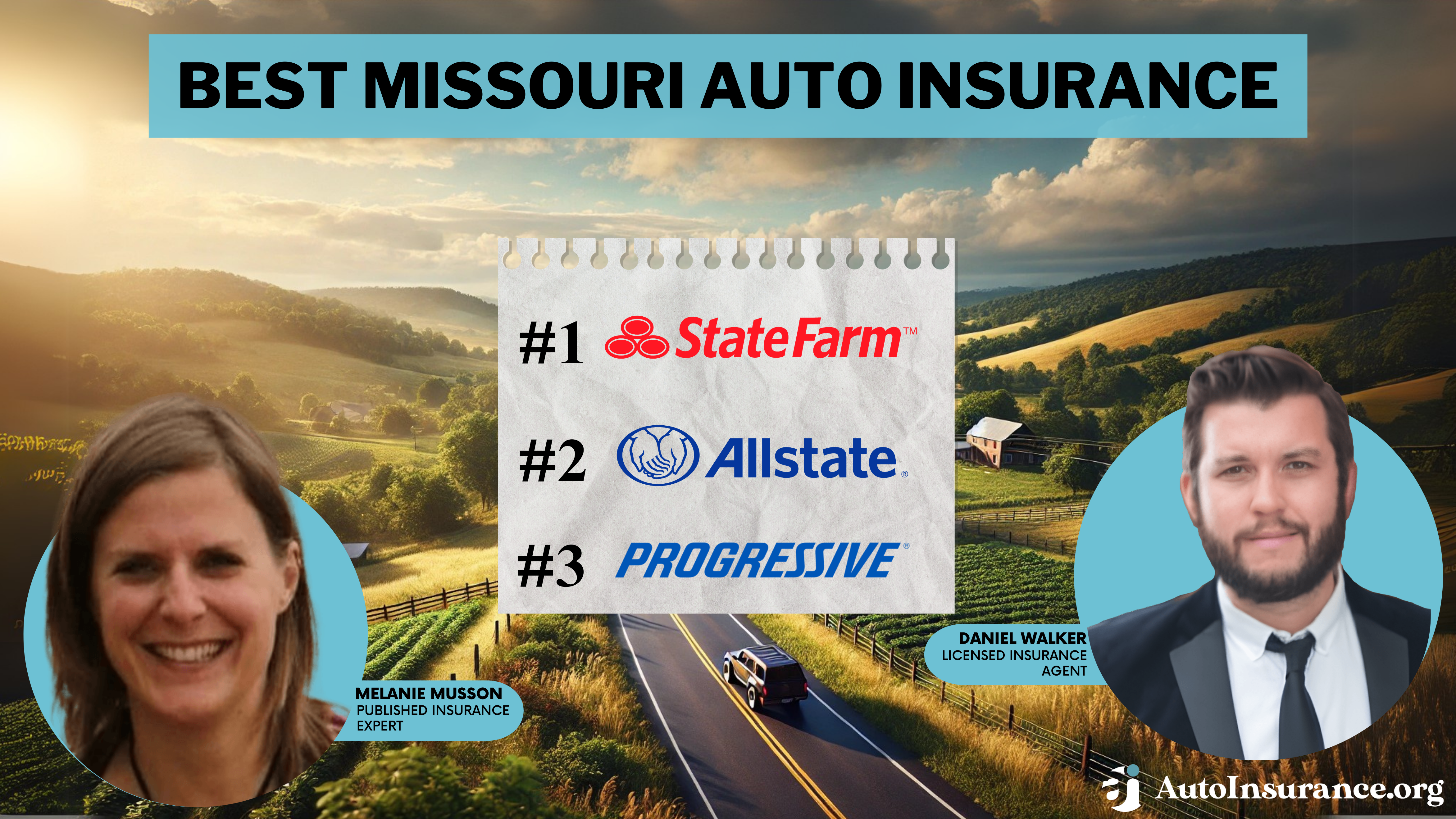

Best Missouri Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

Explore the best Missouri auto insurance and get rates as low as $30 per month with State Farm, Allstate, and Progressive. These companies excel in providing extensive coverage options and excellent customer service. Compare quotes from these top providers to find the cheapest auto insurance in Missouri.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated January 2025

