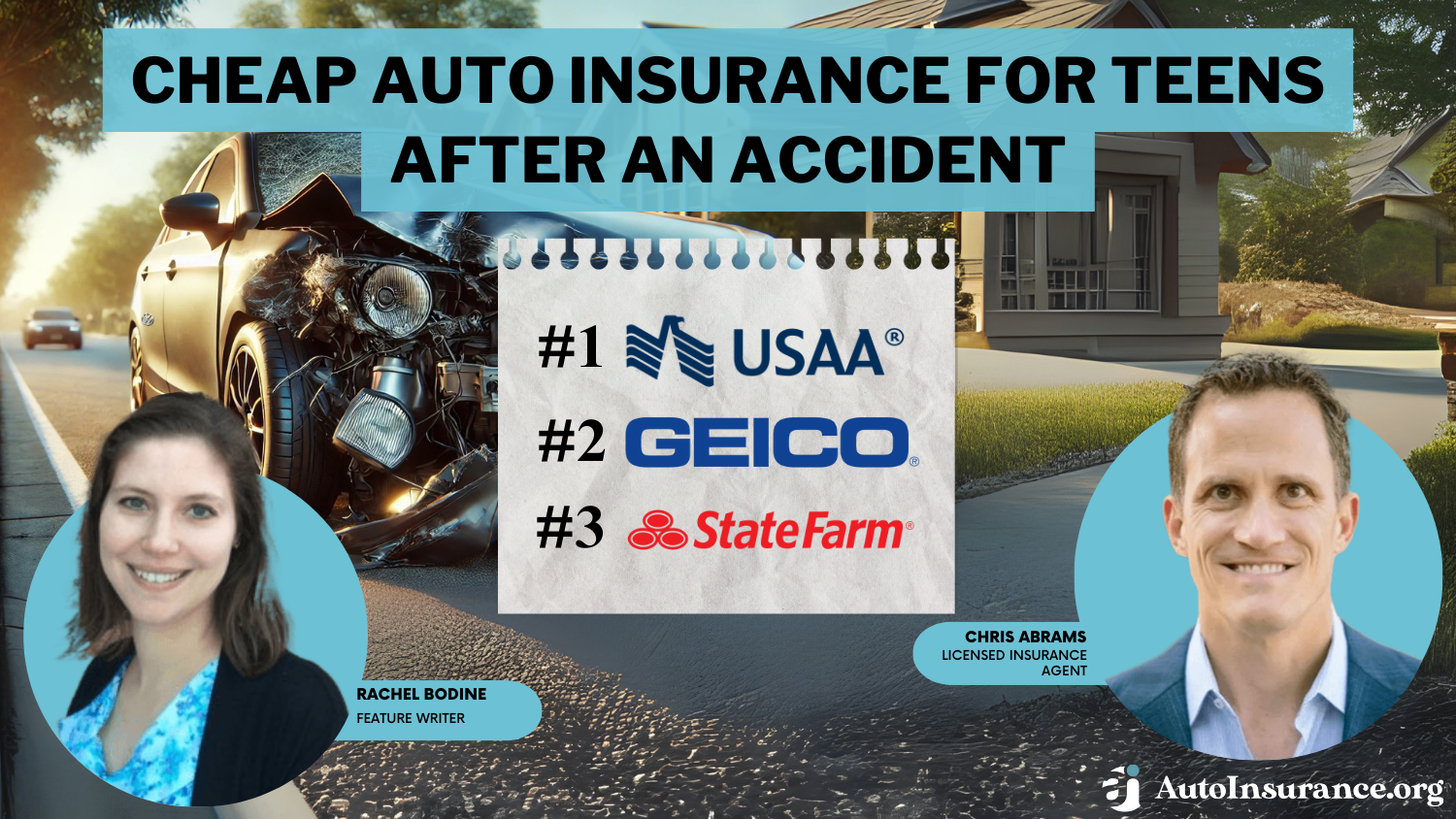

The lowest rates for cheap auto insurance for teens after an accident can be found at USAA, followed by Geico and State Farm. At USAA, minimum coverage averages $87 per month for teens. However, USAA is only for teens with military or veteran parents, so most teens have to shop at Geico or State Farm for insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated January 2025

6,589 reviews

6,589 reviewsCompany Facts

Avg. Monthly Rate for Teens After an Accident

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Avg. Monthly Rate for Teens After an Accident

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Avg. Monthly Rate for Teens After an Accident

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsUSAA has the lowest rates for cheap auto insurance for teens after an accident, with Geico and State Farm’s rates following close behind.