Company Facts

Full Coverage for Missouri

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Missouri

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Missouri

A.M. Best Rating

Complaint Level

Pros & Cons

Our Top 10 Company Picks: Best Missouri Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Many Discounts State Farm

#2 25% A+ Add-on Coverages Allstate

#3 10% A+ Online Convenience Progressive

#4 13% A++ Accident Forgiveness Travelers

#5 10% A++ Military Savings USAA

#6 25% A++ Cheap Rates Geico

#7 20% A+ Usage Discount Nationwide

#8 25% A Student Savings American Family

#9 25% A Customizable Polices Liberty Mutual

#10 20% A Local Agents Farmers

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code above to find the most affordable quotes in your area.

- State Farm is the top pick for reliable coverage and excellent service

- Missouri drivers find affordable full coverage despite low minimum coverage limits

- Driving record and ZIP code affect Missouri auto insurance rates

#1 – State Farm: Top Overall Pick

Pros

- Comprehensive Coverage Options: State Farm offers a wide range of coverage options, including comprehensive, collision, and liability, allowing customers to tailor their policies to their needs.

- Customer Service Reputation: Known for its strong customer service, State Farm has a network of agents who provide personalized service and support.

- Nationally Recognized Brand: As one of the largest insurers in the U.S., State Farm’s reputation and financial stability provide peace of mind. Discover insights in our guide titled State Farm auto insurance review.

Cons

- Rate Increases: Like many insurers, State Farm’s rates can increase significantly after accidents or other incidents.

- Some Issues With Claim Handling: While generally well-regarded, some customers report issues with the speed and efficiency of claim processing.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Add-on Coverages

Pros

- Many Optional Coverages Available: Allstate offers a variety of optional coverages such as roadside assistance, rental reimbursement, and personal injury protection.

- User-Friendly Mobile App: Their mobile app allows customers to manage policies, file claims, and access roadside assistance easily.

- Policy Management: Allstate provides useful tools online for managing policies and understanding coverage options.

Cons

- Higher Premiums: Allstate tends to have higher average premiums compared to some of its competitors. Learn more about their premiums in our Allstate auto insurance review.

- Mixed Customer Reviews: While some customers praise their service, others report frustration with claim handling and customer support.

#3 – Progressive: Best for Online Convenience

Pros

- Name Your Price® Tool: Progressive’s Name Your Price® tool allows customers to customize their policies to fit their budget.

- Strong Online Presence: They have a robust online platform and mobile app that make managing policies and filing claims convenient.

- Wide Range of Discounts: Progressive offers a variety of discounts, including multi-policy, safe driver, and homeowner discounts.

Cons

- High-Risk Drivers: As mentioned in our Progressive auto insurance review, rates can be higher for high-risk drivers.

- Wide Variability in Rates: Rates can vary widely based on individual factors such as driving record, location, and type of coverage.

#4 – Travelers: Best for Accident Forgiveness

Pros

- Strong Financial Stability: Travelers is known for its financial strength and stability, which reassures customers of their ability to pay claims.

- Variety of Insurance Products: In our Travelers auto insurance review, they offer a wide range of insurance products beyond auto.

- Good Discounts and Benefits: Travelers provides various discounts and benefits for policyholders, helping to reduce premiums.

Cons

- Limited Availability: Travelers may not be available in all states or regions, limiting access for some customers.

- Average Ratings: While generally solid, Travelers’ customer service ratings are average compared to top competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Savings

Pros

- Member Benefits: USAA consistently receives high ratings for customer service and offers a range of benefits to military members and their families.

- High Ratings: Members often praise USAA’s dedication to service and support. Check out our USAA auto insurance review to learn more details.

- Serving Military Members: USAA understands the unique needs of military families and provides tailored insurance solutions.

Cons

- Limited Eligibility: Only available to military members and their families.

- Limited Availability: May not have physical locations in all areas.

#6 – Geico: Best for Cheap Rates

Pros

- Competitive Pricing: Geico is known for its competitive pricing and offers discounts that can significantly lower premiums.

- User-Friendly Website: Their digital tools are user-friendly, making it easy to manage policies, file claims, and get quotes online.