Some of the other best auto insurance companies for teens after an accident include Nationwide, Allstate, and more.

Our Top 9 Company Picks: Cheap Auto Insurance for Teens After an Accident

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $87 | A++ | Military Families | USAA | |

| #2 | $106 | A++ | Customizable Policies | Geico | |

| #3 | $124 | B | Local Agents | State Farm | |

| #4 | $167 | A+ | Vanishing Deductibles | Nationwide |

| #5 | $177 | A | Loyalty Discounts | American Family | |

| #6 | $222 | A+ | Usage-Based Discount | Allstate | |

| #7 | $271 | A | 24/7 Support | Farmers | |

| #8 | $278 | A | Add-On Coverages | Liberty Mutual |

| #9 | $280 | A+ | Budgeting Tools | Progressive |

Read on to learn more about the cheapest teen car insurance after an accident, as well as other tips and tricks to help teens with poor driving records save. You can also enter your ZIP code into our free quote comparison tool above to find the cheapest provider for you.

- USAA has the best cheap car insurance for teenagers after an accident

- Geico and State Farm are the best cheap companies for non-military teens

- Teens will find cheaper rates by staying on a parent’s policy

#1 – USAA: Top Pick Overall

Pros

- Cheap rates: USAA has the most affordable rates, on average, for teenagers after a car accident. Learn more about USAA in our USAA auto insurance review.

- Multiple discounts: Besides its already cheap rates, USAA also offers discounts that can benefit teen drivers, such as a good student discount.

- Good customer service reviews: USAA has great customer service reviews and a strong financial standing.

Cons

- Limited availability: USAA is only for families of military members or veterans, so not all teens will be able to get auto insurance from USAA.

- Fewer add-on coverage options: USAA doesn’t offer as many types of auto insurance add-on coverages as other companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Customizable Policies

Pros

- Multiple coverage options: Geico offers a variety of coverages to make customizable policies that meet the needs and budgets of teenage drivers.

- Easy policy management: Geico’s app and website are easy to use and have good ratings, so teens or their parents can easily check on rates and make policy changes.

- Defensive driving course discount: Teens can save on their auto insurance at Geico by taking a defensive driving course. Geico auto insurance discounts also include good student discounts, usage-based discounts, and more.

Cons

- Customer service can vary: Geico has some negative reviews about customer service and claims handling (learn more in our Geico auto insurance review).

- Fewer local agents: While Geico does offer some local agents, they are not as widespread as other companies like State Farm.

#3 – State Farm: Best for Local Agents

Pros

- Local agents: State Farm’s wide array of local agents makes it easy for teens to get in person advice and assistance. Read more in our State Farm auto insurance review.

- Usage-based discounts: State Farm has a Steer Clear program for drivers under 25, as well as a Drive Safe and Safe program (learn more: State Farm Drive Safe and Save Review).

- Multiple coverages: State Farm’s auto insurance coverage selection makes it easy for teens to customize insurance policies.

- Cheap for all teens: Usually, you can find the cheapest coverage for teens with a clean driving record from State Farm.

Cons

- Mixed customer reviews: State Farm has some negative reviews from customers, which is typical for large companies.

- Discount availability may be limited: State Farm’s discount availability and maximum savings vary by region.

#4 – Nationwide: Best for Vanishing Deductibles

Pros

- Vanishing deductibles: If teens stay accident-free for a few years, they will see a decrease in their deductible due to Nationwide’s vanishing deductible program.

- Car accident forgiveness: Teens may be forgiven their first accident, avoiding increased rates, if they meet Nationwide’s accident forgiveness requirements.

- Usage-based discount: Teens may be able to save on their Nationwide policy by participating in the Nationwide SmartRide program (read more: Nationwide SmartRide App Review).

Cons

- Limited availability: Nationwide doesn’t sell auto insurance in a handful of states. Find out more in our Nationwide auto insurance review.

- Mixed customer reviews: Nationwide has some negative claim reviews from customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 –American Family: Best for Loyalty Discounts

Pros

- Usage-based discount: Teens may be able to save by participating in American Family’s usage-based program (learn more: American Family Insurance KnowYourDrive Review).

- Loyalty discounts: American Family offers a loyalty discount to eligible customers, as well as several other discounts.

- Good coverage option: American Family has a good selection of coverage for teens. Learn more in our American Family auto insurance review.

Cons

- Limited availability: American Family is not available in every region.

- Mixed customer reviews: American Family has some negative reviews about the time the company takes to process claims.

#6 – Allstate: Best for Usage-Based Discount

Pros

- Usage-based discount: Teens with an accident on their record can try to lower their rates by participating in Allstate’s Drivewise program (learn more: Allstate Drivewise review).