- Savings Opportunities: Geico provides a variety of discounts for safe driving, see more details in our Geico auto insurance review.

Cons

- Mixed Reviews: While many customers are satisfied, some report issues with claim handling and customer service.

- Potential Rate Increases After Claims: Like most insurers, Geico may raise rates after accidents or other incidents.

#7 – Nationwide: Best for Usage Discount

Pros

- Affordable Premiums: Nationwide offers competitive premiums, making it an attractive option for budget-conscious customers.

- Variety of Coverage Options: They provide a range of coverage options to meet different needs, from basic liability to comprehensive coverage.

- Strong Financial Stability: Nationwide is financially stable, which gives customers confidence. For more information, read our Nationwide auto insurance review.

Cons

- Low Ratings: Nationwide receives lower customer satisfaction ratings compared to some of its competitors.

- Rates by Location: Premiums can vary widely depending on where you live, impacting overall affordability.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Student Savings

Pros

- Customizable Coverage Options: American Family offers customizable coverage options to fit individual needs and budgets.

- Strong Customer Service Reputation: They are known for their excellent customer service and dedication to their policyholders.

- Variety of Discounts Available: American Family provides a range of discounts for policyholders, helping to save on premiums.

Cons

- Higher Premiums: American Family tends to have higher premiums compared to some other insurers (Read More: American Family Auto Insurance Review).

- Limited Availability in Some States: Availability may be limited in certain states, which could restrict access for potential customers.

#9 – Liberty Mutual: Best for Customizable Polices

Pros

- Customizable Coverage Options: American Family offers customizable coverage options to fit individual needs and budgets.

- Strong Customer Service Reputation: They are known for their excellent customer service and dedication to their policyholders.

- Variety of Discounts: American Family provides a range of discounts for policyholders, helping to save on premiums.

Cons

- Customer Service: Some customers report average service experiences.

- Limited Discounts: May not offer as many discount opportunities. Discover more about discounts in our complete Liberty Mutual auto insurance review.

#10 – Farmers: Best for Local Agents

Pros

- Personalized Customer Service: Farmers agents provide personalized service and guidance, which customers appreciate.

- Variety of Discounts: They offer a wide range of discounts that can help reduce premiums.(Read More: Farmers auto insurance discounts).

- Strong Community Involvement: Farmers is known for its involvement in the community and support for various charitable initiatives.

Cons

- Average Customer Service: Some customers report average service experiences.

- Potentially Higher Premiums: Rates may be higher depending on the driver’s profile.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Missouri Minimum Liability Auto Insurance

Missouri is an at-fault state, meaning the driver who caused the damage must pay for repairs. As such, the state mandates drivers have liability coverage that pays for bodily injuries and property damage to others.

There are many factors that affect auto insurance rates, such as age, driving record, credit score, and ZIP code. Additionally, each car insurance company weighs those factors differently and offers different rates.

The table below compares monthly auto insurance rates for minimum and full coverage from top providers in Missouri:

Missouri Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$52 $148

$37 $106

$48 $135

$32 $90

$46 $129

$23 $66

$35 $98

$30 $85

$40 $114

$18 $50

Let’s look at how your coverage amount affects car insurance rates. Although Missouri only requires a small amount of liability auto insurance and uninsured motorist coverage, most drivers opt for full coverage, including collision and comprehensive.

This table shows the average monthly Missouri car insurance rates from top companies based on minimum coverage for a 45-year-old driver with a clean driving record.

Monthly Minimum Auto Insurance Rates from Top Providers in Missouri

| Insurance Company | Monthly Rates |

|---|---|

| $52 | |

| $37 | |

| $48 | |

| $32 | |

| $46 |

| $23 |

| $35 | |

| $30 | |

| $40 | |

| $18 | |

| U.S. Average | $45 |

Geico has the cheapest minimum coverage rates in Missouri, and Nationwide is the second cheapest. Check out our Geico auto insurance review for more information about Geico’s options.

Although Missouri drivers can get the required coverage for around $25 a month, it may not provide enough coverage to meet their needs.

Missouri Full Coverage Auto Insurance

Most drivers find that full coverage auto insurance — which includes collision and comprehensive coverages — is necessary. Collision pays for damages to your vehicle from an accident, and comprehensive pays for damages unrelated to an accident, like theft.

This table shows the rates for average full coverage auto insurance in Missouri:

Missouri Full Coverage Auto Insurance Average Rates From Top Providers

| Insurance Company | Monthly Rates |

|---|---|

| $148 | |

| $106 | |

| $135 | |

| $90 | |

| $129 |

| $66 |

| $98 | |

| $85 | |

| $114 | |

| $50 | |

| U.S. Average | $119 |

While USAA has the cheapest coverage rates in Missouri, it only provides coverage to military members, veterans, and their families. Geico offers the most affordable average Missouri full coverage rates to all drivers at $65 a month, and Nationwide is the next cheapest insurer at $85 a month.

The most expensive rates belong to Allstate, regardless of the coverage type. On average, a 45-year-old driver only pays $65 a month for Nationwide full coverage, but that same driver pays more than twice that with Allstate.

Remember, while full coverage is more expensive, it offers better protection. For example, collision coverage pays for the damages if you hit a tree. However, if you only have the Missouri minimum coverage, you’ll have to pay for expensive repairs.

Missouri Auto Insurance Rates by Age

Car insurance companies consider age when setting rates. Since younger drivers don’t have the experience necessary to avoid accidents, they see significantly higher rates than older, more experienced drivers. Therefore, finding affordable auto insurance for teens can be a challenge.

Nationwide offers the cheapest rates for most ages and averages $116 monthly for full coverage. Read our Nationwide auto insurance review to learn more about the company. On the other hand, Travelers offers very expensive teen rates and averages $306 monthly for full coverage.

Missouri Full Coverage Auto Insurance Monthly Rates for Teens

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $779 | $754 | $574 | $613 | |

| $428 | $526 | $315 | $428 | |

| $851 | $812 | $627 | $660 | |

| $303 | $265 | $223 | $215 | |

| $459 | $462 | $338 | $376 |

| $258 | $304 | $190 | $247 |

| $845 | $866 | $623 | $704 | |

| $298 | $338 | $219 | $275 | |

| $641 | $915 | $473 | $744 | |

| $191 | $206 | $141 | $168 | |

| U.S. Average | $566 | $618 | $416 | $501 |

Fortunately, car insurance rates begin to decrease around age 25. For example, Nationwide’s car insurance rates for 16-year-olds average $300 a month, but Nationwide rates for 25-year-olds average $81 a month.

Gender also affects car insurance rates. Typically, males have higher rates because they’re statistically more likely to take risks. For example, on average, 25-year-old females pay about $10 a month less than their male counterparts.

Missouri Auto Insurance for Accidents and Tickets

Your driving record is one of the most significant factors affecting car insurance rates. Drivers with accidents or tickets show they’re likely to cost the insurance company money.

This table shows how accidents affect Missouri auto insurance rates.

Missouri Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $195 | $148 | |

| $182 | $106 | |

| $207 | $135 | |

| $121 | $90 | |

| $184 | $129 |

| $133 | $66 |

| $197 | $98 | |

| $100 | $85 | |

| $96 | $114 | |

| $74 | $50 | |

| U.S. Average | $173 | $119 |

While State Farm offers some of the best auto insurance for drivers with accidents, Missouri residents still pay about $12 a month more after their first at-fault accident. Additional accidents increase those rates greatly.

Farmers and Allstate have the highest rates after an accident, but Progressive increases them the most after an at-fault accident.

Next, let’s look at how a speeding ticket affects your auto insurance rates in Missouri.

Missouri Full Coverage Auto Insurance Monthly Rates: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $165 | $148 | |

| $140 | $106 | |

| $182 | $135 | |

| $178 | $90 | |

| $165 | $129 |

| $109 | $66 |

| $156 | $98 | |

| $89 | $85 | |

| $100 | $114 | |

| $61 | $50 | |

| U.S. Average | $147 | $119 |

State Farm offers the lowest rates after a speeding ticket, but your rates still increase by around $10 a month.

Liberty Mutual has the highest rates after a speeding ticket and the greatest increase from a clean record to one with a ticket.