- Accident forgiveness: Allstate does offer accident forgiveness to qualifying drivers, so teens may be able to avoid increased rates after their first at-fault accident at Allstate.

- Multiple coverages: Allstate has a good selection of coverage for teens to pick from to make a policy that fits their budget.

Cons

- Mixed customer reviews: Allstate has some negative reviews about its customer service and claims processing (read more: Allstate Auto Insurance Review).

- Fewer local agents: While Allstate does have local agents, they are not as widespread across regions, limiting access to in-person assistance.

#7 – Farmers: Best for 24/7 Support

Pros

- Usage-based discount: Teens may be able to earn a discount by participating in Farmers’ Signal program (read more: Farmers Signal Review).

- 24/7 support: Teens can get 24/7 assistance with claims and policies at Farmers.

- Multiple coverages: Farmers’ coverage options make it easy for teens to choose what coverages fit their budget.

Cons

- Mixed customer reviews: Like most major auto insurance companies, Farmers has some negative customer reviews (read more: Farmers Auto Insurance Review).

- Region rates can be high: In some states, Farmers has more expensive rates, which can make it less affordable for teen drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Add-On Coverages

Pros

- Multiple add-on coverages: Liberty Mutual has a great selection of coverage for teenagers to choose from, such as better car replacement coverage.

- Usage-based discounts: Liberty Mutual has a TeenSMART program for young drivers and a RightTrack program. Read more: Liberty Mutual RightTrack Review.

- Great financial stability: Liberty Mutual has good financial ratings, so it is able to pay out a normal amount of claims each year without financial hardship to the company.

Cons

- Mixed customer reviews: Liberty Mutual’s customer ratings are average, with some negative reviews mixed in with the positive.

- Regional rates vary: Liberty Mutual is not always one of the most affordable companies for teens, depending on what region it is in. Read more in our Liberty Mutual auto insurance review.

#9 – Progressive: Best for Budgeting Tools

Pros

- Budgeting tools: Progressive’s NameYourPrice tool helps customers see how much coverage they can get on their budget.

- Usage-based discounts: Progressive’s Snapshot program offers savings to drivers who do well on the app (learn more: Progressive Snapshot Review).

- Multiple coverages: Progressive’s selection of auto insurance coverages is great, allowing teens to fully protect themselves in case of an accident.

Cons

- Mixed reviews: Progressive has some negative reviews from customers about its customer service and claims processing. Our Progressive auto insurance review covers this in more detail.

- Regional rates may not be the cheapest: Progressive may not be as affordable for teens after an accident in some states.

Teen Auto Insurance Rates

Auto insurance for teens is much more expensive than for adults. Teens lack time behind the wheel and experience in general, which in turn means they are more likely to be in an accident. Insurance companies charge them more with that expectation.

Each company will offer different rates for teen coverage. For example, Geico teenage driver insurance costs will be different from the costs offered by State Farm, USAA car insurance, and any other company you may want to research. Compare Geico vs. State Farm auto insurance for more information.

Let’s look at just how much does it cost to insure a teenage driver after an accident and what factors are involved when determining rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Adding a Teenager to Your Auto Insurance After An Accident

You’re here because you want to know:

- How much will my insurance go up if my teenager has an accident?

- How much does it cost to add a teenager to car insurance on my Allstate or other auto insurance?

- What is the average cost of teenage car insurance?

- Do I have to add my teenager to my car insurance after an accident?

Let’s try to answer your questions.

Insurance rates for teen drivers are already sky-high, even before adding in an accident. So just how much does it cost to add a 16-year-old to auto insurance?

Let’s look at just how much age and gender play a part in auto insurance rates. This table shows you the average auto insurance rates by age and other demographics.

Auto Insurance Monthly Rates by Marital Status, Age, & Gender

| Insurance Company | Married Female (60) | Married Male (60) | Married Female (35) | Married Male (35) | Single Female (25) | Single Male (25) | Single Female (17) | Single Male (17) |

|---|---|---|---|---|---|---|---|---|

| $243 | $249 | $263 | $260 | $285 | $298 | $774 | $887 | |

| $166 | $168 | $184 | $185 | $191 | $225 | $500 | $678 | |

| $195 | $204 | $213 | $213 | $246 | $253 | $710 | $762 | |

| $187 | $190 | $192 | $193 | $198 | $189 | $471 | $523 | |

| $287 | $307 | $317 | $321 | $330 | $375 | $968 | $1,143 |

| $178 | $185 | $197 | $199 | $224 | $241 | $480 | $598 |

| $166 | $171 | $191 | $181 | $225 | $230 | $724 | $802 | |

| $156 | $156 | $173 | $173 | $195 | $213 | $496 | $610 | |

| $171 | $173 | $182 | $183 | $194 | $208 | $776 | $1,071 | |

| $121 | $121 | $129 | $128 | $166 | $177 | $401 | $449 |

How much is insurance for a 16-year-old a month? To find out how much is teenage auto insurance per month, we just divide out the numbers. For example, if you went with Geico, a 17-year-old would pay around $500 per month. And that’s before an accident. A 16-year-old would have similar rates.