Fortunately, accidents and tickets only affect Missouri car insurance for three years. After that, your rates return to normal. So avoid adding accidents or tickets to your driving record to get lower Missouri insurance rates.

Missouri Auto Insurance for Bad Credit

Many drivers aren’t aware that companies use credit scores to help determine their rates (learn about the best auto insurance companies that use credit scores). Statistically, drivers with poor credit are more likely to file claims and be unable to pay for damages out of pocket. However, drivers with a high credit score are more likely to pay for damages themselves and avoid a claim.

This table shows average monthly rates for drivers with poor and good credit scores.

Missouri Full Coverage Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $170 | $188 | $210 | |

| $95 | $110 | $130 | |

| $140 | $157 | $178 | |

| $105 | $123 | $140 | |

| $130 | $147 | $165 |

| $130 | $150 | $168 |

| $140 | $157 | $175 | |

| $98 | $112 | $128 | |

| $110 | $128 | $148 | |

| $92 | $105 | $126 |

Nationwide and Geico offer the cheapest car insurance rates for drivers with bad credit. However, Liberty Mutual has the highest rates, which are more than double those of Nationwide.

Some states, like California, don’t allow insurance companies to use your credit score to determine rates. However, Missouri allows it, so improving your credit score also lowers car insurance rates.

Missouri DUI Laws

In Missouri, you’ll likely be charged with a DUI if your blood alcohol level is 0.08% or higher. Not only will you face jail time and heavy fines, but your car insurance rates will also increase. A DUI increases your rates more than other violations like at-fault accidents or speeding tickets, so it is difficult to find cheap auto insurance for drivers with a DUI.

How DUIs Affect Missouri Auto Insurance Rates

State Farm offers the lowest car insurance rates after a DUI, with only a $6 monthly increase with a clean driving record. Check out our State Farm auto insurance review for more information. On the other hand, Liberty Mutual has the highest rates after a DUI.

Fortunately, you’ll only pay higher rates for five years. After that, your charge doesn’t affect your car insurance rates. However, it does show up on your driving record for 10 years. So, if you’re applying for a driving job, be aware that your DUI may appear.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Missouri Auto Insurance Rates by City

Your location also affects car insurance rates. Large cities tend to have higher crime rates and a larger traffic volume.

Insurers charge higher rates since your car is more likely to be stolen, vandalized, or damaged in an accident. For example, car insurance in Kansas City is higher than in rural areas.

While moving to get cheaper car insurance rates isn’t realistic, it’s something to consider when making your next move. Compare rates from multiple areas to see which offers lower car insurance rates.

Missouri City Auto Insurance Rates Comparison

Explore the comparative rates for various Missouri cities to gain insights into variations that might impact your insurance choices.

Missouri Auto Insurance Cost by City

Start your journey toward finding the right auto insurance for your needs.

Missouri Auto Insurance Requirements

Drivers must meet the Missouri minimum auto insurance requirements to drive legally in the state. However, limits are low, and most drivers opt for more coverage.

Drivers in Missouri must carry the following:

- $25,000 in Bodily Injury Liability per Person

- $50,000 in Bodily Injury Liability per Accident

- $25,000 in Property Damage Liability per Person

- $25,000 in Uninsured Motorist Bodily Injury Liability per Person

- $50,000 in Uninsured Motorist Bodily Injury Liability per Accident

After a severe accident, you may exhaust these limits quickly. Consider increasing limits and adding coverage for full protection.

Additional coverage options in Missouri include:

- Comprehensive: Comprehensive auto insurance pays for damages unrelated to an accident, such as flood, fire, theft, vandalism, and acts of nature.

- Collision: Collision auto insurance pays for damages related to an accident, such as hitting another car, an object, or rolling over.

- Gap Insurance: Gap insurance covers the difference between what you owe on a vehicle and its worth.

- Roadside Assistance: Roadside assistance coverage offers help if your car breaks down. It usually includes tows, jump starts, fuel delivery, and lock-out service.

- Rental Car Reimbursement: Rental car reimbursement coverage pays for a rental car while your vehicle is in the shop for repairs from a covered claim.

You may add the above-listed coverages and features to your policy for better protection, but each coverage raises your rates. In addition, collision and comprehensive coverages have deductibles you must meet before coverage kicks in.

Liability auto insurance in Missouri costs an average of $46 per month.Jeff Root LICENSED INSURANCE AGENT

Most experts recommend full coverage, including the Missouri mandatory minimum, comprehensive, and collision coverages. If you choose just the minimum coverage, your vehicle isn’t protected, and you’ll pay for repairs yourself.

Most lenders also require gap coverage if you have a car loan or lease since cars depreciate quickly.

Missouri Proof of Insurance

You must prove you have at least the minimum car insurance required in Missouri if you’re in an accident or stopped by the police. You can show coverage with a card from your insurer or through your insurer’s app on your phone.

Failing to have car insurance can lead to driver’s license suspension. In addition, you’ll pay a reinstatement fee. The penalties’ severity depends on whether it’s your first or subsequent offense.

For example, if it’s your first offense, your license won’t be suspended, and your reinstatement fee is only $20. However, if it’s your third offense, your license will be suspended for a year, and your fee is $400.

Stuck trying to choose the right coverage? Call State Farm. pic.twitter.com/rwojdNXjFa

— State Farm (@StateFarm) May 7, 2024

According to the Insurance Information Institute, around 12% of drivers nationally are uninsured. However, 16% of Missouri drivers are uninsured. Maintaining car insurance is essential since many other Missouri drivers don’t have coverage.

You’ll also face increased car insurance rates if you have a coverage lapse, and you must pay out of pocket for damages you cause in an accident.

Missouri SR-22 Insurance

SR-22 insurance is available to Missouri drivers. You may be required to carry SR-22 insurance if you have DUIs, multiple at-fault accidents, drove with a suspended license, or drove without insurance.

However, SR-22 isn’t additional insurance coverage. Instead, it’s a form your insurer files with the state showing you have at least the minimum amount of car insurance required. The form is typically inexpensive, but your insurance rates will skyrocket.

Since the need for SR-22 insurance shows you’re a high-risk driver, insurers charge much higher rates. Additionally, some insurers may decline coverage.

If you already have car insurance, you may be able to add SR-22 to your current policy. Unfortunately, not all insurance companies offer SR-22 coverage, but rates will increase significantly if provided. However, you may be able to get lower rates if you have a good history with your insurer.

If you don’t have car insurance, shop around to find the cheapest SR-22 insurance in Missouri. However, finding new coverage may be even more challenging since you’ll have a lapse in insurance history.

If you need SR-22 but don’t have a car, consider non-owner insurance. This type of insurance meets your state requirements and allows you to drive vehicles you don’t own. In addition, it’s typically cheaper than a traditional policy because coverage is limited.

Finding the Best Auto Insurance Company in Missouri

It’s difficult to determine the best auto insurance in Missouri because there are many criteria to consider. While one person may choose the best company based on rates, another may consider customer satisfaction the most critical factor.

For example, J.D. Power ranks insurance companies on customer satisfaction, including service, cost, products available, and billing. Although Nationwide has the lowest average rates in Missouri, it ranks last with J.D. Power.

As you look for the best Missouri car insurance company for you, compare rates, ratings, and products. Remember, low rates are great, but you also need a company you can trust.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips to Save on Missouri Auto Insurance

Since we know that Missouri car insurance rates are above the national average, finding ways to lower costs is essential. So let’s look at some ways to get the lowest rates possible.

Improve Factors That Affect Missouri Auto Insurance Rates

As we discussed above, many factors affect the cost of car insurance in Missouri — improving those factors lowers rates.

Ways to get lower car insurance rates include:

- Avoid Infractions on Your Driving Record: Accidents and tickets increase Missouri auto insurance rates for three years. Keep your driving record clean to get the lowest rates (Read More: What is accident forgiveness?).

- Raise Your Credit Score: Since insurance companies charge higher rates if you have poor credit, do what you can to raise your score, like making on-time car insurance payments.

- Think Carefully About a New Vehicle: New or expensive cars are more costly to repair. Consider an older or inexpensive vehicle to keep rates low.