Even drivers just out of their teens, age 25, will pay less than half that of a 17-year-old. If a teenage driver has an accident or receives a traffic ticket for the same incident, the auto insurance company involved will likely hike up their insurance rates.

Surcharges are likely to last for three years or at least until the young motorist reaches the next age plateau.

Auto Insurance for Teens After an Accident

If a new driver has an accident in the first year of insurance, rates will go up. Auto insurance surcharges will depend on the seriousness of the charge, the cause of the accident, and resulting injuries and property damage.

The most serious charges will most often stem from alcohol or drug-related traffic offenses and accidents. Auto insurance for impaired drivers can be difficult to find.

For example, if your teenager totaled a car while drinking, you can expect much higher rates than if it was a fender bender and the driver was sober.

This table will show you the average annual rate based on driving history. Drivers with no accidents or tickets will pay less, but let’s look at just what one of those things will do to your insurance premiums.

Sports Car Auto Insurance Monthly Rates by Provider & Driving Record

Insurance Company Clean Record One Accident One Speeding Ticket One DUI

$122 $189 $154 $211

$228 $321 $268 $385

$166 $251 $194 $276

$83 $118 $100 $153

$198 $282 $247 $275

$248 $335 $302 $447

$164 $230 $196 $338

$150 $265 $199 $200

$123 $146 $137 $160

$141 $199 $192 $294

Now that you can see what happens when you have an accident or get a ticket, you can see that a teen who’s already paying higher rates will have a huge rate increase for bad driving.

Other factors that affect auto insurance for a teen driver include the kind of car the teen is driving.

Cars that are more expensive will naturally cost more to insure, as will sports cars, classic automobiles, or other specialty or high-performance vehicles.

Where you live will also affect your insurance rates. If you live in one of the best states for cheap teen auto insurance, then your overall cost will be lower. However, if you carry full coverage auto insurance, surcharges for tickets or accidents will rise proportionately. If you carry only minimal coverage, rate increases won’t hit nearly as hard.

Most experts agree that it’s almost always cheaper for teens to hitch on to their parents’ auto insurance policies. Parents often have long-term established relationships with their insurance providers, multiple policy discounts, and other benefits.

While parents can expect their insurance rates to rise if their teen has a chargeable accident, the results wouldn’t be nearly as disastrous as they might be if their teen were to have an accident under his or her own policy.Dani Best Licensed Insurance Producer

In many cases, where accidental damage is minimal and no police report has been filed, it may be well to pay the repair costs out-of-pocket and not report the mishap to the insurance company. The rates you save will definitely be of some consequence. Having an emergency fund or other savings for just such occurrence is always a good idea.

In this way, you can protect your son or daughter from the results of reporting a fender bender to your insurance provider and thus avoid the shocking insurance rate increases that could follow.

Other Facts About Teen Auto Insurance

The National Association of Insurance Commissioners (NAIC) has published several helpful articles on the subject of teenage drivers. NAIC warns of higher rates when you add a teenage driver to your existing auto policy.

While some states disallow gender differences in pricing insurance, you can expect your rates to increase by 50% by adding a female driver in her teens, while you may see as much as a 100% increase when you add a male teen to your current policy. Why are auto insurance rates higher for males? They often get into more auto accidents than females, statistically speaking.

Learn More: Cheapest Teen Driver Auto Insurance in California

Other Factors About Teenage Auto Insurance After an Accident

If your son or daughter will be going away to college and you are thinking of providing them with a car to take with them, you may want to think twice.

Many insurance providers will require your college student to take out their own policy if they are living away from home and have their own car.

Once your children reach their teen years, you may want to consider increasing your liability auto insurance coverage or adding an umbrella policy to your existing homeowners’ insurance package.

In this day and age, coverage of a million dollars or more isn’t too much when protecting your family against potential lawsuits arising from injury accidents.

Controlling costs is possible, says the NAIC if you observe a few simple rules.

One of the best ways to save on your auto insurance rate is to add your teen driver to your insurance policy instead of getting a separate policy for your child.