- Consider Your ZIP Code: If you’re moving, compare ZIP codes to see which one comes with lower car insurance rates.

While you can’t change some factors like your age, making other changes will lower your car insurance rates.

Missouri Auto Insurance Discounts

Most car insurance companies offer car insurance discounts to lower rates based on the driver, policy, and vehicle. However, available discounts and discount amounts vary by insurer. Common savings include multi-car, multi-policy, good driver, good student, and vehicle safety feature discounts.

Most drivers qualify for more than one discount, so bundle all of your eligible discounts for the most savings.

While many states require insurers to offer certain discounts, Missouri doesn’t require companies to offer any specific discount. So speak with your insurer to determine which discounts are available to you in Missouri.

Adjust Missouri Coverage and Deductibles

Two aspects you can control are your car insurance coverages and deductibles. Adjusting these factors lowers your car insurance rates.

First, consider which coverages are on your policy and drop the ones you no longer need.

For example, if your vehicle is older or not worth much money, you may want to drop collision and comprehensive coverages. It may be cheaper to pay for repairs or a replacement vehicle yourself than to pay higher car insurance rates.

Next, look at your auto insurance deductibles. Each coverage comes with its own deductible, usually between $250 and $1,000. Higher deductibles mean lower rates. So although you’ll pay more out of pocket for repairs, your rates will be lower.

Learn more: Auto Insurance Deductibles Defined

Shop Around for Missouri Auto Insurance

Every car insurance company weighs your factors differently and offers different rates. For example, one company may charge higher rates for that speeding ticket you got last year, but another might overlook it since it’s your first infraction.

The best way to find the lowest rates is to compare rates from multiple companies. Compare local and national companies to get your best deal.

Read More: Where to Compare Auto Insurance Rates

Auto Insurance in Missouri: The Bottom Line

Car insurance quotes in Missouri must include 25/50/25 in liability and uninsured motorist coverages, but most drivers carry higher limits and add coverages like collision and comprehensive for better protection.

Factors like age, driving record, credit score, and ZIP code affect cheap Missouri auto insurance rates. However, each insurer weighs factors differently and offers different rates. So, the cheapest Missouri car insurance company for you might not be the most affordable for someone else.

Whether you’re looking for cheap insurance quotes in Kansas City or St. Louis, compare multiple companies to find the best deal on Missouri auto insurance. Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

Do you have to have car insurance in Missouri?

Yes, drivers must have at least 25/50/25 in liability and uninsured motorist coverages. However, Missouri auto insurance limits are very low, and experts recommend increasing them and adding coverage like collision and comprehensive.

How much is car insurance in Missouri?

The cost of car insurance in Missouri varies by driver. Drivers who are young or have bad driving records pay significantly higher rates than older drivers with clean driving records.

Additionally, drivers in larger cities pay higher rates. Urban areas typically have higher crime rates and a larger traffic volume, meaning you’re more likely to experience car theft, vandalism, or an accident.

What is the cheapest car insurance company in Missouri?

On average, Nationwide offers the cheapest minimum car insurance at just $65 a month. In addition, Nationwide offers the most affordable full coverage car insurance at around $147 a month.

However, Missouri auto insurance rates vary based on personal factors like age and driving record. Find the cheapest car insurance in Missouri by comparing multiple companies.

What factors affect Missouri car insurance rates?

Factors that affect car insurance rates in Missouri include driving record, age, credit score, ZIP code, and coverage choices.

How can you save on Missouri car insurance?

Ways to save on car insurance in Missouri: improve driving record, seek discounts, adjust coverage and deductibles, and shop around for Missouri car insurance quotes.

What is the best car insurance company in Missouri?

Popular car insurance companies in Missouri include Geico, State Farm, Progressive, and Allstate.

Is it illegal to drive without auto insurance in Missouri?

Yes, all drivers must carry Missouri auto insurance to drive legally. Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Is Missouri a no-fault state?

Missouri is an at-fault accident auto insurance state.

Is Missouri a PIP state?

No, Missouri does not require drivers to carry PIP auto insurance in Missouri.

What if I get into an accident without insurance in Missouri?

You could be charged fines, lose your driver’s license, and face other similar penalties if you drive without auto insurance in Missouri. Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.