Shop around and compare the rates of a number of auto insurance providers. From company to company, there may be significant differences in how they treat teen drivers. Taking advantage of a student discount can help lower the cost of an auto insurance policy.

Parents should encourage their teens to earn good grades as most insurance companies are willing to discount rates for good students as well as good drivers. Taking a driver’s safety or education class will also help to lower auto insurance rates for teen drivers.

Always check auto insurance rates for the make and model of the car you are considering for your teen. Family wagons and economy cars are most often the least expensive to insure, while SUVs, sports cars, and convertibles are amongst the most expensive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why Insurance Is Expensive for Teen Drivers After an Accident

The Center for Disease Control (CDC) published a recent web article on teenage drivers, focusing on the reasons that they are at such a high risk for potential injuries and even death from motor vehicle accidents on the streets and highways of America.

Teens are much more likely to underestimate or fail to recognize perilous situations than their older counterparts. Teenage drivers are also more likely to speed and tailgate the drivers in front of them. Teenagers, especially males, are also more likely to show off for their peers if there are teenage passengers in the car.

Insurance Information Institute traffic accident statistics do not favor teenagers behind the wheel. Drivers between the ages of 15 and 20 were 5.4% of the driving population but accounted for 8% of the drivers in fatal crashes in 2017.

The risk of crashing is especially high during the first year a teenager is on the road. Among teens 15 to 20 who were involved in fatal auto accidents, 37% had been speeding while 26% had been drinking. Young men are twice as likely to die in an automobile crash as young female drivers are.

Other statistic-based factors are:

- Teens are less likely to use seat belts than older drivers.

- Teenage drivers also engage in a number of other risky behaviors that can be directly linked to car crashes.

- High percentages of teens don’t wear their seatbelts when riding as passengers as well.

- Teen drivers are also distracted easily by friends in the car or by their cell phones, iPods, or other electronic devices. In the last few years, many states have passed motor vehicle laws making it a crime to text while driving in addition to using a cell phone without a hands-free device.

- According to the CDC, a survey completed in 2007 found that almost 30% of teens reported riding with a driver in the previous month that had been drinking. In 2008, of those teens killed in an auto accident after drinking, 75% were not wearing their seat belts.

Most fatal accidents involving teens occur on the weekends between the hours of three in the afternoon and midnight.

Encouraging your child to develop safe driving habits will save money on your annual premium and protect them behind the wheel.

Assigned Risk Insurance: How it Affects Teens After an Accident

Teens who have suffered serious accidents or received multiple traffic violations may find their state’s assigned risk pool the only available insurance coverage if they intend to continue driving.

All avenues should be pursued since obtaining insurance through a private company may still be possible and is usually preferable to the risk pool.

If you can’t get insurance through regular channels, your state will provide at least minimal coverage, but you will certainly pay rates several times those of conventional coverage for the privilege.

Not just teenagers could be caught in the assigned risk pool. Anyone with a less-than-clean driving record or whose insurance may have lapsed for a period of years may need pool coverage.

Adults who have not driven in a number of years may also be classified in the assigned risk category.

Residents of high-crime and therefore high insurance-risk areas will also be subject to very high insurance rates.

Your state insurance department can provide you with information about assigned risk pool auto insurance programs in your area.

Assigned risk pools are created by the voluntary contributions of insurance providers in a particular state.

Some states have created joint underwriting associations to handle the problem of higher-risk motorists. In either case, auto insurance is available for any eligible driver, though rates will be quite high.

Finding the Cheapest Auto Insurance for Teens After an Accident

Because they are not experienced drivers, teenagers pose a number of risks when they first learn to drive and head out on their own. Their newly found freedom, however, comes with a steep price. Thousands of teens lose their lives each year because of traffic-related fatalities.

Tens of thousands of others end up in emergency rooms around the country suffering from injuries because of car crashes.

It is up to us as parents, teachers, friends, and community members to help educate teens and guide them to the proper and safe use of a driver’s license and an automobile.

Driving is a privilege, but it is also a responsibility that should be treated in a serious and adult fashion.

Making sure that we are training our children to be safe drivers will help you find affordable car insurance for teen drivers. Teen drivers who do well in school may be rewarded with good student auto insurance discounts, even after an accident.

Auto Insurance for Teens After an Accident: In Summary

In order to find out what is the cheapest car insurance for a teenager, you need to get multiple quotes to compare. Not all companies offer the same coverages at the same rates for auto insurance for teenagers.

Shop now for the best auto insurance rates for teens now when you click here to enter your ZIP in our free search tool! It’s the best way to find the cheapest car insurance companies in your area.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.